|

市场调查报告书

商品编码

1521411

手錶:市场占有率分析、产业趋势与统计、成长预测(2024-2029)Atomic Clock - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

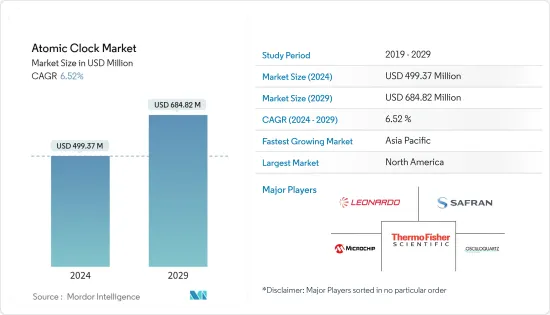

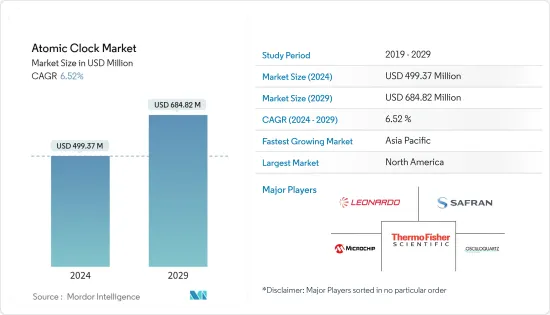

预计 2024 年手錶市场规模为 4.9937 亿美元,2029 年将达到 6.8482 亿美元,在预测期内(2024-2029 年)复合年增长率为 6.52%。

航太和军事领域对高精度手錶的需求不断增长,推动了手錶市场的成长。手錶可确保准确的单向距离测量,并确保保持传输的 GPS 讯号的相位精度。量子计算和量子通讯的开拓预计将为市场带来更好的机会。

全球导航和定位系统的扩展、手錶在 GPS 和 GNSS 系统中应用的兴起也推动了手錶市场的成长。然而,高昂的部署和维护成本可能会阻碍预测期内的市场成长。

手錶市场趋势

预测期内国防占主导市场占有率

随着世界各国军队寻求透过整合新的精确定位导航系统来实现老化飞机的现代化,国防领域的最终用户对手錶的需求量很大。大多数当前一代飞机都使用 GNSS (GPS) 和 TACAN 定位导航系统,预计在预测期内对新飞机的需求也将产生对手錶的平行需求。

在此背景下,2018年12月,美国宣布将在其机队中整合下一代GPS接收器,以提高导航和定位的品质。美国生命週期管理中心已选择罗克韦尔柯林斯为其 F-16 机队提供最新一代数位 GPS 抗干扰接收器 (DIGAR)。预计各个军队的类似倡议将在预测期内推动该领域的成长。

包括美国、德国、印度、澳洲、阿拉伯联合大公国和中国在内的许多国家正在投资对其现有军用飞机机队进行现代化改造,而不是购买全新的平台。例如,2018年12月,美国宣布其战斗机将配备下一代GPS接收器,以改善导航和定位测量。根据该倡议,美国生命週期管理中心选择罗克韦尔柯林斯为其 F-16 机队提供最新一代数位 GPS 抗干扰接收器(DIGAR)。预计各个军队的类似倡议将在预测期内推动该领域的成长。

飞机导航设备的进步预计将为公司创造新的市场机会。例如,诺斯罗普·格鲁曼公司的ASAF(全源自适应融合)软体允许在不使用全球定位系统(GPS)卫星讯号的情况下引导军用飞机和机载武器系统。此类软体与先进的感测器系统相结合,预计将提高航空平台的营运效率。

预计北美在预测期内将占据最大的市场占有率

根据斯德哥尔摩国际和平研究所(SIPRI)预测,2022年全球国防支出将超过2兆美元,美国等军事强国2022年将大幅增加国防预算。 2021年至2022年美国国防支出增加710亿美元,占全球国防支出近40%。

美国继续开发和采购下一代飞机,以满足与俄罗斯和中国的大国衝突的需求。美国拥有 13,247 架飞机,包括作战飞机、储备飞机和退役飞机。由于与日本和台湾等国家的外交和军事关係,日本被迫投入大量资金增加其机队,以应对中国的挑衅性军事行动。

此外,美国介入中东地区的军事衝突对攻击机和运输机的采购也产生了重大影响。美国空军提案2023财年预算要求为1,940亿美元,比2022财年预算要求增加202亿美元(11.7%)。该预算的大部分将用于采购新飞机以及新技术的研发,以支持国家的军事行动。此外,太空领域支出的增加、商业和国防应用卫星发射的数量增加以及 NASA 和 SpaceX 扩大太空探勘活动是美国市场的重要助推器,并正在推动北美地区的手錶市场。

