|

市场调查报告书

商品编码

1521761

保全服务:市场占有率分析、产业趋势/统计、成长预测(2024-2029)Security Services - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

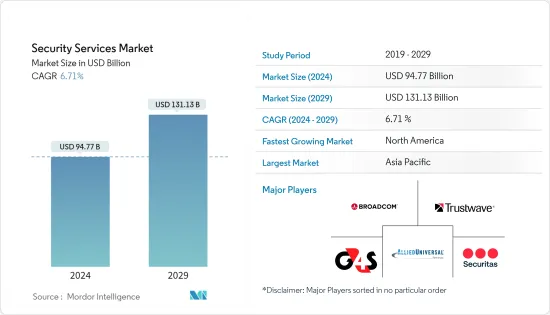

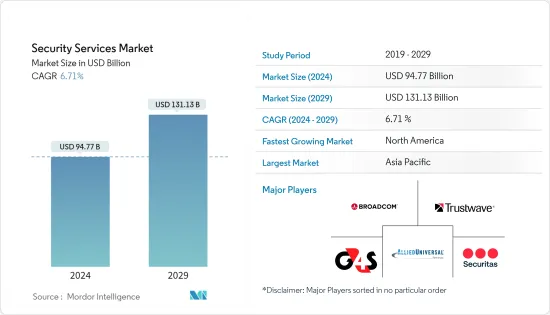

保全服务市场规模预计到 2024 年为 947.7 亿美元,预计到 2029 年将达到 1311.3 亿美元,在预测期内(2024-2029 年)复合年增长率为 6.71%。

主要亮点

- 实体领域和数位领域之间的关係变得越来越复杂,需要开发更复杂的安全系统,特别是在新兴经济体。随着这些系统透过智慧型设备和物联网与巨量资料和人工智慧(AI)等技术集成,对保全服务的需求正在迅速增加。虚拟职场环境的出现和对设施使用不断变化的需求正在催生新的保全服务和解决方案。此外,电子商务的成长进一步增加了物流中心和类似结构对技术支援的安全解决方案的需求。

- 越来越多的人向城市迁移,都市化和工业化速度不断加快。世界城市人口平均每週增加 150 万人,如此高的人口密度可能会引起人们对犯罪的担忧。随着技术监控设备的使用增加,大多数新兴国家的保全服务市场预计将迅速扩大。工业化的不断发展和全球工业生产的成长需要对生产设施、办公室和其他职场环境进行投资,而每个环境都有自己的安全要求。

- 随着世界人口可支配所得的增加,保全服务的需求也随之增加。例如,大众交通工具和公共物流设施等基础设施投资增加了安全需求,因为这些资产需要受到保护。全球经济成长和新建筑的持续投资都促进了保全服务市场的开拓。例如,智慧城市计画计画于2023年7月启动,将在全国100个城市投资数十亿美元,以满足印度快速成长的城市人口的需求。

- 网路威胁的性质不断变化,因此保全服务必须不断适应。随着新的攻击媒介的出现,保全服务不足可能会使您的组织面临风险并阻碍您开拓市场的能力。例如,2023 年资料外洩次数最多的三个产业是医疗保健、金融服务和製造业。

- COVID-19 大流行对全球保全服务市场产生了负面影响。例如,音乐会场馆、会议和体育赛事等重要公共活动已关闭,减少了对保全服务的需求。然而,在保全服务 -19 之后,将需要在封锁期间为零售和医疗保健等基本功能提供保全服务,以及接触者追踪和人群监控等安全服务,以促进社会恢復正常需求。

保全服务市场趋势

云端部署占据主要市场占有率

- 部署在云端的託管保全服务具有高度适应性和扩充性。此外,服务提供者可以存取、追踪和远端解决云端中的任何问题。持续监控使您能够快速有效地解决任何问题。机器学习 (ML)、人工智慧 (AI)、巨量资料分析、威胁情报和进阶自动化平台的日益普及也推动了向云端管理保全服务的转变。一些市场参与企业正在透过创新和协作努力推出综合服务,以满足行业不断变化的需求。

