|

市场调查报告书

商品编码

1521713

可解释的人工智慧- 市场占有率分析、产业趋势/统计、成长预测(2024-2029)Explainable AI - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

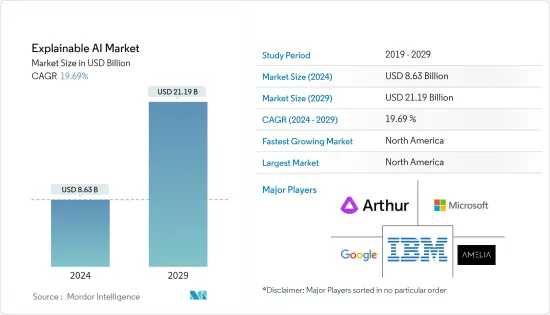

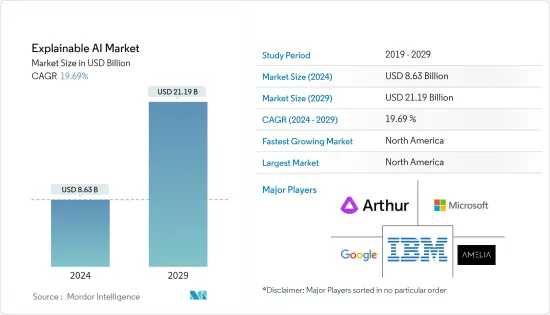

可解释的人工智慧市场规模预计到 2024 年为 86.3 亿美元,预计到 2029 年将达到 211.9 亿美元,在预测期内(2024-2029 年)复合年增长率为 19.69%。

主要亮点

- 可解释的人工智慧是指人工智慧(AI)系统的发展,可以为决策流程提供连贯且透明的解释。人工智慧模型在各个领域都取得了无与伦比的性能。可解释的人工智慧旨在增强人工智慧系统的信任、责任和可解释性。这与技术的普遍成长和进步密切相关。随着技术的不断发展和增强,可解释的人工智慧将使得开发和执行更加复杂和透明的人工智慧系统成为可能。

- 数位转型和进步技术进步(通常称为工业 4.0)是可解释人工智慧 (XAI) 需求背后的驱动趋势。这一发展使不同行业能够透过融入数位技术来成功适应。将 XAI 方法与工业 4.0 技术相集成,可实现准确和高品质的应用,使公司更加敏捷并以客户为中心。工业 4.0 利用人工智慧进行预测性维护和故障检测,以减少非计划性停机。 XAI 使营运商能够了解 AI 预测和建议背后的推理。这种透明度对于维护人员来说至关重要,可让他们了解何时以及如何执行维护活动。

- 由于金融、零售和医疗保健等各行业提供公平、责任和道德使用的监管和合规要求不断提高,全球可解释人工智慧市场正在不断增长。各国和监管机构正在认识到人工智慧系统中透明度和课责的重要性,以确保道德服务并防止偏见和偏见结果。因此,欧洲《一般资料保护规范》(GDPR)的序言以及金融稳定委员会(FSB)等组织的各种指导方针都强调了人工智慧演算法可解释性的必要性,为市场带来了广阔的前景。 。此外,越来越多的公司正在采用符合这些法规和准则的可解释的人工智慧解决方案,以提供透明和可解释的人工智慧系统,这对市场成长产生了积极影响。

- 诈欺侦测是可解释人工智慧的一个主要用途部分,用于预测诈欺攻击并确定哪些攻击具有更高的威胁。网路安全越来越受到企业和政府的关注。网路安全解决方案供应商越来越多地利用人工智慧,解释人工智慧演算法的见解有几个好处,包括增强对系统的信心和更好地理解营运。可解释的人工智慧解决方案被用于网路安全的多个领域,并正在促进市场成长。 XAI 咨询服务专注于协助您部署和实施透明、可解释和可解释的 AI 解决方案。

- 云端基础的解决方案是当今数位环境的重要组成部分。对云端基础的智慧服务不断增长的需求以及多重云端营运的成长趋势正在推动所研究市场的需求。最新的XAI技术为云端运算付加了独特的价值,提升了其价值。这方面不仅对于提高整体製程可行性是必要的,而且对于融入新技术也是必要的。可解释的人工智慧软体还可以帮助缩小云端运算和最新突破之间的差距。它还有助于满足新企业和新兴企业的需求。

