|

市场调查报告书

商品编码

1521494

蒸汽清洁机:市场占有率分析、行业趋势和统计、成长预测(2024-2029)Steam Cleaner - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

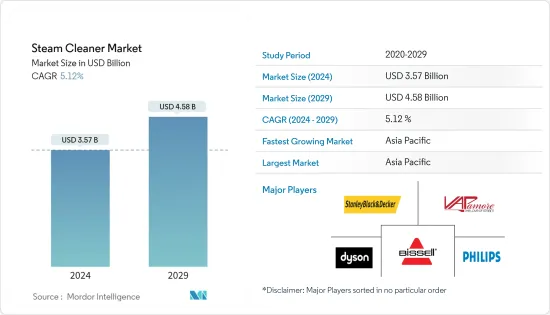

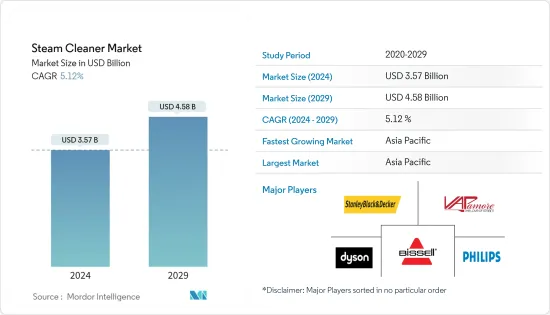

蒸汽清洁机市场规模预计到 2024 年为 35.7 亿美元,预计到 2029 年将达到 45.8 亿美元,在预测期内(2024-2029 年)复合年增长率为 5.12%。

蒸汽清洁机是一种流行的技术和机器,它是一种有效且环保的清洗解决方案。这种多功能蒸气动力工具清洗和去除各种表面上的污垢和污垢,包括地毯、室内装潢和服装类。其应用已扩展到住宅和商业环境,提供卫生、无化学物质的清洁替代方案。客户对无化学清洁产品的需求不断增长以及对环境的关注都极大地促进了蒸汽清洁器市场的成长。

COVID-19 大流行起到了刺激作用,加速了多个行业的产品采用。不断提高的卫生要求导致家用和商业用途清洁剂的需求激增。由于其出色的表面消毒能力,这些清洁剂如今被认为是对抗感染疾病传播的重要工具。人们对蒸汽清洁机有效性的认识不断提高正在推动市场扩张。

由于研发倡议导致了各种创新新产品的推出,蒸汽清洁器市场正在蓬勃发展。世界各地的製造商正在创造新产品并改进现有产品,以提高其产品的有效性。具有更长电池寿命、更多房间内存和其他功能的创新蒸汽清洁器预计将在整个预测期内推动蒸汽清洁器市场。

蒸气清洁机市场趋势

在饭店、医疗保健和食品产业的推动下,商业领域主导市场

在预测期内,商务用领域占据重要份额并主导市场。商务旅行需求的增加促进了旅馆业的成长,从而产生了对蒸汽清洁机的主要需求。蒸汽清洁机广泛用于地毯和衣服,有助于保持行业卫生。旅游业的快速成长是推动酒店业成长的主要因素之一,蒸汽清洁机预计将在全球实现高速成长。此外,棒式清洁器和立式清洁器功能的改进也导致需求增加。最终用户对健康和卫生的日益关注也推动了市场商务用领域的成长。

商务旅行的增加是旅馆业的主要需求来源,导致各酒店广泛使用商务用蒸气清洁机。因此,全球酒店和酒店业的成长以及这些产品的广泛接受度预计将在预测期内增加对商务用蒸汽清洁机的需求。

由于智慧家庭的成长,亚太地区将引领市场

由于可支配收入和购买力的提高,蒸汽清洁机在亚太地区的普及率迅速提高。占据亚太市场大部分份额的主要国家是越南、菲律宾、中国、印度、韩国、澳洲和纽西兰。该地区国家,特别是印度和中国,国内生产毛额(GDP)经历了高速经济成长,并且正在经历快速都市化。这些因素正在推动市场对新住宅和蒸汽清洁器产品推出的需求。

