|

市场调查报告书

商品编码

1521589

绿建筑:市场占有率分析、产业趋势与统计、成长预测(2024-2029)Green Buildings - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

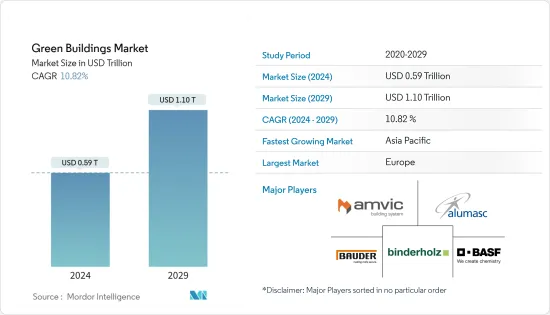

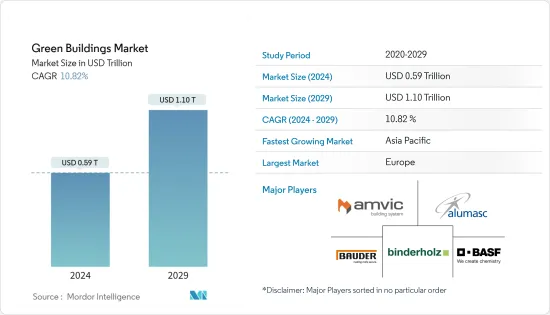

预计到2024年,绿建筑市场规模将达到5,900亿美元,预计2029年将达到1.1兆美元,在预测期内(2024-2029年)复合年增长率为10.82%。

主要亮点

- 绿色建筑市场是指环境友善、永续建筑的建设和营运。这些建筑旨在最大限度地减少对环境的影响,促进居住者的健康和福祉,并节省资源。

- 绿色建筑融合了多种功能和技术,包括节能照明和暖通空调系统、太阳能电池板等再生能源来源、高效的水资源管理系统、回收和永续材料以及改善的室内空气品质。

- 近年来,由于人们对环境问题的认识不断增强以及减少碳排放的愿望,绿色建筑市场迅速增长。许多国家都推出了鼓励绿建筑建设的政策和政策,提供了LEED(能源与环境设计领先)和BREEAM(建筑研究所环境评估方法)等奖励和认证。

- 绿建筑的好处很多。其中包括减少能源消费量、降低营运成本、减少用水量、提高居住者舒适度和生产力,并为更健康、更永续的未来做出贡献。

- 绿建筑市场不仅限于商业设施,还包括住宅、教育、医疗保健和政府建筑。企业、组织和个人正在积极采用绿色建筑,使其成为一项全球机芯。

绿建筑市场趋势

商业领域对永续建筑的投资增加和需求不断增长

企业对永续建筑的需求预计将推动许多全球市场的办公市场动态。未来几年,全球20个最大的办公市场(包括纽约、巴黎和新加坡)预计只能满足34%的低碳需求,目前的需求为平方公尺,即1平方公尺。

永续建筑也正在改变居住者看待建筑的方式。传统上,绿色认证一直是永续建筑的标誌,租户也愿意为此付费。仲量联行 2023 年交易案例表明,经过认证的建筑在全球各个办公市场细分领域继续保持健康的租金溢价,但情况正在改变。

除了绿色认证外,租户也越来越关注环境绩效指标(如能源强度、电气化率等)。例如,仲量联行 2020 年的交易案例显示,儘管该产业成长放缓,但伦敦和巴黎的优质办公空间今年的租金仍创下历史新高。

亚太地区稳定成长

预计亚太地区的绿色建筑市场将在预测期内快速成长。这是由于多种因素造成的,包括政府加强对永续建筑实践的支持、对气候变迁的日益关注以及对绿色建筑好处的认识不断增强。

亚太地区的绿色建筑市场正在经历显着成长。该地区包括中国、印度、日本、新加坡和澳洲。这些国家积极推广永续建筑实践,以解决环境问题并提高能源效率。

中国作为该地区最大的经济体之一,为推动绿色建筑做出了巨大努力。各国政府实施了鼓励节能建筑的法规和政策,并为绿建筑发展制定了宏伟的目标。最近的趋势包括中国绿色建筑计划的激增,其中包括生态城市和永续城市发展倡议。

另一个主要区域参与者印度也在绿建筑领域取得了长足进展。印度绿色建筑委员会(IGBC)一直致力于推广绿色建筑和认证永续计划。印度许多城市都采用了绿色建筑规范和法规,增加了商业和住宅领域对绿建筑的需求。

日本在将永续实践融入建筑业建设产业有着悠久的历史。该国是节能技术的领导者,并推出了严格的建筑规范以促进永续性。日本政府推出了各种奖励和认证来鼓励采用绿色建筑。

新加坡以其创新的城市规划而闻名,并处于亚太地区绿色建筑倡议的前沿。建设局 (BCA) 制定了雄心勃勃的能源效率和永续性目标,绿色建筑认证(例如绿色标誌计画)得到了广泛认可。

