|

市场调查报告书

商品编码

1521727

太阳能板 -市场占有率分析、产业趋势/统计、成长预测(2024-2029)Solar Panel - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

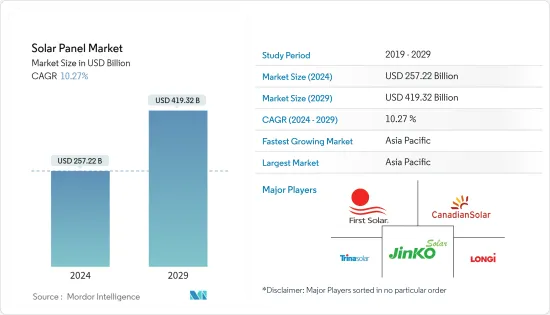

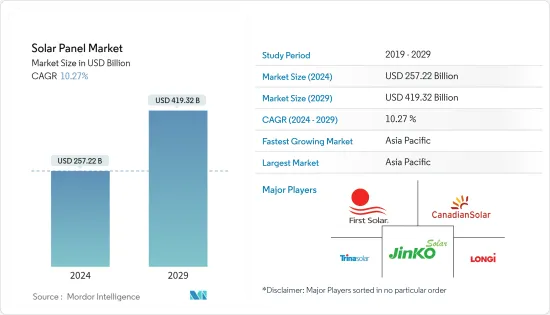

太阳能板市场规模预计到2024年为2,572.2亿美元,预计到2029年将达到4,193.2亿美元,在预测期内(2024-2029年)复合年增长率为10.27%。

主要亮点

- 从中期来看,政府对太阳能采用的支持政策和太阳能价格下降等因素预计将成为预测期内太阳能板市场的最大驱动因素之一。

- 同时,来自生质能源、风力发电和水力发电等其他可再生能源的竞争在预测期内威胁着市场。

- 然而,更具创新性和更有效率的太阳能电池板的开发仍在继续取得进展。预计这一因素将在未来为市场创造一些机会。

- 亚太地区在市场上占据主导地位,并且可能在预测期内实现最高的复合年增长率。中国、印度和日本等国家正在推动太阳能板市场,不仅因为它们拥有强大的太阳能板製造基础,还因为它们积极参与新兴市场和基础设施开拓活动。

太阳能板市场趋势

薄膜太阳能板经历显着成长

- 薄膜太阳能模组被认为是太阳能电池技术的突破,并正在迅速获得光伏领域的市场份额。薄膜太阳能电池包括非晶质(a-Si)、碲化镉(CdTe)和硒化镓(CIGS)电池。 CIGS薄膜太阳能电池将太阳光转化为电能,是透过在玻璃基板上涂覆多层薄膜製成的。 CIGS薄膜太阳能电池在非晶硅太阳能电池中具有较高的吸收係数,因此具有高转换效率和长稳定性。在所有类型中,CdTe应用最为广泛,预计在薄膜太阳能电池行业中占据很大的市场占有率。

- 薄膜太阳能电池比传统晶硅太阳能电池需要更少的建筑材料,因此生产成本(每千瓦)可能略低。例如,薄膜太阳能电池的材料成本约为每瓦0.50美元至1美元,而传统太阳能电池的成本约为每瓦3美元。由于成本较低,薄膜太阳能电池比硅晶型更容易大量生产。然而,它的效率低于硅晶型。

- 薄膜太阳能板可以在不銹钢或卷状塑胶等柔性基板上製造。这种灵活性允许在弯曲表面和屋顶上的不规则形状上进行独特的安装。薄膜面板的多功能性为製造商开拓了新的市场。

- 由于这些太阳能电池板类型的独特功能,太阳能装置近年来经历了显着增长。根据国际可再生能源机构预测,2023年太阳能发电装置容量约为1,412.09GW,而去年同期为1,066.55GW,显示全球太阳能板安装进展迅速。

- 此外,太阳能投资正在世界各地掀起热潮。在面板成本下降和应对气候变迁的紧迫感日益增强的推动下,太阳能投资预计在 2024 年首次超过石油和天然气投资。

- 2024年2月,义大利政府宣布将向Enel位于西西里岛的太阳能发电面板工厂3Sun投资9,000万欧元(约9,700万美元)。国家恢復和恢復计画已为该计划累计了9000万欧元,该项目将加强现有工厂的实力,并有潜力生产不同类型的太阳能电池板,包括薄膜太阳能电池板,并在工厂内建立一条新的生产线。

