|

市场调查报告书

商品编码

1521733

碳计量:市场占有率分析、产业趋势与统计、成长预测(2024-2029)Carbon Accounting - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

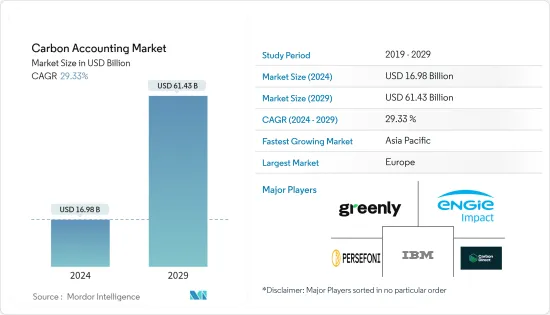

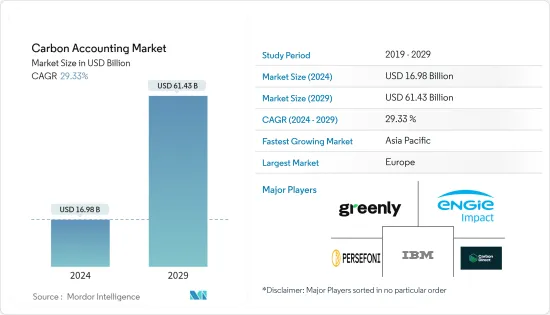

预计2024年碳计量市场规模为169.8亿美元,预计2029年将达614.3亿美元,预测期内(2024-2029年)复合年增长率为29.33%。

主要亮点

- 从中期来看,企业对实现永续性目标的兴趣增加以及碳排放测量和监管方面的监管和合规性加强等因素预计将成为预测期内碳计量市场的最大驱动力。

- 另一方面,准确计算和实施碳计量方法的资料累积很复杂,预计将在预测期内对市场构成威胁。

- 然而,更创新、更有效率的碳计量方法和软体的开发仍在继续取得进展。预计这一因素将在未来几年在市场上创造一些机会。

- 亚太地区在市场上占据主导地位,并且可能在预测期内实现最高的复合年增长率。中国、印度、日本和其他国家由于工业和基础设施发展活动的增加而引领市场。

碳计量市场趋势

电力业务部门实现显着成长

- 电力是温室气体排放的重要来源,因此也是碳计量最重要的产业之一。这些产业严重依赖石油、煤炭和天然气等石化燃料发电。由于这些排放排放大量温室气体,因此需要碳计量来告知投资者和相关人员,并帮助这些公司遵守监管和合规要求。

- 公共产业进行广泛的碳计量,以确定大量排放排放,并制定策略和政策来抵消排放量的增加和减少排放。这些策略和政策包括投资再生能源来源、提高效率、实施碳捕获技术以及采用更清洁的石化燃料技术。碳计量评估发电设施、输电/配电系统和基础设施等复杂营运要素的碳足迹,从而确定工作的优先顺序和资源的最佳化。

- 国际可再生能源机构表示,全球减少碳排放和采用清洁能源来源的迫切需求促使各大电力公司大力投资开发可再生能源发电计划,可再生能源发电装置容量大幅增加。 2023年,全球可再生能源装置容量约为3,869.7GW,而2022年为3,396.32GW,成长率约14%。

- 此外,碳计量为公用事业公司提供了关键资料,以评估和减轻气候变迁的风险,包括潜在的供应中断、基础设施损坏和消费者需求的变化。这有助于为低碳未来制定长期、有弹性的规划和可持续的投资决策。

- 例如,2024年3月,领先的可再生能源计划开发商和营运商GE Vernova宣布将在象牙海岸共和国的Azito Energie SA发电厂实施碳计量软体。该发电厂是该国最大的天然气发电厂。 GE Vernova 期望该软体能够提供有关碳排放的必要信息,并确定资讯来源,以开发更有效率的流程和设备。