手錶产业概况

手錶市场是半固定的,全球只有少数参与企业在企业发展。主要参与企业包括 Thermo Fisher Scientific Inc.、Oscilloquartz (Adtran Networks SE)、Microchip Technology Inc.、Leonardo SpA 和 Safran。市场竞争非常激烈,各公司都在争夺最大的市场占有率。

每家公司都利用其内部製造能力、全球网路、产品阵容、研发投资和强大的基本客群来竞争。特定价格分布内的技术力和产品特性也是重要的市场参数。对精确定位和导航功能不断增长的需求正在推动市场参与企业扩大产品系列。新进入者的威胁是中等的,由于产品/服务的扩张和技术创新的不断发展,预计市场的竞争格局将会加剧。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章 简介

- 调查先决条件

- 调查范围

第二章调查方法

第三章执行概述

第四章市场动态

- 市场概况

- 市场驱动因素

- 市场限制因素

- 波特五力分析

- 买家/消费者的议价能力

- 供应商的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争公司之间敌对关係的强度

第五章市场区隔

- 类型

- 铷 (Rb)手錶

- 铯 (Cs)手錶

- 氢 (H) 脉泽手錶

- 最终用户

- 防御

- 战斗机和直升机

- 无人车

- 装甲车

- 可携式系统

- 船(驱逐舰、巡防舰等)

- 潜水艇

- 巡逻船

- 宇宙

- 防御

- 目的

- 监视

- 导航

- 电子战

- 遥测

- 通讯

- 按地区

- 北美洲

- 美国

- 加拿大

- 欧洲

- 英国

- 德国

- 法国

- 俄罗斯

- 义大利

- 西班牙

- 波兰

- 欧洲其他地区

- 亚太地区

- 中国

- 日本

- 印度

- 其他亚太地区

- 拉丁美洲

- 巴西

- 其他拉丁美洲

- 中东/非洲

- 阿拉伯聯合大公国

- 沙乌地阿拉伯

- 南非

- 其他中东/非洲

- 北美洲

第六章 竞争状况

- 供应商市场占有率

- 公司简介

- AccuBeat Ltd.

- Excelitas Technologies Corp.

- IQD Frequency Products Limited

- Leonardo SpA

- Microchip Technology Incorporated

- Oscilloquartz(Adtran Networks SE)

- Stanford Research Systems

- Tekron International Limited

- VREMYA-CH JSC

- Safran

- MacQsimal(CSEM)(accelopment Schweiz AG)

- Thermo Fisher Scientific Inc

第七章 市场机会及未来趋势

The Atomic Clock Market size is estimated at USD 499.37 million in 2024, and is expected to reach USD 684.82 million by 2029, growing at a CAGR of 6.52% during the forecast period (2024-2029).

The atomic clock market's growth is attributed to the increasing need for high-precision atomic clocks in the aerospace and military sectors. Atomic clocks guarantee accurate one-way range measurements, ensuring the user maintains the transmitted GPS signal's phase precision. Developments in quantum computing and quantum communication are expected to create better opportunities for the market.

The expansion of global navigation and positioning systems and the rise of atomic clock applications in GPS and GNSS systems are also fueling the growth of the atomic clock market. However, the high cost of deployment and maintenance may hinder the market's growth during the forecast period.

Atomic Clock Market Trends

Defense to Dominate Market Share During the Forecast Period

The atomic clocks are in huge demand from defense end-users as the global armed forces look to modernize their aging fleet by integrating new and accurate position and navigation systems. Most current-generation aircraft utilize GNSS (GPS) and TACAN positioning and navigation systems, and the demand for new aircraft would also generate parallel demand for atomic clocks during the forecast period.

On this note, in December 2018, the US Air Force announced the fleet-wide integration of next-generation GPS receivers to enhance the quality of navigation and positioning measurements. The US Air Force Life Cycle Management Center selected Rockwell Collins to provide its latest-generation Digital GPS Anti-Jam Receiver (DIGAR) for its fleet of F-16 aircraft. Similar initiatives from various armed forces are anticipated to propel the segment's growth during the forecast period.

Many countries, such as the United States, Germany, India, Australia, the United Arab Emirates, and China, are investing in modernizing their existing fleet of military aircraft rather than acquiring entirely new platforms. For instance, in December 2018, the US Air Force announced that their fighter aircraft would be fitted with next-generation GPS receivers to enhance the quality of navigation and positioning measurements. Under this initiative, the US Air Force Life Cycle Management Center selected Rockwell Collins to provide its latest-generation Digital GPS Anti-Jam Receiver (DIGAR) for its fleet of F-16 aircraft. Similar initiatives from various armed forces are anticipated to propel the segment's growth during the forecast period.

The anticipated advancement of navigational aids for aircraft is expected to create new market opportunities for companies. For instance, Northrop Grumman Corporation's All Source Adaptive Fusion (ASAF) software allows military aircraft and airborne weapon systems to guide them without using Global Positioning System (GPS) satellite signals. Such software, when used with advanced sensor systems, is anticipated to improve the operational efficiencies of the air platforms.

