|

市场调查报告书

商品编码

1521492

ESG评级服务:市场占有率分析、产业趋势/统计、成长预测(2024-2029)ESG Rating Services - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

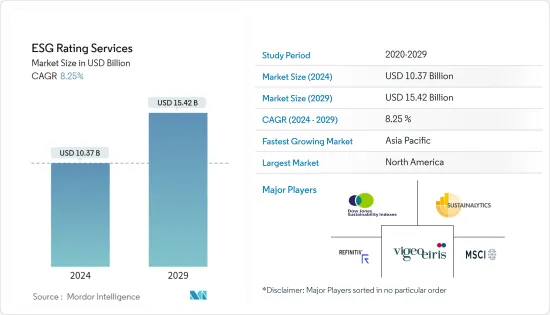

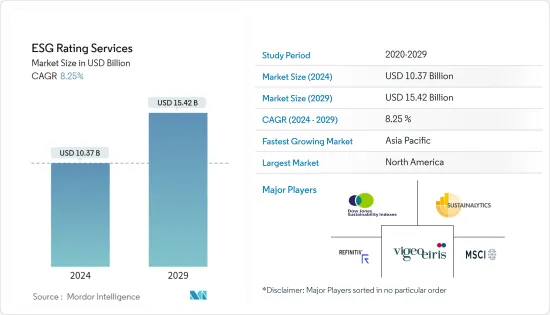

ESG评级服务市场规模预计2024年为103.7亿美元,预计2029年将达到154.2亿美元,在市场预测和预测期间(2024-2029年)复合年增长率为8.25%。

随着投资者、客户、员工和监管机构等相关人员要求公司提高透明度和课责,ESG评级变得越来越重要。 ESG评级服务市场前景十分广。人们对永续性、负责任投资和公司管治实践的认识和重要性不断增强,推动了对 ESG彙报的需求。公司意识到需要将 ESG 考量纳入其业务策略,以降低风险、提高业务效率并增加相关人员的信任。因此,对 ESG 报告服务的需求预计将大幅成长。

随着监管机构要求增加 ESG 报告,该行业也在不断发展。根据欧盟《永续财务揭露条例》(SFDR),金融机构必须公开揭露有关永续性政策和 ESG 风险的资讯。这些法规可能会对市场扩张产生正面影响。此外,人工智慧和巨量资料分析等技术创新使得ESG资料的收集和分析变得更加容易,从而提高了ESG报告的有效性和合法性。这些技术发展预计将增加公司使用 ESG 评级服务的频率。

ESG评级服务的市场趋势

技术进步不断推动市场发展

越来越多的投资正在提高政策制定者、投资者和其他主要相关人员对永续性和品质的标准。全面的道德商业实践受到投资者的高度追捧。 ESG 标准决定和评估公司的绩效,永续性涵盖负责任的商业实践。公司正在考虑其营运中与环境和社会问题相关的潜在风险和机会,并寻求使其投资组合与永续和负责任的做法保持一致。科技的发展和进步使企业能够解决社会和环境问题,这正在推动 ESG 努力创造永续和包容性的经济。对永续投资解决方案的需求正在加速将 ESG 评估纳入投资程序。

与可再生能源、能源效率、洁净科技和永续农业相关的技术正在推动市场发展。这些技术在推动 ESG 实践方面发挥着重要作用。这些技术可以有效收集、储存和分析与 ESG 因素相关的大量资料。

由于气候和能源的变化,预计北美将主导市场

由于对减缓气候变迁和向可再生能源转型的日益关注、具有 ESG 授权的大型机构投资者的存在以及对永续投资选择的需求不断增长,北美市场正在不断增长,该市场在该地区处于领先地位。北美预计将为全球市场成长贡献41%。

美国因其大规模采用环境、永续性和管治(ESG) 报告软体以最大程度地降低环境风险而成为北美最大的市场。 ESG彙报软体已受到许多行业的强制使用,包括材料、化学品、能源和公共产业(E&U),以及职业安全与健康管理局 (OSHA) 等促进工人安全法规的监管机构。结果,劳动风险降低了。还有一些技术进步有助于遵守美国的《清洁空气法》等法规和法律。这些措施减少了工业排放,并促进了永续性管理和环境、永续性和管治(ESG)报告软体的实施。