- 由于大流行,远端工作迅速扩展,增加了对云端基础的协作工具和存取解决方案的依赖。确保这些环境的安全需要专业的保全服务,包括安全存取和全面保护。因此,企业越来越多地选择将自动化安全措施与手动流程结合的混合架构,以降低与云端安全相关的成本和复杂性。

- 随着进行数位转型的公司开始对其本地IT基础设施进行现代化改造并将部分业务迁移到云端这一困难但必要的过程,IT 决策者通常会考虑法规遵循、面临安全性和降低风险的挑战。这些公司的问题因缺乏合格的 IT 人才以及无法跟上最新的工具、技术和实践而变得更加复杂。随着网路和资料安全风险的上升,MSSP 可以帮助不堪重负的企业管理云端配置、降低风险并确保合规性。

- 由于复杂、大规模的架构而需要自订安全云端部署或对不同系统有特定实施要求的组织可以从此类服务中受益匪浅。依赖动态资源分配的组织通常需要改善自动化来有效监控动态环境。这些复杂的自动化要求可以透过 AT&T、Verizon、IBM 和 SecureWorks 等提供者提供的服务来满足。

- 2023 年 10 月,CyberArk 宣布推出新功能,基于该公司基于风险的智慧权限控制,确保所有用户安全存取云端服务和现代基础设施。这种新的安全控制可以安全地存取云端环境的每一层,同时不会中断或改变开发人员和其他使用者存取云端服务的方式。

亚太地区实现显着成长

- 近年来,亚太地区的网路威胁和攻击有所增加。人们越来越多地使用互联网,商业变得更加数位化,并且存在地缘政治紧张局势。这些因素增加了对可靠的网路安全保全服务的需求,以防止网路攻击和破坏。

- MeitY提供的资料显示,2023年印度将报告超过150万起网路攻击,较往年大幅增加。印度是全年网路安全事件数量最多的五个国家之一。此外,印度目前的网路使用者数量位居世界第三。

- 保全服务。可用的。在传统产业中,数位转型和IT技术的进步正在增加对互联网中心服务的需求,进一步推动市场的成长。

- 人工智慧、5G、物联网、虚拟实境技术的快速兴起以及这些技术的商业化正在增加对资料处理和资讯交流的需求。这些因素可能会加速该地区资料中心的建设,从而导致产业快速扩张。随着印度对组织资讯的安全性、机密性和可用性的威胁不断增加,基于业务风险方法的资讯安全标准模型已经被采用、实施、操作、监控,并且需要审查、维护和改进强调。

- 亚太地区越来越多的公司将数位转型作为首要任务。随着越来越多的公司采取正式策略来加速推进,市场对数位转型的需求正在显着增加。中国、印度、日本和韩国等多个国家正在医疗保健、金融服务、政府和製造业等多个领域经历快速数位转型。这种转变需要利用云端运算、物联网和数位平台,并需要提供先进的保全服务来保护数位资产。

保全服务服务业概况

保全服务市场竞争激烈。市场分散,有大大小小的参与者。所有主要公司都拥有较大的市场占有率,并致力于扩大消费群。市场的主要参与者包括 Broadcom、Trustwave Holdings Inc.、G4S Limited、Securitas Inc.、Allied Universal、Unity Resource Group、Constellis、DSS Securitech Pvt.Ltd. 和 Fortra LLC。为了在预测期内获得竞争优势,公司正在透过建立多个合作伙伴关係、联盟、收购以及投资新产品推出来扩大市场占有率。

2023 年 4 月 安全与设施服务供应商 Allied Universal 与 Allied Universal 子公司 MSA Security 合作收购 Elite Tactical Security Solutions。收购精英 Tactical 将使 Allied Universal 能够提供安全和行政保护服务,以及爆炸物和枪支探测犬团队。此次收购后,Allied Universal 的解决方案组合将负责管理拉斯维加斯的安全和高阶主管保护服务。 Elite Tactical 的犬类服务将整合到 MSA Security 的计划中。

