|

市场调查报告书

商品编码

1521546

替代性融资:市场占有率分析、产业趋势与统计、成长预测(2024-2029)Alternative Financing - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

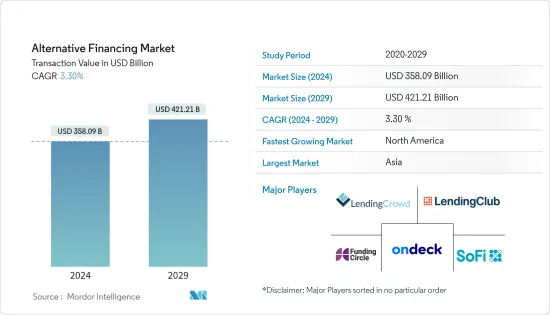

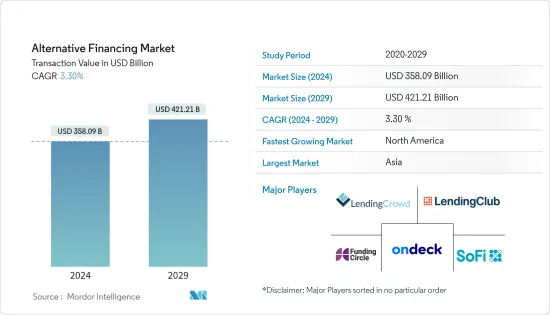

替代性融资市场规模(基于交易价值)预计将从 2024 年的 3,580.9 亿美元扩大到 2029 年的 4,212.1 亿美元,预测期内(2024-2029 年)复合年增长率为 3.30%。

替代性融资市场,也称为替代性融资或P2P借贷,正在经历显着的成长和创新。P2P(P2P)借贷平台是最受欢迎的替代性融资形式之一。这些平台直接匹配借款人和贷款人,消除了对传统金融机构的需求。

群众集资平台已成为个人和企业从大量人群筹集资金的流行方式。发货单融资平台允许企业透过以折扣价向投资者出售未付发货单来赚取即时现金。这减少了延迟付款的机会,并允许企业优化现金流。市场借贷平台将借款人与各种贷款人联繫起来,包括个人、金融机构和银行。这些平台通常使用技术和资料分析来评估信用度并确定利率。

替代性融资市场趋势

拓展业务市场提振市场

业务市场的扩大是替代性融资市场成长的重要趋势。随着商业市场的扩大,更多的企业家和小型企业正在进入市场并为其企业寻求资金筹措。商业市场的成长伴随着科技的进步,特别是金融科技(FinTech)。这些进步正在推动另类融资平台的出现,例如P2P发货单、发票融资和商业预支现金。商业市场的扩张与投资者偏好的变化同时发生。许多投资者,包括机构和个人,正在寻找比传统投资选择提供更高回报的替代投资机会。因此,替代性融资选择正在增加,例如市场借贷和群众集资网站,投资者直接向公司提供资金。

亚洲另类金融市场的崛起

P2P 借贷平台在亚洲越来越受欢迎。这些平台利用科技促进贷款,提供更快、更容易获得的资金筹措选择,特别是对于中小企业(SME)。亚洲的群众集资平台正在激增。这些平台使新兴企业、创新计划和社会倡议能够获得融资。中国、新加坡和韩国等国的群众集资活动正在增加。创投(VC)和私募股权(PE)投资在亚洲迅速成长。中国、印度和东南亚国家等国家是创投和私募股权投资的有吸引力的目的地,并促进创业和创新。

替代性融资业概述

替代性融资市场适度整合。全球主要市场参与者包括 Lending Club、Funding Circle、Kabbage、SoFi 和 OnDeck。在研究期间,市场参与者也进行了併购和联盟,旨在扩大其在市场上的影响力。该市场在预测期内有成长潜力,预计将进一步加剧市场竞争。然而,透过赢得新合约和开拓新市场,中小企业正在透过技术进步和产品创新来增加其市场份额。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场动态

- 市场概况

- 市场驱动因素

- 对多样化资金筹措方式的需求正在推动市场

- 线上平台和社交媒体的兴起

- 市场限制因素

- 与传统资金筹措方式相比,利率可能更高

- 缺乏替代金融意识

- 市场机会

- 资金筹措为中小企业创造机会

- 波特五力分析

- 新进入者的威胁

- 买家/消费者的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争公司之间的敌对关係

- 对市场创新的见解

- COVID-19 对市场的影响

第五章市场区隔

- 按最终用户

- 公司

- 个人

- 按类型

- P2P

- 债务群众集资

- 发货单交易

- 地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 其他北美地区

- 欧洲

- 德国

- 英国

- 法国

- 俄罗斯

- 西班牙

- 其他欧洲国家

- 亚太地区

- 印度

- 中国

- 日本

- 其他亚太地区

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地区

- 中东

- UAE

- 沙乌地阿拉伯

- 其他中东地区

- 北美洲

第六章 竞争状况

- Market Concentration

- 公司简介

- Lending Club

- Funding Circle

- Lending Crowd

- SoFi

- OnDeck

- BlueVine

- Prosper

- Avant

- Square Capital

- Zopa*

第七章 市场机会及未来趋势

第 8 章 免责声明与出版商讯息

The Alternative Financing Market size in terms of transaction value is expected to grow from USD 358.09 billion in 2024 to USD 421.21 billion by 2029, at a CAGR of 3.30% during the forecast period (2024-2029).

