|

市场调查报告书

商品编码

1521651

货运:市场占有率分析、产业趋势与统计、成长预测(2024-2029)Cargo Shipping - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

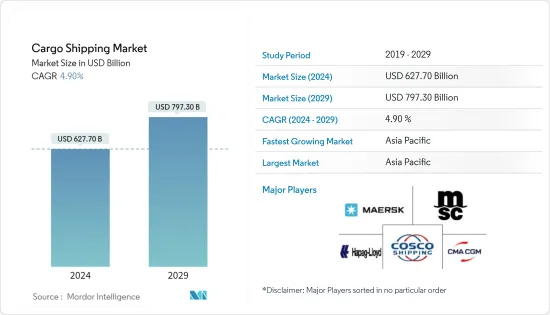

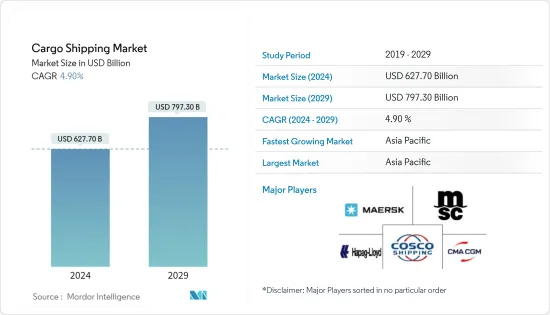

预计2024年货运市场规模为6,277亿美元,预计2029年将达7973亿美元,预测期内(2024-2029年)复合年增长率为4.90%。

由于海上货运活动的增加,对货柜船、散货运输和其他货物运输的需求不断增长,正在推动货物运输市场的发展。

船舶货物运输需求的增加和贸易相关协议的激增等因素正在补充货物运输市场的成长。运输和库存成本的波动阻碍了货运市场的成长。然而,预计海上运输自动化和海上安全标准不断提高等因素预计将为预测期内货物运输市场的成长提供机会。

主要亮点

- 2022年日本沿海船舶运输的国内货物量为3,2,093万吨,而2021年为3,2466万吨。

- 根据印度港口、航运和水道部统计,2022财年印度全国海港的货物吞吐量达到13.23亿吨,较2021财与前一年同期比较增6.0%。

货运市场趋势

跨国交易增加支持市场扩张

海上跨境贸易的增加、电子商务产业的发展带来的海运量的增加以及各国之间各种自由贸易协定的实施都有助于海上贸易活动的扩大,从而推动货运市场的成长积极贡献。

- 截至2022年,全球商船队杂货运输船舶数量已达17,784艘,散装运输船舶数量达12,941艘。

近几十年来,由于海上贸易需求不断增长以及每次航次运输更多货物的需求,世界商船队的运力稳步增长。

- 2022年,货柜船运力将达2.93亿载重吨,2018年至2022年复合年增长率为3.1%。

随着海上贸易活动的增加,对这些货物运输的需求更大,因为这些船舶运输各种货物,从而对市场的快速成长产生积极影响。

近年来,由于跨境电商活动的成长,全球主要海运的货运量急剧增加。由于海运仍是远距运输的主流,对货运代理的需求大幅增加。

- 2022年,美国将占印度消费者网路购物跨境电商市场总量的21%,其次是澳洲。

因此,电子商务的快速发展,加上海上运输活动的活性化,可能会促进未来几年货运市场的快速成长。

欧洲占有很大的市场份额

随着海上贸易的增加和经济的成长,欧洲市场的货运需求预计将大幅成长。

航运业是德国经济最重要的部门之一。年营业额达 500 亿欧元(532.2 亿美元),到 2022 年,直接或间接依赖航运的就业人数将达到 40 万个。

德国有超过 360 家航运公司营运约 2,700 艘船舶。以船东国籍划分,德国是拥有商船队的最大航运国,仅次于希腊、日本和中国(排名第四)。

- 德国在船东国籍方面仍处于国际领先地位,其货柜船约占全球货柜运输能力的29%。

大约 9 个造船厂为德国海军造船业提供支持,约 2,800 家公司活跃在造船和海洋工业。这些公司约 85% 的国内付加来自德国造船厂的交货。

同样,英国近 95% 的进出口都是透过 400 多个英国港口透过海运进行的。

- 2022年,西班牙将成为全球第四大鱼贝类进口国,仅次于美国、中国和日本。

- 2022年,西班牙从各地区的水产品进口额达96亿美元,较2021年成长7.6%。 2022年西班牙出口总额达59亿美元,与前一年同期比较增加3.4%。

西班牙对欧洲航运和物流至关重要。西班牙的航运业得到了完善的基础设施网络的支持,该网络涵盖所有部门(公路、铁路和航空),并拥有欧洲境内外高效且有能力的供应路线。西班牙有100多家航运公司,组成了庞大的船队。西班牙三面环水,是建立港口和其他航运枢纽的理想国家。交通便利,可通往该地区的多个国际机场。

