|

市场调查报告书

商品编码

1521740

蒸气发生水泵:市场占有率分析、产业趋势与统计、成长预测(2024-2029)Steam Generation Water Pumps - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

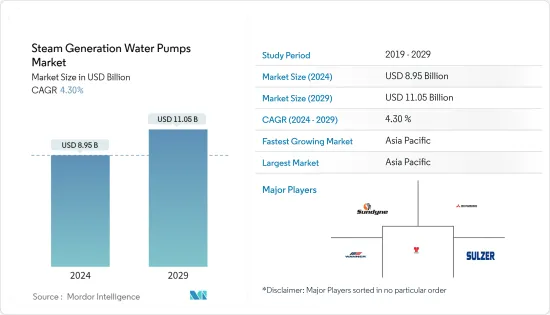

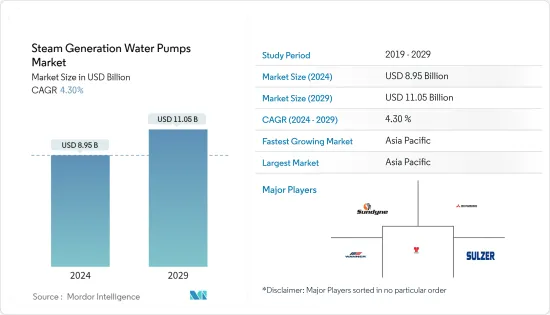

蒸气发电水泵市场规模预计到 2024 年为 89.5 亿美元,预计到 2029 年将达到 110.5 亿美元,在预测期内(2024-2029 年)复合年增长率为 4.30%。

蒸气发电水泵市场预计在预测期内复合年增长率将超过3%。

*从中期来看,政府对水处理基础设施开发的投资增加和蒸气发电的增加预计将在预测期内推动市场发展。

*与此同时,排放法规、高昂的资本和营业成本以及政府的可再生能源目标预计将在预测期内阻碍市场。

*然而,蒸气水泵的技术进步预计将创造未来的市场机会。

*预计亚太地区将在预测期内主导市场。

蒸气发电水泵市场趋势

锅炉给水泵预计将占据主要市场占有率

*锅炉给水泵,也称为给水泵,向锅炉和核子反应炉等蒸汽产生器供水,其供水量与排放的蒸气量相对应。

*锅炉给水泵在 160 至 210°C 之间的流体温度下运作。在特殊情况下,所处理的流体的温度可能会更高。锅炉给水泵的设计主要受电厂技术的发展影响,包括功率输入、材料、泵浦类型和驱动装置。

*发电厂使用的锅炉给水泵是高温高压多级泵,可以输送高温流体。随着电力需求的增加、都市化和人口的增加,发电厂对泵浦的需求预计也会增加。例如,根据《世界能源资料统计回顾》,2022年全球发电量为29,165.1太瓦时,与前一年同期比较每年增长2.3%。

*典型的复合迴圈发电厂有 50 到 100 个泵,包括锅炉给水泵。随着新的复合迴圈工厂的建设以满足能源需求的增加,预计泵浦的数量(包括锅炉给水泵)将会增加。

*例如,三菱重工有限公司的电力解决方案品牌三菱动力于 2023 年 7 月收购了全系列复合迴圈设备,包括锅炉给水泵。例如,三菱重工业株式会社的动力解决方案品牌Mitsubishi Power将于2023年7月由千叶袖浦电力有限公司生产65万千瓦级天然气燃气涡轮机复合迴圈(GTCC)发电机我们已订单位于千叶县袖浦市的三座反应器计划的完整交钥匙订单。

*因此,由于电力消耗和电厂建设的增加,锅炉给水泵预计将在市场上占据较大份额。

亚太地区预计将主导市场

*亚太地区是一个发展中大陆,由于基础设施发展和许多大型建设计划导致经济和电力需求显着增长,经济快速增长。

*根据《世界能源数据统计回顾》,2022年亚太地区能源消费量总量为277.6艾焦耳,年成长与前一年同期比较2.1%。蒸气发生水泵通常用于发电厂和其他应用,以蒸气形式提供能源。

*亚太地区几乎占全球能源消费量总量的46%。随着能源消费量的增加,水泵的使用预计会随着蒸气运作的使用而增加。

*例如,2023年10月,Thermax订单菲律宾内格罗斯岛19.9MW发电厂合约。该公司完成的计划包括一座 90 TPH 锅炉、一座 19.9 MW蒸气涡轮和一套平衡装置系统。

