|

市场调查报告书

商品编码

1521672

气动废弃物管理系统:全球市场占有率分析、产业趋势/统计、成长预测(2024-2029)Global Pneumatic Waste Management System - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

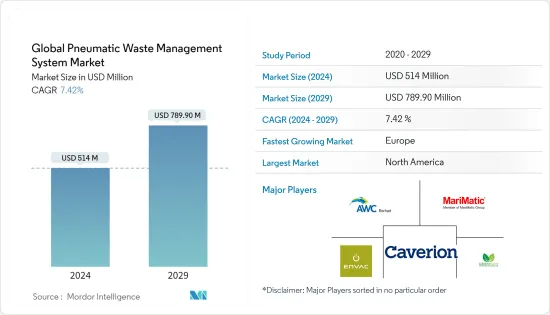

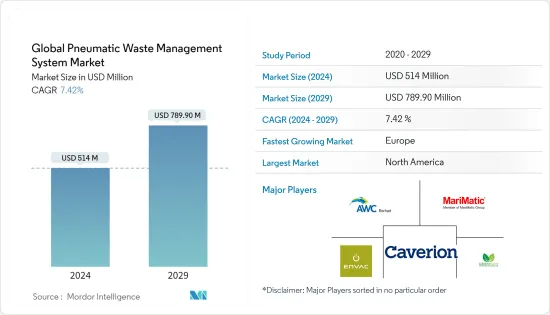

气动废弃物管理系统的全球市场规模预计2024年为5.14亿美元,预计2029年将达到7.899亿美元,预计将以7.42%的复合年增长率成长。

主要亮点

- 鑑于对智慧城市解决方案的需求不断增长、政府促进永续发展的努力以及城市固态废弃物产生量的增加,气动废弃物管理系统预计在未来几年将显着增长。与传统的废弃物收集方法相比,这些系统有许多好处,包括减少噪音和交通拥堵、改善公共健康和安全以及减少温室气体排放。

- 随着环境法规变得更加严格,此类系统符合永续性目标并可能受益于公共奖励,因此变得越来越有吸引力。到2050年,全球固态废弃物产量预计将增加,这也是一个主要驱动力。透过促进有效的废弃物管理和减少对垃圾掩埋场的依赖,气动废弃物收集系统提供了实用的解决方案。

- 2023 年 7 月,大清奈公司 (GCC) 访问了罗马、巴黎和巴塞隆纳,考虑对这些城市实施的固态废弃物管理 (SWM) 系统进行改进。

- 为了轻鬆处理废弃物并避免溢出和直接接触,GCC 将安装盖子上有孔的垃圾箱,并用彩色带指示废弃物类型。这些将被引入到海滩等人流量大的地区。单独的玻璃瓶容器也将在海滩上放置数月。此外,海合会也提案试行在垃圾车上安装秤重机,测量各用户排放垃圾的重量,并辨识大宗垃圾排放。

全球气动废弃物管理系统市场趋势

预计欧洲市场在未来几年将显着成长

- 几十年来,气动废弃物管理系统已在欧洲各地实施,被认为是先进技术。这些系统在斯堪地那维亚广泛分布,其中瑞典和芬兰的集中度最高。随着对更永续的环境的需求不断增加,废弃物管理策略变得越来越全球化。在需要减少交通和污染的都市区,气动废弃物收集提供了传统道路运输的替代方案。

- 据欧洲资讯来源称,定置型真空废弃物收集系统的投资成本(不包括建筑工程以及初步调查和测试)从 230 万欧元(250 万美元)到 1,360 万欧元(1,476 万美元)不等。这些成本根据系统的大小而有很大差异。入口数量、网路长度、废弃物收集数量以及一套真空废弃物收集系统的规模根据连接人口进行调整。

- 每米管道的平均成本为 1,000 至 3,000 欧元,每个入口的平均成本为 20,000 至 70,000 欧元(21,706 至 75,974 美元)。每栋住宅的平均投资为 2,400 欧元(2,604 美元),每位居民的平均投资为 835 欧元(906 美元)。

- 2023年8月,恩华特发明了气动垃圾收集系统,将整个过程移至地下,取代了单一垃圾槽的手动垃圾收集,减少了与垃圾相关的拥堵,并大幅减少了碳排放。在中国,许多智慧城市和医院都采用了这项技术。

医院对气动废弃物管理系统的需求增加

- 从医疗保健和食品服务的角度来看,气动废弃物系统用于运输医疗废弃物、厨余垃圾和其他潜在危险物质。卫生和安全的促进有助于使用气动系统管理某些类型的废弃物。

- 2023年10月,恩华特法国公司负责在伊西勒穆利诺市、罗曼维尔市以及巴黎巴蒂诺尔区安装气动废弃物收集系统。这项先进技术显着减少了传统废弃物收集车的收集路线,并减少了80%的NO2和CO2排放。

- 在魁北克省伊西勒和巴蒂诺尔,穆兰和罗曼维尔目前有两个废弃物收集设施正在运作,恩华特正在与永续城市发展供应商合作,安装气动废弃物管理系统。此外,蒙彼利埃和斯特拉斯堡医院的两个手术室合计容量超过1,500张床位。

