|

市场调查报告书

商品编码

1521638

空间电力电子:市场占有率分析、产业趋势与统计、成长预测(2024-2029)Space Power Electronics - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

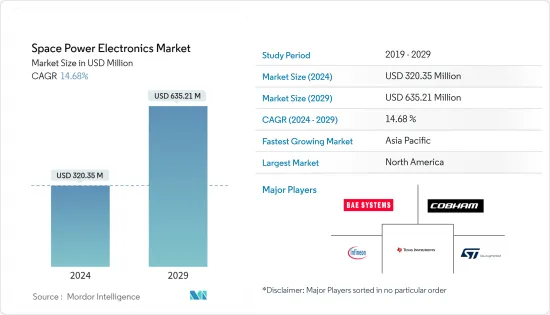

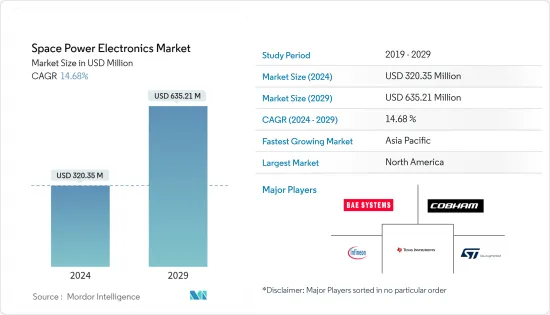

太空电力电子市场规模预计到2024年为3.2035亿美元,预计到2029年将达到6.3521亿美元,在预测期内(2024-2029年)复合年增长率为14.68%。

半导体技术的进步和对高效能电源管理系统的需求推动了太空电力电子技术的发展。例如,宽能带隙半导体已成为一项重要的创新,其性能优于传统材料。太空电力电子系统还包括模组化电力电子子系统(PESS),透过输入和输出电源连接埠连接到电源和负载。这些系统对于卫星、太空船、火箭、探测车等的运作至关重要,确保它们拥有执行其功能所需的电力。

由于低地球轨道(LEO)卫星和可重复使用火箭市场开发的不断开拓,空间电力电子市场正在不断增长。这些进步推动了对更先进电源管理设备、电池和电源转换器的需求,这些设备对于太空任务的长期永续性和效率至关重要。

然而,市场面临重大挑战,包括设计和开发这些复杂系统的高成本以及空间应用所需的严格整合和品质检查流程。儘管面临这些挑战,该行业的研发工作预计将克服这些阻碍因素,并在预测期内实现显着成长。

空间电力电子市场趋势

预计卫星将在预测期内主导市场

由于通讯、导航和地球观测等各种应用对卫星的需求不断增加,预计卫星产业将在预测期内主导市场。过去十年,在重大技术进步、产业商业化和私人资本涌入的推动下,小型卫星产业快速成长。人们对太空探勘的兴趣日益浓厚,以及对小型卫星执行姿态控制、轨道控制、轨道转移和负责任的终端脱轨策略等复杂任务的需求,推动了这一势头。

电力电子设备的小型化对于立方卫星特别有利,可以提高其性能和可靠性。同时,新兴的航太产业正在拥抱模组化,小型化辐射固化MOSFET、闸极启动器、DC-DC转换器和固态继电器等组件成为常态,使其更加高效、可扩展并得到体现。成本效益的卫星设计趋势。

例如,2023年1月,空中巴士与比利时国防部签署合同,为军方提供为期15年的战术卫星通讯服务。到2024年,空中巴士计划为其他欧洲国家和北约盟国的军队推出新的超高频(UHF)通讯服务。此类新兴市场的开拓正在支撑市场成长。

预计亚太地区在预测期内将维持最高复合年增长率

亚太地区正在经历太空产业的重大进步,特别是在航太电力电子领域。主要趋势包括人们日益认识到太空是国家安全的重要组成部分、小型私人商业太空新兴企业的崛起以及重点转向太空资源开发。中国、印度和日本等国家正在引领雄心勃勃的太空计划,寻求透过开发月球探勘和小行星采矿技术来在太空中占有一席之地。

由于对高速网路连线的需求不断增长,该地区的卫星通讯设备市场正在成长。这一成长得到了 Singtel 和 Thaicom 等主要卫星通讯业者的支持,这些营运商为亚洲用户。例如,2023年12月,中国宣布将建造自己版本的星链,这是一个利用低地球轨道的卫星网路卫星群,我们计画发射。

