|

市场调查报告书

商品编码

1521500

刺绣机:市场占有率分析、产业趋势与统计、成长预测(2024-2029)Embroidery Machine - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

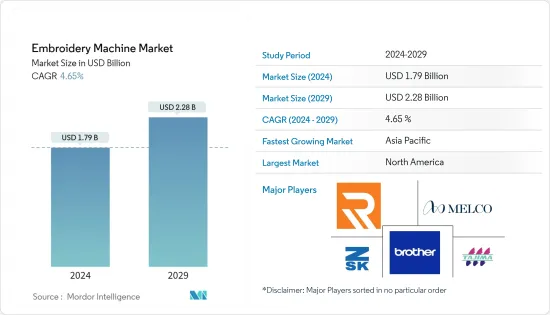

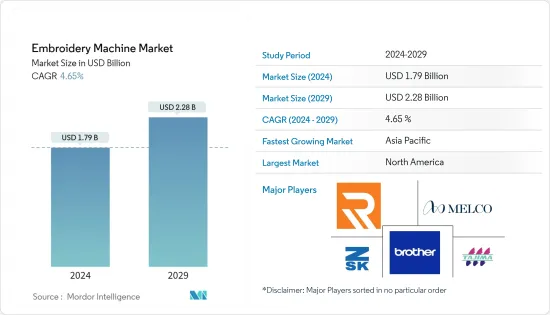

刺绣机市场规模预计到 2024 年为 17.9 亿美元,预计到 2029 年将达到 22.8 亿美元,在预测期内(2024-2029 年)复合年增长率为 4.65%。

近年来,绣花机市场成长显着。客製化和刺绣的需求、技术进步以及纺织服装业的成长等因素推动了这一成长。主要市场参与企业不断创新以提高其机器的功能。

主要亮点

- 它提供快速的缝纫速度、高精度和易于使用的介面。该市场主要由中国、印度和日本等亚太国家主导。这些国家在刺绣机的生产和消费中发挥主要作用。亚太纺织业快速扩张,个人化刺绣及绣花产品潮流方兴未艾。

- 除亚太地区外,北美和欧洲也在市场中发挥重要作用。客製化和独特的纺织品越来越受欢迎,市场正在转向自动化、电脑化机械,实现更有效率、更复杂的设计。

- 人工智慧和自动化等技术创新正在改变产业。这些创新透过提高效率、减少体力劳动并提供更大的设计灵活性,推动了刺绣机在各种最终用户行业的采用。

绣花机市场趋势

多头绣花机的发展-头数越多越好

多针绣花机的未来是光明的。另一方面,单针绣花机则有点乏善可陈。单针绣花机有着悠久的历史。儘管如此,直到最近,小企业主才开始意识到使用单针绣花机经营业务的限制。

配备多个绣花机头的绣花机可以同时缝製同一服装或织物的不同部分。这意味着多个机头可以同时在绣花机的同一部分上工作,与单针绣花机相比,大大提高了绣花机的效率和产量。

多头绣花机特别适合需要生产大量绣花产品的纺织服装业公司。换句话说,多头绣花机是必须履行大订单的製造商的完美选择。

当一台绣花机上的多个机头同时绣製同一件绣品时,完成一批绣花所需的时间会显着减少。这对于在紧迫的期限内完成任务并需要优化生产计划的公司来说尤其重要。

亚太地区占主导地位

亚太地区拥有全球最大的服装市场,包括中国、印度和日本。中国是全球最大的服饰产品出口国。孟加拉和越南位列世界前五位服装出口国。亚洲的几个经济体拥有大型 GTF(服饰、纺织品和鞋类)製造业。

服饰、纺织和製鞋业继续在亚洲经济中发挥重要作用,为该地区约6000万人提供就业机会,并以间接就业的形式支持数百万人就业。

东亚大部分地区的纺织业持续成长,其中中国、越南、印尼和柬埔寨的成长率最高。该地区是 Nike、Zara、C&A 和 H&M 等欧洲主要时尚公司的所在地。纺织产品在欧洲消费环境负担中占第四位。

东亚作为全球最大的服饰生产国,在全球纺织服装供应链中发挥重要作用,2019年约占全球纺织品出口的55%。

2022年,光是越南就向世界出口了价值376亿美元的服装、服饰和纺织品,其中出口额为58亿美元。该产业持续快速成长,部分原因是随着欧洲自由贸易联盟和欧盟-越南自由贸易协定这两项自由贸易协定的实施,东南亚地区的参与度不断提高。由于欧洲经济区自由贸易协定(欧盟-越南自由贸易协定),越南产品越来越依赖欧盟市场。然而,自COVID-19爆发以来,东亚服饰和纺织业受到欧盟(EU)和美国(美国)等主要市场需求减少的影响。此外,2020年印尼、马来西亚、泰国和越南市场的纺织品出口也有所下降。