- 相反,业务咨询、研发、运算能力和建构最小可行产品的成本是在实施之前产生的。自动资料准备、基础设施提供、处理以及系统和员工的实用化等因素构成了总效能成本。实施成本很高,并且根据行业规模而有所不同。市场的一个关键挑战是用人工智慧取代人类劳动力。人工智慧技术是最大限度地提高生产力的下一步,用工厂生产线取代个人製程。

可解释的人工智慧市场趋势

BFSI 细分市场预计将占据主要市场份额

- XAI 的新兴业务将使银行能够解决此类透明度和信任问题,并让人工智慧管治更加清晰。糟糕的客户引导流程给金融机构造成了数百万美元的损失。对于许多银行来说,申请贷款和评估您的健康状况将很困难。可解释的人工智慧描述了在保持透明度的同时进行合格检查和风险管理的系统。 XAI 预测追踪银行绩效的关键见解。例如,Akira AI 提供准确、动态、自动化的预测,帮助在供应链管理和客户流失做出更好的决策。

- XAI正在为BFSI产业带来前所未有的变化。这些技术透过自动化日常业务、减少错误、提高准确性和提高效率,正在彻底改变会计。根据 ICAEW 报告,人工智慧可以将财务职能的总成本降低 16%,88% 的会计专业人士认为人工智慧将在未来几年改善他们的工作生活。诈欺检测和预防也是人工智慧和技术将改变会计的一个领域。传统的审核技术依赖手动采样和测试,既耗时又容易出错。人工智慧驱动的审核工具可以快速准确地分析大量资料并识别异常和可疑交易。这使得审核能够专注于高风险领域和潜在的诈欺,降低公司财务损失和声誉受损的风险。

- 人工智慧透过预测贷款需求、付款速度和 ATM 要求来改善银行的现金管理。银行使用历史现金资料来建立预测现金可用性的模型。这些见解使银行能够在需要的时间和地点提供适量的资金。可以使用人工智慧工具监控每个地区自动提款机(ATM)的运作状态,让金融机构知道哪些ATM机现金用完并重新启动,而不会给客户带来不便。例如,根据日本银行家协会的数据,截至 2023 年 9 月,地区银行在日本各地安装了超过 28,500 台 ATM 和自动提款机(CD)。日本邮政银行有近 31,500 台 ATM 和 CD 的记录。

- 许多银行和金融机构都引进了XAI,以便为客户提供更好的服务。例如,2023 年 9 月,Temenos 宣布了一款生成式人工智慧解决方案,可自动对银行交易进行分类。该技术使银行能够提供个人化见解、创造独特的数位银行体验并提供相关产品。该公司表示,Temenos 处于业务人工智慧的前沿。将第一个真正可解释的人工智慧引入金融服务业,金融机构现在可以用简单的商业语言向客户及其交易对手解释基于人工智慧的决策。

- 根据 Nvidia Research 2023 的数据,资料分析是 2023 年金融服务业中最常使用的人工智慧应用程式。调查显示,69%的受访者使用人工智慧进行资料分析,其次是资料处理。其他常见的人工智慧使用案例包括自然语言处理和大规模语言模型。预计从 2022 年起,金融业务中人工智慧的采用将大幅增加,并在未来几年进一步增加。人工智慧在此类金融领域的大量采用预计将推动市场成长。

预计北美将占据很大的市场份额

- 除了联邦政府对先进技术的战略投资外,北美还拥有由世界各地领先科学家和企业家以及知名研究中心支持的强大基础设施,加速了该地区人工智慧的发展。该产业预计将受益于美国政府多项与人工智慧相关的倡议。例如,美国国家科学基金会与美国农业部、美国国防安全保障部、科学技术局、美国标准与技术研究所、美国食品和农业研究所以及美国农业部合作。智慧创新”·第二部分”计划已经启动。

