|

市场调查报告书

商品编码

1521726

建筑用可携式发电机:市场占有率分析、产业趋势与统计、成长预测(2024-2029)Construction Portable Generators - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

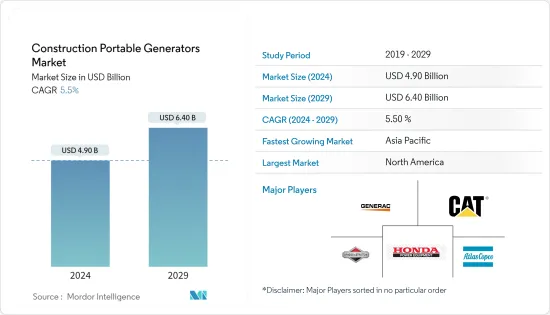

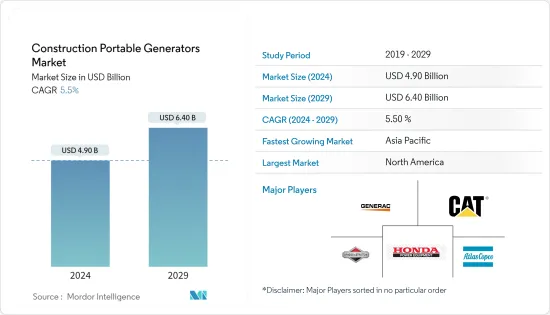

建筑用可携式发电机市场规模预计到 2024 年将达到 49 亿美元,预计到 2029 年将达到 64 亿美元,在预测期内(2024-2029 年)复合年增长率为 5.5%。

*从中期来看,不断增长的电力需求、缺乏可靠的电网基础设施、对紧急备用电源解决方案的需求以及建筑工地稳定供电的需求等因素将推动可携式发电机市场的发展。

*另一方面,可携式发电机面临来自电池储存系统的激烈竞争。此外,其他更清洁的备用电力源预计将阻碍可携式发电机市场的发展。

*然而,新兴经济体商业/工业和住宅领域的新建筑预计将在不久的将来为市场参与企业提供重大机会。

*北美市场占有率较大,需求预计来自美国和印度等国。

建筑可携式发电机的市场趋势

10KW以上将是重要细分市场

*可携式发电机对于建设产业至关重要。承包商经常发现自己所处的工地缺乏电力服务或停电,需要他们使用可携式照明装置。由于多种因素,建设产业的可携式发电机市场预计在未来几年将显着成长。首先,市场受到全球基础设施开发和建设活动不断增长的需求的推动。

*工地采用10kVA以上柴油发电机组持续供电。建筑工地对于为起重机和挖掘机等重型机械提供动力以及移动重要工具至关重要。

*此外,停电频率不断增加,特别是在新兴国家,增加了对可携式发电机的需求。不稳定的电网需要使用可携式发电机来防止工作中断。

*2023年2月,卡特彼勒宣布推出由Cat C9.3B柴油引擎提供动力的XQ330可携式柴油发电机。它还包括可供租赁的功能,例如电池充电器、块式加热器、可切换电压输出、永磁发电机 (PMG) 和拖车安装选项。

*此外,近年来美国的建筑支出一直在稳定成长。 2023年,住宅支出和非住宅支出也将增加。环保建筑实践的趋势也促进了市场的成长。建设公司越来越多地采用运作生物柴油和天然气等替代燃料的可携式发电机,以减少排放气体和环境影响。

*由于这些因素,预计该细分市场将在未来几年占据重要的市场占有率。

北美将占据主要市场占有率

*2023 年,美国的电力消耗量约为 4,000兆瓦瓦时。儘管全国范围内存在复杂的电网基础设施和100%的电力接入,但停电和备用电源需求增加等问题预计将推动该国备用发电市场的需求。停电每年对该国造成的损失平均约为 180 亿美元至 330 亿美元。运作,备用发电机和UPS被认为是不间断连续业务的最实用选择。

*此外,由于激进的货币紧缩导致房屋抵押贷款利率上升,而高通膨对住宅负担能力造成压力,预计住宅将出现最大程度的收缩。然而,由于政府的奖励策略,非住宅仍然保持弹性。 《基础设施投资和就业促进法案》旨在对老化基础设施(道路、高速公路、桥樑、铁路、宽频发展等)进行全面投资,预计将刺激今年的建设。住宅领域建设的不断增加也将增加建筑用可携式发电机的市场供应。

