|

市场调查报告书

商品编码

1521636

空气煞车系统:市场占有率分析、产业趋势/统计、成长预测(2024-2029)Air Brake System - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

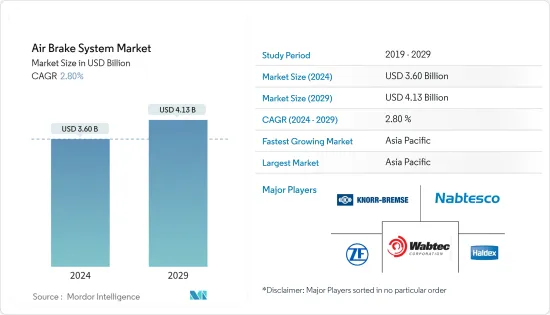

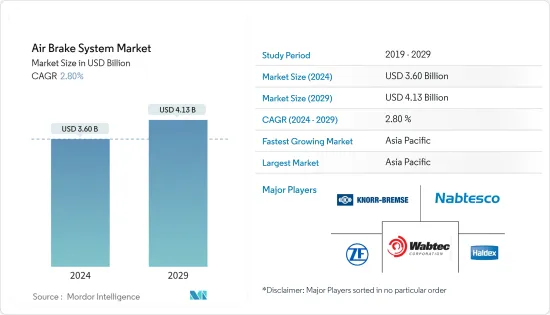

空气煞车系统市场规模预计到 2024 年为 36 亿美元,预计到 2029 年将达到 41.3 亿美元,在预测期内(2024-2029 年)复合年增长率为 2.80%。

从中期来看,商用卡车和巴士的需求预计将在预测期内显着推动市场成长,销售和产量增加,特别是在物流和建筑领域。

一些地区正在开发大型基础设施计划,包括高速公路、支线公路、港口和机场的建设,这对增强重型卡车的需求发挥关键作用。

由于电动车 (EV) 零件的特殊製造要求,电动车 (EV) 正在快速成长。对轻量、高性能组件的需求不断增加,为市场创造了利润丰厚的机会。

空气煞车系统市场趋势

客车占主要市场占有率

- 混合和电动客车使用两种煞车系统:再生煞车和空气煞车。再生煞车的工作原理是使用马达作为发电机,透过执行「再生减速」来回收煞车过程中释放的能量。在此过程中,动能转化为电能并储存在电池中以供以后使用。这个过程类似于自行车发电机的原理。

- 如果车辆配备再生製动,则空气煞车系统的使用频率将低于仅依赖空气煞车的柴油公车。需要记住的一件事是,再生煞车虽然有帮助,但不足以使车辆停止。因此,这项重要功能仍然需要空气煞车。因此,未来几年对空气煞车系统的需求可能会大幅成长。

- 到2030年,电动公车的价格预计将与柴油引擎公车相当。与柴油公车相比,电动公车可降低81-83%的维护和营运成本,预计将增加对空气煞车系统的需求。製造商越来越注重推出新的客车型号,预计在预测期内推出内装和美观度得到改善的客製化客车。许多政府和城市当局正在投资对其公车队进行现代化改造,以改善大众交通工具基础设施、解决交通拥堵并减少空气污染。

亚太地区正在经历显着成长

- 由于拥有先进研究设施的领先商用车製造商的存在,商用卡车和公共汽车的销量不断增加,亚太地区目前占据了主要市场占有率。

- 卡车在采矿、建筑、基础设施开发和能源工厂等许多行业中发挥着重要作用。为了确保电力行业材料的稳定供应并加速采矿活动,对高效碎片清除的需求日益增长。

- 目前,中国、印度和韩国是电动公车的三大市场。光是中国就占全球电动公车总数的 98% 以上,拥有超过 50 万辆持有。

- 全部区域汽车零件製造商的快速扩张正在推动市场发展。例如,2023 年 5 月,Kendrion NV 开设了占地 28,000平方公尺的新工厂,是 Kendrion 集团中最大的工厂。

- 亚太地区商用车销量的增加和电动商用车需求的增加预计将推动空气煞车系统市场的成长。

空气煞车系统产业概况

空气煞车系统市场由几家主要企业主导,包括克诺尔股份公司、西屋煞车公司、采埃孚股份公司和瀚德集团。由于製造业的快速扩张和主要企业的策略开拓,预计该市场在预测期内将显着成长。

- 2023年12月,康士伯汽车的流量控制系统业务部门获得了为期三年、价值3258万美元的延期合约。该合约延期是由欧洲商用车OEM为 FCS Coupling 的压缩空气系统进行的。

- 2023 年 6 月,领先的煞车系统製造商克诺尔股份公司推出了最先进的电子机械列车煞车系统 (EM Brake),该系统使用压缩空气将煞车皮有效地固定到煞车盘。此先进系统旨在提供最佳煞车性能并确保火车乘客和货物的安全。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第一章简介

- 研究成果

- 调查先决条件

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场动态

- 市场驱动因素

- 商用车销售量增加

- 市场限制因素

- 维护成本高

- 产业吸引力-波特五力分析

- 新进入者的威胁

- 买家/消费者的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争公司之间敌对关係的强度

第五章市场区隔(市场规模-金额)

- 按煞车类型

- 鼓式空气煞车器

- 方形煞车

- 按车型分类

- 刚体卡车

- 重型卡车

- 半拖车

- 公车

- 其他车型

- 按成分

- 压缩机

- 州长

- 储存槽

- 鬆弛调节器

- 其他组件

- 按地区

- 北美洲

- 欧洲

- 亚太地区

- 世界其他地区

第六章 竞争状况

- 供应商市场占有率

- 公司简介

- ZF Friedrichshafen AG

- Haldex Group

- Nabtesco Corporation

- Knorr-Bremse AG

- Wabtec Corporation

- TSE Brakes Inc.

