|

市场调查报告书

商品编码

1521445

日本资料中心储存:市场占有率分析、产业趋势与成长预测(2024-2029)Japan Data Center Storage - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

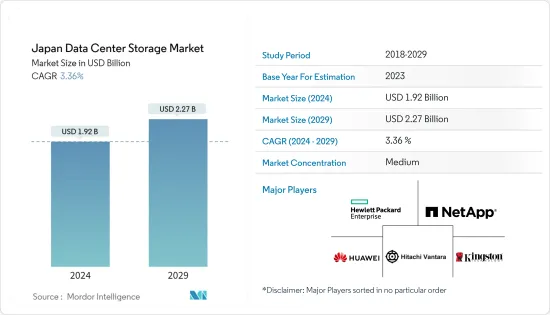

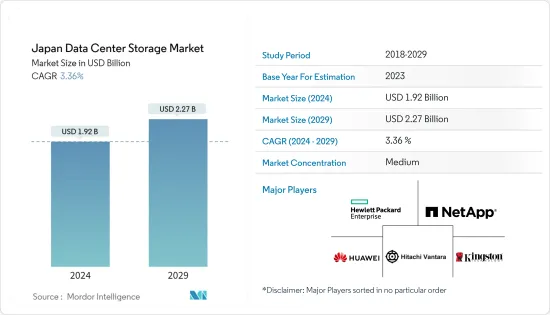

日本资料中心储存市场规模预计到 2024 年为 19.2 亿美元,预计到 2029 年将达到 22.7 亿美元,预测期内(2024-2029 年)复合年增长率为 3.36%。

主要亮点

- 中小企业对云端运算需求的增加、政府对国内资料安全的监管以及国内企业加大投资是推动国内资料中心需求的主要因素,导致资料中心储存设备的需求增加。

- 在建IT负载容量:预计到2029年,日本资料中心市场的IT负载容量将达到2000MW。

- 正在建造的高架建筑面积:到 2029 年,日本的占地面积预计将增加到 1,000 万平方英尺。

- 规划的机架:预计到2029年,全国安装的机架总数将达到50万个。到 2029 年,东京将安装最多数量的机架。

- 规划中的海底电缆:连接菲律宾的海底电缆有近30条,其中许多正在建造中。预计于 2023 年投入使用的一条海底电缆是东南亚-日本 2 号电缆 (SJC2),该电缆将从日本千仓到志摩,全长 10,500 公里。

日本资料中心储存市场趋势

IT和通讯领域占据大部分市场

- 2020年,一项针对日本儿童网路使用状况的调查发现,高中生平均每天上网时间为4小时8分钟,比前一年增加了31分钟,显示他们对网路的依赖程度有所降低。根据同一项调查,99.1%的高中生使用互联网,其中91.9%透过智慧型手机上网。预计这一趋势将在预测期内导致大量交通占用。

- 资料中心在国家安全、网路基础设施和经济表现中发挥着至关重要的作用,资料中心基础设施在日本正在快速成长。这种增长是由资料中心和储存设备的使用增加所推动的,这是由于人们对云端服务的偏好不断增加,以及不断增长的数位用户群对资料的消耗和产生的增加。

- 日本实施了一项政府政策,旨在到2028年将几乎所有家庭连接到高速光纤网络,并拨款约500亿日元用于分散海底电缆和资料中心,以改善安全和经济发展。 IT基础设施透过资料中心的进步使公司能够管理和处理大量资料,从而需要扩展储存基础设备,包括新增快闪记忆体。这将推动现有和新资料资料的建设。资料中心数量的增加与IT基础设施中储存设备的需求直接相关。

- 对资料中心服务的需求将进一步受到提高资料程式效能的需求、不断扩大的储存需求以及由于应用程式采用和互联网使用量增加而增加的行动资料使用量的推动。随着世界各地的企业转向云端资料存储,对资料中心服务的需求正在上升。

- 从2021年开始,日本行动通讯业者正在加速5G部署,在基地台部署和人口覆盖方面製定了雄心勃勃的目标,反映出通讯业日益增长的主导地位。智慧型手机的普及和5G网路的广泛使用将有助于资料流量的快速成长,这将对日本资料中心的成长产生积极影响。因此,对资料储存和资料中心储存设备的需求不断增加,从而增加了整体市场的价值。