ESG评级服务业概况

这是主要企业在ESG评级服务中采取的重大策略倡议。竞争格局包括 Sustainalytics、Refinitiv、MSCI Inc.、Vigeo Eiris 和道琼永续指数。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场动态与洞察

- 市场概况

- 市场驱动因素

- 道德和永续投资的需求不断增长

- 企业资料量稳定成长

- 市场限制因素

- 缺乏标准化框架

- 各组织自行报告的资料

- 市场机会

- 采用人工智慧等先进技术

- 政府加大力度促进 ESG 投资

- 价值链分析

- 产业吸引力波特五力分析

- 新进入者的威胁

- 买方议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争公司之间的敌对关係

- 洞察产业技术进步

- 洞察塑造市场的各种监理趋势

- COVID-19 对市场的影响

第五章市场区隔

- 按类型

- 对 ESG 的期望

- 建立ESG报告

- ESG资料的保证

- 沟通 ESG 策略

- 其他类型

- 按用途

- 金融业

- 消费品/零售

- 製造业

- 能源/自然资源

- 房地产

- 其他用途

- 按地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 北美其他地区

- 欧洲

- 英国

- 德国

- 法国

- 俄罗斯

- 义大利

- 西班牙

- 其他欧洲国家

- 亚太地区

- 印度

- 中国

- 日本

- 澳洲

- 其他亚太地区

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地区

- 中东/非洲

- 阿拉伯聯合大公国

- 南非

- 其他中东和非洲

- 北美洲

第六章 竞争状况

- 市场集中度概况

- 公司简介

- Sustainalytics

- Refinitiv

- MSCI Inc.

- Vigeo Eiris

- Dow Jones Sustainability Indices

- PwC

- Deloitte

- Smith & Williamson

- KPMG

- EY*

第七章 未来市场趋势

第 8 章 免责声明与出版商讯息

The ESG Rating Services Market size is estimated at USD 10.37 billion in 2024, and is expected to reach USD 15.42 billion by 2029, growing at a CAGR of 8.25% during the forecast period (2024-2029).

ESG rating has become increasingly important as stakeholders, including investors, customers, employees, and regulators, demand better company transparency and accountability. The outlook of the ESG rating services market is highly promising. The growing awareness and importance of sustainability, responsible investment, and corporate governance practices are driving the demand for ESG reporting. Companies are realizing the need to integrate ESG considerations into their business strategies to mitigate risks, improve operational efficiency, and enhance stakeholder trust. As a result, the demand for ESG reporting services is expected to witness significant growth.

The industry is also growing since regulatory authorities are mandating ESG reporting to increase. Financial institutions are required to publish information about their sustainability policies and ESG risks under the Sustainable Finance Disclosure Regulation (SFDR) of the European Union. Such regulations are likely to impact the market's expansion positively. Technological breakthroughs like Artificial Intelligence and Big Data analytics are also making it easier to gather and analyze ESG data, which improves the effectiveness and legitimacy of ESG reporting. It is anticipated that corporations may use ESG rating services more frequently due to these technical developments.

ESG Rating Services Market Trends

The Growing Number of Technological Advancements is Driving the Market

The rising number of investments is leading to increased sustainability and quality standards by policymakers, investors, and other key stakeholders. Ethical business practice in a holistic manner is highly demanded by investors. The ESG standards determine or evaluate the company's performance, while sustainability encompasses responsible business practices. Various businesses seek to align their portfolios with sustainable and responsible practices, considering the potential risks and opportunities for the business associated with environmental and social issues. Technological developments and advancements that allow businesses to address social and environmental concerns are driving ESG's efforts to create a sustainable and inclusive economy. Demand for sustainable investing solutions is driving an increasing integration of ESG ratings into investment procedures.

Technologies involved in renewable energy, energy efficiency, clean technology, and sustainable agriculture are fueling the market. These technologies play a crucial role in advancing ESG practices. They enable the efficient collection, storage, and analysis of large volumes of data related to the ESG factor.

