|

市场调查报告书

商品编码

1521767

视讯管理系统:市场占有率分析、产业趋势/统计、成长预测(2024-2029)Video Management System - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

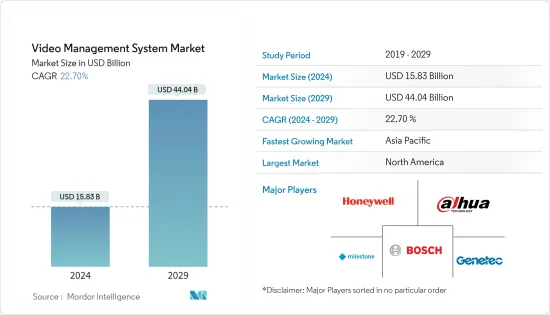

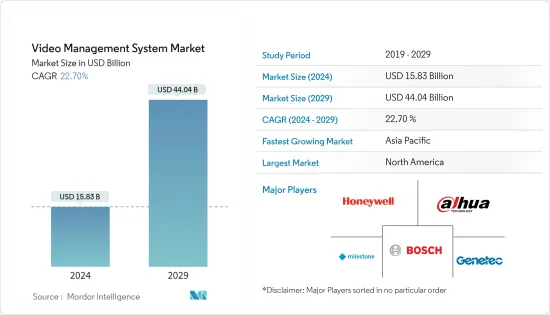

视讯管理系统市场规模预计到2024年为158.3亿美元,预计到2029年将达到440.4亿美元,在市场估计和预测期间(2024-2029年)复合年增长率为22.70%,预计将增长。

视讯管理系统 (VMS) 提供增强的功能以及与其他系统的互通性,从而提高整体安全性。透过实施视讯管理系统,您可以将视讯监控影像整合到统一的介面中并提高营运效率。采用视讯管理系统的主要原因是其相对于传统网路视讯录製设备的先进功能以及能够容纳网路中大量摄影机的能力。

主要亮点

- 人们对公共和安全的日益关注正在推动视讯管理系统在全球的普及。对智慧城市计画的投资增加、IP 摄影机成本的下降以及高级分析和软体的开发导致对无线和监视录影机的需求增加,以保护公民。

- 视讯管理系统透过考虑分割和去噪等主题,促进监视视讯的处理,探索新的视讯处理方法。随着恐怖主义和犯罪的盛行增加了公民对视讯监控的需求,视讯监控在全球变得越来越流行。视讯管理软体有助于发现罪犯并防止轻微犯罪。预计这些因素将增加对视讯管理系统的需求。

- 基于云端基础技术的成长趋势进一步促进了云端视讯管理系统的成长。近年来,VMS平台的使用者介面发生了重大转变,包括手势控制以及扩增实境(AR)和虚拟实境(VR)的集成,使用户能够收集内部或外部材料的视觉证据。

- Honeywell表示,全面且可自订的安全解决方案是新安全环境中的常态。该公司领先的商业安全解决方案之一是 MAXPRO 视讯管理系统,这是一款面向企业的全面视讯监控解决方案。 MAXPRO VMS 提供企业内的即时监控、事故调查影像审查以及监视录影机的集中管理。 MAXPRO VMS 还提供先进的分析功能,例如人数统计、终身车牌识别和脸部辨识,以改善安全性和业务运作。

- 2023年1月,Wisenet VMS发布了重大升级版本,以满足安全专业人员和系统整合商不断变化的需求。 5.0版本的平台重点在于网路安全、系统公共事业、便利性和互动性。包括进阶物件搜寻、元资料驱动的主动备份、透过伺服器的 Web 代理程式、2FA、资源分组、音讯对应等。

- 客户正在从摄影机过渡到 IP 摄影机 (IP) 系统。此外,世界各国政府在智慧城市计画上投入大量资金的趋势日益明显,有助于扩大视讯管理系统市场。新冠疫情大流行显着提高了全球商业业务的数位化,智慧城市监控领域对视讯管理系统的需求激增。

视讯管理系统市场趋势

基于IP的细分市场占据主要市场占有率

- 视讯管理系统将视讯网路的所有元素整合到一个系统中。基于 TCP/IP 的视讯安全和监控网路使企业能够利用经济高效的视讯和电脑硬体来建立视讯系统。网路视讯系统可以根据需要从一台摄影机扩展到多台摄影机。将物联网 (IoT) 引入视讯监控增加了对支援 IP 的摄影机系统的需求。这一趋势,加上智慧家庭的日益普及,预计将在未来几年推动网路摄影机的需求。

- 近年来,由于对高解析度影像和周界监控的需求不断增加,网路摄影机的使用迅速增加。每个城市采用的关键技术包括专用 LTE通讯(PLC)、资料储存、自动车牌识别 (ANPR)、视讯分析以及配套的资讯和通讯技术 (ICT) 设备。