*截至 2023 年,美国是全球最大的资料中心生产国之一。主要市场包括纽约和芝加哥的金融中心、湾区(旧金山)、西雅图和波特兰的高科技中心、达拉斯和洛杉矶的人口中心以及华盛顿特区/维吉尼亚的政府中心。美国的资料中心总数是最近市场(英国)的五倍,美国也是无可争议的「网路之母」。随着资料中心的持续建设,预计市场成长将在不久的将来达到顶峰。

*鑑于上述情况,美国、加拿大和墨西哥的住宅建筑和工业建筑正在增加,预计北美将主导市场。

建筑可携式发电机产业概况

建筑可携式发电机市场较为分散。该市场的一些主要企业包括 Generac Holdings Inc.、Caterpillar Inc.、Honda Siel Power Products Ltd.、Briggs &Stratton Corporation 和 Atlas Copco AB。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 调查范围

- 市场定义

- 研究场所

第二章调查方法

第三章执行概述

第四章市场概况

- 介绍

- 至2029年市场规模及需求预测(单位:十亿美元)

- 最新趋势和发展

- 政府法规政策

- 市场动态

- 促进因素

- 对可携式电源的需求增加

- 全球建筑业投资增加

- 抑制因素

- 对电池储存系统和其他清洁备用电力源的需求增加

- 促进因素

- 供应链分析

- 波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争公司之间的敌对关係

第五章市场区隔

- 额定输出

- 5KW以下

- 5至10千瓦

- 10KW以上

- 汽油种类

- 气体

- 柴油引擎

- 其他燃料

- 地区

- 北美洲

- 美国

- 加拿大

- 北美其他地区

- 欧洲

- 德国

- 法国

- 英国

- 西班牙

- 北欧的

- 土耳其

- 俄罗斯

- 欧洲其他地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 马来西亚

- 泰国

- 印尼

- 越南

- 其他亚太地区

- 南美洲

- 巴西

- 阿根廷

- 哥伦比亚

- 南美洲其他地区

- 中东/非洲

- 沙乌地阿拉伯

- 阿拉伯聯合大公国

- 南非

- 埃及

- 奈及利亚

- 卡达

- 其他中东/非洲

- 北美洲

第六章 竞争状况

- 併购、合资、联盟、协议

- 主要企业策略

- 公司简介

- Generac Holdings Inc.

- Caterpillar Inc.

- Honda Siel Power Products Ltd.

- Briggs & Stratton Corporation

- Kohler Power Systems

- Wacker Neuson SE

- Atlas Copco AB

- Eaton Corporation PLC

- Yamaha Motor Co. Ltd.

- 市场排名/份额(%)分析

第七章 市场机会及未来趋势

- 新兴国家不断成长的商业和工业部门

The Construction Portable Generators Market size is estimated at USD 4.90 billion in 2024, and is expected to reach USD 6.40 billion by 2029, growing at a CAGR of 5.5% during the forecast period (2024-2029).

* Over the medium term, factors such as the ever-increasing demand for power, lack of reliable grid infrastructure, the need for emergency backup power solutions, and the demand for steady power supply at construction sites are driving the portable generator market.

* On the other hand, Portable generators face tough competition from battery storage systems. Also, other cleaner sources of standby power are expected to hinder the portable generators market.

* Nevertheless, the new constructions in the commercial and industrial sectors of emerging economies and the residential sector of developed economies are expected to create significant opportunities for market participants in the near future.

* North America is expected to have a significant market share, with the majority of the demand coming from countries such as the United States and India.

Construction Portable Generators Market Trends

Above 10 KW to be a Significant Market Segment

* Portable power generators are an essential part of the construction industry. In many situations, contractors may find themselves at job sites where the lack of electrical service or power failures requires them to utilize portable lighting units. The portable generator market in the construction industry is expected to witness substantial growth in the coming years due to several factors. Firstly, the growing demand for infrastructure development and construction activities across the globe is driving the market.

* The above 10 kVA diesel generators are used at construction sites for continuous power supply. Construction sites are vital for powering heavy machinery, such as cranes and excavators, and for running essential tools.

* Additionally, the increasing frequency of power outages, especially in developing countries, is boosting the demand for portable generators. Unreliable grid power necessitates the use of portable generators to ensure uninterrupted work progress.

* In February 2023, Caterpillar announced the launch of the XQ330 portable diesel generator powered by the Cat C9.3B diesel engine. It is also equipped with several rental-ready features, including a battery charger, block heater, switchable voltage outputs, permanent magnet generator (PMG), and optional mounting on a trailer.