- 因此,预计薄膜太阳能电池板在预测期内将显着增长。

亚太地区预计将主导市场

- 由于快速增长的能源需求、有利的政府政策以及对可再生能源转型的坚定承诺,亚太地区正在成为全球太阳能板市场的重要力量。这个广阔而多样化的地区包括中国、印度、日本、澳洲和东南亚等国家,为太阳能板製造商、安装商和相关行业提供了巨大的成长机会。

- 亚太地区是印度和中国等一些人口最多且发展迅速的经济体的所在地。随着该地区工业化和都市化的不断推进,能源需求迅速增加。随着这些国家太阳能发电潜力巨大且太阳能成本不断下降,迫切需要部署可再生能源,太阳能已成为理想的解决方案。

- 中国拥有庞大的製造设施,在太阳能板製造方面处于世界领先地位。该国负责全球约80%的太阳能板及相关设备製造,凸显了该地区对太阳能板产业的重要性。

- 除了中国已经建立的太阳能板製造业之外,各国目前正在努力发展其製造基础设施。例如,2023年10月,中国太阳能电力公司隆基与马来西亚政府签订合同,在马来西亚首都吉隆坡以北25公里的双文丹(Serendah)建设三座太阳能光伏(PV)工厂。

- 促进清洁能源的有利政府政策和不断下降的太阳能电池板价格使太阳能成为越来越有吸引力的选择。这一趋势在屋顶太阳能领域尤其明显,商业和工业部门正在部署太阳能解决方案以降低能源成本并提高永续性,进一步推动该地区的太阳能板市场。

- 除了分散式屋顶太阳能之外,亚太地区大型太阳能发电工程也在激增。中国、印度、澳洲和越南等国家正在大力投资太阳能园区和公共产业规模设施,以实现可再生能源目标并减少碳排放。这些大型计划需要大型太阳能电池板,为电池板製造商和供应商创造了利润丰厚的市场。

- 因此,预计亚太地区在预测期内将主导太阳能板市场。

太阳能板产业概况

太阳能电池板市场部分分割。该市场的主要企业(排名不分先后)包括隆基绿色能源科技、天合光能、晶科能源、阿特斯阳光电力和第一太阳能公司。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 调查范围

- 市场定义

- 研究场所

第二章执行概述

第三章调查方法

第四章市场概况

- 介绍

- 2029年之前的市场规模与需求预测(单位:美元)

- 最新趋势和发展

- 政府法规政策

- 市场动态

- 促进因素

- 政府扶持政策及政策

- 太阳能价格下降

- 抑制因素

- 与其他可再生能源的竞争

- 促进因素

- 供应链分析

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代产品服务的威胁

- 竞争公司之间的敌对关係

第五章市场区隔

- 类型

- 结晶

- 多晶

- 薄膜

- 硅晶型

- 其他的

- 最终用户

- 住宅

- 商业/工业

- 公共产业

- 地区(2029 年之前的市场规模和需求预测)(仅按地区)

- 北美洲

- 美国

- 加拿大

- 北美其他地区

- 欧洲

- 德国

- 法国

- 英国

- 义大利

- 西班牙

- 北欧的

- 俄罗斯

- 土耳其

- 欧洲其他地区

- 亚太地区

- 中国

- 印度

- 澳洲

- 日本

- 韩国

- 马来西亚

- 泰国

- 印尼

- 越南

- 其他亚太地区

- 中东/非洲

- 沙乌地阿拉伯

- 阿拉伯聯合大公国

- 奈及利亚

- 埃及

- 卡达

- 南非

- 其他中东/非洲

- 南美洲

- 巴西

- 阿根廷

- 哥伦比亚

- 南美洲其他地区

- 北美洲

第六章 竞争状况

- 併购、合资、联盟、协议

- 主要企业策略

- 公司简介

- First Solar Inc.