混合储存预计将占据较大份额

- 日本政府数位机构正积极推动中央和地方政府机构采用云端服务。该倡议的一个例子是 2022 年 10 月关于年底采用政府云端服务的公告。这种方法称为资料中心混合存储,结合了本地和云端储存解决方案,充分利用了两种环境的优点,并提供了储存和管理资料的灵活性。

- 在混合储存中整合本地和云端储存解决方案可协助企业客製化储存策略以满足特定的法律要求,确保资料完整性和法规遵循。这种混合储存解决方案的采用有助于满足该国对资料储存不断增长的需求。

- 自 2017 财年以来,经济产业省 (METI) 一直透过补贴,在促进包括云端服务在内的 IT 引进方面发挥作用。此外,厚生劳动省将于 2021 年向受 COVID-19 大流行影响的组织提供“工作方式改革促进津贴”,涵盖云端服务和其他 IT 设备的合约费和设备费用,这有助于我们转型。工作。随着业务的扩展和发展,资料中心不断发展,以满足各行业的连接需求,增加了对混合基础设施和云端功能的依赖,以实现灵活性、扩充性和远端工作。资料流量的增加增强了储存对企业的重要性,并增加了混合储存解决方案的市场价值。

- 为了确保混合云中的资料可用性和访问,各种服务提供者正在部署先进的储存解决方案。特别是,HPE GreenLake 等公司宣布将于 2022 年推出优化的混合储存系统,包括平台升级和新的云端服务。拥有大资料储存容量的大型企业正在采用该产品系列,进一步推动日本对混合储存的需求。

- 日本的网路用户数量大幅增加,从 2021 年到 2022 年增加了 844,000 人(0.7%)。 2019 年网路流量激增,比新冠肺炎 (COVID-19) 爆发前的水平高出 1.6 倍,这可归因于疫情导致的家庭视讯会议、远距学习和视讯串流的增加。云端储存和音讯会议服务的日益普及导致更多公司采用远端工作,从而促进了利用混合储存的资料中心的出现。推出结合了硬碟和SSD功能的混合储存解决方案,利用SSD的高速存取能力和硬碟的大储存容量,并透过使用快取来优化经常存取的资料的存取速度。

日本资料中心储存产业概况

日本资料中心储存市场呈现出适度的碎片化,主要企业占据了大部分市场占有率。该市场的一些知名公司包括惠普企业 (Hewlett Packard Enterprise)、NetApp Inc.、华为技术有限公司、Hitachi Vantara LLC 和金士顿科技有限公司 (Kingston Technology Company Inc.)。这些公司正在做出策略性的协作努力,以增加市场占有率并增强盈利。

2023 年 8 月,铠侠公司宣布推出专为企业和资料中心基础设施设计的新型 PCIe 5.0 SSD,为储存解决方案的进步做出贡献。

2023 年 8 月,铠侠公司宣布将铠侠 CD8P 系列加入其资料中心级固态硬碟 (SSD) 产品阵容。 KIOXIA CD8P 系列适用于可利用 PCIe 5.0 (32GT/s x4) 效能的通用伺服器和云端环境。这些资料中心运作可以产生复杂的混合工作负载,分布在 24x7资料中心的大型虚拟系统中。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场动态

- 市场概况

- 市场驱动因素

- 由于IT基础设施的扩展,市场成长不断扩大

- 由于对超大规模资料中心的投资增加,市场成长不断扩大

- 市场限制因素

- 高昂的初始投资成本阻碍了市场成长

- 价值链/供应链分析

- 产业吸引力-波特五力分析

- 新进入者的威胁

- 买家/消费者的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争公司之间敌对关係的强度

- COVID-19 影响评估

第五章市场区隔

- 储存技术

- 网路附加储存 (NAS)

- 储存区域网路 (SAN)

- 直接附加储存 (DAS)

- 其他技术

- 储存类型

- 传统储存

- 全快闪储存

- 混合储存

- 最终用户

- 资讯科技/通讯

- BFSI

- 政府机关

- 媒体与娱乐

- 其他最终用户

第六章 竞争状况

- 公司简介

- Hewlett Packard Enterprise

- NetApp Inc.

- Huawei Technologies Co. Ltd.