*因此,由于蒸气使用量的增加,特别是在发电领域,亚太地区预计将在预测期内主导市场。

蒸气发生水泵产业概况

蒸气发生水泵市场细分为:市场的主要企业包括(排名不分先后)Sulzer Limited、Thermax Limited、Wanner International Limited、Sundyne 和 Mitsubishi Heavy Industries Ltd。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 调查范围

- 市场定义

- 研究场所

第二章调查方法

第三章执行概述

第四章市场概况

- 介绍

- 至2029年市场规模及需求预测(单位:十亿美元)

- 最新趋势和发展

- 政府法规政策

- 市场动态

- 促进因素

- 政府增加水处理基础建设投资

- 增加蒸气发电量

- 抑制因素

- 排放法规、资本和营运成本高

- 促进因素

- 供应链分析

- 波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争公司之间的敌对关係

第五章市场区隔

- 类型

- 锅炉水泵

- 立式多级管道泵

- 卧式环段式多段泵

- 循环泵

- 蒸气冷凝水水泵

- 其他的

- 锅炉水泵

- 地区

- 北美洲

- 美国

- 加拿大

- 北美其他地区

- 欧洲

- 英国

- 法国

- 德国

- 西班牙

- 俄罗斯

- 土耳其

- 北欧的

- 欧洲其他地区

- 亚太地区

- 中国

- 印度

- 日本

- 越南

- 泰国

- 印尼

- 马来西亚

- 其他亚太地区

- 南美洲

- 巴西

- 阿根廷

- 哥伦比亚

- 南美洲其他地区

- 中东/非洲

- 阿拉伯聯合大公国

- 沙乌地阿拉伯

- 奈及利亚

- 卡达

- 埃及

- 其他中东/非洲

- 北美洲

第六章 竞争状况

- 併购、合资、联盟、协议

- 主要企业策略

- 公司简介

- Sulzer Limited

- Thermax Limited

- Wanner International Limited

- Sundyne

- Mitsubishi Heavy Industries, Ltd.

- EBARA CORPORATION.

- Modo Pumps Co, Ltd.

- Castle Pumps.

- Inproheat Industries.

- Fuji Electric Co., Ltd.

- 跑马灯排名分析

第七章 市场机会及未来趋势

- 蒸气发生水泵的技术进步

The Steam Generation Water Pumps Market size is estimated at USD 8.95 billion in 2024, and is expected to reach USD 11.05 billion by 2029, growing at a CAGR of 4.30% during the forecast period (2024-2029).

The Steam Generation Water Pumps market is expected to register a CAGR of over 3% during the forecast period.

* Over the medium period, increased government investment in establishing water treatment infrastructure and increased power generation using steam is expected to drive the market in the forecast period.

* On the other hand, the emissions regulations, high capital and operations costs, and government renewable energy targets are expected to hinder the market in the forecast period.

* Nevertheless, technological advancements in steam-generation water pumps are expected to create future market opportunities.

* Asia-Pacific is expected to dominate the market in the forecast period.

Steam Generation Water Pumps Market Trends

Boiler feed pump is Expected to have a Significant Market Share

* Boiler feed pumps, also known as feed pumps, feed a steam generator such as a boiler or a nuclear reactor with a quantity of feed water corresponding to the amount of steam emitted.

* Boiler feed pumps operate at fluid temperatures of 160 to 210 ºC. In exceptional cases, the temperature of the fluid handled may be higher still. The design of boiler feed pumps, including power input, material, type of pump, and drive, is primarily governed by developments in power station technology.

* The boiler feed water pump used in power plants is a high-temperature and high-pressure multi-stage pump that can transport high-temperature fluids. With the increase in power demand and growing urbanization and population, the need for pumps used in power plants is expected to increase. For instance, according to the Statistical Review of World Energy Data, in 2022, global electricity generation accounted for 29165.1 TWh, with an annual growth rate of 2.3% compared to the previous year.

* A typical combined-cycle plant may have between 50 to 100 pumps, including boiler feed pumps. With the establishment of new combined-cycle plants to cope with the increasing energy demand, boiler feed pumps and other pumps are expected to increase.

