|

市场调查报告书

商品编码

1521754

纺织品回收:市场占有率分析、产业趋势与统计、成长预测(2024-2029)Textile Recycling - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

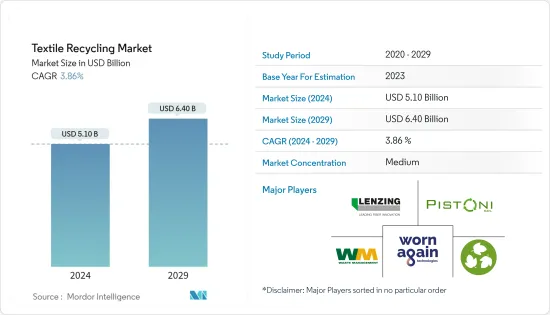

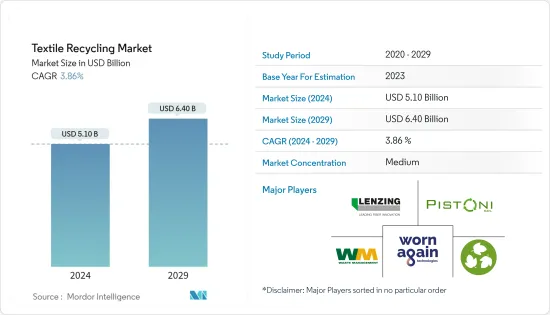

纺织品回收市场规模预计到 2024 年为 51 亿美元,预计到 2029 年将达到 64 亿美元,在预测期内(2024-2029 年)复合年增长率为 3.86%。

根据产业报告称,纺织产品是欧洲消费量中第四大环境和气候变迁压力来源。管理废旧纺织品和纺织废弃物是欧洲面临的重大挑战。由于欧洲的再利用和回收能力有限,欧盟境内收集的大部分废旧纺织品都被交易并出口到未来不确定的非洲和亚洲。

美国国际贸易委员会(USITC)2023年10月报告称,2021年全球服饰业占全球温室气体排放的1.8%。下游材料(纤维和纺织品)的生产约占该行业总碳排放的 90%。该产业预计将大幅超过《巴黎协定》1.5°C 路径设定的 2030 年碳排放目标。

政府政策对于推动纺织废弃物管理产业的努力和创新非常重要。它们反映了全球和国家促进纺织废弃物管理领域的运作和创新的迫切需求。例如,2021年3月,英国政府启动了一项全面的废弃物预防计划,以减少纺织废弃物对环境和社会的影响,并且在其他领域也启动了回收、监管、合规、永续性和付加倡议。

纺织品回收市场趋势

欧洲将审查以减少废弃物为重点的努力

2023年7月,欧盟委员会发布了废弃物框架指令修订策略,强调了纺织品生产商责任的新规则和减少食品废弃物的新目标。欧洲环境署表示,该提案可能会使有效减少食品和纺织业的生产过剩和废弃物变得困难。

欧洲面临气候变迁和自然资源劣化的威胁。为了因应这些挑战,欧洲绿色新政旨在将欧盟转变为资源节约型和有竞争力的经济体,并在 2050 年实现温室气体净零排放。

欧盟委员会表示,自 COVID-19 大流行以来,欧洲绿色新政一直是其生命线。下一代欧盟復苏计画和欧盟七年预算的 1.8 兆欧元(1.93 兆美元)投资中的三分之一用于资助欧洲绿色新政。

科技彻底改变纺织废弃物处理

低价值废弃物可以透过回收技术转化为新的高价值纺织产品。政治压力和气候危机凸显了开发新回收技术以将纺织废弃物用作基础材料的创新需求。为了确保循环策略的有效性,我们必须获得高品质的可回收材料。

苏尔寿有限公司为此製程提供核心设备、技术和专业知识,以及 Worn Again Technologies 的专有溶剂技术。为了提高效率和效益,纺织品回收商也正在采用新技术和新製程。例如,苏尔寿和 H&M 创立了 Worn Again Technologies,该公司致力于开发独特的纺织品回收工艺,将纺织品转化为消费后的原始材料。

2023年3月,韩国化学技术研究所开发出纺织废弃物封闭式回收技术。 KRICT 研究小组采用了一种廉价、无害、生物分解性的材料,透过化学方法从废纤维混合物中识别出聚酯。