- 巴黎环带的城市设施总合涵盖了 11,000 个家庭,提供了自动化废弃物收集服务,超过 36,000 名居民受益于创新的废弃物管理服务,这些服务不仅提供了便利,而且有助于改善城市环境。

全球气动废弃物管理系统产业概况

气动废弃物处理系统市场已整合并由全球参与者主导。参与者正专注于扩大其地理影响力,以占领主要市场份额。市场主要企业包括Envac Group、Stream、MariMatic Oy、Aerbin ApS、Logiwaste AB等。这些公司不断采取併购、策略联盟、合资、合作等策略来占领更多的市场占有率。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第一章 简介

- 调查先决条件

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场洞察

- 目前的市场状况

- 市场技术进步

- 政府法规和市场倡议

- 运输费用注意事项

- 价值链/供应链分析

- COVID-19 对市场的影响

第五章市场动态

- 市场驱动因素

- 都市化和人口成长

- 政府法规和倡议

- 投资技术进步

- 市场限制因素

- 社会认知度和接受度

- 维护和营运成本

- 市场机会

- 开拓新兴市场

- 采用循环经济模式

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 消费者/买方议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争公司之间敌对关係的强度

第六章 市场细分

- 按最终用户

- 住宅

- 商业(办公室)

- 医院

- 款待

- 其他的

- 按地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 法国

- 西班牙

- 义大利

- 其他欧洲国家

- 亚太地区

- 中国

- 印度

- 日本

- 澳洲

- 新加坡

- 马来西亚

- 泰国

- 其他亚太地区

- 中东/非洲

- 沙乌地阿拉伯

- 卡达

- 阿拉伯聯合大公国

- 埃及

- 其他中东和北非地区

- 拉丁美洲

- 巴西

- 阿根廷

- 其他拉丁美洲

- 北美洲

第七章 竞争格局

- 市场集中度

- 公司简介

- ENVAC

- MARIMATIC OY

- AWC BERHAD

- Stream

- ATREO

- Ecosir Group OY

- GreenWave Solutions

- CAVERION Corporation

- Air-Log International GmbH

- LOGIWASTE AB

- AERBIN APS

- Peakway Environmental Sci & Tech Co. Ltd*

- 其他公司

第八章市场的未来

第九章 附录

The Global Pneumatic Waste Management System Market size is estimated at USD 514 million in 2024, and is expected to reach USD 789.90 million by 2029, growing at a CAGR of 7.42% during the forecast period (2024-2029).

Key Highlights

- In view of the growing demand for smart city solutions, government initiatives promoting sustainable development, and increasing municipal solid waste generation, pneumatic waste management systems are expected to grow significantly over the next few years. Such systems offer a number of advantages, such as reducing noise and traffic congestion, improving public health and safety, and lowering greenhouse gas emissions compared to conventional waste collection methods.

- These systems, aligned with sustainability objectives and the potential to benefit from public incentives, are becoming increasingly attractive as environmental regulations become more stringent. The global municipal solid waste production is expected to increase by 2050, and this is another major growth driver. By facilitating efficient waste management and reducing reliance on landfills, pneumatic waste collection systems provide a practical solution.

- In July 2023, following a trip to Rome, Paris, and Barcelona, the Greater Chennai Corporation (GCC) mulled over the introduction of measures practiced by these cities to improve the solid waste management (SWM) system.

- In order to allow easy disposal of waste and avoid spilling and direct contact with it, GCC intends to install dustbins with holes in the lids and colored bands to indicate the category of waste to be disposed of. These are expected to be introduced in high-traffic areas such as beaches. For a period of 2 to 3 months, separate containers for glass bottles will also be placed on the beach. Additionally, the GCC proposed installing a weighing machine in garbage collection vehicles on a pilot basis to determine the weight generated by different users and identify bulk waste generators.

Global Pneumatic Waste Management System Market Trends

Europe is Expected to Witness Significant Market Growth in the Coming Years

- For decades, pneumatic waste management systems have been in place throughout Europe and are considered to be an advanced technology. These systems are widespread in Scandinavia, with Sweden and Finland having the highest concentration. Waste management strategies are becoming increasingly global as the need for a more sustainable environment grows. In urban areas where there is a need to reduce traffic and pollution, pneumatic waste collection provides an alternative to traditional road haulage.

- According to European sources, the cost of investing in stationary vacuum waste collection systems, excluding construction works and preliminary studies or tests, is between EUR 2.3 million (USD 2.50 million) and EUR 13.6 million (USD 14.76 million). Due to the size of the systems, these costs differ significantly. The number of inlets, the length of the network, the number of waste fractions collected, and the size of one vacuum waste collection system are adjusted according to the connected population.

- The average cost per meter of pipe was EUR 1,000-3,000, and the average cost per inlet was EUR 20,000-70,000 (USD 21,706-75,974). The average investment was EUR 2,400 (USD 2,604) per dwelling and EUR 835 (USD 906) per inhabitant.