* For example, in July 2023, Mitsubishi Power, a power solutions brand of Mitsubishi Heavy Industries, Ltd. (MHI), got a full-turnkey contract from Chiba-Sodegaura Power Co., Ltd., for a project to build three gas turbine combined cycle (GTCC) power plants with 650MW class natural gas-fired units in Sodegaura City, Chiba Prefecture.

* Thus, owing to the increasing power consumption and power plant construction, boiler feed pump is expected to have a significant share in the market.

Asia-Pacific is Expected to Dominate the Market

* Asia-Pacific is a developing continent with rapid economic and power demands due to significant growth driven by infrastructure development and many large construction projects.

* According to the Statistical Review of World Energy Data, in 2022, the Asia Pacific's total energy consumption accounted for 277.6 Exajoules, with an annual growth rate of 2.1 % compared to the previous year. Steam generation water pumps are generally used in power plants or any other application to provide energy in the form of steam.

* The share of Asia-Pacific's total global energy consumption is nearly 46%. With increasing energy consumption, the use of water pumps is expected to grow with its use coming from power plants running from steams.

* For instance, in October 2023, Thermax commissioned a contract for the 19.9 MW power plant in Negros Island in the Philippines - a first in South East Asia. The company completed the project, whose scope comprised a 90 TPH boiler, 19.9 MW steam turbine generator, and Balance of Plant systems.

* Thus, owing to the above points, with the increasing use of steam, especially in power generation, Asia-Pacific is expected to dominate the market in the forecast period.

Steam Generation Water Pumps Industry Overview

The steam generation water pumps market is partially fragmented. Some of the key players in this market include (in no particular order) Sulzer Limited, Thermax Limited, Wanner International Limited, Sundyne, and Mitsubishi Heavy Industries Ltd.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD billion, till 2029

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.1.1 Increased Government Investment in Establishing Water Treatment Infrastructure

- 4.5.1.2 Increase in Power Generation Using Steam

- 4.5.2 Restraints

- 4.5.2.1 The Emissions Regulations, High Capital and Operations Costs

- 4.5.1 Drivers

- 4.6 Supply Chain Analysis

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes Products and Services

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Type

- 5.1.1 Boiler feed pump

- 5.1.1.1 Vertical multistage inline pumps

- 5.1.1.2 Multistage horizontal ring section pumps

- 5.1.2 Circulation pumps

- 5.1.3 Steam condensate pumps

- 5.1.4 Others

- 5.1.1 Boiler feed pump

- 5.2 Geography

- 5.2.1 North America

- 5.2.1.1 United States

- 5.2.1.2 Canada

- 5.2.1.3 Rest of North America

- 5.2.2 Europe

- 5.2.2.1 United Kingdom

- 5.2.2.2 France

- 5.2.2.3 Germany

- 5.2.2.4 Spain

- 5.2.2.5 Russia

- 5.2.2.6 Turkey

- 5.2.2.7 NORDIC

- 5.2.2.8 Rest of the Europe

- 5.2.3 Asia-Pacific

- 5.2.3.1 China

- 5.2.3.2 India

- 5.2.3.3 Japan

- 5.2.3.4 Vietnam

- 5.2.3.5 Thailand

- 5.2.3.6 Indonesia

- 5.2.3.7 Malaysia

- 5.2.3.8 Rest of Asia-Pacific

- 5.2.4 South America

- 5.2.4.1 Brazil

- 5.2.4.2 Argentina

- 5.2.4.3 Colombia

- 5.2.4.4 Rest of South America

- 5.2.5 Middle East and Africa

- 5.2.5.1 United Arab Emirates

- 5.2.5.2 Saudi Arabia

- 5.2.5.3 Nigeria

- 5.2.5.4 Qatar

- 5.2.5.5 Egypt

- 5.2.5.6 Rest of Middle East & Africa

- 5.2.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers & Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 Sulzer Limited

- 6.3.2 Thermax Limited

- 6.3.3 Wanner International Limited

- 6.3.4 Sundyne

- 6.3.5 Mitsubishi Heavy Industries, Ltd.

- 6.3.6 EBARA CORPORATION.

- 6.3.7 Modo Pumps Co, Ltd.

- 6.3.8 Castle Pumps.

- 6.3.9 Inproheat Industries.

- 6.3.10 Fuji Electric Co., Ltd.

- 6.4 Markey Ranking Analysis

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 The Technological Advancement in the Steam Generation Water Pumps