|

市场调查报告书

商品编码

1521567

家庭食品储存容器:市场占有率分析、产业趋势/统计、成长预测(2024-2029)Home Food Storage Containers - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

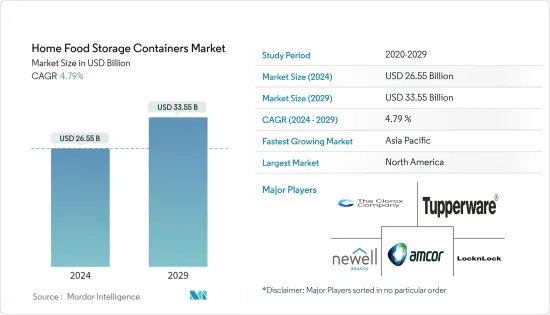

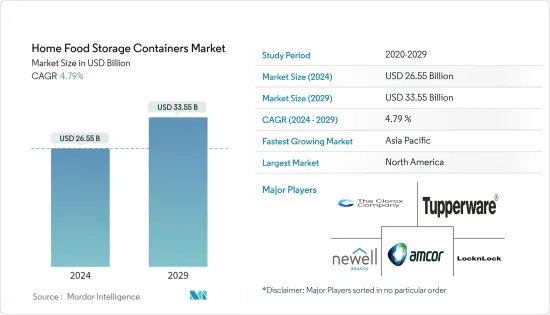

家庭食品储存容器市场规模预计到2024年为265.5亿美元,到2029年达到335.5亿美元,在预测期内(2024-2029年)复合年增长率为4.79%。

由于人们对永续性问题和环境挑战的认识不断增强,食品储存容器市场在全球范围内不断增长。製造商专注于食品容器的美观和创新,为客户提供各种创新的食品包装,以扩大市场成长。

随着世界继续应对气候变迁的影响,消费者正在改变偏好,以推广环保和永续的包装产品。市场上的重要参与者正在改变其包装材料以满足客户的要求。例如,具有环保意识的Z世代正在推动食品储存容器等环保包装产品,这正在创造市场机会。

随着对储存已调理食品的食品容器的需求增加,製造商正在增加产量。都市化的加速、生活方式的改变以及对包装食品的需求增加将支持食品储存容器的未来成长。

家用食品储存容器的市场趋势

食品容器提供的便利性正在推动市场发展。

对家用食品容器的需求增加,因为它们变得更方便携带和包装。製造商已适应不断变化的消费者生活方式。推动家庭食品容器需求的因素之一是包装食品和加工食品消费的增加。袋子和小袋因其视觉吸引力、保鲜性、便利性和便携性而受到消费者的欢迎。这些特性正在推动对家庭食品储存容器的需求。

北美市场占据主导地位

由于家庭食品储存容器的需求不断增长以及电子商务领域的市场开拓不断加快,北美在市场上占据主导地位。此外,零售业对可重复使用的家用食品储存容器的需求不断增加,也促进了市场的成长。随着北美消费者意识到一次性塑胶容器和可重复使用的替代品对环境的影响,该地区对由永续和环保产品製成的家庭食品储存容器的需求不断增加。这家北美製造商生产无BPA且食品安全的家用食品储存容器。因此,製造商的这些产品创新增加了北美对家用食品容器的需求。

家用食品储存容器产业概况

家庭食品储存容器市场分散。市场上的主要企业正在投资研发以扩大其产品线。市场参与者也采取各种策略,透过巨额投资、新产品发布、併购和收购来扩大其全球足迹。主要参与者包括高乐氏公司 (The Clorox Company)、特百惠 (Tupperware)、Newell Brands、Amcor PLC、乐扣乐扣 (LocknLock Co.)。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场动态与洞察

- 市场概况

- 市场驱动因素

- 人们越来越偏好家常饭菜

- 食品废弃物和永续性意识

- 市场限制因素

- 市场竞争与物流挑战

- 对环境造成的影响

- 市场机会

- 家庭食品储存容器市场的技术进步

- 更多转向生态包装产品

- 产业价值链分析

- 产业吸引力-波特五力分析

- 新进入者的威胁

- 买方议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争公司之间的敌对关係

- 对市场创新的见解

- COVID-19 对市场的影响

第五章市场区隔

- 按类型

- 难的

- 软质的

- 按材质

- 塑胶

- 纸

- 金属

- 玻璃

- 副产品

- 包包

- 小袋

- 容器

- 按用途

- 水果和蔬菜

- 肉品

- 糖果/糖果零食

- 按地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 北美其他地区

- 亚太地区

- 印度

- 中国

- 日本

- 澳洲

- 其他亚太地区

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地区

- 欧洲

- 英国

- 德国

- 义大利

- 其他欧洲国家

- 中东/非洲

- 南非

- 阿拉伯聯合大公国

- 其他中东和非洲

第六章 竞争状况

- 市场集中度概况

- 公司简介

- The Clorox Company

- Tupperware

- Newell Brands

- Amcor plc

- LocknLock Co.