因此,太空电力电子技术的进步对于卫星电源管理的发展至关重要,这对于长期任务和深空探勘至关重要,因为它们能够建立更有效率、更可靠的系统。

航太电力电子产业概况

航太电力电子市场得到整合,主要企业占据重要的市场占有率。该市场的主要企业是: BAE Systems PLC、Cobham Limited、英飞凌科技股份公司、德州仪器公司和意法半导体这些公司处于开发能够承受太空恶劣条件(例如极端温度和辐射)的强大电子设备的前沿。

市场领导企业越来越注重赢得合约以维持其市场地位。这种方法通常会透过引进配备最尖端科技的创新产品来补充。例如,2023年4月,采埃孚与义法半导体签署了碳化硅元件多年供应协议。此次合作帮助建立了一个致力于开发空间电力电子设备的研发中心,体现了对这一高科技领域创新和发展的坚定承诺。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第一章简介

- 调查先决条件

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场动态

- 市场概况

- 市场驱动因素

- 市场限制因素

- 波特五力分析

- 买家/消费者的议价能力

- 供应商的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争公司之间敌对关係的强度

第五章市场区隔

- 平台

- 卫星

- 太空船和火箭

- 其他的

- 类型

- 抗辐射

- 抗辐射

- 目的

- 通讯

- 地球观测

- 导航、全球定位系统 (GPS)、监控

- 技术开发/教育

- 其他的

- 地区

- 北美洲

- 美国

- 加拿大

- 欧洲

- 英国

- 法国

- 德国

- 俄罗斯

- 其他欧洲国家

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 其他亚太地区

- 拉丁美洲

- 巴西

- 其他拉丁美洲

- 中东/非洲

- 沙乌地阿拉伯

- 阿拉伯聯合大公国

- 其他中东和非洲

- 北美洲

第六章 竞争状况

- 供应商市场占有率

- 公司简介

- BAE Systems PLC

- Cobham Limited

- Microchip Technology Inc.

- RUAG Group

- STMicroelectronics NV

- Teledyne Technologies Incorporated

- Texas Instruments Incorporated

- Honeywell International Inc.

- Microsemi Conduction

- ON Semiconductor

- Analog Devices Inc.

- Renesas Electronics Corporation

- Infineon Technologies AG

The Space Power Electronics Market size is estimated at USD 320.35 million in 2024, and is expected to reach USD 635.21 million by 2029, growing at a CAGR of 14.68% during the forecast period (2024-2029).

The development of power electronics for space applications has been driven by advancements in semiconductor technologies and the need for efficient power management systems. Wide bandgap semiconductors, for instance, have emerged as a significant innovation, offering improved performance over traditional materials. Power electronics systems in space also include modular power electronic subsystems (PESS) that connect to a source and load at their input and output power ports. These systems are integral to operating satellites, spacecraft, launch vehicles, and rovers, ensuring they have the necessary power to perform their functions.

The space power electronics market is experiencing growth due to the increasing development of low-Earth orbit (LEO) satellites and reusable launch vehicles. These advancements drive the demand for more sophisticated power management devices, batteries, and power converters, which are essential for the long-term sustainability and efficiency of space missions.

However, the market faces significant challenges, such as the high costs associated with designing and developing these complex systems and the rigorous integration and quality inspection process required for space applications. Despite these challenges, the industry's commitment to research and development is expected to overcome these restraining factors, leading to considerable growth over the forecast period.

Space Power Electronics Market Trends

Satellites are Expected to Dominate the Market During the Forecast Period

The satellite segment is expected to dominate the market during the forecast period owing to the increasing demand for satellites for various applications such as communication, navigation, earth observation, and others. A surge in the small satellite sector was witnessed in the last decade, fueled by significant technological advancements, the commercialization of the industry, and an influx of private capital. This momentum was propelled by increased interest in space exploration and the need for small satellites to perform complex tasks such as attitude and orbit control, orbital transfers, and responsible end-of-life deorbiting strategies.

The miniaturization of power electronics has been particularly beneficial for CubeSats, enhancing their performance and reliability. Concurrently, the burgeoning NewSpace industry is embracing modularization, with components like miniaturized radiation-hardened MOSFETs, gate drivers, DC-DC converters, and solid-state relays becoming standard, reflecting a trend toward more efficient, scalable, and cost-effective satellite designs.