- Hitachi Vantara LLC

- Kingston Technology Company Inc.

- Pure Storage Inc.

- Lenovo Group Limited

- Fujitsu Limited

- Seagate Technology LLC

- Western Digital Corporation

第七章 投资分析

第八章 市场机会及未来趋势

The Japan Data Center Storage Market size is estimated at USD 1.92 billion in 2024, and is expected to reach USD 2.27 billion by 2029, growing at a CAGR of 3.36% during the forecast period (2024-2029).

Key Highlights

- The increasing demand for cloud computing among SMEs, government regulations for local data security, and growing investment by domestic players are some of the major factors driving the demand for data centers in the country, leading to a growing need for data center storage equipment.

- Under Construction IT Load Capacity: The upcoming IT load capacity of the Japan data center market is expected to reach 2,000 MW by 2029.

- Under Construction Raised Floor Space: The country's construction of raised floor area is expected to increase to 10 million sq. ft by 2029.

- Planned Racks: The country's total number of racks to be installed is expected to reach 500K units by 2029. Tokyo is expected to house the maximum number of racks by 2029.

- Planned Submarine Cables: There are close to 30 submarine cable systems connecting the Philippines, and many are under construction. One such submarine cable that is estimated to start service in 2023 is Southeast Asia-Japan Cable 2 (SJC2), which stretches over 10,500 Kilometers with landing points from Chikura, Japan, to Shima, Japan.

Japan Data Center Storage Market Trends

IT & Telecommunication Segment to Hold Major Share in the Market

- In 2020, a survey on internet usage among Japanese children revealed that high school students spent an average of 4 hours and 8 minutes online daily, marking a 31-minute increase from the previous year and underlining the escalating reliance on the internet. The survey found that 99.1% of high schoolers use the internet, with 91.9% accessing it through smartphones. This trend is anticipated to contribute to significant traffic occupancy in the forecast period.

- Data centers play a crucial role in national security, internet infrastructure, and economic performance, and Japan is witnessing rapid growth in its data center infrastructure. This growth is propelled by an increasing preference for cloud services and the rising consumption and generation of data by an expanding digital user base, leading to higher data center and storage device usage.

- Japan has implemented a government policy aiming to connect nearly all households to a high-speed fiber optic network by 2028, with an allocation of approximately JPY 50 billion for subsea cable and data center decentralization to enhance security and economic development. The advancement of IT infrastructure through data centers has enabled businesses to manage and process larger volumes of data, requiring the scaling of storage infrastructure, including the addition of flash storage. It drives to existing data centers or the construction of new ones. The growth in the number of data centers is directly linked to the demand for storage devices in IT infrastructure.

- The demand for data center services is further fueled by increasing data center workloads, driven by the need for improved application performance, expanding storage requirements, and rising mobile data usage due to the proliferation of applications and increased internet usage. As businesses worldwide shift to cloud data storage, the demand for data center services is on the rise.

- The acceleration of the 5G rollout by Japan's mobile operators since 2021, with ambitious targets for base station deployment and population coverage, reflects the growing dominance of the telecommunications sector. The widespread adoption of smartphones and the increasing use of 5G networks contribute to a surge in data traffic, positively impacting the growth of data centers in Japan. This, in turn, augments the demand for data storage and data center storage equipment, thereby increasing the overall market value.

Hybrid Storage Expected To Hold Significant Share

- The Government of Japan's Digital Agency actively promotes the adoption of cloud services for both central and local government offices. An example of this initiative is the announcement made in October 2022, wherein the agencies of the Government of Japan committed to adopting "Government Cloud" services for the fiscal year. This approach combines on-premises and cloud storage solutions, referred to as data center hybrid storage, leveraging the strengths of both environments and offering flexibility in storing and managing data.

- The integration of on-premises and cloud storage solutions in hybrid storage supports enterprises in tailoring their storage strategies to meet specific legal requirements, ensuring data integrity and legal compliance. This adoption of hybrid storage solutions contributes to the increasing need for data storage in the country.