住宅产业的成长帮助该地区的供应商深入了解消费者对住宅的电器产品。澳洲是一个新兴市场,由于智慧家庭和双收入家庭的兴起,住宅环境中对蒸汽清洁器的需求很高。不断增长的中阶人口也促进了市场的成长。

蒸气清洗机产业概况

蒸气清洁机市场适度分散。每家公司都专注于各种成长策略,包括产品创新、业务扩张和合作伙伴关係,以扩大其跨区域业务。报告也分析了市场竞争格局。主要企业包括 BISSELL Homecare Inc.、Dyson Ltd.、飞利浦、Stanley Black &Decker Inc. 和 Vapamore。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场动态与洞察

- 市场概况

- 市场驱动因素

- 不断增长的汽车工业推动市场

- 严格的健康和卫生法规推动产品需求

- 市场限制因素

- 开发中国家替代清洗方法的可近性

- 初始成本和认知度低阻碍了市场扩张

- 市场机会

- 消费者对家庭自动化的兴趣不断增加

- 蒸气清洁机与智慧技术的融合

- 价值链分析

- 产业吸引力:波特五力分析

- 新进入者的威胁

- 买方议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争公司之间的敌对关係

- 洞察产业技术进步

- COVID-19 对市场的影响

第五章市场区隔

- 按类型

- 全自动

- 半自动

- 按用途

- 住宅

- 业务

- 按销售管道

- 在线的

- 离线

- 按地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 北美其他地区

- 欧洲

- 英国

- 德国

- 法国

- 俄罗斯

- 义大利

- 西班牙

- 其他欧洲国家

- 亚太地区

- 印度

- 中国

- 日本

- 澳洲

- 其他亚太地区

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地区

- 中东/非洲

- 阿拉伯聯合大公国

- 南非

- 其他中东和非洲

- 北美洲

第六章 竞争状况

- 市场集中度概况

- 公司简介

- BISSELL Homecare Inc.

- Dyson Ltd

- Philips

- Stanley Black & Decker Inc.

- Vapamore

- HAAN Corporation

- Samsung

- Oreck

- TechnoVap

- Panasonic*

第七章 市场趋势

第 8 章 免责声明与出版商讯息

The Steam Cleaner Market size is estimated at USD 3.57 billion in 2024, and is expected to reach USD 4.58 billion by 2029, growing at a CAGR of 5.12% during the forecast period (2024-2029).

One type of technology and machinery that has become popular is the steam cleaner, an effective and eco-friendly cleaning solution. Using steam power, these multipurpose tools clean and eliminate filth and grime from various surfaces, such as carpets, upholstery, and clothing. Their uses are widespread in both residential and commercial environments, providing a hygienic and chemical-free cleaning substitute. Growing customer demand for chemical-free cleaning products and environmental concerns have both contributed significantly to the rise of the steam cleaner market.

The COVID-19 pandemic served as a stimulant, accelerating the product's uptake in several industries. Increased hygienic requirements led to a sharp rise in the demand for these cleaners in both home and commercial settings. Because of their exceptional ability to disinfect surfaces, these cleaners are today regarded as vital instruments in the battle against the transmission of infectious diseases. The increasing awareness of the effectiveness of steam cleaners has driven market expansion.

The market for steam cleaners has flourished owing to R&D initiatives that have led to the introduction of various innovative and new products. Global manufacturers are creating new items and improving their existing ones to boost the effectiveness of their products. Innovative steam cleaners with longer battery lives, more room memory, and other features are projected to propel the steam cleaner market throughout the forecast period.

Steam Cleaner Market Trends

Commercial Segment Dominates the Market, Driven by the Hospitality, Healthcare, and Food Industries

The commercial segment has witnessed significant market share and dominated the market during the review period. The increasing demand for business travel has contributed to the growth of the hospitality industry, which, in turn, generated a major demand for steam cleaners. Steam cleaners are used extensively in carpets and garments and help the industry maintain hygiene. The exponential growth of the tourism industry is one of the prime factors fueling the growth of the hospitality industry, and steam cleaners are expected to witness high growth worldwide. The increased functionality of stick and upright cleaners has also led to a rise in demand. Increasing concerns about health and hygiene among end users are also driving the growth of the commercial segment in the market.