纺织品回收产业概述

纺织品回收市场的竞争格局是经验丰富的公司、新公司和致力于永续解决方案的组织的混合体。废弃物管理、回收和纺织品领域的知名公司已指定专门负责纺织品回收的单独部门或子公司。此外,一些时尚品牌和零售商正在将可再生纺织品纳入其产品中,将永续性纳入其经营模式。公共当局和机构透过法规、奖励和资助计划影响竞争格局,以促进永续实践和纺织品回收。纺织品回收市场的世界领导者包括 Wornagain Technologies、Lenzing Group 和 Birla Cellulose。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第一章简介

- 研究成果

- 研究场所

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场洞察

- 目前的市场状况

- 科技趋势

- 产业价值链分析

- 政府法规和倡议

第五章市场动态

- 促进因素

- 环保意识不断增强

- 监理机关措施与政策

- 抑制因素

- 回收过程的复杂性

- 基础设施和意识有限

- 机会

- 回收过程中的技术进步

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 消费者/买方议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争公司之间敌对关係的强度

第六章 市场细分

- 按材质

- 棉布

- 聚酯和聚酯纤维

- 羊毛

- 尼龙和尼龙纤维

- 其他的

- 按原料分

- 服装废弃物

- 家庭衣物废弃物

- 汽车废弃物

- 其他的

- 按流程

- 机器

- 化学

- 按地区

- 北美洲

- 美国

- 加拿大

- 欧洲

- 英国

- 德国

- 法国

- 义大利

- 俄罗斯

- 其他欧洲国家

- 亚太地区

- 中国

- 印度

- 印尼

- 孟加拉

- 其他亚太地区

- 中东/非洲

- 南美洲

- 北美洲

第七章 竞争格局

- 公司简介

- Worn Again Technologies

- Lenzing Group

- Birla Cellulose

- Pistoni SRL

- Waste Management Inc.

- The Woolmark Company

- American Textile Recycling

- Boer Group Recycling Solutions

- I:Collect

- Infinited Fiber Company*

- 其他公司

第八章 市场机会及未来趋势

第九章 附录

The Textile Recycling Market size is estimated at USD 5.10 billion in 2024, and is expected to reach USD 6.40 billion by 2029, growing at a CAGR of 3.86% during the forecast period (2024-2029).

According to industry reports, textiles are the fourth highest source of environmental and climatic change pressure in terms of European consumption. The management of used textiles, as well as textile waste, is a major challenge for Europe. Due to the limited capacity for reuse and recycling in Europe, many used textiles collected within the EU are traded and exported to Africa and Asia, where their future is uncertain.

The US International Trade Commission (USITC) reported in October 2023 that the global apparel sector accounted for 1.8 % of global GHG emissions in 2021. The production of downstream materials (textile fibers and fabrics) accounted for about 90 % of the total sector's carbon emissions. The industry is expected to significantly exceed its carbon emissions target for 2030, which is set in the 1.5°C pathway by the Paris Agreement.

Government policies are important in driving efforts and innovation in the textile waste management industry. They are a reflection of global and national obligations that drive operationalization and technological innovation in the area of textile waste management. For example, in March 2021, the UK government launched a comprehensive Waste Prevention Program to reduce the environmental and social impact of textile waste, as well as in other sectors focused on key areas such as recycling, regulation, compliance, sustainability, value addition, innovation, and entrepreneurship.

Textile Recycling Market Trends

Europe is Set to Revamp Initiatives Focused on Reducing Waste

In July 2023, the European Commission issued its strategies to revise the Waste Framework Directive, stressing new rules on the responsibility of textile producers and new targets for reducing food waste. According to the European Environmental Agency, the proposal could face difficulties effectively reducing overproduction and waste in the food and textiles sectors.

Europe faces a threat from climate change and the degradation of natural resources. To meet such challenges, the European Green Deal is set to change the EU into a resource-efficient and competitive economy, ensuring no net greenhouse gas emissions by 2050.

The European Commission says the European Green Deal has been its lifeline since the COVID-19 pandemic. One-third of the EUR 1.8 trillion (USD 1.93 trillion) investment in the Next Generation EU Recovery Plan and the EU's seven-year budget is financing the European Green Deal.