For instance, in January 2023, Airbus signed a contract with the Belgian Ministry of Defense to provide tactical satellite communications services to the armed forces for 15 years. Airbus plans to launch a new ultra-high frequency (UHF) communications service by 2024 for the armed forces of other European nations and NATO allies. Developments such as these are driving the growth of the market.

Asia-Pacific is Expected to Register the Highest CAGR During the Forecast Period

The Asia-Pacific region is witnessing a significant evolution in the space industry, particularly in space power electronics. Key trends include the increasing recognition of space as a vital part of national security, the rise of small private commercial space startups, and a shift in focus toward exploiting space resources. Countries like China, India, and Japan are leading the way with ambitious space programs to establish their presence in space by developing technologies for lunar exploration and asteroid mining.

The satellite communication equipment market in the region is experiencing growth due to the rising demand for high-speed internet connectivity. This growth is supported by major satellite operators such as Singtel and Thaicom, which contribute to the more than 100 million active pay satellite TV subscribers in Asia. For instance, in December 2023, China announced that it would be building its version of StarLink, a satellite internet constellation using low-Earth orbit, with plans to launch around 26,000 satellites to cover the entire world, led by state-run companies.

Thus, the advancements in space power electronics are crucial for these developments, as they enable the creation of more efficient and reliable systems for power management in satellites, which is essential for long-term missions and deep space exploration.

Space Power Electronics Industry Overview

The space power electronics market is consolidated, with key players occupying a significant market share. The major players in this market are BAE Systems PLC, Cobham Limited, Infineon Technologies AG, Texas Instruments Incorporated, and STMicroelectronics NV. These companies are at the forefront of developing powerful electronic devices that can withstand harsh conditions in space, such as extreme temperatures and radiation.

The leading market players are focusing more on acquiring contracts to maintain their market position. This approach is often complemented by introducing innovative products featuring cutting-edge technologies. For instance, in April 2023, ZF signed a multi-year supply agreement with STMicroelectronics for silicon carbide devices. Collaborations have become instrumental in establishing specialized research and development centers dedicated to advancing space power electronics equipment, signifying a robust commitment to innovation and growth in this high-tech field.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.3 Market Restraints

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Buyers/Consumers

- 4.4.2 Bargaining Power of Suppliers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products

- 4.4.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Platform

- 5.1.1 Satellites

- 5.1.2 Spacecraft and Launch Vehicles

- 5.1.3 Others

- 5.2 Type

- 5.2.1 Radiation-Hardened

- 5.2.2 Radiation-Tolerant

- 5.3 Application

- 5.3.1 Communication

- 5.3.2 Earth Observation

- 5.3.3 Navigation, Global Positioning System (GPS) and Surveillance

- 5.3.4 Technology Development and Education

- 5.3.5 Others

- 5.4 Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.2 Europe

- 5.4.2.1 United Kingdom

- 5.4.2.2 France

- 5.4.2.3 Germany

- 5.4.2.4 Russia

- 5.4.2.5 Rest of Europe

- 5.4.3 Asia-Pacific

- 5.4.3.1 China

- 5.4.3.2 India

- 5.4.3.3 Japan

- 5.4.3.4 South Korea

- 5.4.3.5 Rest of Asia-Pacific

- 5.4.4 Latin America

- 5.4.4.1 Brazil

- 5.4.4.2 Rest of Latin America

- 5.4.5 Middle East and Africa

- 5.4.5.1 Saudi Arabia

- 5.4.5.2 United Arab Emirates

- 5.4.5.3 Rest of Middle East and Africa

- 5.4.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Vendor Market Share

- 6.2 Company Profiles

- 6.2.1 BAE Systems PLC

- 6.2.2 Cobham Limited

- 6.2.3 Microchip Technology Inc.

- 6.2.4 RUAG Group

- 6.2.5 STMicroelectronics NV

- 6.2.6 Teledyne Technologies Incorporated

- 6.2.7 Texas Instruments Incorporated

- 6.2.8 Honeywell International Inc.

- 6.2.9 Microsemi Conduction

- 6.2.10 ON Semiconductor

- 6.2.11 Analog Devices Inc.

- 6.2.12 Renesas Electronics Corporation

- 6.2.13 Infineon Technologies AG