|

市场调查报告书

商品编码

1521743

工业废弃物管理:市场占有率分析、产业趋势与统计、成长预测(2024-2029)Industrial Waste Management - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

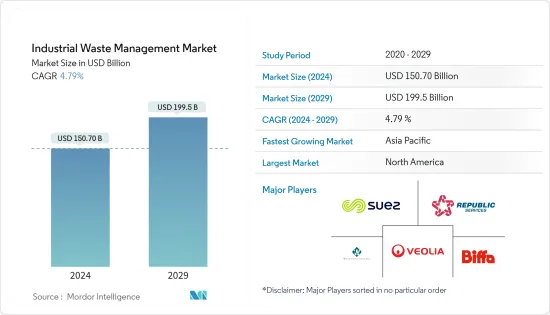

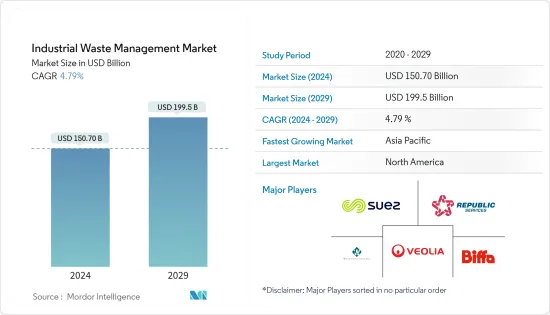

工业废弃物管理市场规模预计到 2024 年为 1507 亿美元,预计到 2029 年将达到 1995 亿美元,在预测期内(2024-2029 年)复合年增长率为 4.79%。

废弃物管理业务、资料分析和机器学习越来越多地应用于工业。预测分析可以预测废弃物流的趋势,并帮助市政当局和废弃物管理公司分配资源。 Greyparrot 是废弃物管理市场上值得信赖的解决方案。透过提高废弃物管理的透明度和自动化程度,Greyparrot 的人工智慧废弃物分析平台处于发展中循环经济国家的前沿。

一次性塑胶和不可降解包装材料的激增是废弃物管理的主要挑战之一。正在开发创新的包装解决方案来解决这个问题。人们正在开发生物分解性和可堆肥材料来取代传统塑胶并减少包装废弃物对环境的影响。 2023 年 5 月,北欧化工推出了专回收再生用设计的单一材料袋,据说其成分超过 95% 是聚丙烯。该袋用于包装干食品,旨在满足生产者延伸责任 (EPR) 计划的生态调节标准。

机器人系统在简化回收过程中扮演重要角色。这些机器人可以以令人难以置信的准确性和速度识别和分类可回收材料。透过自动化分类过程,回收设施可以提高业务效率并减少回收材料的污染。 2023 年 4 月,义大利废弃物管理公司 Il Solco 将与 Recycleye 合作,将人工智慧机器人引入全球废弃物管理产业。

工业废弃物管理市场趋势

亚洲对工业废弃物管理的需求预计将增加

由于工业快速发展和经济成长,预计亚太东部和南部地区的生产和工业活动将会增加。工业废弃物的产生通常与该行业的成长成正比。

工业废弃物的增加是由于纺织、化学、电子设备等製造业的发展。纺织和化学品等行业在生产过程中会产生大量废弃物。 2023 年 11 月,柬埔寨非营利组织 LICADHO 报告称,七家工厂正在焚烧消费前服饰废弃物,包括品牌的橡胶、织物和塑胶。为了节省燃料成本,工厂焚烧生产现场的废弃物,导致工人头痛和呼吸系统问题。

快速的技术创新可能使旧技术不再适用,甚至可能导致电子废弃物的产生。随着亚洲国家采用新技术,废弃物产生量可能会增加。根据产业专家预测,2027年亚太地区的人工智慧支出预计将达到784亿美元,其中包括人工智慧专用系统的服务、软体和硬体。

物联网是废弃物管理的未来

由于废弃物容器的管理方式,废弃物堆积和处理是都市区的一个主要问题。事实证明,新技术是应对这些挑战的创新解决方案和有效方法。例如,无线感测器网路(WSN)和物联网(IoT)技术被用来管理废弃物容器。

Raspberry Pi 与 Broadcom 共同开发,是一款经济实惠的计算机,可以运行 Linux。它配备 GPIO(通用输入/输出)引脚,可与实体运算电子设备连接,并允许您进入物联网 (IoT) 领域。 Raspberry Pi 用于废弃物管理国家可以采用的产业。