- Prepara

- Thermos LLC

- Freshware

- Oneida

- Glasslock*

第七章 市场趋势

第 8 章 免责声明与出版商讯息

The Home Food Storage Containers Market size is estimated at USD 26.55 billion in 2024, and is expected to reach USD 33.55 billion by 2029, growing at a CAGR of 4.79% during the forecast period (2024-2029).

The food storage containers market is growing globally due to the increased awareness regarding sustainability issues and environmental challenges. Manufacturers focus on the aesthetics and innovation of food containers to provide customers with different innovative food packaging, expanding the market's growth.

Consumers are changing their preferences to promote environmentally friendly and sustainable packaging products because the world continues to fight against the effects of weather change. Significant players in the market are changing the packaging materials to meet customers' requirements. For instance, the environmentally conscious Z generation promotes eco-friendly packaging products, such as food storage containers, which creates opportunities for the market.

Manufacturers are increasing production levels with the rise in demand for food containers to store ready-to-eat meals. Rising urbanization, changing lifestyles, and increased demand for packaged food support the growth of food storage containers in the future.

Home Food Storage Containers Market Trends

The Convenience Offered by Food Containers is Driving the Market

The demand for home food containers increased because of the convenience of carrying and packaging. Manufacturers have adapted to the changing lifestyles of consumers. One of the factors that is increasing the demand for home food containers is that consumption of packaged and processed food is increasing. Bags and pouches became popular among consumers because they provide visual appeal, preservation of freshness, convenience, and portability. These qualities increase the demand for home food storage containers.

North America Dominates the Market

North America dominates the market due to the region's rising demand for home food storage containers and increased development in the e-commerce sector. Moreover, increasing demand for reusable home food storage containers in the retail sector increased the market growth. Consumers in North America are conscious of the environmental impact of disposable plastic containers and reusable alternatives; therefore, the demand for home food storage containers made of sustainable and eco-friendly products has increased in the region. Manufacturers in North America make home food storage containers made of BPA-free and food-safe. Thus, these product innovations made by the manufacturers increased the demand for home food containers in North America.

Home Food Storage Containers Industry Overview

The home food storage container market is fragmented. Major players in the market are investing in research and development to expand the product line. Market players are also taking various strategies to expand their global footprint through huge investments, new product launches, mergers, and acquisitions. The major players are The Clorox Company, Tupperware, Newell Brands, Amcor PLC, and LocknLock Co.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS AND INSIGHTS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Growing Preference Toward Home Cooked Meals

- 4.2.2 Awareness on Food Waste and Sustainability

- 4.3 Market Restraints

- 4.3.1 Market Competition and Logistics Challenges

- 4.3.2 Environmental Impact

- 4.4 Market Opportunities

- 4.4.1 Technological Advancements in the Home Food Storage Containers Market

- 4.4.2 Increasing Shift Toward Environmentally Packaging Products

- 4.5 Industry Value Chain Analysis

- 4.6 Industry Attractiveness - Porters' Five Forces Analysis

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Buyers

- 4.6.3 Bargaining Power of Suppliers

- 4.6.4 Threat of Substitutes

- 4.6.5 Intensity of Competitive Rivalry

- 4.7 Insights on Technology Innovation in the Market

- 4.8 Impact of COVID-19 on the Market

5 MARKET SEGMENTATION

- 5.1 By Type

- 5.1.1 Rigid

- 5.1.2 Flexible

- 5.2 By Material

- 5.2.1 Plastic

- 5.2.2 Paper

- 5.2.3 Metal

- 5.2.4 Glass

- 5.3 By Product

- 5.3.1 Bag

- 5.3.2 Pouch

- 5.3.3 Containers

- 5.4 By Application

- 5.4.1 Fruits and Vegetables

- 5.4.2 Meat Products

- 5.4.3 Candy and Confections

- 5.5 By Geography

- 5.5.1 North America

- 5.5.2 United States

- 5.5.3 Canada

- 5.5.4 Mexico

- 5.5.5 Rest of North America

- 5.6 Asia-Pacific

- 5.6.1 India

- 5.6.2 China

- 5.6.3 Japan

- 5.6.4 Australia

- 5.6.5 Rest of Asia-Pacific

- 5.7 South America

- 5.7.1 Brazil

- 5.7.2 Argentina

- 5.7.3 Rest of South America

- 5.8 Europe

- 5.8.1 UK

- 5.8.2 Germany

- 5.8.3 Italy

- 5.8.4 Rest of Europe

- 5.9 Middle East & Africa

- 5.9.1 South Africa

- 5.9.2 UAE

- 5.9.3 Rest of Middle East & Africa

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concetration Overview

- 6.2 Company Profiles

- 6.2.1 The Clorox Company

- 6.2.2 Tupperware

- 6.2.3 Newell Brands

- 6.2.4 Amcor plc

- 6.2.5 LocknLock Co.

- 6.2.6 Prepara

- 6.2.7 Thermos L.L.C.

- 6.2.8 Freshware

- 6.2.9 Oneida

- 6.2.10 Glasslock*