Technology is Revolutionizing the Textile Waste Management

Low-value waste can be transformed into new high-value textiles by recycling technologies. The need for innovation to exploit new recycling technologies enabling textile waste to be used as a basic material is underlined by political pressures and the climate crisis. To ensure any circular strategy's effectiveness, quality materials that can be recycled must be obtained.

Sulzer Ltd, together with Worn Again Technologies' unique solvent technology, provides equipment, technology, and expertise to form the heart of the process. New technologies and processes are also being adopted by textile recyclers to enhance efficiency and effectiveness. For example, Sulzer and H&M established Worn Again Technologies, which is working on a unique textile recycling process that turns textiles into virgin raw materials at their end of use.

A technology for the closed-loop recycling of textile waste was developed in March 2023 by Korea's Korean Research Institute on Chemical Technology. The KRICT research team has adopted an inexpensive and nontoxic biodegradable material to chemically discriminate polyester from a mixture of waste fabrics.

Textile Recycling Industry Overview

The competitive landscape in the textile recycling market consists of a mix of experienced enterprises, new companies, and organizations working on solutions that can be sustainably implemented. Separate divisions or subsidiaries dedicated to textile recycling are designated by well-established companies in the area of waste management, recycling, and textiles. Some fashion brands and retailers also integrate sustainability into their business models by including renewable textiles in their products. Public authorities and agencies affect the competitive landscape through regulation, incentives, and funding schemes to promote sustainable practices and textile recycling. Global leaders in the textile recycling market are Worn Again Technologies, Lenzing Group, and Birla Cellulose.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Deliverables

- 1.2 Study Assumptions

- 1.3 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Current Market Scenario

- 4.2 Technological Trends

- 4.3 Industry Value Chain Analysis

- 4.4 Government Regulations and Initiatives

5 MARKET DYNAMICS

- 5.1 Drivers

- 5.1.1 Growing Environmental Awareness

- 5.1.2 Regulatory Initiatives and Policies

- 5.2 Restraints

- 5.2.1 Complexity in Recycling Processes

- 5.2.2 Limited Infrastructure and Awareness

- 5.3 Opportunities

- 5.3.1 Technological Advancements in Recycling Processes

- 5.4 Industry Attractiveness - Porter's Five Forces Analysis

- 5.4.1 Bargaining Power of Suppliers

- 5.4.2 Bargaining Power of Consumers / Buyers

- 5.4.3 Threat of New Entrants

- 5.4.4 Threat of Substitute Products

- 5.4.5 Intensity of Competitive Rivalry

6 MARKET SEGMENTATION

- 6.1 By Material

- 6.1.1 Cotton

- 6.1.2 Polyester and Polyester Fiber

- 6.1.3 Wool

- 6.1.4 Nylon and Nylon Fiber

- 6.1.5 Others

- 6.2 By Source

- 6.2.1 Apparel Waste

- 6.2.2 Home Furnishing Waste

- 6.2.3 Automotive Waste

- 6.2.4 Others

- 6.3 By Process

- 6.3.1 Mechanical

- 6.3.2 Chemical

- 6.4 By Geography

- 6.4.1 North America

- 6.4.1.1 United States

- 6.4.1.2 Canada

- 6.4.2 Europe

- 6.4.2.1 United Kingdom

- 6.4.2.2 Germany

- 6.4.2.3 France

- 6.4.2.4 Italy

- 6.4.2.5 Russia

- 6.4.2.6 Rest of Europe

- 6.4.3 Asia-Pacific

- 6.4.3.1 China

- 6.4.3.2 India

- 6.4.3.3 Indonesia

- 6.4.3.4 Bangladesh

- 6.4.3.5 Rest of Asia-Pacific

- 6.4.4 Middle East and Africa

- 6.4.5 South America

- 6.4.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Overview (Market Concentration and Major Players)

- 7.2 Company Profiles

- 7.2.1 Worn Again Technologies

- 7.2.2 Lenzing Group

- 7.2.3 Birla Cellulose

- 7.2.4 Pistoni SRL

- 7.2.5 Waste Management Inc.

- 7.2.6 The Woolmark Company

- 7.2.7 American Textile Recycling

- 7.2.8 Boer Group Recycling Solutions

- 7.2.9 I: Collect

- 7.2.10 Infinited Fiber Company*

- 7.3 Other Companies