|

市场调查报告书

商品编码

1521663

洗车:市场占有率分析、产业趋势与统计、成长预测(2024-2029)Car Wash - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

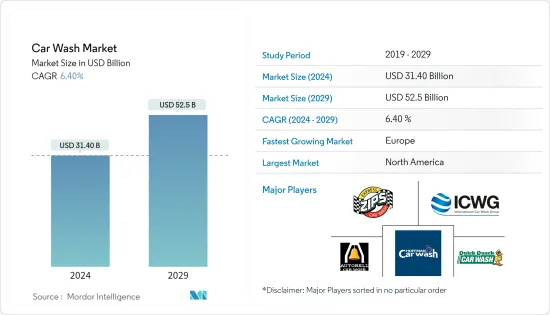

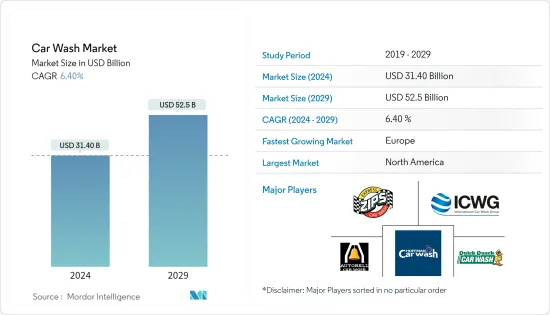

洗车市场规模预计到2024年为314亿美元,预计到2029年将达到525亿美元,在市场估计和预测期间(2024-2029年)复合年增长率为6.40%。

洗车市场是一个蓬勃发展的行业,涵盖从私家车到商用车的车辆清洁和保养服务。随着越来越多的人更加重视汽车的美观和清洁,并寻求保养良好的外观,这一领域正在经历显着的增长。洗车服务有多种形式,包括自助式洗车站、自动化洗车系统和全方位服务的手洗设施。

近年来,在消费者选择的变化、技术进步和日益增长的环境问题的推动下,洗车行业经历了显着的扩张和发展。在充满活力的商业房地产(CRE)环境中,洗车市场已成为一个盈利的行业,吸引了全国投资者和企业家的注意。由于汽车持有量的增加、消费者可支配收入的增加以及车主越来越频繁地使用专业洗车设施等因素,预计洗车服务的需求将会增加。

在这一领域,我们实施了各种创新,重塑了按需洗车服务,例如先进的水循环系统、混合清洗技术、非接触式清洗技术以及其他经济高效的解决方案。这些创新旨在简化手动车辆准备流程、减少摩擦并在更短的时间内交付更清洁、更干燥的车辆。

在繁忙的日程和快节奏的生活方式的推动下,消费者偏好的变化使得专业洗车服务比个人方法更受青睐。自动洗车机强调方便、省时,已成为常态,并有助于市场扩张。

随着利率上升和通货膨胀导致市场动态变化,提供洗车等非必要服务的服务企业必须进行创新,以留住客户并增加资产价值。许多洗车设施正在采用更自助的经营模式,采用驾车穿过菜单,使客户无需直接与员工互动即可选择服务。

传统上由本土业者主导的快速洗车产业,私募股权投资激增,推动了产业成长和整合。私募股权公司专注于拥有快速洗车场(也称为输送机洗车场或隧道洗车场)的洗车公司,随着信用品质的提高,预计这些洗车场将变得更具吸引力。此外,引入会员资格和订阅的新经营模式提供了可靠且稳定的收益来源。

洗车市场高度分散,但仍是许多投资者的主要吸引力。这种行业结构,加上基于订阅的销售体系,仍然是投资者的热门市场。

洗车市场趋势

翻转式/海湾式洗车机引领市场

与手洗或自动隧道等其他方法相比,翻转/海湾洗车提供了更快、更实惠的清洗选择。这使我们能够满足广大客户的预算和时间限制。它也以其在短时间内执行基本洗车的能力而闻名。这种便利性对于忙碌的人们尤其有吸引力。 Inbay Automatic 通常会提供自助服务选项,进一步提高喜欢 DIY 方法的客户的效率。