2023 年 3 月 - Fortra 的 Terranova Security 与 Elevate Security 合作,为市场带来最佳的安全意识和威胁监控。对于希望保护敏感资讯、增强资讯安全以及降低网路攻击和资料外洩的人为风险的组织来说,此元素至关重要。 80%的网路钓鱼事件是由4%的用户引起的,92%的恶意软体事件是由3%的用户引起的。 Elevate Security 为安全团队提供可见性和分析能力,以主动识别和回应组织中最脆弱的用户,并在安全事件发生之前降低用户风险。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场洞察

- 市场概况

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争公司之间的敌对关係

- COVID-19 和其他宏观经济因素对市场的影响

第五章市场动态

- 市场驱动因素

- 数位化颠覆和不断增长的合规要求

- 更多采用多重云端或混合云端策略

- 政府关注网路安全

- 市场挑战

- 缺乏保全服务意识

- 组织的保全服务预算有限

- 复杂性和整合挑战

第六章 市场细分

- 按服务类型

- 託管保全服务

- 专业保全服务

- 咨询服务

- 威胁情报和保全服务

- 依实施类型

- 本地

- 云

- 按最终用户产业

- 资讯科技和基础设施

- 政府机关

- 产业

- 卫生保健

- 运输/物流

- 银行

- 其他最终用户产业

- 按地区*

- 北美洲

- 美国

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 亚洲

- 印度

- 中国

- 日本

- 澳洲/纽西兰

- 拉丁美洲

- 中东/非洲

- 北美洲

第七章 竞争格局

- 公司简介

- Broadcom

- Trustwave Holdings Inc

- G4S Limited

- Allied Universal

- Securitas Inc

- Unity Resource Group

- Constellis

- DSS Securitech Pvt. Ltd

- Fortra LLC

- IBM Corporation

- VS4 Security Services

- Fujitsu

- Verizon

- Wipro

第八章投资分析

第9章市场的未来

The Security Services Market size is estimated at USD 94.77 billion in 2024, and is expected to reach USD 131.13 billion by 2029, growing at a CAGR of 6.71% during the forecast period (2024-2029).

Key Highlights

- The relationship between the physical and digital realms is becoming increasingly complex, necessitating the development of more sophisticated security systems, particularly in more developed economies. The need for security services is rapidly growing as these systems integrate with technologies such as big data and artificial intelligence (AI) through smart devices and the IoT. The emergence of virtual working environments and the ever-evolving demands for facility utilization are leading to new security services and solutions. Additionally, the growth of e-commerce has further increased the demand for technology-enabled security solutions in distribution centers and similar structures.

- The rate of urbanization and industrialization is accelerating as more and more people relocate to cities. The world's urban population is increasing by an average of 1.5 million individuals each week, and this high population density could raise concerns about criminal activity. It is anticipated that the security services market will experience a rapid expansion in the majority of developed countries as the utilization of technological monitoring equipment increases. The ongoing industrialization and growth of global industrial production necessitates the investment of production facilities, offices, and other work environments, each with its security requirements.

- As the global population increases its disposable income, the requirement for security services is likely to grow. For instance, infrastructure investments in public transport and public logistics facilities require the protection of these properties, thus necessitating an increase in the demand for security. Economic growth and ongoing global investment in new construction are both contributing to the development of the security services market. For instance, in July 2023, the Smart Cities Mission seeks to address India's rapidly expanding urban population by investing billions in 100 cities nationwide.

- The ever-changing nature of cyber threats necessitates that security services must be constantly adapted. As new attack vectors emerge, organizations can be put at risk if security services are inadequate, thus impeding market development. For instance, in 2023, the three industries that experienced the highest number of data breaches were the healthcare, financial services, and manufacturing sectors.