- Fedral-Mogul Holding Corporation

- Meritor Inc.

- SORL Auto Parts Inc.

- Brakes India Limited

- Continenal AG

第七章 市场机会及未来趋势

The Air Brake System Market size is estimated at USD 3.60 billion in 2024, and is expected to reach USD 4.13 billion by 2029, growing at a CAGR of 2.80% during the forecast period (2024-2029).

Over the medium term, the demand for commercial trucks and buses witnessed a rise in sales and production, particularly in the logistics and construction sectors, which is likely to drive the growth of the market significantly during the forecast period.

The development of major infrastructure projects in several regions, encompassing the construction of highways, feeder roads, ports, and airports, is playing a pivotal role in bolstering the demand for heavy-duty trucks, which is anticipated to enhance the demand for air brake systems in the coming years.

Electric vehicles (EVs) are growing rapidly due to the specific manufacturing requirements of EV components. The demand for lightweight and high-performance components has increased, creating a lucrative opportunity for the market.

Air Brake System Market Trends

Buses Hold Major Market Share

- Hybrid and electric buses employ two braking systems: regenerative braking and air braking. Regenerative braking works by utilizing the electric motor as a generator to capture the energy released during braking by performing 'regenerative deceleration.' In this process, kinetic energy is converted into electrical energy, which is stored in the battery for later use. This process is similar to the principle of a dynamo on a bicycle.

- When vehicles are fitted with regenerative braking, the air brake system is used less frequently than diesel buses that rely solely on air braking. It is important to note that while regenerative braking is helpful, it is not sufficient to stop a vehicle. Therefore, air braking remains necessary for this critical function. Thus, the demand for air brake systems is likely to witness significant growth in the coming years.

- By 2030, the prices of electric buses are expected to be on par with diesel-engine buses. Electric buses can reduce maintenance and operating costs by 81-83% compared to diesel-engine buses, which is expected to increase demand for air brake systems. Manufacturers are increasingly focused on launching new bus models and are expected to roll out customized buses with improved interiors and aesthetics over the forecast period. Many governments and city authorities are investing in the modernization of their bus fleets to improve public transportation infrastructure, address traffic congestion, and reduce air pollution.

Asia-Pacific Witnessing Major Growth

- Asia-Pacific currently holds a major market share due to an increase in the sale of commercial trucks and buses, driven by the presence of major commercial vehicle manufacturers with advanced research facilities.

- Trucks play a vital role in many industries, such as mining, construction, infrastructure development, and energy plants. There is a growing need for a consistent supply of materials to the power industries and efficient debris removal to speed up mining activities.

- China, India, and South Korea are currently the top three markets for electric buses. China alone has more than 98% of all-electric buses globally, with a fleet of over 500,000 units.

- The rapid expansion of automotive component manufacturers across the region is driving the market. For instance, in May 2023, Kendrion NV opened a new facility spanning 28,000 square meters - the largest one in the Kendrion Group.

- The increase in the sale of commercial vehicles in Asia-Pacific and the rise in demand for electric commercial vehicles is expected to boost the growth of the air brake systems market.

Air Brake System Industry Overview

The air brake system market is dominated by several key players, such as Knorr-Bremse AG, Wabtec Corporation, ZF Friedrichshafen AG, Haldex Group, and others. The market is expected to witness significant growth during the forecast period due to the rapid expansion of manufacturing industries and growing strategic development among key players worldwide.

- In December 2023, Kongsberg Automotive's Flow Control Systems business unit secured a three-year contract extension worth over USD 32.58 million. The extension was granted by a European commercial vehicle OEM for FCS Couplings' compressed air systems.

- In June 2023, Knorr-Bremse AG, a leading manufacturer of braking systems, introduced a cutting-edge electromechanical train braking system (EM brake) that utilizes compressed air to apply the brake pads to the brake discs effectively. This advanced system is designed to deliver optimal braking performance and ensure the safety of passengers and freight on trains.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Deliverables

- 1.2 Study Assumptions

- 1.3 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Drivers

- 4.1.1 Rise in Sale of Commercial Vehicles

- 4.2 Market Restraints

- 4.2.1 High Maintenance Cost

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Threat of New Entrants

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Bargaining Power of Suppliers

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION (Market Size in Value - USD)

- 5.1 By Brake Type

- 5.1.1 Drum Air Brake

- 5.1.2 Disc Air Brake

- 5.2 By Vehicle Type

- 5.2.1 Rigid Body Trucks

- 5.2.2 Heavy-Duty Trucks

- 5.2.3 Semi-Trailer Tractors

- 5.2.4 Buses

- 5.2.5 Other Vehicle Types

- 5.3 By Component

- 5.3.1 Compressor

- 5.3.2 Governor

- 5.3.3 Storage Tank

- 5.3.4 Slack Adjuster

- 5.3.5 Other Components

- 5.4 By Geography

- 5.4.1 North America

- 5.4.2 Europe

- 5.4.3 Asia-Pacific

- 5.4.4 Rest of the World

6 COMPETITIVE LANDSCAPE

- 6.1 Vendor Market Share

- 6.2 Company Profiles*

- 6.2.1 ZF Friedrichshafen AG

- 6.2.2 Haldex Group

- 6.2.3 Nabtesco Corporation

- 6.2.4 Knorr-Bremse AG

- 6.2.5 Wabtec Corporation

- 6.2.6 TSE Brakes Inc.

- 6.2.7 Fedral-Mogul Holding Corporation

- 6.2.8 Meritor Inc.

- 6.2.9 SORL Auto Parts Inc.

- 6.2.10 Brakes India Limited

- 6.2.11 Continenal AG