- 因此,如上所述,电力业务部门预计在预测期内将呈现显着成长。

亚太地区主导市场

- 未来几年,亚太地区可能主导全球碳计量市场。在快速工业化、人口成长和应对气候变迁日益紧迫的推动下,该地区主要依靠石化燃料来满足其能源需求。中国、印度、日本和东南亚国家等製造中心和新兴经济体是全球温室气体排放的主要贡献者。然而,这些国家正在积极追求永续发展目标并实施遏制碳排放的政策。

- 亚太地区不断增长的工业活动和能源需求正在推动对稳健的碳计量实践的需求,以准确测量、报告并最终减少排放。在该地区营运的跨国公司面临日益严格的环境法规和报告要求,迫使他们采用先进的碳计量系统。此外,该地区正在专注于发展太阳能和风能等可再生能源,迫切需要进行全面的碳生命週期分析以量化减排放。

- 2023年11月,中国政府宣布放宽製造业外商投资限制,反映了中国欢迎外商投资的持续承诺。这项先进措施预计将在预测期内促进中国製造业的成长,影响整个製造业,并推动碳计量市场的发展。

- 此外,亚太市场在新的干净科技、基础设施升级以及各种其他清洁能源解决方案产品和计划方面正在取得重大进展和投资。因此,需要采用碳计量方法来追踪和减少碳排放并识别低效率资源。这导致了与各个国际参与企业的合作以及更准确的碳计量方法的发展。亚太地区消费者和相关人员的环保意识不断增强,进一步增加了企业对透明碳报告的需求。

- 电池、汽车、仪器和设备等製造业的大规模开拓为国际市场参与企业提供了巨大的机会,开拓适合不同行业的碳计量服务提供者、软体开发商和顾问公司。

- 因此,亚太地区预计将在预测期内主导该细分市场。

碳计量产业概述

全球碳计量市场是半固定的。该市场的主要企业(排名不分先后)包括 Greenly、International Business Machines Corporation、ENGIE Impact、Persefoni AI 和 Carbon Direct。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 调查范围

- 市场定义

- 研究场所

第二章执行概述

第三章调查方法

第四章市场概况

- 介绍

- 2029年之前的市场规模与需求预测(单位:美元)

- 最新趋势和发展

- 政府法规政策

- 市场动态

- 促进因素

- 企业永续性目标

- 严格的法规和合规性

- 抑制因素

- 碳计量的复杂性

- 促进因素

- 供应链分析

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代产品服务的威胁

- 竞争公司之间的敌对关係

第五章市场区隔

- 市场类型

- 云端基础

- 本地

- 最终用户

- 油和气

- 电力业务

- 建筑/基础设施

- 通讯

- 饮食

- 其他的

- 按地区划分:2029 年之前的市场规模和需求预测(仅按地区划分)

- 北美洲

- 美国

- 加拿大

- 北美其他地区

- 欧洲

- 德国

- 法国

- 英国

- 义大利

- 西班牙

- 北欧的

- 俄罗斯

- 土耳其

- 欧洲其他地区

- 亚太地区

- 中国

- 印度

- 澳洲

- 日本

- 韩国

- 马来西亚

- 泰国

- 印尼

- 越南

- 其他亚太地区

- 中东/非洲

- 沙乌地阿拉伯

- 阿拉伯聯合大公国

- 奈及利亚

- 埃及

- 卡达

- 南非

- 其他中东/非洲

- 南美洲

- 巴西

- 阿根廷

- 哥伦比亚

- 南美洲其他地区

- 北美洲

第六章 竞争状况

- 併购、合资、联盟、协议

- 主要企业策略

- 公司简介

- Greenly

- International Business Machines Corporation

- ENGIE Impact

- Persefoni AI

- Normative

- Carbon Direct

- Sphera

- Emitwise

- SINAI Technologies

- Diligent Corporation

- Market Ranking/Share Analysis

第七章 市场机会及未来趋势

- 开发创新的碳计量解决方案

简介目录

Product Code: 50002216

The Carbon Accounting Market size is estimated at USD 16.98 billion in 2024, and is expected to reach USD 61.43 billion by 2029, growing at a CAGR of 29.33% during the forecast period (2024-2029).