- 基于 IP 的摄影机具有多种高级功能,有助于解决各行业的几个重要问题。例如,在零售业,有大量报告指出员工诈欺金融交易猖獗,每年导致大量收益损失。该领域的 IP 视讯监控系统透过电子连接所有交易和事件的视讯记录来帮助解决这个问题。所有这些资料都储存在中央资料库中,零售商可以在其中查看特定交易的所有状态并对各种参数进行搜寻。

- 基于 IP 的先进数位摄影机和录影机可在不同的照明条件下提供零售店内外更清晰的镜头,有助于防止盗窃、诈骗、滑倒等毫无根据的索赔。

- 此外,零售店的激增需要实施网际网路通讯协定(IP) 网路监控系统。这使得管理人员可以从办公室、家中或任何可以存取网路的地方有效地监控商店的绩效。

亚太地区实现显着成长

- 由于大规模的基础设施投资,亚太地区在全球视讯管理系统市场中正在迅速扩张。该地区的政府机构正致力于开发用于人口稠密地区的先进监视录影机,以确保公共。

- 亚太地区人口不断增长,尤其是印度和中国,为视讯管理系统创造了巨大的商机。视讯管理系统提供监控和管理人口稠密区域的解决方案。资讯科技是该地区成长最快的行业之一,为投资者提供高投资收益。

- 例如,在印度,监控系统OEMInfinova 于 2023 年 4 月被任命管理 60 多个机场,并致力于加强安全措施并防止恐怖分子行为。 Infinova 是一家可靠的安全系统和产品製造商,在印度主要机场部署了 6,000 多个视讯监视录影机,包括 PTZ(高速)半球、防破坏迷你半球和固定日夜摄影机。这些机场大多数都使用 Infinova 的本地视讯管理软体,但有些机场将 Infinova 的摄影机与第三方 VMS 供应商整合。

- 拥有多个地点的组织应该拥有一个整合所有区域并提供集中监控的视讯管理系统。该元素可让您即时追踪所有背景,从而减少回应时间。例如,2023年5月,日本安全整合公司Secom向两家专注于云端基础的视讯监控的安全解决方案提供商Eagle Eye Networks Inc.和Brivo Inc.支付了1.92亿美元。 EagleEye 是一家云端视讯监控供应商,提供全面的产品,将网路安全的云端基础视讯与人工智慧和分析功能相结合。该公司的旗舰产品鹰眼云端视讯管理系统(VMS)旨在集中视讯监控并帮助企业提高安全性和业务效率。

- 由于政府措施越来越多地实施智慧城市计划,市场也出现了积极的发展。例如,2023 年 5 月,印度政府报告称,截至 2023 年 5 月 1 日,智慧城市任务分配的资金已使用 90% 以上,73% 的计划已完成。

视讯管理系统产业概况

视讯管理系统市场是分散的,由多个参与者组成。市场上的公司不断努力透过推出新产品、扩大业务、策略併购、结盟和合作关係来提高其市场占有率。主要参与者包括 Milestone Systems、Bosch Security Systems GmbH、Genetec Inc.、Honeywell International Inc.、大华科技、Axis Communications AB、Panasonic Corporation、NetApp、Kedacom、Hikvision、Cisco Systems Inc. 等。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场洞察

- 市场概况

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争公司之间的敌对关係

- COVID-19 后遗症和其他宏观经济趋势对市场的影响

第五章市场动态

- 市场驱动因素

- 扩大基于 IP 的摄影机的使用

- 日益增长的安全性问题以及对即时影像处理和追踪的需求

- 市场挑战

- 缺乏熟练的工程师

- 关于保存高解析度视讯和录音的担忧

第六章 市场细分

- 按成分

- 解决方案

- 按服务

- 依技术

- 模拟基地

- 基于IP

- 依部署类型

- 本地

- 云

- 按最终用户产业

- 零售

- 飞机场

- 教育

- 银行

- 卫生保健

- 运输/物流

- 其他最终用户产业

- 按地区

- 北美洲

- 美国

- 加拿大

- 欧洲

- 英国

- 德国

- 法国

- 亚洲

- 中国

- 日本

- 印度

- 澳洲/纽西兰

- 拉丁美洲

- 中东/非洲

- 北美洲

第七章 竞争格局

- 公司简介

- Milestone Systems

- Genetec Inc.

- Bosch Security Systems GmbH

- Honeywell International Inc.

- Dahua Technology Corporation

- Avigilon Corporation(Motorola Solutions Inc.)

- Hanwha Vision

- NetApp

- Kedacom

- Hikvision

- Verint System Inc.

- Axis Communications AB

- Cisco Systems Inc.

- Axon Enterprise Inc.

第八章投资分析

第9章市场的未来

The Video Management System Market size is estimated at USD 15.83 billion in 2024, and is expected to reach USD 44.04 billion by 2029, growing at a CAGR of 22.70% during the forecast period (2024-2029).

