|

市场调查报告书

商品编码

1521641

空间感测器和致动器:市场占有率分析、行业趋势和统计、成长预测(2024-2029)Space Sensors And Actuators - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

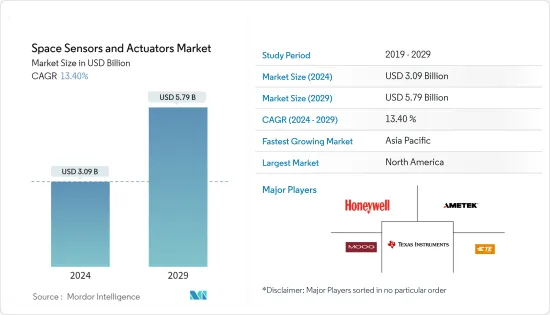

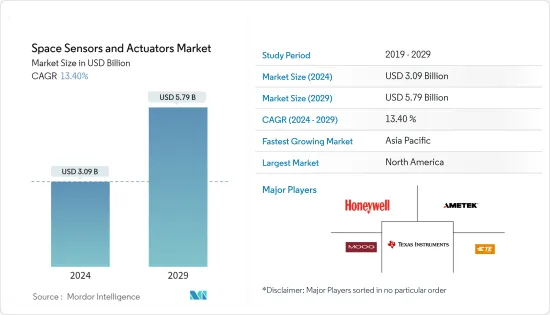

空间感测器和致动器市场规模预计到 2024 年为 30.9 亿美元,预计到 2029 年将达到 57.9 亿美元,预测期内(2024-2029 年)复合年增长率为 13.40%。

随着私人公司的进入和投资,太空产业正在经历重大转型。 SpaceX 和 Blue Origin 等先驱者正在透过太空船设计、推进和任务执行的创新方法重塑格局。现成的组件正在使太空技术民主化,使其更易于使用且更具成本效益。这与机器人技术和积层製造技术的进步相结合,正在降低太空探勘的经济障碍。

新兴国家也在增加太空预算,进一步刺激市场成长。这些市场开拓不仅推动了太空感测器和致动器市场的发展,也为行星探勘的新时代铺平了道路,让更多的探险家和企业家能够接触到太空。技术进步和投资增加的协同效应正在为未来的创新和曾经看似遥不可及的使命创造肥沃的土壤。

空间感测器和致动器市场面临着可能阻碍其成长的重大挑战。用于地面任务的感测器和致动器技术的成熟度是一个主要问题,而承受太空恶劣条件(例如辐射和腐蚀性大气)的系统设计的复杂性也是如此。与太空船开发和部署相关的政府政策也可能是一个障碍。儘管存在这些挑战,由于技术进步和私人公司投资增加,市场预计将成长。

空间感测器和致动器的市场趋势

预计感测器领域将在预测期内推动市场成长

空间感测器和致动器是现代太空任务的重要组成部分,每一个都是为了满足每种应用的独特需求而量身定制的。这些复杂的设备设计用于在恶劣的太空条件下运行,并执行环境监测、太空船操纵和资料收集等关键功能。例如,配备先进感测器的气象卫星可精确测量大气状况,致动器可确保卫星精确定位,以实现最佳成像和太阳能发电。

同样,太空观测卫星利用基于 MEMS 的致动器进行微调运动,并利用抗辐射感测器来承受强烈的宇宙辐射。这些技术提高了太空船和探勘的性能和可靠性,有助于提高太空任务的成本效益。 ESA 的 Copernicus 等计画采用了 Teledyne e2v 的高解析度感测器,说明了这些组件在支持地球观测和其他科学事业方面的重要性。

随着太空探勘的不断发展,感测器和致动器在突破太空技术的可能界限方面将变得越来越重要。空间领域意识的进步反映了对增强在轨安全和监视能力的重大承诺。美国太空军对感测器和监视系统的投资是一项战略倡议,旨在保持外太空情境察觉,外太空是一个竞争日益激烈的空间。

光学望远镜和监视卫星的发展旨在加强对太空活动的监测能力,确保对潜在威胁的快速反应。这种积极主动的做法强调了太空作为国防和全球安全关键前沿的重要性。

预计北美将在预测期内主导市场

预计在预测期内,北美将引领空间感测器和致动器市场。美国在北美空间感测器和致动器市场中占有很大份额。美国市场的成长得益于空间感测器和致动器系统主要製造商的存在。美国主要的空间感测器和致动器製造商包括德州仪器公司、内华达山脉公司、霍尼韦尔国际公司、穆格公司和布拉德福德太空公司。在预测期内,从行星探勘的角度来看,美国太空总署发射次数的增加预计也将推动美国太空感测器和致动器市场的发展。例如,SpaceX 的猎鹰系列火箭已成功完成 96 次任务。