- 国家安全委员会关于人工智慧的最终报告提案国会每年将人工智慧的联邦研发预算增加一倍,预计到 2026 财政年度总计达到 320 亿美元。拜登政府的2023财年预算提案将增加联邦研发支出超过2,040亿美元,比2021财年授权水准增加28%。国家人工智慧研究机构,无论是新的还是现有的,都将获得这些资金的一部分。这些机构将商业部门、组织、学术机构以及联邦、州和地方当局聚集在一起,共同应对人工智慧研究和劳动力发展的挑战。这些政府针对人工智慧发展的措施被认为将为所研究的市场的成长创造机会。

- 此外,与许多其他国家统计机构一样,加拿大统计局正在采用机器学习和人工智慧,并越来越多地利用替代资料来源来增强和现代化其许多统计系统。由于这些新资料来源的数量和速度,经常需要机器学习技术来利用它们。人工智慧推动加拿大的经济发展和优质就业,因此加拿大政府致力于资助加速人工智慧在经济和社会中采用的措施。例如,联邦政府最近宣布将为泛加拿大人工智慧战略第二阶段投资4.43亿美元。泛加拿大人工智慧策略第二阶段将有助于最大限度地发挥人工智慧的潜力,造福加拿大人,加速可靠的技术开发,并促进人工智慧社群内的多样性和协作。

- 北美地区的各种零售公司正在实施人工智慧,以更好地服务客户。例如,线上委託零售商 ThredUp 推出了 Goody Boxes,其中包含根据每位客户的个人风格量身定制的各种二手服饰。顾客保留他们想要的东西,付款,然后退回他们不需要的东西。 AI演算法会记住每位顾客的喜好,以便未来的盒子将更适合他们的口味。客户更喜欢非订阅盒,因为他们可以看到单独的零件。特斯拉的自动驾驶汽车是人工智慧和物联网如何协同工作的例子之一。透过结合人工智慧,自动驾驶汽车可以预测汽车和行人在各种情况下的行为。例如,它判断路况、天气、最佳速度等,每次开车都变得更聪明。

- 大多数製造商与能够提供全面服务以支援大规模 XAI 解决方案的公司合作。像微软这样的供应商正在提供人工智慧来帮助製造业。製造组织中越来越多地采用人工智慧将提高缺陷检测、品质保证、组装整合、组装优化和生成设计的效率。由人工智慧和深度学习驱动的新电脑视觉技术正在开发中,以实现视觉检查自动化,以满足不断增长的全球需求。

可解释的人工智慧产业概述

XAI 市场是半静态的,有一些着名的参与企业,包括: IBM Corporation、Microsoft Corporation、Amelia US LLC、Google LLC 和 Arthur.ai 不断在策略合作伙伴关係或收购以及解决方案和服务开发上投入资金。

- 2024 年 3 月,苹果收购了 DarwinAI,这是一家人工智慧视觉品质保证Start-Ups,提供端到端解决方案,在提高产品品质的同时提高生产效率。 Darwin AI的取得专利的XAI平台被许多财富500强公司使用。苹果收购 DarwinAI 符合苹果长期以来小心地将创新科技公司融入其生态系统的做法。

- 2023年7月,富士通有限公司宣布与Informa D&B达成策略协议,透过将XAI引入商业和金融资讯产业来创造新价值。此次合作将透过结合可解释的人工智慧技术,开创决策的新时代。透过采用这项技术,富士通和 Informa 致力于为产业带来变革性创新。这将使 Informa 在西班牙的 450 万用户能够以敏捷、高效的方式存取高度复杂的资料,从而显着提高商业资讯解决方案的品质。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行概述

