|

市场调查报告书

商品编码

1521569

ESG投资分析:市场占有率分析、产业趋势/统计、成长预测(2024-2029)ESG Investment Analytics - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

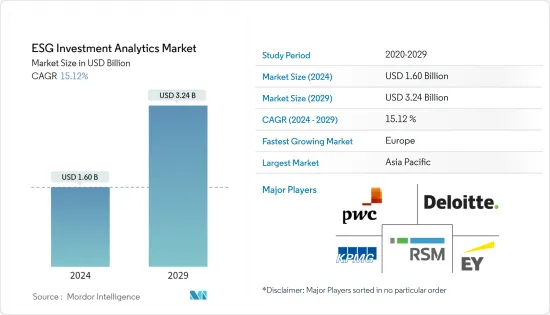

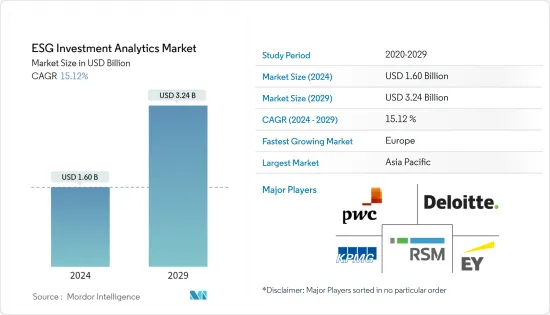

ESG投资分析的市场规模预计2024年为16亿美元,预计2029年将达到32.4亿美元,在市场估算和预测期间(2024-2029年)复合年增长率为15.12%。

ESG投资分析涉及ESG因素相关资料的收集、分析和解释。这些资料可帮助投资人根据 ESG 表现决定投资哪些公司。 ESG 分析提供者提供各种工具和服务来评估和衡量公司的 ESG 绩效。

投资者越来越清楚在投资策略中考虑 ESG 的重要性。许多投资者认为 ESG 因素有助于长期价值创造,并正在将 ESG 考量纳入决策流程中。 ESG 分析可深入了解与公司 ESG 实践相关的风险和机会,使投资者能够有效管理风险。 ESG 考量正在融入传统投资流程。资产管理公司和机构投资者正在将 ESG 分析纳入投资研究、投资组合建构和风险管理。

ESG投资分析的市场趋势

消费者和零售成长提振市场

- ESG(环境、社会、管治)投资分析市场受到不断成长的消费者和零售业的影响。随着投资者越来越意识到永续性、社会影响和道德商业实践,他们越来越多地寻求反映这些原则的投资。消费者和零售业在推动这一趋势方面发挥关键作用。

- 随着客户越来越意识到永续性、社会影响和道德商业实践,他们越来越多地寻求符合这些理想的投资。消费者对永续和社会责任产品的需求不断增加可能会奖励公司提高其 ESG 绩效。因此,投资者越来越有兴趣分析 ESG 因素,以确定符合这些不断变化的消费者偏好的投资机会。

ESG投资分析在欧洲的兴起

- 为了在欧洲推广ESG投资分析,政府和监管机构必须实施要求企业揭露相关ESG资讯的法规。这些法规可以设定ESG指标的报告标准,并确保资料的透明度和可比较性。将ESG资料与现有金融资料相结合并利用技术将加深对欧洲ESG因素的分析和理解。我们分析大量 ESG资料,并使用人工智慧和机器学习技术来发现重要趋势和见解。

- 让投资者了解 ESG 因素的重要性及其对投资绩效的影响正在推动欧洲对 ESG 投资分析的需求。我们鼓励投资者透过投资者教育计划、研讨会和宣导活动将 ESG方面纳入其投资计划,以认识到 ESG资料的重要性。

ESG投资分析产业概况

ESG 投资分析市场正在整合。 ESG投资分析市场由技术先进的国际大公司占据。中小企业正在透过获取新契约和开拓新市场来扩大其影响力。 ESG投资分析市场的主要企业包括普华永道、毕马威、安永、RSM Global和德勤。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场动态

- 市场概况

- 市场驱动因素

- 日益关注企业社会责任

- 市场限制因素

- 缺乏标准化ESG资料限制市场

- 市场机会

- 投资决策中对 ESG 整合的需求不断增长

- 波特五力分析

- 新进入者的威胁

- 买家/消费者的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争公司之间的敌对关係

- 对市场创新的见解

- COVID-19 对市场的影响

第五章市场区隔

- 按类型

- 处理 ESG 预测

- 建立ESG报告

- 按用途

- 金融业

- 消费品/零售

- 按地区

- 北美洲

- 美国

- 加拿大

- 北美其他地区

- 欧洲

- 德国

- 英国

- 俄罗斯

- 其他欧洲国家

- 亚太地区

- 印度

- 中国

- 日本

- 其他亚太地区

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地区

- 中东/非洲

- 阿拉伯聯合大公国

- 沙乌地阿拉伯

- 南非

- 其他中东和非洲

- 北美洲

第六章 竞争状况

- 市场集中度概况

- 公司简介

- PWC

- EY

- Deloitte

- KPMG

- RSM Global

- RPS Group

- MSCI Inc.