空间感测器和致动器的使用正在增加,包括耐辐射电光空间感测器的不断发展以及卫星、胶囊货物、行星际太空船和探勘、漫游车/太空船着陆器、火箭和太空站。同样在 2023 年 6 月,美国太空军授予 L3Harris Technologies Inc. 一份价值 2900 万美元的合同,为该军种计划中的弹性导弹预警和跟踪卫星星系设计传感器。此类新兴市场的开拓将在预测期内推动市场成长。

空间感测器和致动器产业概述

着名空间感测器和致动器製造商的不断增加预计将加剧预测期内竞争对手之间的敌对行动。由于主要参与者的存在,市场是半固定的,例如:霍尼韦尔国际公司、穆格公司、德州仪器公司、TE Connectivity Ltd. 和 Ametek Inc.。

持续的产品推出和技术升级有效滚打了航太领域整体市场的成长。例如,2023年6月,Honeywell与量子网路和计算公司Aegiq宣布推出综合解决方案,使空间有效载荷和相关地面资产的设计和部署更加准确和更具成本效益,并签署了一份谅解备忘录来考虑建设。此次合作旨在将霍尼韦尔的大气感测技术与 Aegiq 的模拟套件相结合,以提高小型卫星中使用的光子技术链路性能。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 调查先决条件

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场动态

- 市场概况

- 市场驱动因素

- 市场限制因素

- 波特五力分析

- 买家/消费者的议价能力

- 供应商的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争公司之间敌对关係的强度

第五章市场区隔

- 产品类别

- 感应器

- 致动器

- 平台

- 卫星

- 胶囊/货物舱

- 行星际探勘

- 探测车/太空船着陆器

- 运载火箭

- 最终用户

- 商业的

- 政府/国防

- 地区

- 北美洲

- 美国

- 加拿大

- 欧洲

- 英国

- 法国

- 德国

- 俄罗斯

- 其他欧洲国家

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 其他亚太地区

- 世界其他地区

- 北美洲

第六章 竞争状况

- 供应商市场占有率

- 公司简介

- Honeywell International Inc.

- TE Connectivity Ltd.

- Moog Inc.

- Ametek Inc.

- Texas Instruments Incorporated

- RUAG Group

- STMicroelectronics NV

- RTX Corporation

- Cobham Advanced Electronics Solutions(Cobham Limited)

- Maxar Technologies Inc.

- Bradford Space(Bradford Engineering BV)

The Space Sensors And Actuators Market size is estimated at USD 3.09 billion in 2024, and is expected to reach USD 5.79 billion by 2029, growing at a CAGR of 13.40% during the forecast period (2024-2029).

The space industry is witnessing a significant transformation fueled by the entry and investments of private companies. Pioneers like SpaceX and Blue Origin are reshaping the landscape with their innovative approaches to spacecraft design, propulsion, and mission execution. Commercial-off-the-shelf components have democratized space technology, making it more accessible and cost-effective. This, coupled with robotics and additive manufacturing advancements, has reduced the financial barriers to space exploration.

Emerging countries are also increasing their space budgets, further stimulating the market's growth. These developments are not only propelling the space sensors and actuators market forward but are also paving the way for a new era of planetary exploration, where space is within reach of a broader range of explorers and entrepreneurs. The synergy of technological progress and increased investment is creating a fertile ground for future innovations and missions that once seemed beyond our grasp.

The space sensors and actuators market faces significant challenges that could impede growth. The maturity of sensor and actuator technologies for surface missions is a critical concern, as is the complexity of designing systems that can withstand the harsh conditions of space, such as radiation and corrosive atmospheres. Government policies related to spacecraft development and deployment can also pose obstacles. Despite these challenges, the market is expected to grow, driven by technological advancements and increased investments from private companies.

Space Sensors And Actuators Market Trends

The Sensors Segment is Anticipated to Drive the Growth of the Market During the Forecast Period

Space sensors and actuators are integral components of modern space missions, each tailored to meet the unique demands of their respective applications. These sophisticated devices are designed to operate in the harsh conditions of space, performing critical functions such as environmental monitoring, spacecraft maneuvering, and data collection. For instance, weather monitoring satellites with advanced sensors can accurately measure atmospheric conditions, while actuators ensure precise satellite positioning for optimal image capture or solar power generation.