第四章市场洞察

- 市场概况

- 产业价值链分析

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争公司之间的敌对关係

第五章市场动态

- 市场驱动因素

- 人工智慧系统对课责和透明度的需求日益增长

- 更多地利用最尖端科技进行创新

- 市场限制因素

- 可解释人工智慧的实施成本高昂

- 缺乏熟练的人工智慧工程师

- 对科技的影响

- 机器学习演算法

- 深度学习

- 神经网路

- 使用案例分析

- AI模型效能监控

- 监理与合规风险管理

- 在混合云中部署人工智慧计划

- 案例研究分析

第六章 市场细分

- 按服务

- 解决方案

- 按服务

- 按发展

- 云

- 本地

- 按最终用户产业

- BFSI

- 医疗保健

- 製造业

- 零售

- 资讯科技/通讯

- 其他的

- 按地区*

- 北美洲

- 欧洲

- 亚洲

- 澳洲/纽西兰

- 拉丁美洲

- 中东/非洲

第七章 竞争格局

- 公司简介

- IBM Corporation

- Microsoft Corporation

- Amelia US LLC

- Google LLC

- Arthur.ai

- Ditto.ai

- Intel

- AWS

- NVIDIA

- Mphasis

- Alteryx

第八章投资分析

第9章市场的未来

The Explainable AI Market size is estimated at USD 8.63 billion in 2024, and is expected to reach USD 21.19 billion by 2029, growing at a CAGR of 19.69% during the forecast period (2024-2029).

Key Highlights

- Explainable AI refers to the growth of artificial intelligence (AI) systems that can provide coherent and transparent explanations for their decision-making processes. AI models have achieved unparalleled performance in various domains. Explainable AI seeks to enhance trust, responsibility, and interpretability in AI systems. It is closely tied to more general growth and advancements in technology. As technology continues to evolve and enhance, explainable AI allows for the development and execution of more refined and transparent AI systems.

- The advancements in digital transformation and progressive technologies, often referred to as Industry 4.0, are a driving trend behind the demand for explainable AI (XAI). This development has led to the successful adaptation of diverse industries by embracing digital technologies. Integrating XAI methods with Industry 4.0 technologies allows precise and high-quality applications, making firms more agile and customer-focused. Industry 4.0 leverages Al for predictive maintenance and fault detection, lowering unplanned downtime. With XAI, operators can understand the reason behind Al's predictions and recommendations. This transparency is crucial for maintenance personnel, permitting them to make informed findings about when and how to conduct maintenance activities.

- The global explainable AI market is growing due to the rising regulatory and compliance requirements in various industries, such as finance, retail, and healthcare, to provide fairness, responsibility, and ethical use. Nations and regulatory bodies have recognized the significance of transparency and accountability in AI systems to assure ethical service and prevent biases or prejudiced outcomes. As a result, the preface of the General Data Protection Regulation (GDPR) in Europe and different guidelines from organizations, such as the Financial Stability Board (FSB), underline the need for explainability in AI algorithms, thus creating a promising outlook for the market. Moreover, a growing number of firms are adopting explainable AI solutions in adherence with these regulations and guidelines to provide transparent and interpretable AI systems, which, in turn, is positively influencing the market growth.

- Fraud detection is a primary application area of explainable AI where it predicts fraudulent attacks and determines which attack has a more elevated threat. Cybersecurity is an increasing concern for companies and governments. Vendors of cybersecurity solutions are increasingly utilizing AI and explaining an AI algorithm's findings brings several benefits, including greater confidence in the system and a better understanding of its operation. Explainable AI solutions are being used in several areas of cybersecurity, enhancing the market growth. XAI consulting services specialize in assisting institutions adopt and implement AI solutions that are transparent, interpretable, and accountable.

- Cloud-based solutions are an essential component of the present digital environment. The expanding trend of multi-cloud operation, as well as the growing need for cloud-based intelligence services, drives the demand in the market under study. The latest XAI technologies add unique and increased value to cloud computing. This aspect not only improves overall process viability but is also necessary for incorporating new technology. Explainable AI software can also help bridge the gap between cloud computing and modern breakthroughs. It also assists in satisfying the needs of new enterprises and startups.

- On the contrary, the costs of business consulting, research and development, computing power, and cost to build minimal viable products are incurred before implementation. Factors such as automatic data preparation, delivering the infrastructure, processing, and making it actionable for systems and employees constitute the total cost for performance. The implementation cost is high and depends on the size of the industry. A significant challenge in the market is replacing the human workforce with AI. AI technology is the next step in maximum productivity, replacing individual craftsmanship with the factory production line.

Explainable AI Market Trends

BFSI Segment is Expected to Hold Significant Share of the Market

- The emerging field of XAI can enable banks to navigate such transparency and trust issues and provide greater clarity on AI governance. Due to insufficient customer onboarding processes, financial institutions lose millions of dollars. It becomes difficult for many banks to evaluate their health by applying for a loan. Explainable AI provides a system for eligibility checks and risk management while maintaining transparency. XAI forecasts the key insights to track the banks' performance. For example, Akira AI provides accurate, dynamic, and automated predictions, helping it to make better decisions for supply chain management and customer churn.