Increasing business travel is the major demand generator of the hotel industry, which, in turn, contributes to various hotels using commercial steam cleaners extensively. Therefore, the global hotel and hospitality industry's growth and wider acceptance of these products are expected to increase the demand for commercial steam cleaners during the forecast period.

Asia-Pacific Leads the Market owing to Growing Smart Homes in the Region

In Asia-Pacific, the prevalence of steam cleaners has surged due to the region's substantial disposable income and purchasing power. The primary countries that control the majority of the Asia-Pacific market are Vietnam, the Philippines, China, India, South Korea, Australia, and New Zealand. Countries in the region, India and China in particular, are witnessing high economic growth in terms of GDP and rapid urbanization. These factors boost the market's demand for newly constructed homes and steam cleaner product launches.

The growth of the residential sector has helped vendors in the region gain insights into consumer preferences regarding residential appliances. Australia has a developed market with significant demand for steam cleaners in residential settings because of the rise in smart homes and dual-income households. The growing middle-class population has also contributed to market growth.

Steam Cleaner Industry Overview

The steam cleaner market is moderately fragmented. The companies are focusing on various growth strategies such as product innovations, expansions, and partnerships to expand their presence across regions. The competitive landscape of the market has also been analyzed in the report. Some of the major players include BISSELL Homecare Inc., Dyson Ltd, Philips, Stanley Black & Decker Inc., and Vapamore.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS AND INSIGHTS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Growing Automotive Sector is Propelling the Sector

- 4.2.2 Stringent Health and Hygiene Regulations Fuels Product Demand

- 4.3 Market Restraints

- 4.3.1 Accessibility of Alternative Cleaning Methods in Developing Nations

- 4.3.2 Initial Cost and Limited Awareness Impede Market Expansion

- 4.4 Market Opportunities

- 4.4.1 Increasing Consumer Inclination for Home Automation

- 4.4.2 Integration of Smart Technology with Steam Cleaners

- 4.5 Value Chain Analysis

- 4.6 Industry Attractiveness: Porter's Five Forces Analysis

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Buyers

- 4.6.3 Bargaining Power of Suppliers

- 4.6.4 Threat of Substitutes

- 4.6.5 Intensity of Competitive Rivalry

- 4.7 Insights into Technological Advancements in the Industry

- 4.8 Impact of COVID-19 on the Market

5 MARKET SEGMENTATION

- 5.1 By Type

- 5.1.1 Fully Automatic

- 5.1.2 Semi-automatic

- 5.2 By Application

- 5.2.1 Residential

- 5.2.2 Commercial

- 5.3 By Distribution Channel

- 5.3.1 Online

- 5.3.2 Offline

- 5.4 By Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Mexico

- 5.4.1.4 Rest of North America

- 5.4.2 Europe

- 5.4.2.1 United Kingdom

- 5.4.2.2 Germany

- 5.4.2.3 France

- 5.4.2.4 Russia

- 5.4.2.5 Italy

- 5.4.2.6 Spain

- 5.4.2.7 Rest of Europe

- 5.4.3 Asia-Pacific

- 5.4.3.1 India

- 5.4.3.2 China

- 5.4.3.3 Japan

- 5.4.3.4 Australia

- 5.4.3.5 Rest of Asia-Pacific

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Rest of South America

- 5.4.5 Middle East and Africa

- 5.4.5.1 United Arab Emirates

- 5.4.5.2 South Africa

- 5.4.5.3 Rest of Middle East and Africa

- 5.4.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration Overview

- 6.2 Company Profiles

- 6.2.1 BISSELL Homecare Inc.

- 6.2.2 Dyson Ltd

- 6.2.3 Philips

- 6.2.4 Stanley Black & Decker Inc.

- 6.2.5 Vapamore

- 6.2.6 HAAN Corporation

- 6.2.7 Samsung

- 6.2.8 Oreck

- 6.2.9 TechnoVap

- 6.2.10 Panasonic*