- Crowe

- RepRisk

- ISS ESG

- Kroll*

第七章 市场趋势

第 8 章 免责声明与出版商讯息

The ESG Investment Analytics Market size is estimated at USD 1.60 billion in 2024, and is expected to reach USD 3.24 billion by 2029, growing at a CAGR of 15.12% during the forecast period (2024-2029).

ESG investment analytics involves collecting, analyzing, and interpreting data related to ESG factors. This data helps investors decide which companies to invest in based on their ESG performance. ESG analytics providers offer various tools and services to assess and measure companies' ESG performance.

The significance of including ESG considerations in investment strategies is becoming apparent to investors. Many investors incorporate ESG considerations into their decision-making processes, believing ESG factors may contribute to long-term value creation. ESG analytics provide insights into the risks and opportunities associated with a company's ESG practices, allowing investors to manage risks effectively. ESG considerations are becoming more integrated into traditional investment processes. Asset managers and institutional investors incorporate ESG analytics into their investment research, portfolio construction, and risk management practices.

ESG Investment Analytics Market Trends

Increasing Consumer and Retail Fueling the Market

- The increasing consumer and retail sectors impact the ESG (environmental, social, and governance) investment analytics market. Investors are calling for investments that reflect these principles more and more as they become more aware of sustainability, social impact, and ethical corporate practices. The consumer and retail sectors play a crucial role in driving this trend.

- Investments that align with these ideals are in greater demand as customers' awareness of sustainability, social impact, and ethical corporate practices grows. This increased consumer demand for sustainable and socially responsible products may incentivize companies to improve their ESG performance. As a result, investors are increasingly interested in analyzing ESG factors to identify investment opportunities that align with these changing consumer preferences.

Increasing ESG Investment Analytics in Europe

- Governments and regulatory bodies are crucial in promoting ESG investment analytics in Europe by implementing regulations requiring companies to disclose relevant ESG information. These regulations can set standards for reporting ESG metrics and ensure transparency and comparability of the data. Integrating ESG data with existing financial data and leveraging technology enhances the analysis and understanding of ESG factors in Europe. Huge amounts of ESG data are being analyzed to find important trends and insights using artificial intelligence and machine learning techniques.

- Educating investors about the importance of ESG factors and their impact on investment performance is driving demand for ESG investment analytics in Europe. Investors are encouraged to incorporate ESG aspects into their investing plans by employing investor education programs, workshops, and awareness efforts that assist them in recognizing the importance of ESG data.

ESG Investment Analytics Industry Overview

The ESG investment analytics market is consolidated. Major international players with technological advancement are operating in the ESG investment analytics market. Mid-size to smaller companies are increasing their presence by securing new contracts and tapping new markets. Major players in the ESG investment analytics market are PwC, KPMG, EY, RSM Global, and Deloitte.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Increased Focus on Corporate Social Responsibility

- 4.3 Market Restraints

- 4.3.1 Lack of Standardized ESG Data Restraining the Market

- 4.4 Market Opportunities

- 4.4.1 Increasing Demand for ESG Integration in Investment Decision Making

- 4.5 Porter's Five Force Analysis

- 4.5.1 Threat of New Entrants

- 4.5.2 Bargaining Power of Buyers/Consumers

- 4.5.3 Bargaining Power of Suppliers

- 4.5.4 Threat of Substitute Products

- 4.5.5 Intensity of Competitive Rivalry

- 4.6 Insights on Technological Innovations in the Market

- 4.7 Impact of COVID-19 on the Market

5 MARKET SEGMENTATION

- 5.1 By Type

- 5.1.1 Addressing ESG Expectations

- 5.1.2 Preparing ESG Reports

- 5.2 By Application

- 5.2.1 Financial Industry

- 5.2.2 Consumer and Retail

- 5.3 Geography

- 5.3.1 North America

- 5.3.1.1 United States

- 5.3.1.2 Canada

- 5.3.1.3 Rest of North America

- 5.3.2 Europe

- 5.3.2.1 Germany

- 5.3.2.2 United Kingdom

- 5.3.2.3 Russia

- 5.3.2.4 Rest of Europe

- 5.3.3 Asia-Pacific

- 5.3.3.1 India

- 5.3.3.2 China

- 5.3.3.3 Japan

- 5.3.3.4 Rest of Asia-Pacific

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle East & Africa

- 5.3.5.1 United Arab Emirates

- 5.3.5.2 Saudi Arabia

- 5.3.5.3 South Africa

- 5.3.5.4 Rest of Middle East & Africa

- 5.3.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Company Profiles

- 6.2.1 PWC

- 6.2.2 EY

- 6.2.3 Deloitte

- 6.2.4 KPMG

- 6.2.5 RSM Global

- 6.2.6 RPS Group

- 6.2.7 MSCI Inc.

- 6.2.8 Crowe

- 6.2.9 RepRisk

- 6.2.10 ISS ESG

- 6.2.11 Kroll*