绣花机产业概况

绣花机市场细分,众多参与企业纷纷进入市场。主要参与企业包括兄弟工业有限公司、伯尼纳国际股份公司和田岛工业有限公司。由于技术进步、消费者对客製化产品的偏好不断增加以及全球纺织和服装行业的成长,全球刺绣机市场正在不断增长。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章 简介

- 调查先决条件

- 调查范围

第二章调查方法

第三章执行概述

第四章市场洞察

- 目前的市场状况

- 政府法规和倡议

- 科技趋势

- COVID-19 对市场的影响

第五章市场动态

- 市场驱动因素

- 时尚和纺织业的成长推动市场

- 电脑绣花机需求增加

- 市场限制因素

- 营业成本高

- 市场机会

- 技术进步和自动化

- 波特五力分析

- 供应商的议价能力

- 消费者/买方议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争公司之间敌对关係的强度

第六章 市场细分

- 按类型

- 自由运动绣花机

- 康乃利指南刺绣机

- 飞梭绣花机

- 按最终用户

- 住宅

- 商业的

- 按地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 法国

- 德国

- 义大利

- 西班牙

- 欧洲其他地区

- 亚太地区

- 印度

- 中国

- 日本

- 韩国

- 其他亚太地区

- 中东/非洲

- 阿拉伯聯合大公国

- 沙乌地阿拉伯

- 其他中东/非洲

- 南美洲

- 北美洲

第七章 竞争格局

第八章概述(市场集中度及主要企业)

第九章 公司简介

- Brother Industries, Ltd.

- Bernina International AG

- Janome Sewing Machine Co., Ltd.

- Tajima Industries Ltd.

- ZSK Stickmaschinen GmbH

- Ricoma International Corporation

- Melco International

- PFAFF Industriesysteme und Maschinen GmbH

- Singer Sewing Company

- SWF Embroidery Machines*

第 10 章 *列表并不详尽。

第十一章市场展望 市场未来

第十二章市场附录

The Embroidery Machine Market size is estimated at USD 1.79 billion in 2024, and is expected to reach USD 2.28 billion by 2029, growing at a CAGR of 4.65% during the forecast period (2024-2029).

The market for embroidery machines has grown significantly in recent years. Factors such as customization and embroidery demand, technological advancement, and the growth of the textile and apparel industry have contributed to this growth. Key market players are constantly innovating to improve machine capabilities.

Key Highlights

- They offer faster stitching speed, better precision, and easy-to-use interfaces. The market is dominated by Asia-Pacific countries such as China, India, and Japan. These countries play a major role in the production and consumption of embroidery machines. The textile industry in Asia-Pacific is expanding rapidly, and the trend of personalized embroidery and embroidery products is on the rise.

- In addition to Asia-Pacific, North America and Europe are also playing an important role in the market. Customized and unique textiles are becoming increasingly popular, and the market has shifted towards computerized and automatic machines, allowing for more efficient and complex designs.

- Technological innovations, such as AI and automation, are changing the industry. These innovations improve efficiency, reduce manual labor, and provide more design flexibility, which is driving the adoption of Embroidery machines across different end-user industries.

Embroidery Machine Market Trends

Multi-head Embroidery Machines are growing - More heads are better than one

Multi-needle embroidery machines have a bright future ahead of them. Single-needle machine embroidery machines, on the other hand, are a bit less exciting. Single-needle sewing machines have been around for a long time. Still, it's only recently that small business owners have started to realize the limitations of using a single-needle machine to run a business.

Embroidery machines with multiple sewing heads can work on different areas of the same garment or fabric at the same time. This means that multiple heads can work on the same part of the embroidery machine at the same time, significantly increasing the efficiency and output of the machine compared to a single-head machine.

Multi-head machines are used by businesses, particularly in the textiles and apparel industry, that need to produce large amounts of embroidery products. This means that multi-head machines are the best choice for manufacturers that have to deal with high-volume orders.

When multiple heads are working on the same embroidery product at the same time on the same machine, the amount of time needed to complete one batch of embroidery decreases significantly. This is especially important for businesses that need to meet tight deadlines and optimize their production schedules.