The alternative financing market, also known as alternative lending or peer-to-peer lending, has been experiencing significant growth and innovation. Platforms for peer-to-peer (P2P) lending are among the most popular types of alternative finance. These platforms match borrowers and lenders directly, eliminating the need for a traditional financial institution.

Crowdfunding platforms have gained popularity for individuals and businesses to raise funds from many people. Invoice financing platforms allow companies to obtain immediate cash by selling their outstanding invoices to investors at a discount. This lowers the possibility of late payments and helps firms optimize their cash flow. Marketplace lending platforms connect borrowers with various lenders, including individuals, institutions, or banks. These platforms often use technology and data analytics to assess creditworthiness and determine interest rates.

Alternative Financing Market Trends

Increase Business Market is Fuelling the Market

The increasing business market is a significant trend for the growth of the alternative financing market. As the business market expands, more entrepreneurs and small businesses are entering the market, seeking capital to finance their ventures. The growth of the business market has been accompanied by technological advancements, particularly in financial technology (FinTech). These advancements have facilitated the emergence of alternative financing platforms, such as peer-to-peer lending, crowdfunding, invoice financing, and merchant cash advances. The expansion of the business market has coincided with a shift in investor preferences. Many investors, including institutional and retail investors, are now looking for alternative investment opportunities that offer potentially higher returns than traditional investment options. As a result, there has been an increase in alternative financing options that let investors directly fund firms, like marketplace lending and crowdfunding websites.

Rise in Alternative Financing Market in Asia

P2P lending platforms have gained popularity in Asia. These platforms leverage technology to facilitate lending and offer quicker and more accessible funding options, particularly for small and medium-sized enterprises (SMEs). Asia has witnessed a surge in crowdfunding platforms. These platforms allow capital access to startups, creative projects, and social initiatives. Countries like China, Singapore, and South Korea have seen a rise in crowdfunding activities. Asia has witnessed a surge in venture capital (VC) and private equity (PE) investments. Countries such as China, India, and Southeast Asian nations have become attractive destinations for venture capital and private equity investments, fostering entrepreneurship and innovation.

Alternative Financing Industry Overview

The alternative financing market is moderately consolidated. Some major global market players include Lending Club, Funding Circle, Kabbage, SoFi, and OnDeck, among others. In the study period, market players were also involved in mergers and acquisitions, and partnerships focused on expanding their presence in the market. The market has the potential to grow during the forecast period, and this is likely to further fuel competition. However, by securing new contracts and tapping new markets, small- to medium-sized enterprises are increasing their presence on the market with technological progress and product innovation.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Need for More Diverse Funding Options is Driving the Market

- 4.2.2 The Rise of Online Platforms and Social Media

- 4.3 Market Restraints

- 4.3.1 Potential for Higher Interest Rates Compared to Traditional Financing Options

- 4.3.2 Lack of Awareness on Alternative Financing

- 4.4 Market Opportunities

- 4.4.1 Access to Capital for Small and Medium-Sized Enterprises is Creating an Opportunity

- 4.5 Porters 5 Force Analysis

- 4.5.1 Threat of New Entrants

- 4.5.2 Bargaining Power of Buyers/Consumers

- 4.5.3 Bargaining Power of Suppliers

- 4.5.4 Threat of Substitute Products

- 4.5.5 Intensity of Competitive Rivalry

- 4.6 Insights on Technological Innovations in the Market

- 4.7 Impact of Covid-19 on the Market

5 MARKET SEGMENTATION

- 5.1 By End User

- 5.1.1 Businesses

- 5.1.2 Individuals

- 5.2 Type

- 5.2.1 Peer-To-Peer Lending

- 5.2.2 Debt-Based Crowdfunding

- 5.2.3 Invoice Trading

- 5.3 Geography

- 5.3.1 North America

- 5.3.1.1 US

- 5.3.1.2 Canada

- 5.3.1.3 Mexico

- 5.3.1.4 Rest of North America

- 5.3.2 Europe

- 5.3.2.1 Germany

- 5.3.2.2 UK

- 5.3.2.3 France

- 5.3.2.4 Russia

- 5.3.2.5 Spain

- 5.3.2.6 Rest of Europe

- 5.3.3 Asia Pacific

- 5.3.3.1 India

- 5.3.3.2 China

- 5.3.3.3 Japan

- 5.3.3.4 Rest of Asia Pacific

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle East

- 5.3.5.1 UAE

- 5.3.5.2 Saudi Arabia

- 5.3.5.3 Rest of Middle East

- 5.3.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Company Profiles

- 6.2.1 Lending Club

- 6.2.2 Funding Circle

- 6.2.3 Lending Crowd

- 6.2.4 SoFi

- 6.2.5 OnDeck

- 6.2.6 BlueVine

- 6.2.7 Prosper

- 6.2.8 Avant

- 6.2.9 Square Capital

- 6.2.10 Zopa*