- The Ministry of Economics, Trade, and Industry (METI) has played a role in promoting IT adoption, including cloud services, through subsidies provided since FY2017. Additionally, in 2021, the Ministry of Health, Labour, and Welfare (MHLW) offered a "Workstyle Reform Promotion" subsidy to organizations affected by the COVID-19 pandemic, supporting their transition to remote work by covering contracting fees and equipment costs for cloud services and other IT devices. As businesses expand and evolve, data centers are growing to meet the connectivity needs of various industries, with an increasing reliance on hybrid infrastructure and cloud capabilities for flexibility, scalability, and remote work. The rising data traffic reinforces the importance of storage for businesses, contributing to an increased market value for hybrid storage solutions.

- Various service providers are deploying advanced storage solutions to ensure data availability and access in hybrid clouds. Notably, companies like HPE GreenLake have introduced optimized hybrid storage systems, including platform upgrades and new cloud services in 2022. Large enterprises with substantial data storage capacities are adopting such product portfolios, further driving the demand for hybrid storage in the country.

- The number of internet users in Japan saw a significant increase, rising by 844 thousand (0.7%) between 2021 and 2022. The surge in internet traffic, 1.6 times higher than pre-COVID-19 levels in 2019, can be attributed to the pandemic-driven rise in at-home videoconferencing, distance learning, and video streaming. The growing popularity of cloud storage and audio conferencing services has led more companies to embrace remote work, contributing to the emergence of data centers utilizing hybrid storage. The introduction of hybrid storage solutions, combining the functionality of hard drives and SSDs, demonstrates an innovative approach where cache utilization optimizes access speed for frequently accessed data, capitalizing on the fast access capabilities of SSDs and the greater storage capacity of hard drives.

Japan Data Center Storage Industry Overview

The Japan Data Center Storage market exhibits a moderate level of fragmentation, with a majority of the market share held by key players. Noteworthy companies in this market include Hewlett Packard Enterprise, NetApp Inc., Huawei Technologies Co. Ltd., Hitachi Vantara LLC, and Kingston Technology Company Inc. These entities strategically engage in collaborative initiatives to enhance their market share and bolster profitability.

In August 2023, Kioxia Corporation introduced new PCIe 5.0 SSDs designed for Enterprise and Data Center Infrastructures, contributing to advancements in storage solutions.

In August 2023, Kioxia Corporation announced the addition of the KIOXIA CD8P Series to its lineup of data center-class solid state drives (SSDs). The KIOXIA CD8P Series is well-suited to general purpose server and cloud environments that can take advantage of PCIe 5.0 (32GT/s x4) performance. These data center applications can generate complex mixed workloads spread across large scale virtualized systems in 24x7 operational data centers.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumption & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Dynamics

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Expansion of IT Infrastructure to Increase Market Growth

- 4.2.2 Increased Investments in Hyperscale Data Centers To Increase Market Growth

- 4.3 Market Restraints

- 4.3.1 High Initial Investment Cost To Hinder Market Growth

- 4.4 Value Chain / Supply Chain Analysis

- 4.5 Industry Attractiveness - Porter's Five Forces Analysis

- 4.5.1 Threat of New Entrants

- 4.5.2 Bargaining Power of Buyers/Consumers

- 4.5.3 Bargaining Power of Suppliers

- 4.5.4 Threat of Substitute Products

- 4.5.5 Intensity of Competitive Rivalry

- 4.6 Assessment of COVID-19 Impact

5 MARKET SEGMENTATION

- 5.1 Storage Technology

- 5.1.1 Network Attached Storage (NAS)

- 5.1.2 Storage Area Network (SAN)

- 5.1.3 Direct Attached Storage (DAS)

- 5.1.4 Other Technologies

- 5.2 Storage Type

- 5.2.1 Traditional Storage

- 5.2.2 All-Flash Storage

- 5.2.3 Hybrid Storage

- 5.3 End-User

- 5.3.1 IT & Telecommunication

- 5.3.2 BFSI

- 5.3.3 Government

- 5.3.4 Media & Entertainment

- 5.3.5 Other End-Users

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 Hewlett Packard Enterprise

- 6.1.2 NetApp Inc.

- 6.1.3 Huawei Technologies Co. Ltd.

- 6.1.4 Hitachi Vantara LLC

- 6.1.5 Kingston Technology Company Inc.

- 6.1.6 Pure Storage Inc.

- 6.1.7 Lenovo Group Limited

- 6.1.8 Fujitsu Limited

- 6.1.9 Seagate Technology LLC

- 6.1.10 Western Digital Corporation