North America is Expected to Have the Largest Market Share During the Forecast Period

The world defense expenditure crossed over USD 2 trillion in 2022, with significant military powers such as the US surging their defense budgets in 2022, according to the Stockholm International Peace Research Institute (SIPRI). US defense spending increased by USD 71 billion from 2021 to 2022, which comprised nearly 40% of global defense expenditures.

The US Air Force continues developing and procuring next-generation aircraft to meet the demands of great power conflicts with Russia and China. The US Air Force comprises 13,247 aircraft that are part of an operational, reserve, and out-of-service fleet. The country's diplomatic and military relations with nations such as Japan and Taiwan have compelled it to drive significant investments into increasing the fleet of aircraft to counter any provocative military action from China successfully.

Furthermore, the US involvement in the military conflict in the Middle Eastern region majorly drove its procurement of attack aircraft and transport aircraft. The Department of Air Force proposed a budget request of USD 194 billion for FY2023, a USD 20.2 billion or 11.7% increase from the FY2022 budget request. A major chunk of this budget will be channeled toward the procurement of new aircraft and research and development of new technologies that can aid the military actions undertaken by the country. Also, the rising expenditure on the space sector, increasing number of satellite launches for commercial and defense applications, and growing space exploration activities from NASA and SpaceX are significant boosters for the US market, which drives the atomic clock market in the North American region.

Atomic Clock Industry Overview

The atomic clock market is semi-consolidated, with a handful of players operating globally. Thermo Fisher Scientific Inc., Oscilloquartz (Adtran Networks SE), Microchip Technology Inc., Leonardo SpA, and Safran are some of the major market players. The market is highly competitive, with players competing to gain the largest market share.

Market players compete, leveraging their in-house manufacturing capabilities, global network footprint, product offerings, research and development investments, and robust client base. Technical capabilities and product features at definite price points are also key market parameters. The increasing demand for accurate positioning and navigation capabilities drives the market players to broaden their product portfolio. With a moderate threat of new entrants, the market's competitive landscape is projected to intensify due to heightened product/service extensions and technological innovations.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.3 Market Restraints

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Buyers/Consumers

- 4.4.2 Bargaining Power of Suppliers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products

- 4.4.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Type

- 5.1.1 Rubidium (Rb) Atomic Clock

- 5.1.2 Cesium (Cs) Atomic Clock

- 5.1.3 Hydrogen (H) Maser Atomic Clock

- 5.2 End User

- 5.2.1 Defense

- 5.2.1.1 Combat Aircraft and Helicopters?

- 5.2.1.2 Unmanned Vehicles?

- 5.2.1.3 Armoured Vehicles

- 5.2.1.4 Portable Systems

- 5.2.1.5 Naval Ships (Destroyers, Frigates, etc)

- 5.2.1.6 Submarines?

- 5.2.1.7 Patrol Vessels?

- 5.2.2 Space

- 5.2.1 Defense

- 5.3 Application

- 5.3.1 Surveillance

- 5.3.2 Navigation

- 5.3.3 Electronic Warfare?

- 5.3.4 Telemetry

- 5.3.5 Communication

- 5.4 By Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.2 Europe

- 5.4.2.1 United Kingdom

- 5.4.2.2 Germany

- 5.4.2.3 France

- 5.4.2.4 Russia

- 5.4.2.5 Italy

- 5.4.2.6 Spain

- 5.4.2.7 Poland

- 5.4.2.8 Rest of Europe

- 5.4.3 Asia-Pacific

- 5.4.3.1 China

- 5.4.3.2 Japan

- 5.4.3.3 India

- 5.4.3.4 Rest of Asia-Pacific

- 5.4.4 Latin America

- 5.4.4.1 Brazil

- 5.4.4.2 Rest of Latin America

- 5.4.5 Middle East and Africa

- 5.4.5.1 United Arab Emirates

- 5.4.5.2 Saudi Arabia

- 5.4.5.3 South Africa

- 5.4.5.4 Rest of Middle East and Africa

- 5.4.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Vendor Market Share

- 6.2 Company Profiles

- 6.2.1 AccuBeat Ltd.

- 6.2.2 Excelitas Technologies Corp.

- 6.2.3 IQD Frequency Products Limited

- 6.2.4 Leonardo S.p.A.

- 6.2.5 Microchip Technology Incorporated

- 6.2.6 Oscilloquartz (Adtran Networks SE)

- 6.2.7 Stanford Research Systems

- 6.2.8 Tekron International Limited

- 6.2.9 VREMYA-CH JSC

- 6.2.10 Safran

- 6.2.11 MacQsimal (CSEM) (accelopment Schweiz AG)

- 6.2.12 Thermo Fisher Scientific Inc