- The COVID-19 pandemic had a detrimental effect on the global security services market. For instance, the closure of significant public events, such as concert venues, conferences, and sports competitions, reduced the need for security services. However, post-COVID-19, there is an increase in the demand for security services for essential functions, such as retail and healthcare during lockdown, as well as for security and technology-enabled security services, such as contact tracing and crowd surveillance, to facilitate the return of societies to normalcy.

Security Services Market Trends

Cloud Deployment to Hold Significant Market Share

- Managed security services deployed in the cloud are highly adaptable and scalable. Additionally, the service provider can access, track, and even remotely resolve any problems within the cloud. Continuous monitoring ensures the prompt and effective resolution of any issues. The rising adoption of machine learning (ML), artificial intelligence (AI), big data analytics, threat intelligence, and advanced automation platforms further supports the transition to cloud-managed security services. Several market participants are introducing comprehensive services through innovative and collaborative initiatives to meet the changing needs of the industry.

- The rapid expansion of remote work due to the pandemic has necessitated a greater reliance on cloud-based collaborative tools and access solutions. Specialized security services are necessary to guarantee the safety of these environments, including secure access and comprehensive protection. As a result, enterprises will increasingly opt for hybrid architectures that combine automated security measures with manual processes to reduce the costs and intricacies associated with cloud security.

- IT decision-makers typically face regulatory compliance, security, and risk reduction challenges as companies amid digital transformation embark on the difficult yet necessary process of modernizing their on-premise IT infrastructure and transitioning some of their operations into the cloud. The lack of qualified IT personnel and the inability to remain up-to-date with the latest tools, technologies, and practices exacerbate these corporate worries. At a time when network and data security risks are on the rise, MSSPs can assist overwhelmed enterprises in managing cloud configuration, reducing risk, and ensuring regulatory compliance.

- Organizations that require a custom security cloud deployment due to a complex or expansive architecture or have specific implementation requirements with disparate systems can benefit significantly from such services. Organizations that rely on dynamic resource allocation typically require improved automation to monitor their dynamic environments efficiently. These complex automation requirements can be met through the services provided by providers such as AT&T, Verizon, IBM, and SecureWorks.

- In October 2023, CyberArk announced new capabilities for securing access to cloud services and modern infrastructure for all users based on the company's risk-based intelligent privilege controls. The new security controls enable secure access to every layer of cloud environments while causing no disruption or change to how developers and other users access cloud services.

Asia-Pacific to Witness Significant Growth

- Cyber threats and attacks have increased in Asia-Pacific over the last few years. People increasingly use the internet, businesses are digitalizing, and geopolitical tension exists. These factors have heightened the need for reliable cybersecurity services to safeguard against cyberattacks and breaches.

- In India, according to data provided by MeitY, more than 1.5 million cyberattacks were reported in 2023, which was a considerable rise from previous years. India was one of the five countries with the highest number of cybersecurity incidents in the year. Additionally, India is currently ranked third worldwide in terms of internet user numbers.

- Organizations in the region are increasingly turning to managed security services due to the growing threats to cybersecurity, such as IT ransomware attacks, distributed denial-of-service (DDoS) attacks, data extraction, and the increased visibility of major cyberattacks in the media. Traditional industries are increasingly embracing digital transformation and improving their IT technologies, increasing the demand for Internet center services, further contributing to the market's growth.

- The rapid emergence of artificial intelligence, 5G, the Internet of Things, and virtual reality technologies, as well as the commercialization of these technologies, has increased the need for data processing and the exchange of information. These factors may lead to accelerating data center construction in the region, potentially resulting in a rapid expansion of the industry. The threats to the security, confidentiality, and availability of organization information are on the rise in India, thus emphasizing the need for a standardized model of information security based on the business risk approach to be implemented, implemented, operated, monitored, reviewed, maintained, and improved for the overall security of customers.

- Asia-Pacific has seen an increase in the adoption of digital transformation as a top priority. As more businesses adopt formal strategies to facilitate their efforts, the market demand for digital transformation has increased significantly. Several countries, such as China, India, Japan, and South Korea, are experiencing rapid digital transformation in various sectors, including healthcare, financial services, administration, and manufacturing. This transformation necessitates the utilization of cloud computing and the Internet of Things (IoT), as well as digital platforms, which requires the provision of sophisticated security services to protect digital assets.