Key Highlights

- Over the medium term, factors such as growing corporate focus on achieving their sustainability goals and increasing stringent regulations and compliances over carbon emission measuring and regulations are expected to be among the most significant drivers for the carbon accounting market during the forecast period.

- On the other hand, the complexity of accumulating data and implementing carbon accounting methodology for accurate calculation is high, which is expected to pose a threat to the market during the forecast period.

- However, continued advancements in developing more innovative and efficient carbon accounting methodologies and software are ongoing. This factor is expected to create several opportunities for the market in the future.

- Asia-Pacific dominates the market and will likely register the highest CAGR during the forecast period. China, India, Japan, and others drive it due to the growing number of industries and infrastructural development activities in these countries.

Carbon Accounting Market Trends

The Power Utilities Segment to Witness Significant Growth

- The power utilities end-user segment is one of the most essential industries for carbon accounting as these segments are significant contributors to greenhouse gas emissions. These industries heavily rely on fossil fuels such as oil, coal, and natural gas for power generation. These sources are heavy emitters of greenhouse gases, which makes carbon accounting necessary for these companies to comply with the regulations and compliance requirements, along with informing investors and stakeholders.

- Utilities will identify the highest emitting sources by conducting extensive carbon accounting practices and developing strategies and policies to counter the growth and reduce emissions. These strategies and policies can include investing in renewable energy sources, improving efficiency, implementing carbon capture technologies, or adopting cleaner fossil fuel technology. Carbon accounting allows for assessing the carbon footprint across complex operational components like generation facilities, transmission/distribution systems, and supporting infrastructure, prioritizing efforts and optimizing resources.

- According to the International Renewable Energy Agency, the global imperative of reducing carbon emissions and adopting cleaner energy sources has led significant power utility companies to invest heavily in developing renewable energy power projects, significantly increasing the renewable energy installed capacity. In 2023, the global renewable energy installed capacity was around 3869.7 GW compared to 3396.32 GW in 2022, registering a growth rate of approximately 14%.

- Moreover, carbon accounting provides power utilities with crucial data to assess and mitigate risks posed by climate change, such as potential supply disruptions, infrastructure damage, and shifting consumer demands. This informs long-term resilient planning and sustainable investment decisions for a low-carbon future.

- For instance, in March 2024, GE Vernova, a primary renewable energy project developer and operator, announced that it would deploy carbon accounting software in Globeleq's Azito Energie S.A. power plant in Cote D'Ivoire. This is the largest natural gas power plant in the country. GE Vernova expects the software to provide necessary information on carbon emissions and identify sources to develop more efficient processes and equipment.

- Therefore, as mentioned above, the power utilities segment is expected to witness a significant growth rate during the forecast period.

Asia-Pacific to Dominate the Market

- Asia-Pacific will dominate the global carbon accounting market in the coming years. It is driven by rapid industrialization, population growth, and the increasing urgency to address climate change, as the region predominantly relies on fossil fuels to meet its energy demands. As manufacturing hubs and developing economies, countries like China, India, Japan, and Southeast Asian nations are major contributors to global greenhouse gas emissions. However, they are also actively pursuing sustainable development goals and implementing policies to curb their carbon footprints.

- The growing intensity of industrial activities and energy demands across Asia-Pacific drives the demand for robust carbon accounting practices to accurately measure, report, and ultimately reduce emissions. Multinational corporations operating in the region face stricter environmental regulations and reporting requirements, driving the adoption of sophisticated carbon accounting systems. Additionally, the region's focus on renewable energy development, such as solar and wind power, creates a pressing need for comprehensive carbon lifecycle analysis to quantify emissions savings.