智慧废弃物管理 (SWM) 包括安装在智慧垃圾箱 (SGB) 中的感测器的资料收集和分析、废弃物车与城市基础设施之间的协作以及废弃物车路线的策略规划和最佳化。为了提供全面、即时的观点,SWM 系统可以分为两类:改善内部流程的系统和提供资讯的系统。多项研究显示 SWM 系统具有经济效益和环境效益。

物联网也可能对经济产生重大影响。根据专家预测,到 2025 年,物联网每年将创造 11.1 兆美元的收入。

工业废弃物管理产业概述

工业废弃物管理市场适度分散且竞争激烈,多家大公司与中小型公司形成策略联盟,以利用区域物流能力。主要企业致力于为工业废弃物的高效处理、处理和处置提供全面的解决方案。一些公司专注方面工业废弃物管理的特定方面,例如危险废弃物处理、电子废弃物回收和能源回收。这些专业服务提供者满足具有独特废弃物管理要求的行业。废弃物管理、威立雅环境和苏伊士等知名公司是工业废弃物管理领域的世界领导者。这些公司规模庞大,为工业客户提供广泛的废弃物管理服务。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第一章简介

- 研究成果

- 研究场所

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场洞察

- 目前的市场状况

- 科技趋势

- 产业价值链分析

- 政府法规和倡议

第五章市场动态

- 促进因素

- 严格的环境法规

- 永续性意识不断增强

- 抑制因素

- 初始资本投资高

- 复杂的监管环境

- 机会

- 技术进步数位化

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 消费者/买方议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争公司之间敌对关係的强度

第六章 市场细分

- 依加工方法分

- 掩埋

- 焚化

- 回收

- 按类型

- 有害

- 无危险

- 按地区

- 北美洲

- 美国

- 加拿大

- 欧洲

- 英国

- 德国

- 法国

- 俄罗斯

- 其他欧洲国家

- 亚太地区

- 中国

- 日本

- 印度

- 韩国

- 其他亚太地区

- 中东/非洲

- 拉丁美洲

- 北美洲

第七章 竞争格局

- 公司简介

- Veolia Environnement SA

- Suez Environment SA

- Republic Services Inc.

- Waste Connections

- Waste Management Inc.

- Remondis AG & Co. Kg

- Biffa Group

- Clean Harbors Inc.

- Covanta Holding Corporation

- Daiseki Co. Ltd*

第八章市场机会与未来趋势

第九章 附录

The Industrial Waste Management Market size is estimated at USD 150.70 billion in 2024, and is expected to reach USD 199.5 billion by 2029, growing at a CAGR of 4.79% during the forecast period (2024-2029).

Waste management operations, data analysis, and machine learning are being applied increasingly in industries. Predictive analytics can forecast trends in the generation of waste streams to help municipalities and waste management companies allocate resources. Greyparrot is a trusted solution in the waste management market. By increasing translucency and automation in waste management, Greyparrot's AI waste analytics platform is at the forefront of circular economy development.

The proliferation of single-use plastics and nondegradable packaging materials is one of the major challenges in managing waste. Innovative packaging solutions are being developed to tackle this problem. Biodegradable and compostable materials are being developed to replace traditional plastics and reduce the environmental impact of packaging waste. In May 2023, Borealis introduced a mono-material pouch specifically designed for recycling that is said to represent more than 95% polypropylene. The pouch is intended to pack dry food products and aims to meet the eco-modulation criteria for extended producer responsibility (EPR) programs.

Robotic systems have a key role to play in streamlining the recycling process. These robots can identify and sort recyclable materials with remarkable accuracy and speed. Recycling facilities can increase the efficiency of their operations and reduce the contamination of recycled materials by automation of the sorting process. In April 2023, Il Solco, an Italian waste management company, partnered with Recycleye, intending to introduce artificial intelligence robotics in the waste management industry worldwide.

Industrial Waste Management Market Trends

A Growing Demand for Industrial Waste Management is Anticipated in Asia

Increased production and industrial activity can be expected in the East and South of Asia-Pacific due to rapidly developing industries and economic growth. The production of industrial waste is usually proportional to the growth of the sector.

Increased production of waste from industry is a result of the development of manufacturing industries such as textiles, chemicals, and electronics. During the production process, sectors such as textiles and chemicals may generate a significant amount of waste. In November 2023, LICADHO, a non-profit organization in Cambodia, reported that pre-consumer garment waste, including rubber, fabric, plastic, and other materials from the brands, was being burned at seven factories. To save fuel costs, factories burned waste from the production site, which caused headaches and respiratory problems for their workers.