虽然以基本洗车而闻名,但技术的进步改进了翻滚/inbay 系统的功能。其中包括用于精緻汽车饰面的非接触式洗车、底盘清洗选项以及用于更彻底清洗的高压水刀等功能。

2023 年,洗车会议上强调了非接触式洗车技术的进步,表明可以节省成本,并且有可能在翻转/inbay 系统中广泛采用。新的环保清洗解决方案正在引入翻转/内湾系统,以解决环境问题,并有可能吸引环保意识的客户。

- 2023年5月,美国领先的洗车营运商Sonny's Enterprises宣布计划扩大其自助快速洗车网络,确认该细分市场继续主导市场。

- 2022 年 10 月,全国洗车协会 (NCWA) 报告称,Express Car Wash 会员人数有所增加,这表明客户对翻转/inbay 选项的便利性和可负担性的忠诚度。

- 2022 年 3 月,国际洗车协会 (ICA) 报告称,自助洗车业务持续成长,显示客户对翻转/inbay 选项提供的便利性和经济性越来越偏好。

这些因素共同巩固了翻转式/嵌入式洗车机在当前市场上的主导地位。其实实惠、便利性和不断发展的技术不断吸引客户,使其成为快速高效洗车体验的首选。

预计北美将占据很大的市场份额

北美地区,尤其是美国,在全球洗车机市场中占据主导地位。北美人均汽车持有率较高,汽车文化浓厚。这意味着洗车服务拥有庞大的潜在基本客群。美国每千人拥有持有数量位居世界第二,到 2022 年将达到 837 辆。

北美消费者的可支配收入相对较高,可以在洗车等非必需服务上花费更多。这将推动市场成长并实现洗车类型和服务包的创新。

北美洗车市场提供多种选择,可满足各种客户需求和预算。这包括从经济实惠的自助翻车/车内洗车到优质的全方位服务细节套餐的一切。

- 2024年3月,Flagstop Car Wash成功收购了维吉尼亚州里奇蒙大都会圈的三个单位,完成了Flagstop品牌的转换,并重新开放了这些单位。

- 2024 年 3 月,总部位于高峰会的 Spark Car Wash 将在 Ledgewood 开设第五家分店,这标誌着该公司在透过最尖端科技和会员服务实现东北地区洗车现代化的使命中迈出了重要一步。

洗车业概况

洗车市场竞争激烈,各领域参与企业该市场。 Mister Car Wash、Take 5 Oil Change 和 Splash Car Wash 等大型全国性和地区洗车连锁店占据市场主导地位,提供标准洗车选项,强调便利性。除了这些巨头之外,还有许多本地经营的独立洗车店,它们迎合特定客户的偏好或利基市场,提供个人化服务或强调环保做法。

洗车市场的间接竞争对手是行动美容等服务,它可以在客户所在地提供按需豪华汽车美容服务。经销商洗车也有助于间接竞争,并可吸引寻求服务和维护的客户。此外,消费者可以选择使用家用汽车清洁产品作为一种经济实惠的方法,但需要更多的时间和精力。这些竞争措施受到位置、便利性、定价、技术整合和永续性实践等因素的影响。随着竞争格局的演变,所有细分市场的参与者都必须应对先进的技术和不断变化的客户偏好,并进行调整和创新以保持竞争力。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第一章简介

- 调查先决条件

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场动态

- 市场驱动因素

- 市场限制因素

- 产业吸引力-波特五力分析

- 新进入者的威胁

- 买家/消费者的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争公司之间敌对关係的强度

第五章市场区隔

- 类型

- 隧道

- 展期/Inbay

- 自助服务

- 付款方式

- 现金

- 无现金

- 地区

- 北美洲

- 美国

- 加拿大

- 北美其他地区

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 其他欧洲国家

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 其他亚太地区

- 世界其他地区

- 南美洲

- 中东/非洲

- 北美洲

第六章 竞争状况

- 供应商市场占有率

- 公司简介

- Zips Car Wash

- Splash Car Wash

- International Car Wash Group(ICW)

- Autobell Car Wash

- Quick Quack Car Wash

- Super Star Car Wash

- True Blue Car Wash LLC

- Magic Hands Car Wash

- Hoffman Car Wash

- Mister Car Wash

第七章 市场机会及未来趋势

The Car Wash Market size is estimated at USD 31.40 billion in 2024, and is expected to reach USD 52.5 billion by 2029, growing at a CAGR of 6.40% during the forecast period (2024-2029).