North America is Expected to Dominate the Market owing to Climate and Energy Transitions

The North American market is growing, owing to the increasing focus on climate change mitigation and renewable energy transition, the presence of large institutional investors with ESG mandates, and the growing demand for sustainable investing options driving the market in the region. North America is expected to contribute 41% to the growth of the global market.

The United States is the largest market in North America due to the large-scale implementation of environmental, sustainability, and governance (ESG) reporting software to minimize environmental hazards. ESG reporting software has been mandated by numerous industries, including materials, chemicals, energy, and utilities (E&U), and regulatory bodies like the Occupational Safety and Health Administration (OSHA), which promote worker safety rules. As a result, occupational risks were reduced. There are several technological advancements to guide compliance with regulations and acts, such as the Clean Air Act in the United States. These have reduced industrial emissions and promoted the adoption of sustainability management and environmental, sustainability, and governance (ESG) reporting software.

ESG Rating Services Industry Overview

The ESG rating services market is moderately consolidated. Partnerships, expansions, and product enhancements are the key strategic moves adopted by major players to strengthen their presence across regions. The competitive landscape of the market is analyzed, and some of the major players include Sustainalytics, Refinitiv, MSCI Inc., Vigeo Eiris, and Dow Jones Sustainability Indices.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS AND INSIGHTS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Increasing Demand for Ethical and Sustainable Investments

- 4.2.2 Steady Growth in Corporate Data Volumes

- 4.3 Market Restraints

- 4.3.1 Lack of Standardized Frameworks

- 4.3.2 Self-Reported Data by Organizations

- 4.4 Market Opportunities

- 4.4.1 Adoption of Advanced Technologies such as AI

- 4.4.2 Increasing Government Initiatives to Promote ESG Investments

- 4.5 Value Chain Analysis

- 4.6 Industry Attractiveness: Porter's Five Forces Analysis

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Buyers

- 4.6.3 Bargaining Power of Suppliers

- 4.6.4 Threat of Substitutes

- 4.6.5 Intensity of Competitive Rivalry

- 4.7 Insights into Technological Advancements in the Industry

- 4.8 Insights into Various Regulatory Trends Shaping the Market

- 4.9 Impact of COVID-19 on the Market

5 MARKET SEGMENTATION

- 5.1 By Type

- 5.1.1 Addressing ESG Expectations

- 5.1.2 Preparing ESG Reports

- 5.1.3 Assuring ESG Data

- 5.1.4 Communicating ESG Strategy

- 5.1.5 Other Types

- 5.2 By Application

- 5.2.1 Financial Industry

- 5.2.2 Consumer and Retail

- 5.2.3 Industrial Manufacturing

- 5.2.4 Energy and Natural Resources

- 5.2.5 Real Estate

- 5.2.6 Other Applications

- 5.3 By Geography

- 5.3.1 North America

- 5.3.1.1 United States

- 5.3.1.2 Canada

- 5.3.1.3 Mexico

- 5.3.1.4 Rest of North America

- 5.3.2 Europe

- 5.3.2.1 United Kingdom

- 5.3.2.2 Germany

- 5.3.2.3 France

- 5.3.2.4 Russia

- 5.3.2.5 Italy

- 5.3.2.6 Spain

- 5.3.2.7 Rest of Europe

- 5.3.3 Asia-Pacific

- 5.3.3.1 India

- 5.3.3.2 China

- 5.3.3.3 Japan

- 5.3.3.4 Australia

- 5.3.3.5 Rest of Asia-Pacific

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle East and Africa

- 5.3.5.1 United Arab Emirates

- 5.3.5.2 South Africa

- 5.3.5.3 Rest of Middle East and Africa

- 5.3.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration Overview

- 6.2 Company Profiles

- 6.2.1 Sustainalytics

- 6.2.2 Refinitiv

- 6.2.3 MSCI Inc.

- 6.2.4 Vigeo Eiris

- 6.2.5 Dow Jones Sustainability Indices

- 6.2.6 PwC

- 6.2.7 Deloitte

- 6.2.8 Smith & Williamson

- 6.2.9 KPMG

- 6.2.10 EY*