Rapid technological change may also lead to the generation of electronic waste, as old technologies are no longer relevant. There may be an increase in waste generation due to the adoption of new technology by Asian countries. As per industry experts, AI spending in Asia-Pacific is expected to reach USD 78.4 billion in 2027, including services, software, and hardware for AI-focused systems.

The Internet of Things is the Future of Waste Management

Due to how waste containers are managed, the accumulation and disposal of waste have become major problems for urban areas. The new technologies are proving to be a revolutionary solution and efficient way of addressing these challenges. For instance, wireless sensor network (WSN) and Internet of Things (IoT) technologies are used to manage waste containers.

The Raspberry Pi, developed in collaboration with Broadcom, is an affordable computer that can run Linux. It includes GPIO (general-purpose input/output) pins, enabling users to interface with electronic components for physical computing and delve into the realm of the Internet of Things (IoT). The Raspberry Pi is used in industries where it can be adopted by countries managing waste.

Smart waste management (SWM) encompasses the gathering and analysis of data from sensors installed on smart garbage bins (SGBs), the coordination of waste trucks and urban infrastructure, and the strategic planning and optimization of waste truck routes. To provide a comprehensive real-time perspective, SWM systems can be grouped into two categories, i.e., those that improve internal processes and those that distribute information. Several studies have suggested the economic and environmental benefits of SWM systems.

IoT is also set to have a significant impact on the economy. According to experts, the Internet of Things could create USD 11.1 trillion a year by 2025.

Industrial Waste Management Industry Overview

The industrial waste management market is moderately fragmented and competitive, with several large companies strategically forming alliances with mid-sized or small-sized companies to leverage their regional capabilities in logistics. Key players are engaged in offering comprehensive solutions for the efficient handling, treatment, and disposal of industrial waste. Certain companies focus on specific aspects of industrial waste management, such as hazardous waste disposal, electronic waste recycling, or energy recovery. These specialized service providers cater to industries with unique waste management requirements. Prominent companies such as Waste Management, Veolia Environnement, and SUEZ are global leaders in industrial waste management. These companies operate on a large scale, providing a wide range of waste management services to industrial clients.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Deliverables

- 1.2 Study Assumptions

- 1.3 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Current Market Scenario

- 4.2 Technological Trends

- 4.3 Industry Value Chain Analysis

- 4.4 Government Regulations and Initiatives

5 MARKET DYNAMICS

- 5.1 Drivers

- 5.1.1 Stringent Environmental Regulations

- 5.1.2 Growing Awareness of Sustainability

- 5.2 Restraints

- 5.2.1 High Initial Capital Investment

- 5.2.2 Complex Regulatory Landscape

- 5.3 Opportunities

- 5.3.1 Technological Advancements and Digitalization

- 5.4 Industry Attractiveness - Porter's Five Forces Analysis

- 5.4.1 Bargaining Power of Suppliers

- 5.4.2 Bargaining Power of Consumers / Buyers

- 5.4.3 Threat of New Entrants

- 5.4.4 Threat of Substitute Products

- 5.4.5 Intensity of Competitive Rivalry

6 MARKET SEGMENTATION

- 6.1 By Disposal Methods

- 6.1.1 Landfill

- 6.1.2 Incineration

- 6.1.3 Recycling

- 6.2 By Type

- 6.2.1 Hazardous

- 6.2.2 Non-hazardous

- 6.3 By Geography

- 6.3.1 North America

- 6.3.1.1 United States

- 6.3.1.2 Canada

- 6.3.2 Europe

- 6.3.2.1 United Kingdom

- 6.3.2.2 Germany

- 6.3.2.3 France

- 6.3.2.4 Russia

- 6.3.2.5 Rest of Europe

- 6.3.3 Asia-Pacific

- 6.3.3.1 China

- 6.3.3.2 Japan

- 6.3.3.3 India

- 6.3.3.4 South Korea

- 6.3.3.5 Rest of Asia-Pacific

- 6.3.4 Middle East and Africa

- 6.3.5 Latin America

- 6.3.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Overview (Market Concentration and Major Players)

- 7.2 Company Profiles

- 7.2.1 Veolia Environnement SA

- 7.2.2 Suez Environment SA

- 7.2.3 Republic Services Inc.

- 7.2.4 Waste Connections

- 7.2.5 Waste Management Inc.

- 7.2.6 Remondis AG & Co. Kg

- 7.2.7 Biffa Group

- 7.2.8 Clean Harbors Inc.

- 7.2.9 Covanta Holding Corporation

- 7.2.10 Daiseki Co. Ltd*