澳洲拥有广阔的景观和多样化的气候,致力于永续建筑实践,以减少对环境的影响。澳洲绿建筑委员会(GBCA)致力于推广绿建筑标准,澳洲许多城市都采用了绿色建筑政策和法规。

总体而言,在政府措施、环保意识不断提高以及对能源效率的渴望的推动下,亚太地区绿色建筑市场正在经历显着增长。该地区的绿色建筑计划、认证和永续城市发展努力不断增加。

随着亚太地区人口迅速增加和可支配收入增加,预计该地区对绿色建筑的需求也将增加。 2023年亚洲人口为47亿,预计2050年将达88亿。因此,亚洲的都市化预计将在预测期内持续下去。

绿建筑产业概况

随着越来越多的国家和公司认识到永续性和能源效率的重要性,绿色建筑市场的竞争日益激烈。这个市场有几个主要企业,每个参与者都提供独特的解决方案和服务,以满足对绿色建筑不断增长的需求。

市场的主要企业之一是建设产业。许多建设公司正在采用绿色建筑实践,并将永续设计原则融入计划中。这些公司与建筑师、工程师和其他专业人士密切合作,确保他们的建筑符合最高的永续性标准。

市场主要企业包括 Ambic Systems、Alumasc Group PLC、 BASF SE、Binderholz Gmbh 和 Bauder Limited。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

- 分析方法

- 调查阶段

第三章执行摘要

第四章市场洞察

- 目前的市场状况

- 科技趋势

- 绿建筑产业供应链/价值链分析洞察

- 预製建筑业使用的不同结构概述

- 绿建筑产业成本结构分析

- COVID-19 的影响

第五章市场动态

- 促进因素

- 建筑能源效率

- 灵活性和自订选项

- 抑制因素

- 适合建设的土地有限

- 与传统建筑相比品质较低

- 机会

- 各行业需求

- 节能建筑

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 消费者/买方议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争公司之间敌对关係的强度

第六章 市场细分

- 副产品

- 外饰商品

- 室内装潢产品

- 其他产品(建筑系统、太阳能係统等)

- 按最终用户

- 住宅

- 办公室

- 零售

- 设施

- 其他最终用户

- 按地区

- 亚太地区

- 北美洲

- 欧洲

- 南美洲

- 中东/非洲

第七章 竞争格局

- 公司简介

- Amvik Systems

- Alumasc Group PLC

- BASF SE

- Binderholz Gmbh

- Bauder Limited

- Interface Inc.

- Forbo International SA

- Owens Corning SA

- CEMEX

- Kingspan Group PLC*

- 其他公司

第八章市场的未来

第九章 附录

The Green Buildings Market size is estimated at USD 0.59 trillion in 2024, and is expected to reach USD 1.10 trillion by 2029, growing at a CAGR of 10.82% during the forecast period (2024-2029).

Key Highlights

- The green buildings market refers to constructing and operating environmentally friendly and sustainable buildings. These buildings are designed to minimize their environmental impact, promote the health and well-being of occupants, and conserve resources.

- Green buildings incorporate various features and technologies such as energy-efficient lighting and HVAC systems, renewable energy sources like solar panels, efficient water management systems, recycled and sustainable materials, and improved indoor air quality.

- The market for green buildings has been growing rapidly in recent years due to increased awareness of environmental issues and the desire to reduce carbon emissions. Many countries have introduced policies and regulations to encourage the construction of green buildings, offering incentives and certifications such as LEED (Leadership in Energy and Environmental Design) or BREEAM (Building Research Establishment Environmental Assessment Method).

- The benefits of green buildings are numerous. They help reduce energy consumption, lower operating costs, decrease water usage, improve occupant comfort and productivity, and contribute to a healthier and more sustainable future.

- The green buildings market is not limited to commercial buildings but includes residential, educational, healthcare, and government buildings. It has become a global movement, with companies, organizations, and individuals actively adopting green building practices.

Green Buildings Market Trends

Increasing investment and rise in demand for sustainable buildings in the commercial segment

Corporate demand for sustainable buildings is expected to drive office market dynamics in many global markets. Across 20 of the world's largest office markets (New York, Paris, Singapore, etc.) in the next few years, only 34% of low-carbon demand is expected to be met, one square meter for every three square meters currently in demand.

Sustainable buildings are also changing the way occupiers view them. Green certifications have traditionally been the hallmark of sustainable buildings, and tenants are willing to pay for them. JLL's 2023 transaction evidence shows that certified buildings are still achieving healthy rental premiums across various global office market segments, but the landscape is changing.

Tenants increasingly look for environmental performance indicators (e.g., energy intensity, electrification, etc.) in addition to green credentials. For example, JLL's 2020 transaction evidence shows that high-quality prime office spaces in London and Paris are reaching record rental heights this year, even as the sector slows down.

Asia-Pacific is growing at a steady pace

The Asia-Pacific green buildings market is expected to grow rapidly during the forecast period. This is due to various factors, such as the increasing government support for sustainable building practices, growing concerns about climate change, and increasing awareness of the benefits of green buildings.