- In August 2023, Envac invented a pneumatic waste collection system that moves the procedure underground and replaces manual waste collection from individual refuse chutes, dramatically reducing waste-related heavy traffic and carbon emissions. In China, a number of smart cities and hospitals have adopted this technology.

The Demand for Pneumatic Waste Management Systems for Hospitals is Increasing

- In terms of healthcare and food services, pneumatic waste systems are used to transport medical waste, food scraps, and other potentially hazardous materials. Promoting hygiene and safety contributes to the specific types of garbage managed through pneumatic systems.

- In October 2023, Envac France was responsible for installing pneumatic waste collection systems in the municipalities of Issy-le-Moulineaux and Romainville, as well as in the Batignolles district of Paris. This advanced technology significantly reduces the number of conventional waste truck collection routes, resulting in an 80% reduction in NO2 and CO2 emissions.

- In the municipalities of Issy le Quebec, which currently have two waste collection facilities in operation, Moulin and Romainville, as well as Batignolles, Envac joined forces with suppliers for sustainable urban development to install pneumatic waste management systems. In addition, a combination of over 1,500 beds is available in two operating units at Montpellier Hospital and Strasbourg Hospital.

- In total, the urban facilities in the Paris Belt cover the automated waste collection service of 11,000 households, which means that more than 36,000 inhabitants benefit from an innovative waste management service that, in addition to being convenient, contributes to improving the environment in cities.

Global Pneumatic Waste Management System Industry Overview

The pneumatic waste system market is consolidated and dominated by global players. The players are focusing on expanding their geographical presence to capture a major share of the market. Some of the key players in the market include Envac Group, Stream, MariMatic Oy, Aerbin ApS, and Logiwaste AB. They are continuously adopting strategies like mergers and acquisitions, strategic alliances, joint ventures, and partnerships to gain more market shares.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Current Market Scenario

- 4.2 Technology Advancements in the Market

- 4.3 Government Regulations and Initiatives in the Market

- 4.4 Spotlight on Transport Rates

- 4.5 Value Chain/Supply Chain Analysis

- 4.6 Impact on COVID-19 on the Market

5 Market Dynamics

- 5.1 Market Drivers

- 5.1.1 Growing Urbanization and Population

- 5.1.2 Government Regulations and Initiatives

- 5.1.3 Investments in Technology Advancements

- 5.2 Market Restraints

- 5.2.1 Public Awareness and Acceptance

- 5.2.2 Maintenance and Operational Costs

- 5.3 Market Opportunities

- 5.3.1 Market Expansions in Developing Regions

- 5.3.2 Adoption of Circular Economy Models

- 5.4 Industry Attractiveness - Porter's Five Forces Analysis

- 5.4.1 Bargaining Power of Suppliers

- 5.4.2 Bargaining Power of Consumers/Buyers

- 5.4.3 Threat of New Entrants

- 5.4.4 Threat of Substitute Products

- 5.4.5 Intensity of Competitive Rivalry

6 MARKET SEGMENTATION

- 6.1 By End User

- 6.1.1 Residential

- 6.1.2 Commercial (Offices)

- 6.1.3 Hospitals

- 6.1.4 Hospitality

- 6.1.5 Others

- 6.2 By Geography

- 6.2.1 North America

- 6.2.1.1 United States

- 6.2.1.2 Canada

- 6.2.1.3 Mexico

- 6.2.2 Europe

- 6.2.2.1 Germany

- 6.2.2.2 France

- 6.2.2.3 Spain

- 6.2.2.4 Italy

- 6.2.2.5 Rest of Europe

- 6.2.3 Asia-Pacific

- 6.2.3.1 China

- 6.2.3.2 India

- 6.2.3.3 Japan

- 6.2.3.4 Australia

- 6.2.3.5 Singapore

- 6.2.3.6 Malaysia

- 6.2.3.7 Thailand

- 6.2.3.8 Rest of Asia-Pacific

- 6.2.4 Middle East and Africa

- 6.2.4.1 Saudi Arabia

- 6.2.4.2 Qatar

- 6.2.4.3 United Arab Emirates

- 6.2.4.4 Egypt

- 6.2.4.5 Rest of MENA

- 6.2.5 Latin America

- 6.2.5.1 Brazil

- 6.2.5.2 Argentina

- 6.2.5.3 Rest of Latin America

- 6.2.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Market Concentration

- 7.2 Company Profiles

- 7.2.1 ENVAC

- 7.2.2 MARIMATIC OY

- 7.2.3 AWC BERHAD

- 7.2.4 Stream

- 7.2.5 ATREO

- 7.2.6 Ecosir Group OY

- 7.2.7 GreenWave Solutions

- 7.2.8 CAVERION Corporation

- 7.2.9 Air-Log International GmbH

- 7.2.10 LOGIWASTE AB

- 7.2.11 AERBIN APS

- 7.2.12 Peakway Environmental Sci & Tech Co. Ltd*

- 7.3 Other Companies