- In November 2023, the Chinese government declared its intention to eliminate all restrictions on foreign involvement in manufacturing, showcasing the nation's ongoing commitment to embracing foreign enterprises. This progressive step is anticipated to foster growth in the Chinese manufacturing sector, subsequently influencing the overall manufacturing landscape and propelling the carbon accounting market forward during the forecast period.

- Moreover, the Asia-Pacific market has witnessed significant developments and investments in new clean technologies, infrastructure upgrades, and various other clean energy solution products and projects. This necessitates adopting carbon accounting methods to track and reduce carbon emissions and identify inefficient resources. This has led to collaboration with various international players and the development of more precise carbon accounting methodologies. The rising environmental consciousness among consumers and stakeholders in Asia-Pacific further fuels companies' demand for transparent carbon reporting.

- The large-scale development of manufacturing industries, such as batteries, automobiles, instruments, and equipment, presents enormous opportunities for international market players to explore carbon accounting service providers, software developers, and consulting firms catering to diverse industries.

- Thus, the Asia-Pacific region is expected to dominate the market segment during the forecast period.

Carbon Accounting Industry Overview

The global carbon accounting market is semi-consolidated. Some key players in this market (in no particular order) include Greenly, International Business Machines Corporation, ENGIE Impact, Persefoni AI, and Carbon Direct.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD, till 2029

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.1.1 Corporate Sustainability Goals

- 4.5.1.2 Stringent Regultions and Compliance

- 4.5.2 Restraints

- 4.5.2.1 High Complexity in Carbon Accounting

- 4.5.1 Drivers

- 4.6 Supply Chain Analysis

- 4.7 Industry Attractiveness - Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes Products and Services

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Type

- 5.1.1 Cloud Based

- 5.1.2 On Premise

- 5.2 End Users

- 5.2.1 Oil and Gas

- 5.2.2 Power Utilities

- 5.2.3 Construction and Infrastructure

- 5.2.4 Telecommunication

- 5.2.5 Food and Beverages

- 5.2.6 Other End Users

- 5.3 Geography [Market Size and Demand Forecast till 2029 (for Regions Only)]

- 5.3.1 North America

- 5.3.1.1 United States

- 5.3.1.2 Canada

- 5.3.1.3 Rest of North America

- 5.3.2 Europe

- 5.3.2.1 Germany

- 5.3.2.2 France

- 5.3.2.3 United Kingdom

- 5.3.2.4 Italy

- 5.3.2.5 Spain

- 5.3.2.6 NORDIC

- 5.3.2.7 Russia

- 5.3.2.8 Turkey

- 5.3.2.9 Rest of Europe

- 5.3.3 Asia-Pacific

- 5.3.3.1 China

- 5.3.3.2 India

- 5.3.3.3 Australia

- 5.3.3.4 Japan

- 5.3.3.5 South Korea

- 5.3.3.6 Malaysia

- 5.3.3.7 Thailand

- 5.3.3.8 Indonesia

- 5.3.3.9 Vietnam

- 5.3.3.10 Rest of Asia-Pacific

- 5.3.4 Middle East and Africa

- 5.3.4.1 Saudi Arabia

- 5.3.4.2 United Arab Emirates

- 5.3.4.3 Nigeria

- 5.3.4.4 Egypt

- 5.3.4.5 Qatar

- 5.3.4.6 South Africa

- 5.3.4.7 Rest of Middle East and Africa

- 5.3.5 South America

- 5.3.5.1 Brazil

- 5.3.5.2 Argentina

- 5.3.5.3 Colombia

- 5.3.5.4 Rest of South America

- 5.3.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 Greenly

- 6.3.2 International Business Machines Corporation

- 6.3.3 ENGIE Impact

- 6.3.4 Persefoni AI

- 6.3.5 Normative

- 6.3.6 Carbon Direct

- 6.3.7 Sphera

- 6.3.8 Emitwise

- 6.3.9 SINAI Technologies

- 6.3.10 Diligent Corporation

- 6.4 Market Ranking/Share Analysis

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Development of Innovative Carbon Accounting Solutions

02-2729-4219

+886-2-2729-4219