Security Services Industry Overview

The security services market is very competitive. The market is fragmented due to the presence of various small and large players. All the major players account for a significant market share and focus on expanding the consumer base. Some of the significant players in the market are Broadcom, Trustwave Holdings Inc., G4S Limited, Securitas Inc., Allied Universal, Unity Resource Group, Constellis, DSS Securitech Pvt. Ltd, and Fortra LLC. Companies are increasing their market share by forming multiple partnerships, collaborations, and acquisitions and investing in introducing new products to earn a competitive edge during the forecast period.

April 2023: Allied Universal, a security and facility services provider, partnered with MSA Security, a subsidiary of Allied Universal, to acquire Elite Tactical Security Solutions, a strategic extension of their services to the Las Vegas area. The acquisition of Elite Tactical will enable Allied Universal to provide security and executive protection services and explosives and firearms detection canine teams. As a result of this acquisition, Allied Universal's portfolio of solutions will be responsible for managing security guard and executive protection services in Las Vegas. Elite Tactical's canine services will be integrated into MSA Security's program.

March 2023 - Fortra's Terranova Security partnered with Elevate Security to bring the best security awareness and threat monitoring to the marketplace. This factor is essential for organizations looking to protect sensitive information, enhance information security, and mitigate the human risk of cyber-attacks and data breaches. 4% of users account for 80% of all phishing incidents and 3% for 92% of all malware incidents. Elevate security proactively identifies and responds to an organization's most vulnerable users and provides security teams with visibility and analytics to mitigate user risk before enabling a security incident.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Impact of COVID-19 Aftereffects and Other Macroeconomic Factors on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Rising Digital Disruption and Increased Compliance Demands

- 5.1.2 Increasing Adoption of Multi-Cloud or Hybrid Cloud Strategies

- 5.1.3 Governments Focus on CyberSecurity

- 5.2 Market Challenges

- 5.2.1 Lack of Awareness of Security Services

- 5.2.2 Limited Budget Constraints by Organizations for Security Services

- 5.2.3 Complexity and Integration Challenges

6 MARKET SEGMENTATION

- 6.1 By Service Type

- 6.1.1 Managed Security Services

- 6.1.2 Professional Security Services

- 6.1.3 Consulting Services

- 6.1.4 Threat Intelligence Security Services

- 6.2 By Mode of Deployment

- 6.2.1 On-Premise

- 6.2.2 Cloud

- 6.3 By End-user Industry

- 6.3.1 IT and Infrastructure

- 6.3.2 Government

- 6.3.3 Industrial

- 6.3.4 Healthcare

- 6.3.5 Transportation and Logistics

- 6.3.6 Banking

- 6.3.7 Other End-user Industries

- 6.4 By Geography***

- 6.4.1 North America

- 6.4.1.1 United States

- 6.4.1.2 Canada

- 6.4.2 Europe

- 6.4.2.1 Germany

- 6.4.2.2 United Kingdom

- 6.4.2.3 France

- 6.4.3 Asia

- 6.4.3.1 India

- 6.4.3.2 China

- 6.4.3.3 Japan

- 6.4.3.4 Australia and New Zealand

- 6.4.4 Latin America

- 6.4.5 Middle East and Africa

- 6.4.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles*

- 7.1.1 Broadcom

- 7.1.2 Trustwave Holdings Inc

- 7.1.3 G4S Limited

- 7.1.4 Allied Universal

- 7.1.5 Securitas Inc

- 7.1.6 Unity Resource Group

- 7.1.7 Constellis

- 7.1.8 DSS Securitech Pvt. Ltd

- 7.1.9 Fortra LLC

- 7.1.10 IBM Corporation

- 7.1.11 VS4 Security Services

- 7.1.12 Fujitsu

- 7.1.13 Verizon

- 7.1.14 Wipro