Asia- Pacific is dominating the region

Asia-Pacific region is home to some of the world's largest apparel markets, such as China, India, and Japan. China is the world's largest exporter of apparel products. Bangladesh and Vietnam are among the top five apparel exporters in the world. Several Asian economies have significant GTF (garment, textiles, and footwear) manufacturing industries.

The garment, textiles, and footwear industries continue to play a vital role in Asian economies, providing employment for around 60 million people in the region and supporting millions more in the form of indirect employment.

The textile sector continues to grow in most of East Asia, with the highest growth rates observed in China, Vietnam, Indonesia, and Cambodia. This region is home to some of the biggest names in the European fashion industry, such as Nike and Zara, as well as C&A, H&M, and others. Textiles represent the fourth largest environmental impact due to European consumption.

As the world's largest garment producer, the East Asian region plays a significant role in the global textiles and apparel supply chain, accounting for around 55 percent of global textile exports in 2019.

Vietnam alone exported an estimated USD 37.6 billion worth of apparel, garments, and textile products to the world in 2022, of which USD 5.8 billion. The industry continues to grow rapidly, partly due to increased involvement in Southeast Asia due to the implementation of the two free trade agreements, the EFTA and the EU-Vietnam free trade agreement. As a result of the European Economic Area Free Trade Agreement (EU-Vietnam Free Trade Agreement), Vietnamese goods have become increasingly dependent on the EU market. However, since the outbreak of COVID-19, the garment and textile industries in East Asia have been affected by a decrease in demand in key markets such as the European Union (EU) and the United States (U.S.). In addition, textile exports from the Indonesian, Malaysian, Thai, and Vietnamese markets also decreased in 2020.

Embroidery Machine Industry Overview

The embroidery machine market is fragmented, with many players operating in the market. Some of the major players in the market are Brother Industries, Ltd, Bernina International AG, Tajima Industries Ltd, and many more. The global market for embroidery machines is on the rise due to technological advancements, growing consumer preferences for bespoke items, and the global growth of the textile and apparel industries.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Current Market Scenario

- 4.2 Government Regulations and Initiatives

- 4.3 Technological Trends

- 4.4 Impact of COVID-19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Growth in Fashion and Textile Industry is driving the market

- 5.1.2 Rise in the demnad for Computerized Embroidery Machines

- 5.2 Market Restraints

- 5.2.1 High Operating Costs

- 5.3 Market Opportunities

- 5.3.1 Technological Advancements and Automation

- 5.4 Porter's Five Forces Analysis

- 5.4.1 Bargaining Power of Suppliers

- 5.4.2 Bargaining Power of Consumers/Buyers

- 5.4.3 Threat of New Entrants

- 5.4.4 Threat of Substitute Products

- 5.4.5 Intensity of Competitive Rivalry

6 MARKET SEGMENTATION

- 6.1 By Type

- 6.1.1 Free Motion Embroidery Machine

- 6.1.2 Cornely Hand Guided Embroidery Machine

- 6.1.3 Schiffli Embroidery Machine

- 6.2 By End -User

- 6.2.1 Residential

- 6.2.2 Commercial

- 6.3 By Geography

- 6.3.1 North America

- 6.3.1.1 USA

- 6.3.1.2 Canada

- 6.3.1.3 Mexico

- 6.3.2 Europe

- 6.3.2.1 France

- 6.3.2.2 Germany

- 6.3.2.3 Italy

- 6.3.2.4 Spain

- 6.3.2.5 Rest of Europe

- 6.3.3 Asia-Pacific

- 6.3.3.1 India

- 6.3.3.2 China

- 6.3.3.3 Japan

- 6.3.3.4 South Korea

- 6.3.3.5 Rest of Asia-Pacific

- 6.3.4 Middle East and Africa

- 6.3.4.1 UAE

- 6.3.4.2 Saudi Arabia

- 6.3.4.3 Rest of Middle East and Africa

- 6.3.5 South America

- 6.3.1 North America

7 COMPETITIVE LANDSCAPE

8 Overview (Market Concentration and Major Players)

9 Company Profiles

- 9.1 Brother Industries, Ltd.

- 9.2 Bernina International AG

- 9.3 Janome Sewing Machine Co., Ltd.

- 9.4 Tajima Industries Ltd.

- 9.5 ZSK Stickmaschinen GmbH

- 9.6 Ricoma International Corporation

- 9.7 Melco International

- 9.8 PFAFF Industriesysteme und Maschinen GmbH

- 9.9 Singer Sewing Company

- 9.10 SWF Embroidery Machines*