The Asia-Pacific region has been witnessing significant growth in the green building market. The region includes China, India, Japan, Singapore, and Australia. These countries have actively promoted sustainable building practices to address environmental concerns and encourage energy efficiency.

China, one of the region's largest economies, has made substantial efforts to promote green buildings. The government has implemented policies and regulations to encourage energy-efficient construction and has set ambitious targets for green building development. In recent years, China has seen a surge in green building projects, including eco-cities and sustainable urban development initiatives.

India, another major regional player, has also made strides in the green building sector. The Indian Green Building Council (IGBC) has been instrumental in promoting green building practices and certifying sustainable projects. Many cities in India have adopted green building codes and regulations, and there is a growing demand for green buildings in both the commercial and residential sectors.

Japan has a long history of incorporating sustainable practices in its architecture and construction industry. The country has been a leader in energy-efficient technologies and has implemented strict building standards to promote sustainability. The Japanese government has introduced various incentives and certifications to encourage green building adoption.

Singapore, known for its innovative urban planning, has been at the forefront of green building initiatives in the Asia-Pacific region. The Building and Construction Authority (BCA) has set ambitious targets for energy efficiency and sustainability, and green building certifications such as the Green Mark scheme are widely recognized.

Australia, with its vast landscapes and diverse climate, has been focusing on sustainable building practices to reduce its environmental impact. The Green Building Council of Australia (GBCA) has been instrumental in promoting green building standards, and many Australian cities have adopted green building policies and regulations.

Overall, the Asia-Pacific green building market is experiencing significant growth, driven by government initiatives, increasing environmental awareness, and the desire for energy efficiency. The region is witnessing a rise in green building projects, certifications, and sustainable urban development initiatives.

The demand for green buildings in Asia-Pacific is also expected to grow due to its rapidly growing population and rising disposable income. In 2023, Asia had a population of 4.7 billion, which is expected to reach 8.8 billion people by 2050. As a result, Asia's urbanization is expected to continue during the forecast period.

Green Buildings Industry Overview

The green building market has become increasingly competitive as more countries and companies recognize the importance of sustainability and energy efficiency. Several key players have emerged in this market, each offering unique solutions and services to meet the growing demand for green buildings.

One of the major players in the market is the construction industry. Many construction companies have embraced green building practices and incorporated sustainable design principles into their projects. These companies often work closely with architects, engineers, and other professionals to ensure their buildings meet the highest sustainability standards.

Some of the major players in the market include Amvik Systems, Alumasc Group PLC, BASF SE, Binderholz Gmbh, and Bauder Limited.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definitions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

- 2.1 Analysis Methodology

- 2.2 Research Phases

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Current Market Scenario

- 4.2 Technological Trends

- 4.3 Insights on Supply Chain/Value Chain Analysis of the Green Buildings Industry

- 4.4 Brief on Different Structures Used in the Prefabricated Buildings Industry

- 4.5 Cost Structure Analysis of the Green Buildings Industry

- 4.6 Impact of COVID 19

5 MARKET DYNAMICS

- 5.1 Drivers

- 5.1.1 Energy Efficiency in Construction

- 5.1.2 Flexibility and Customization Options

- 5.2 Restraints

- 5.2.1 Limited Availability of Suitable Land for Construction

- 5.2.2 Lower Quality Compared to Traditional Construction

- 5.3 Opportunitites

- 5.3.1 Demand Across Various Sectors

- 5.3.2 Energy Efficient Construction

- 5.4 Industry Attractiveness - Porter's Five Forces Analysis

- 5.4.1 Bargaining Power of Suppliers

- 5.4.2 Bargaining Power of Consumers/Buyers

- 5.4.3 Threat of New Entrants

- 5.4.4 Threat of Substitute Products

- 5.4.5 Intensity of Competitive Rivalry

6 MARKET SEGMENTATION

- 6.1 By Product

- 6.1.1 Exterior Products

- 6.1.2 Interior products

- 6.1.3 Other Products (Building Systems, Solar Systems, etc.)

- 6.2 By End User

- 6.2.1 Residential

- 6.2.2 Office

- 6.2.3 Retail

- 6.2.4 Institutional

- 6.2.5 Other End Users

- 6.3 By Geography

- 6.3.1 Asia-Pacific

- 6.3.2 North America

- 6.3.3 Europe

- 6.3.4 South America

- 6.3.5 Middle East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Overview (Market Concentration and Major Players)

- 7.2 Company Profiles

- 7.2.1 Amvik Systems

- 7.2.2 Alumasc Group PLC

- 7.2.3 BASF SE

- 7.2.4 Binderholz Gmbh

- 7.2.5 Bauder Limited

- 7.2.6 Interface Inc.

- 7.2.7 Forbo International SA

- 7.2.8 Owens Corning SA

- 7.2.9 CEMEX

- 7.2.10 Kingspan Group PLC*

- 7.3 Other Companies