Similarly, space observation satellites utilize MEMS-based actuators for fine-tuned movements and radiation-hardened sensors to withstand intense cosmic radiation. These technologies enhance the performance and reliability of spacecraft and rovers and contribute to the cost-effectiveness of space missions. Programs like ESA's Copernicus, which employs high-resolution sensors from Teledyne e2v, exemplify the importance of these components in supporting Earth observation and other scientific endeavors.

As space exploration continues to evolve, the role of sensors and actuators becomes increasingly vital in pushing the boundaries of what is possible in space technology. The advancements in space domain awareness reflect a significant commitment to enhancing security and surveillance capabilities in orbit. The US Space Force's investment in sensors and surveillance systems is a strategic move to maintain situational awareness in space, which is increasingly becoming a contested domain.

The development of optical telescopes and surveillance satellites aims to bolster the ability to monitor space activities, ensuring a rapid response to any potential threats. This proactive approach underscores the importance of space as a critical frontier for national defense and global security.

North America is Expected to Dominate the Market During the Forecast Period

North America is expected to lead the space sensors and actuators market during the forecast period. The US accounted for a major share of the space sensors and actuators market in North America. The market's growth in the US can be attributed to the presence of key manufacturers of space sensors and actuator systems. Some key US-based space sensors and actuator companies include Texas Instruments Incorporated, Sierra Nevada Corporation, Honeywell International Inc., Moog Inc., and Bradford Space. The rise in the number of launches from NASA is also anticipated to drive the US space sensors and actuators market in terms of planetary exploration during the forecast period. For instance, SpaceX launched 96 successful missions with its Falcon series of rockets.

The use of space sensors and actuators is expected to grow due to the increasing development of radiation-hardened electro-optical space sensors and the miniaturization of space sensors and actuators for satellites, capsules cargos, interplanetary spacecraft & probes, rovers/spacecraft landers, launch vehicles, and space stations. Also, in June 2023, the US Space Force awarded L3Harris Technologies Inc. a USD 29 million contract to design a sensor for the service's planned Resilient Missile Warning and Tracking satellite constellation. Thus, developments such as these will drive the market's growth during the forecast period.

Space Sensors And Actuators Industry Overview

The increasing presence of prominent space sensors and actuator manufacturers is expected to intensify competitive rivalry during the forecast period. The market is semi-consolidated with the presence of key players such as Honeywell International Inc., Moog Inc., Texas Instruments Incorporated, TE Connectivity Ltd., and Ametek Inc. These players have continuously expanded their operations by focusing on market expansions and acquisitions.

Continuous product launches and technological upgrades effectively set the ball rolling regarding overall market growth in the space sector. For instance, in June 2023, Honeywell and Aegiq, a quantum networking and computing company, signed an MoU to explore creating a comprehensive solution to enable more precise and cost-effective design and deployment of space payloads and related ground assets. This collaboration was intended to combine Honeywell's atmospheric sensing technology and Aegiq's emulation toolkit for link performance of optical communication technologies used by small satellites.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.3 Market Restraints

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Buyers/Consumers

- 4.4.2 Bargaining Power of Suppliers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products

- 4.4.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Product Type

- 5.1.1 Sensors

- 5.1.2 Actuators

- 5.2 Platform

- 5.2.1 Satellites

- 5.2.2 Capsules/Cargo Modules

- 5.2.3 Interplanetary Spacecraft & Probes

- 5.2.4 Rovers/Spacecraft Landers

- 5.2.5 Launch Vehicles

- 5.3 End User

- 5.3.1 Commercial

- 5.3.2 Government and Defense

- 5.4 Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.2 Europe

- 5.4.2.1 United Kingdom

- 5.4.2.2 France

- 5.4.2.3 Germany

- 5.4.2.4 Russia

- 5.4.2.5 Rest of Europe

- 5.4.3 Asia-Pacific

- 5.4.3.1 China

- 5.4.3.2 India

- 5.4.3.3 Japan

- 5.4.3.4 South Korea

- 5.4.3.5 Rest of Asia-Pacific

- 5.4.4 Rest of the World

- 5.4.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Vendor Market Share

- 6.2 Company Profiles

- 6.2.1 Honeywell International Inc.

- 6.2.2 TE Connectivity Ltd.

- 6.2.3 Moog Inc.

- 6.2.4 Ametek Inc.

- 6.2.5 Texas Instruments Incorporated

- 6.2.6 RUAG Group

- 6.2.7 STMicroelectronics NV

- 6.2.8 RTX Corporation

- 6.2.9 Cobham Advanced Electronics Solutions (Cobham Limited)

- 6.2.10 Maxar Technologies Inc.

- 6.2.11 Bradford Space (Bradford Engineering BV)