- XAI is unprecedentedly transforming the BFSI industry. These technologies are revolutionizing accounting by automating routine tasks, reducing errors, improving accuracy, and improving efficiency. According to a report by ICAEW, AI can save 16% of the total cost of the finance function, and 88% of accounting experts believe AI will enhance their working lives in the next few years. Deception detection and prevention are another area where AI and technology transform accounting. Traditional auditing methods depend on manual sampling and testing, which can be time-consuming and prone to errors. AI-powered auditing tools can analyze large amounts of data quickly and accurately, identifying anomalies and questionable transactions. This enables auditors to focus on high-risk areas and potential frauds, lowering the risk of financial loss and reputational damage for businesses.

- AI improves the cash management of banks by predicting loan demand, payment speed, and ATM requirements. Banks are using historical cash data to build models that predict cash availability. These insights give banks the right amount of money where and when anyone needs it. The operations of automated teller machines (ATMs) in various regions can be monitored by AI tools and financial institutions can know which ATMs have cash shortage and can be refilled again without causing any inconvenience to the customer. For instance, according to Japanese Bankers Association, as of September 2023, regional banks had installed over 28.5 thousand ATMs and cash dispensers (CDs) across Japan. The Japan Post Bank recorded almost 31.5 thousand ATMs and CDs.

- There are various banks and financial institutions that are incorporating XAI to provide better services to their customers. For instance, in September 2023, Temenos unveiled a generative AI solution that automatically categorizes banking transactions. The technology empowers banks to offer personalized insights, create unique digital banking experiences, and provide relevant products. The company stated that Temenos is at the forefront of AI in banking. The first to bring true explainable AI to the financial services industry, which helps financial institutions explain in simple business language to customers and their clients alike how AI-based decisions are taken.

- According to Nvidia survey 2023, data analytics was the most used AI-enabled application in the financial services industry in 2023. Based on the survey, 69% of the respondents used AI for data analytics, followed by data processing. Other common AI use cases were natural language processing and large language models. The adoption of AI in financial businesses increased significantly since 2022, and it is anticipated to increase even further in the coming years. Such huge adoption of AI in finance sector would drive the growth of the market.

North America is Expected to Hold Significant Share of the Market

- North America has a robust innovation ecosystem supported by strategic federal investments in advanced technology, in addition to the presence of forward-thinking scientists and entrepreneurs who come together from around the world and renowned research centers that have accelerated the development of AI in the North American region. The industry is anticipated to benefit from many US government initiatives related to AI. For instance, the Expanding AI Innovation through Capacity Building and Part II program was launched by the US National Science Foundation in coordination with the US Department of Agriculture, the US Department of Homeland Security, the Science and Technology Directorate, the National Institute of Standards and Technology, National Institute of Food and Agriculture, and the US Department of Defense.

- The National Security Commission on Artificial Intelligence's final report proposed that Congress is expected to increase federal R&D funding for AI by a factor of two annually, up to a total of USD32 billion by fiscal year 2026. The federal R&D budget will be increased by 28% from FY 2021 authorized levels to more than USD 204 billion under the Biden administration's fiscal 2023 budget plan. The National AI Research Institutes, both new and established, would get some of those funds. To address the difficulties of AI research and workforce development, these institutes bring together the commercial sector, organizations, academics, and federal, state, and municipal authorities. Such government initiatives for the development of AI will create an opportunity for the market studied to grow.

- In addition, Statistics Canada, like many other national statistical agencies, has embraced machine learning and artificial intelligence and is increasingly utilizing alternative data sources to enhance and modernize its many statistical systems. Machine learning techniques are frequently needed to exploit these new data sources because of their volume and speed. Since AI is promoting economic development and high-quality employment in Canada, the government of Canada is dedicated to funding initiatives to accelerate the adoption of AI throughout the economy and society. For instance, the federal government announced an investment of USD 443 million recently in the Pan-Canadian Artificial Intelligence Strategy's second phase. The Pan-Canadian Artificial Intelligence Strategy's second phase will assist in maximizing AI's potential for Canadians' benefit, speed up reliable technology development, and promote diversity and collaboration within the AI community.