The car wash market is a thriving industry encompassing services for cleaning and maintaining vehicles, ranging from personal cars to commercial fleets. This sector has witnessed significant growth due to the increasing emphasis on vehicle aesthetics, cleanliness, and the desire for a well-maintained appearance. Car wash services are provided through various formats, including self-service car wash stations, automatic car wash systems, and full-service hand car wash facilities.

In recent years, the car wash sector has witnessed notable expansion and evolution, propelled by shifts in consumer choices, technological progress, and a growing emphasis on environmental considerations. Within the dynamic commercial real estate (CRE) environment, the car wash market has emerged as a profitable industry, drawing interest from investors and entrepreneurs across the country. Anticipated growth in demand for car wash services aligns with an expanding number of vehicles, heightened consumer disposable income, and a rising trend among car owners to opt for professional carwashing facilities more frequently.

The sector is implementing various technological innovations that are reshaping on-demand vehicle wash services, including advanced water recycling systems, hybrid and touch-free washing technology, and other cost-effective solutions. These innovations aim to streamline the manual vehicle preparation process, reduce friction, and deliver cleaner and drier vehicles in a shorter timeframe.

The shift in consumer preferences, driven by hectic schedules and fast-paced lifestyles, has led to a preference for professional carwashing services over personal methods. The prevalence of automated carwashing, emphasizing convenience and time savings, has become the standard, contributing to the market's expansion.

As market dynamics change amid increasing interest rates and inflation, service-based businesses offering non-essential services like carwashes must innovate to retain customers and enhance property values. Many carwash facilities have adopted a more self-serve business model, incorporating drive-thru menus for customers to choose services without direct employee interaction.

Traditionally dominated by local operators, express carwashes are experiencing a surge in private equity investment, driving growth and consolidation in the industry. Private equity firms are redirecting their focus toward carwash companies that own express washes, also known as conveyor or tunnel washes, which are anticipated to enhance attractiveness as credit quality improves. Additionally, emerging business models introducing memberships or subscriptions provide a reliable and consistent revenue stream.

Given the considerable fragmentation of the carwash market, it remains a significant attraction for numerous investors. The industry's structure, coupled with subscription-based sales systems, continues to keep the market in the spotlight for investors.

Car Wash Market Trends

Roll-over/ In-Bay Car Wash Type to Lead the Market

Roll-over/in-bay car washes offer a quicker and more affordable cleaning option compared to other methods like hand washes or automatic tunnels. This caters to a wider range of customer budgets and time constraints. They are also known for their fast turnaround times, allowing customers to get a basic car wash within minutes. This convenience is particularly attractive for busy individuals. In-bay automatics often offer self-service options, further increasing efficiency for customers who prefer a DIY approach.

While known for basic washes, advancements in technology are enhancing the capabilities of roll-over/in-bay systems. These include features like touchless washes for delicate car finishes, undercarriage cleaning options, and high-pressure water jets for more thorough cleanliness.

In 2023, Touchless car wash technology advancements were highlighted at car wash conventions, signifying potential cost reductions and wider adoption in roll-over/in-bay systems. New eco-friendly cleaning solutions were introduced for roll-over/in-bay systems, addressing environmental concerns and potentially attracting environmentally conscious customers.

- In May 2023, Sonny's Enterprises, a major car wash operator in the United States, announced plans to expand its network of self-service express car washes, highlighting the continued market dominance of this segment.

- In October 2022, the National Carwash Association (NCWA) reported an increase in express car wash memberships, indicating customer loyalty toward the convenience and affordability of roll-over/in-bay options.

- In March 2022, the International Carwash Association (ICA) reported a continued rise in self-service car washes, indicating a growing customer preference for the convenience and affordability offered by roll-over/in-bay options.

These factors combined solidify the leading position of roll-over/in-bay car washes in the current market. Their affordability, convenience, and evolving technology continue to attract customers, making them the preferred choice for a quick and efficient car wash experience.

North America is Expected to Occupy a Significant Share in the Market

North America, particularly the United States, holds the dominant position in the global car wash market. North America boasts a strong car culture with a high vehicle ownership rate per capita. This translates to a larger potential customer base for car wash services. The United States has the second-highest number of vehicles per capita globally, at 837 vehicles per 1,000 people in 2022.