- Hanwha Q CELLS Technology Co. Ltd

- Canadian Solar

- JinkoSolar Holding Co. Ltd

- Trina Solar Europe

- LONGi Solar

- JA SOLAR Technology Co. Ltd

- SunPower Corporation

- Adani Solar

- TataPower Solar

- Market Ranking/Share Analysis

第七章 市场机会及未来趋势

- 技术创新进展

简介目录

Product Code: 50002210

The Solar Panel Market size is estimated at USD 257.22 billion in 2024, and is expected to reach USD 419.32 billion by 2029, growing at a CAGR of 10.27% during the forecast period (2024-2029).

Key Highlights

- Over the medium term, factors such as supportive government policies for solar energy adoption and decreasing solar energy prices are expected to be among the most significant drivers for the solar panel market during the forecast period.

- On the other hand, competition from other renewable energy sources, such as bioenergy, wind energy, and hydropower, threatens the market during the forecast period.

- However, advancements in developing more innovative and efficient solar panels are ongoing. This factor is expected to create several opportunities for the market in the future.

- The Asia-Pacific region dominates the market and will likely register the highest CAGR during the forecast period. Due to the growing number of industries and infrastructural development activities in countries such as China, India, and Japan, as well as their high solar panel manufacturing base, they are driving the solar panel market.

Solar Panel Market Trends

Thin Film Solar Panel to Witness Significant Growth

- The thin-film photovoltaic module is considered a breakthrough in solar technology and is rapidly increasing its share in the solar power sector. Thin-film solar cells include amorphous silicon (a-Si), cadmium telluride (CdTe), and gallium selenide (CIGS) cells. CIGS thin-film solar cells convert sunlight into electrical energy and are made by coating multiple thin films on a glass substrate. They have a relatively higher absorption coefficient among non-silicon-based cells, which results in high conversion efficiency and long stability. Among all the types, CdTe is the most widely used and is estimated to hold a significant market share in the thin-film industry.

- Thin-film solar PV cells can be slightly less expensive to produce (per kW) than traditional silicon solar cells, as they require fewer construction materials. For instance, thin-film solar panels cost around USD 0.50 to USD 1 per watt for the materials, while traditional solar panels cost around USD 3 per watt. Due to their lower cost, mass production of thin-film solar cells is much easier than crystalline silicon. However, they are less efficient than crystalline silicon.

- Thin-film solar panels can be manufactured on flexible substrates, such as rolls of stainless steel or plastic. This flexibility allows for unique installations with irregular shapes on curved surfaces and rooftops. The versatility of thin-film panels opens up a new market for manufacturers to explore.

- With such unique features of this solar panel type, solar energy installation has witnessed significant growth in recent years. According to the International Renewable Energy Agency, the installed solar PV capacity in 2023 was around 1412.09 GW compared to 1066.55 GW, signifying the rapid solar panel installations worldwide.

- Additionally, investment in solar energy is experiencing a global boom. Driven by falling panel costs and a growing urgency to combat climate change, solar is on track to surpass oil and gas investment for the first time as of 2024.

- In February 2024, the Italian government announced an investment of EUR 90 million (USD 97 million) in Enel's 3Sun solar photovoltaic panel factory in Sicily. The National Recovery and Resilience Plan has EUR 90 million for this project, which allows the current factory to strengthen itself and establish a new production line potentially manufacturing different solar panel types in the factory, including thin film solar panels.

- Therefore, the thin-film solar panel is expected to grow significantly during the forecast period.

Asia-Pacific is Expected to Dominate the Market

- Asia-Pacific is emerging as a powerhouse in the global solar panel market, driven by rapidly growing energy demands, favorable government policies, and a solid commitment to transitioning toward renewable energy sources. This vast and diverse region, encompassing countries like China, India, Japan, Australia, and Southeast Asia, presents immense growth opportunities for solar panel manufacturers, installers, and associated industries.

- Asia-Pacific is home to the most populous and rapidly developing economies like India and China. As industrialization and urbanization activities in the region increase, there is a surge in energy demand. With the imperative of renewable energy adoption, solar energy has emerged as an ideal solution as these countries have high solar potential, and the cost of solar energy is declining.

- With its massive manufacturing facilities, China has been a global leader in solar panel manufacturing. The country is responsible for approximately 80% of the global solar panel and associated equipment manufacturing, highlighting the region's importance in the solar panel industry.