- Various retail firms in the North American region are adopting AI to provide better services to customers. For example, ThredUp, an online consignment business, introduced Goody Boxes, comprising different used apparel items tailored to each customer's style. Customers keep and pay for the things they want while returning the ones they do not want. An AI algorithm recalls each customer's preferences so that future boxes are more tailored to their interests. Customers prefer non-subscription boxes overlooking individual parts. Tesla's self-driving cars are one of the examples of AI and IoT working in tandem. With the incorporation of AI, self-driving cars predict the behavior of cars and pedestrians in various circumstances. For instance, they can determine road conditions, weather, optimal speed and get smarter with each trip.

- Most manufacturers partner with firms that can provide complete services to support a large-scale XAI solution. Vendors like Microsoft are helping manufacturing organizations with their AI offerings. The increasing adoption of AI within manufacturing institutions enables increased efficiencies in defect detection, quality assurance, assembly line integration, assembly line optimization, and generative design. New computer vision technologies are being developed, powered by AI and deep learning, making it possible to automate visual inspection to match the increasing global demand.

Explainable AI Industry Overview

The XAI market is semi-consolidated, with a few prominent players such as IBM Corporation, Microsoft Corporation, Amelia US LLC, Google LLC, and Arthur.ai. To increase market share, corporations continually spend on strategic partnerships or acquisitions and solution and services development. The following are some recent market developments:

- In March 2024, Apple Inc. acquired DarwinAI, an AI visual quality assurance startup that provides an end-to-end solution for improving product quality while increasing production efficiency. Darwin AI's patented XAI platform has been adopted by numerous Fortune 500 companies. Apple's acquisition of DarwinAI aligns with its longstanding practice of discreetly assimilating innovative technology firms into its ecosystem.

- In July 2023, Fujitsu Limited announced a strategic agreement with Informa D&B to deliver new value by bringing XAI to the business and financial information industry. This collaboration brings with it a new era of decision-making through the incorporation of explainable AI technology. Fujitsu and Informa are committed to bringing transformative innovation to the industry through the introduction of this technology, which will allow Informa's 4.5 million users in Spain access to highly sophisticated data in an agile and efficient manner, significantly improving the quality of business information solutions.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Consumers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitutes

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Growing Need for Accountability and Transparency in AI Systems

- 5.1.2 Increasing Use of Cutting-edge Technologies for Innovation

- 5.2 Market Restraints

- 5.2.1 High Implementation Cost of Explainable AI

- 5.2.2 Lack of Skilled and Expert AI Technicians

- 5.3 Technology Impact

- 5.3.1 Machine Learning Algorithms

- 5.3.2 Deep Learning

- 5.3.3 Neural Network

- 5.4 Use Cases Analysis

- 5.4.1 Monitoring of AI Model Performance

- 5.4.2 Managing Regulatory, Compliance Risk

- 5.4.3 Deployment of AI Projects across Hybrid Cloud

- 5.5 Case Study Analysis

6 MARKET SEGMENTATION

- 6.1 By Offering

- 6.1.1 Solution

- 6.1.2 Services

- 6.2 By Deployment

- 6.2.1 Cloud

- 6.2.2 On-premise

- 6.3 By End-user Industry

- 6.3.1 BFSI

- 6.3.2 Healthcare

- 6.3.3 Manufacturing

- 6.3.4 Retail

- 6.3.5 IT and Telecommunication

- 6.3.6 Other End-user Industries

- 6.4 By Geography***

- 6.4.1 North America

- 6.4.2 Europe

- 6.4.3 Asia

- 6.4.4 Australia and New Zealand

- 6.4.5 Latin America

- 6.4.6 Middle East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles*

- 7.1.1 IBM Corporation

- 7.1.2 Microsoft Corporation

- 7.1.3 Amelia US LLC

- 7.1.4 Google LLC

- 7.1.5 Arthur.ai

- 7.1.6 Ditto.ai

- 7.1.7 Intel

- 7.1.8 AWS

- 7.1.9 NVIDIA

- 7.1.10 Mphasis

- 7.1.11 Alteryx