Consumers in North America have a relatively high disposable income, allowing them to spend more on discretionary services like car washes. This fuels market growth and allows for innovation in wash types and service packages.

The North American car wash market offers a wide range of options, catering to various customer needs and budgets. This includes everything from budget-friendly self-service roll-over/in-bay washes to premium full-service detail packages.

- In March 2024, Flagstop Car Wash successfully acquired a three-unit platform in the greater Richmond metropolitan area, Virginia, completing the conversion to the Flagstop brand and reopening the units.

- In March 2024, Spark Car Wash, headquartered in Summit, celebrated the opening of its fifth location in Ledgewood, marking a significant step in the company's mission to modernize car washing with cutting-edge technology and membership-driven services in the Northeast.

Car Wash Industry Overview

The car wash market is highly competitive, featuring a diverse array of participants across different segments. Dominating the scene are large national and regional car wash chains like Mister Car Wash, Take 5 Oil Change, and Splash Car Wash, providing standardized wash options with a focus on convenience. Alongside these giants, numerous locally operated independent car washes cater to specific customer preferences or niche markets, offering personalized services or highlighting eco-friendly practices.

Indirect competition in the car wash market comes from services like mobile detailing, which provides on-demand premium car detailing at the customer's location. Car washes at dealerships also contribute to indirect competition, potentially attracting customers seeking service or maintenance. Furthermore, consumers have the option of using at-home car cleaning products for a budget-conscious approach that requires more time and effort. These competitive dynamics are influenced by factors such as location, convenience, pricing structures, technology integration, and sustainability practices. As the landscape evolves, players in all segments must adapt and innovate to stay competitive in response to advancing technology and changing customer preferences.

- In March 2024, Zips Car Wash rolled out an advanced car wash loyalty and membership platform developed by AMP Memberships. This innovative solution allows for company-wide or regional campaigns, emphasizing personalized engagement for members and loyal retail customers.

- In February 2024, Enmarket introduced a pioneering monthly subscription car washing service through its Marketwash mobile app, aiming to provide customers with a seamless and contactless solution for car care.

- In November 2023, Spark Car Wash secured USD 30 million in additional growth capital through a Series B funding round led by GoPoint Ventures. This funding will support the Summit-based company's expansion of modern, membership-driven car wash locations in a region with substantial growth potential.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Drivers

- 4.2 Market Restraints

- 4.3 Industry Attractiveness - Porter's Five Force Analysis

- 4.3.1 Threat of New Entrants

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Bargaining Power of Suppliers

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Type

- 5.1.1 Tunnels

- 5.1.2 Roll-over/ In-Bay

- 5.1.3 Self-Service

- 5.2 Mode of Payment

- 5.2.1 Cash

- 5.2.2 Cashless

- 5.3 Geography

- 5.3.1 North America

- 5.3.1.1 United States

- 5.3.1.2 Canada

- 5.3.1.3 Rest of North America

- 5.3.2 Europe

- 5.3.2.1 Germany

- 5.3.2.2 United Kingdom

- 5.3.2.3 France

- 5.3.2.4 Italy

- 5.3.2.5 Spain

- 5.3.2.6 Rest of Europe

- 5.3.3 Asia-Pacific

- 5.3.3.1 China

- 5.3.3.2 India

- 5.3.3.3 Japan

- 5.3.3.4 South Korea

- 5.3.3.5 Rest of Asia-Pacific

- 5.3.4 Rest of the World

- 5.3.4.1 South America

- 5.3.4.2 Middle East and Africa

- 5.3.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Vendor Market Share

- 6.2 Company Profiles

- 6.2.1 Zips Car Wash

- 6.2.2 Splash Car Wash

- 6.2.3 International Car Wash Group (ICW)

- 6.2.4 Autobell Car Wash

- 6.2.5 Quick Quack Car Wash

- 6.2.6 Super Star Car Wash

- 6.2.7 True Blue Car Wash LLC

- 6.2.8 Magic Hands Car Wash

- 6.2.9 Hoffman Car Wash

- 6.2.10 Mister Car Wash