- Beyond China's already established solar panel manufacturing sector, various countries are still striving to develop their manufacturing base. For instance, in October 2023, China-based photovoltaics company Longi announced that the company reached an agreement with the Malaysian government to build three photovoltaic (PV) factories in Serendah, a town located 25km north of the country's capital, Kuala Lumpur.

- Favorable government policies promoting clean energy and declining solar panel prices are making solar power an increasingly attractive option. This trend is particularly evident in the rooftop solar segment, where commercial and industrial sectors are embracing solar solutions to reduce energy costs and enhance their sustainability profile, further driving the solar panel market in the region.

- In addition to distributed rooftop solar, Asia-Pacific is witnessing a surge in large-scale, utility-scale solar power projects. Countries like China, India, Australia, and Vietnam invest heavily in solar parks and utility-scale installations to meet their renewable energy targets and reduce carbon footprints. These massive projects require substantial solar panels, creating a lucrative market for panel manufacturers and suppliers.

- Therefore, the Asia-Pacific region is expected to dominate the solar panel market during the forecast period.

Solar Panel Industry Overview

The solar panel market is partially fragmented. Some key players in this market (in no particular order) include LONGI Green Energy Technology Co. Ltd, Trina Solar Co. Ltd, JinkoSolar Holding Co. Ltd, Canadian Solar Inc., and First Solar Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD, till 2029

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.1.1 Supportive Government Policies and Regulations

- 4.5.1.2 Decreasing Solar Prices

- 4.5.2 Restraints

- 4.5.2.1 Competition from Other Renewable Energy Sources

- 4.5.1 Drivers

- 4.6 Supply Chain Analysis

- 4.7 Industry Attractiveness - Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes Products and Services

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Type

- 5.1.1 Monocrystalline

- 5.1.2 Polycrystalline

- 5.1.3 Thin Film

- 5.1.4 Crystal Silicon

- 5.1.5 Other Types

- 5.2 End Users

- 5.2.1 Residential

- 5.2.2 Commercial and Industrial

- 5.2.3 Utility

- 5.3 Geography [Market Size and Demand Forecast till 2029 (for Regions Only)]

- 5.3.1 North America

- 5.3.1.1 United States

- 5.3.1.2 Canada

- 5.3.1.3 Rest of North America

- 5.3.2 Europe

- 5.3.2.1 Germany

- 5.3.2.2 France

- 5.3.2.3 United Kingdom

- 5.3.2.4 Italy

- 5.3.2.5 Spain

- 5.3.2.6 NORDIC

- 5.3.2.7 Russia

- 5.3.2.8 Turkey

- 5.3.2.9 Rest of Europe

- 5.3.3 Asia-Pacific

- 5.3.3.1 China

- 5.3.3.2 India

- 5.3.3.3 Australia

- 5.3.3.4 Japan

- 5.3.3.5 South Korea

- 5.3.3.6 Malaysia

- 5.3.3.7 Thailand

- 5.3.3.8 Indonesia

- 5.3.3.9 Vietnam

- 5.3.3.10 Rest of Asia-Pacific

- 5.3.4 Middle East and Africa

- 5.3.4.1 Saudi Arabia

- 5.3.4.2 United Arab Emirates

- 5.3.4.3 Nigeria

- 5.3.4.4 Egypt

- 5.3.4.5 Qatar

- 5.3.4.6 South Africa

- 5.3.4.7 Rest of Middle East and Africa

- 5.3.5 South America

- 5.3.5.1 Brazil

- 5.3.5.2 Argentina

- 5.3.5.3 Colombia

- 5.3.5.4 Rest of South America

- 5.3.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 First Solar Inc.

- 6.3.2 Hanwha Q CELLS Technology Co. Ltd

- 6.3.3 Canadian Solar

- 6.3.4 JinkoSolar Holding Co. Ltd

- 6.3.5 Trina Solar Europe

- 6.3.6 LONGi Solar

- 6.3.7 JA SOLAR Technology Co. Ltd

- 6.3.8 SunPower Corporation

- 6.3.9 Adani Solar

- 6.3.10 TataPower Solar

- 6.4 Market Ranking/Share Analysis

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Increasing Technological Innovation

02-2729-4219

+886-2-2729-4219