由于上述因素,欧洲市场预计在预测期内将成长。

货运业概况

货运市场高度分散,许多国际公司参与其中。该领域的主要企业包括马士基、MSC、CMA、COSCO 和 Hapag Lloyd。由于车辆成本上升和规模经济不断增强,进入壁垒高限制了市场,进而影响产业竞争。然而,主要企业正在进行策略合作和收购,以在未来几年获得市场占有率。

- 2023年1月,AP穆勒-马士基宣布完成对拥有强大非货柜计划物流和全球营运能力的丹麦计划物流专家Martin Bencher Group的收购。随着Martin Venture的加入,两家公司将增强为全球客户提供计划物流服务的能力,并为更广泛的行业提供更全面的服务。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第一章简介

- 研究成果

- 研究场所

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场动态

- 市场概况

- 市场驱动因素

- 国家间贸易协定的增加

- 国际贸易量增加

- 市场限制因素

- 燃料成本上涨影响市场

- 价值链/供应链分析

- 行业法规政策

- 波特五力分析

- 新进入者的威胁

- 买家/消费者的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争公司之间敌对关係的强度

第五章市场区隔

- 船型

- 散货船

- 一般货物运输

- 货柜船

- 油船

- 冷藏船

- 产业

- 饮食

- 製造业

- 油和气

- 製药

- 电力/电子

- 其他的

- 货物类型

- 液体货物

- 干货

- 普通货物

- 地区

- 北美洲

- 美国

- 加拿大

- 其他北美地区

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 其他欧洲国家

- 亚太地区

- 印度

- 中国

- 日本

- 韩国

- 其他亚太地区

- 世界其他地区

- 南美洲

- 中东/非洲

- 北美洲

第六章 竞争状况

- 供应商市场占有率

- 公司简介

- AP Moller-Maersk AS

- MSC Mediterranean Shipping Company SA

- CMA CGM

- China COSCO Holdings Company Limited

- Hapag-Lloyd

- ONE(Ocean Network Express)

- Evergreen Line

- Wan Hai Lines

- Zim

- SITC

- Zhonggu Logistics Corp.

- Antong Holdings(QASC)

第七章 市场机会及未来趋势

- 物流领域技术发展

The Cargo Shipping Market size is estimated at USD 627.70 billion in 2024, and is expected to reach USD 797.30 billion by 2029, growing at a CAGR of 4.90% during the forecast period (2024-2029).

The rising demand for cargo vessels such as container ships, bulk carriers, and others due to the growth in sea freight activity is driving the cargo shipping market.

Factors such as the increasing demand for cargo transportation through ships and the surge in trade-related agreements supplement the growth of the cargo shipping market. Fluctuations in transportation and inventory costs hamper the growth of the cargo shipping market. However, factors such as the anticipated trend of automation in marine transportation and an increase in marine safety norms are expected to provide opportunities for the growth of the cargo shipping market during the forecast period.

Key Highlights

- In 2022, the freight volume transported domestically via coastwise vessels in Japan stood at 320.93 million metric ton, compared to 324.66 million metric ton in 2021.

- According to the Indian Ministry of Ports, Shipping, and Waterways, the total volume of cargo handled at seaports across India touched 1,323 million metric ton in FY 2022, witnessing a Y-o-Y increase of 6.0% compared to FY 2021.

Cargo Shipping Market Trends

Increasing Cross-border Trading to Support Market Expansion

The increasing cross-border trading activity via sea, rising sea freight volumes due to the growth of the e-commerce industry, and the implementation of various free-trade agreements across nations are contributing to expanding sea trade activity, which, in turn, is positively contributing to the growth of the cargo shipping market.

- The number of general cargo ships in the global merchant fleet stood at 17,784 units as of 2022, while the number of bulk cargo carriers reached 12,941 units.

The capacity of the global merchant fleet has increased steadily in recent decades, attributed to the rising demand for more seaborne trade, which calls for larger vessels to transport more volume in one trip.

- In 2022, the capacity of container ships touched 293 million dwt, registering a CAGR of 3.1% between 2018 and 2022.

With the rising seaborne trade activity, there exists a greater demand for these cargo carriers as these ships transport various goods, thereby positively impacting the surging growth of the market.

Leading ocean freight forwarders across the world are witnessing a rapid surge in the volume of freight they are transporting in recent years, owing to the growth in cross-border e-commerce activity. Since sea freight remains the dominant transportation medium to ship goods across long distances, the demand for cargo carriers shoots up extensively.

- In 2022, the United States was the leading market among Indian consumers who shop online, capturing 21% of the cross-border e-commerce market out of the overall cross-border e-commerce share, followed by Australia.

Thus, the rapid advancement in e-commerce, coupled with rising sea freight activity, may contribute to the surging growth of the cargo shipping market in the coming years.

Europe Holds a Significant Share in the Market

With the increasing seaborne trade and economic growth, the demand for cargo shipping is anticipated to witness evident growth in the European market.