* Furthermore, construction spending has grown steadily in the United States over the last couple of years. Up to 2023, residential building construction spending and non-residential construction also increased. The rising trend of green construction practices also contributes to market growth. Construction companies are increasingly adopting portable generators that run on alternative fuels, such as biodiesel and natural gas, to reduce emissions and environmental impact.

* Thus, owing to such factors, the segment is expected to have a significant market share in the coming years.

North America to Have a Significant Market Share

* In 2023, the electricity consumption in the United States was about 4000 terawatt-hours. Despite the presence of a complex electricity grid infrastructure and 100% electricity access across the country, problems like power outages and increasing demand for standby power sources are expected to drive the demand for the backup power generation market in the country. Power outages cost an average of about USD 18 billion to USD 33 billion per year in the country. Therefore, backup generators and UPS are considered the most viable options for making business operations run continuously without any interruption.

* Moreover, It is expected that the residential building segment will see the largest contraction because aggressive monetary tightening is feeding into higher mortgage rates, and high inflation weighs on the affordability of homeownership. However, non-residential construction remains more resilient due to government stimulus. The Infrastructure Investment and Jobs Act will provide a stimulus for construction this year, aiming at comprehensive investments in aging infrastructure (including roads, highways, bridges, rail, and broadband development). The growing residential sector constructions will, in turn, culminate in the growth in the utilization of construction portable generators in the market.

* As of 2023, the United States was one of the largest countries in the world for the construction of data centers. Major markets include the financial hubs of New York and Chicago, the tech hubs of the Bay Area (San Francisco), Seattle, and Portland, the population hubs of Dallas and Los Angeles, and the center of Government in Washington DC/Virginia. With the country's total data center numbers outweighing its nearest market (the United Kingdom) by five times, the United States is also the undisputed "home of the internet. The growing construction of data centers will culminate in the market's growth in the near future.

* Owing to the above points, with the increase in residential and industrial construction in the United States, Canada, and Mexico, North America is expected to dominate the market.

Construction Portable Generators Industry Overview

The Construction Portable Generators Market is fragmented. Some of the major companies operating in the market include Generac Holdings Inc., Caterpillar Inc., Honda Siel Power Products Ltd, Briggs & Stratton Corporation, and Atlas Copco AB.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD billion, till 2029

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.1.1 Increasing Demand for portable power source

- 4.5.1.2 Increasing investments in Construction Sector across the Globe

- 4.5.2 Restraints

- 4.5.2.1 Increasing Demand for Battery Storage Systems and other Cleaner Sources of Standby Power

- 4.5.1 Drivers

- 4.6 Supply Chain Analysis

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes Products and Services

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Power Rating

- 5.1.1 Below 5 KW

- 5.1.2 5-10 KW

- 5.1.3 Above 10 KW

- 5.2 Fuel Type

- 5.2.1 Gas

- 5.2.2 Diesel

- 5.2.3 Other Fuel Types

- 5.3 Geography

- 5.3.1 North America

- 5.3.1.1 United States

- 5.3.1.2 Canada

- 5.3.1.3 Rest of North America

- 5.3.2 Europe

- 5.3.2.1 Germany

- 5.3.2.2 France

- 5.3.2.3 United Kingdom

- 5.3.2.4 Spain

- 5.3.2.5 NORDIC

- 5.3.2.6 Turkey

- 5.3.2.7 Russia

- 5.3.2.8 Rest of Europe

- 5.3.3 Asia Pacific

- 5.3.3.1 China

- 5.3.3.2 India

- 5.3.3.3 Japan

- 5.3.3.4 South Korea

- 5.3.3.5 Malaysia

- 5.3.3.6 Thailand

- 5.3.3.7 Indonesia

- 5.3.3.8 Vietnam

- 5.3.3.9 Rest of Asia Pacific

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Colombia

- 5.3.4.4 Rest of South America

- 5.3.5 Middle East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 United Arab Emirates

- 5.3.5.3 South Africa

- 5.3.5.4 Egypt

- 5.3.5.5 Nigeria

- 5.3.5.6 Qatar

- 5.3.5.7 Rest of Middle East and Africa

- 5.3.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 Generac Holdings Inc.

- 6.3.2 Caterpillar Inc.

- 6.3.3 Honda Siel Power Products Ltd.

- 6.3.4 Briggs & Stratton Corporation

- 6.3.5 Kohler Power Systems

- 6.3.6 Wacker Neuson SE

- 6.3.7 Atlas Copco AB

- 6.3.8 Eaton Corporation PLC

- 6.3.9 Yamaha Motor Co. Ltd.

- 6.4 Market Ranking/Share (%) Analysis

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Growing Commercial and Industrial Sectors of Emerging Economies