The marine sector is one of the most important sectors of the German economy. The annual turnover is up to EUR 50 billion (USD 53.22 billion), and the number of jobs directly or indirectly dependent on the maritime industry was up to 400,000 in 2022.

In Germany, more than 360 shipping companies operate around 2,700 seagoing vessels. According to owner nationality, Germany is the largest shipping nation after Greece, Japan, and China (ranked 4th) with its merchant fleet.

- Germany holds around 29% of all container-carrying capacities worldwide in container shipping and is still positioned as an international leader according to owner nationality.

About nine shipyards support the German naval shipbuilding industry, and about 2,800 companies are active in the shipbuilding and ocean industries. The companies generate a domestic value added of approximately 85% on deliveries from German shipyards.

Likewise, almost 95% of all UK imports and exports move by sea through over 400 British ports.

- In 2022, Spain was the world's fourth largest importer of fish and seafood after the United States, China, and Japan.

- In 2022, Spain's seafood imports from all origins were USD 9.6 billion, up 7.6% from 2021. Total Spanish exports in 2022 reached USD 5.9 billion, up 3.4% compared to the previous year.

Spain is vital to the shipping and logistics in Europe. Spain's shipping industry is supported by its network of maintained infrastructure across all sectors (road, rail, and air), allowing it to boast efficient and capable supply routes through Europe and beyond. Over a hundred different shipping companies in Spain make up its massive fleet. Spain is covered by water on three sides, making it ideal for establishing ports and other shipping hubs. Well-connected facilities are linked to several international airports in the region.

Owing to the abovementioned factors, the European segment of the market is expected to grow during the forecast period.

Cargo Shipping Industry Overview

The cargo shipping market is fragmented in nature, with the presence of many international companies in the market. The top players in the segment include Maersk, MSC, CMA, COSCO, and Hapag Lloyd. High barriers to entry restrain the market due to the high cost of vehicles and increasing economies of scale, which affect competition in the industry. However, key players are involved in strategic partnerships and acquisitions to capture market share in the coming years.

- In January 2023, A.P. Moller-Maersk (Maersk) announced the completion of its acquisition of Martin Bencher Group, a Danish project logistics expert with premium capabilities within non-containerized project logistics and global operations. With the addition of Martin Bencher, these companies are strengthening their ability to offer project logistics services to their global clients while providing a more comprehensive offering to a wide array of industries.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Deliverables

- 1.2 Study Assumptions

- 1.3 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 The Rise of Trade Agreements Between Nations

- 4.2.2 Increasing Volume of International Trade

- 4.3 Market Restraints

- 4.3.1 Surge in Fuel Costs Affecting the Market

- 4.4 Value Chain/Supply Chain Analysis

- 4.5 Industry Policies and Regulations

- 4.6 Porter's Five Forces Analysis

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Buyers/Consumers

- 4.6.3 Bargaining Power of Suppliers

- 4.6.4 Threat of Substitute Products

- 4.6.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Ship Type

- 5.1.1 Bulk Carriers

- 5.1.2 General Cargo Ships

- 5.1.3 Container Ships

- 5.1.4 Tankers

- 5.1.5 Reefer Ships

- 5.2 Industry Type

- 5.2.1 Food and Beverages

- 5.2.2 Manufacturing

- 5.2.3 Oil and Gas

- 5.2.4 Pharmaceutical

- 5.2.5 Electrical and Electronics

- 5.2.6 Others

- 5.3 Cargo Type

- 5.3.1 Liquid Cargo

- 5.3.2 Dry Cargo

- 5.3.3 General Cargo

- 5.4 Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Rest of North America

- 5.4.2 Europe

- 5.4.2.1 Germany

- 5.4.2.2 United Kingdom

- 5.4.2.3 France

- 5.4.2.4 Italy

- 5.4.2.5 Spain

- 5.4.2.6 Rest of Europe

- 5.4.3 Asia-Pacific

- 5.4.3.1 India

- 5.4.3.2 China

- 5.4.3.3 Japan

- 5.4.3.4 South Korea

- 5.4.3.5 Rest of Asia-Pacific

- 5.4.4 Rest of the World

- 5.4.4.1 South Ameria

- 5.4.4.2 Middle East and Africa

- 5.4.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Vendor Market Share

- 6.2 Company Profiles

- 6.2.1 A. P. Moller-Maersk AS

- 6.2.2 MSC Mediterranean Shipping Company SA

- 6.2.3 CMA CGM

- 6.2.4 China COSCO Holdings Company Limited

- 6.2.5 Hapag-Lloyd

- 6.2.6 ONE (Ocean Network Express)

- 6.2.7 Evergreen Line

- 6.2.8 Wan Hai Lines

- 6.2.9 Zim

- 6.2.10 SITC

- 6.2.11 Zhonggu Logistics Corp.

- 6.2.12 Antong Holdings (QASC)

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Technological Developments in the Logistics Sector