A video management system (VMS) offers enhanced capabilities and interoperability with other systems to enhance overall security. Implementing a video management system can facilitate operational efficiency by combining video surveillance footage into a unified interface. The primary driver for adopting video management systems lies in their advanced capabilities compared to conventional network video recording devices and their capacity to accommodate a more significant number of cameras within the network.

Key Highlights

- The increasing concern for public security and safety drives the global adoption of video management systems. The increased investment in smart city initiatives, the decrease in the cost of IP cameras, and the development of advanced analytics and software are leading to an increased demand for wireless and surveillance cameras to protect citizens.

- A video management system facilitates the processing of surveillance videos to explore new video processing approaches by examining topics such as segmentation and noise elimination. Video surveillance is becoming increasingly popular globally as the prevalence of terrorism and crime has increased the public's demand for video surveillance. Video management software assists in the detection of criminals and the prevention of minor crimes. These factors are expected to contribute to the demand for video management systems.

- The increasing trend toward cloud-based technology has further contributed to the growth of cloud video management systems. In recent years, VMS platforms have undergone a significant transformation in user interfaces, including the integration of gesture control and augmented reality (AR) and virtual reality (VR), which allows users to collect visual evidence of internal or external material.

- According to Honeywell, comprehensive and customizable security solutions are the new security environment standard. One of the company's leading security solutions for business is the MAXPRO Video Management System, a comprehensive video surveillance solution for businesses. It provides firms with real-time monitoring of their premises, footage review for incident investigation purposes, and centralized control of their security cameras. MAXPRO VMS also offers advanced analytics capabilities such as people counting, lifetime license plate recognition, and facial recognition to improve security and business operations

- In January 2023, Wisenet VMS released a substantially upgraded version to meet the evolving requirements of Security Professionals and System Integrators. The 5.0 version of the platform expands the platform's focus on cybersecurity, system utility, convenience, and interactivity. It includes advanced object search, metadata-driven active backup, web proxy via servers, 2FA, resource grouping, audio mapping, etc.

- Customers are shifting from video cameras to IP video camera (IP) systems. Furthermore, governments globally are increasingly investing in smart city initiatives through substantial funding, contributing to expanding the market for video management systems. The COVID pandemic resulted in a significant increase in the digitization of global commercial operations, which has led to a surge in the need for video management systems in the field of smart city monitoring.

Video Management System Market Trends

IP-Based Segment to Hold Significant Market Share

- Video management systems combine all the elements of a video network into a single system. TCP/IP-based video security and surveillance networks allow organizations to construct video systems utilizing cost-effective video and computer hardware. Network video systems can scale from one camera to many as required. Implementing the Internet of Things (IoT) in video surveillance has increased the need for IP-enabled camera systems. This trend, coupled with the rising popularity of smart homes, is expected to propel the demand for IP cameras in the coming years.

- In recent years, there has been a surge in the use of IP cameras due to the increasing need for high-resolution images and perimeter monitoring. The critical technologies adopted by the cities include private LTE communications (PLC), data storage, automatic number plate recognition (ANPR), video analytics, and accompanying information and communication technology (ICT) equipment.

- IP-based cameras offer a range of advanced features that have been instrumental in addressing several critical issues in various industries. For instance, in the retail sector, there have been numerous reports of employees engaging in widespread fraudulent financial transactions, resulting in the loss of a considerable amount of revenue each year. The IP video surveillance system in this sector has been instrumental in addressing this issue by electronically connecting all transactions and video recordings of the events. All of this data is stored in a centralized database, allowing retailers to view all the circumstances of a particular transaction and perform a search on various parameters.

- Advanced digital IP-based video cameras and recorders enable more explicit images to be taken inside and outside the retail store in various lighting conditions to prevent theft, fraud, and unsubstantiated claims, such as slips and falls.

- Furthermore, the proliferation of retail stores necessitates implementing internet protocol (IP) network surveillance systems, which allow executives to effectively monitor the performance of their stores from the comfort of their offices, homes, or any other location with access to the Internet.

Asia-Pacific to Witness Significant Growth

- Asia-Pacific is rapidly expanding in the global video management system market due to substantial infrastructure investments. Government entities in the region are concentrating on developing sophisticated surveillance cameras to be utilized in densely populated areas to ensure public safety.

- Asia-Pacific is experiencing an increase in population, particularly in India and China, which is providing a significant opportunity for video management systems. Video management systems provide a solution for monitoring and managing densely populated areas. Information technology is one of the fastest-growing industries in the region, resulting in a higher return on investment for investors.

- In India, for instance, the surveillance system OEM, Infinova, was entrusted with the responsibility of managing more than 60 airports in April 2023 to enhance security measures and prevent acts of terrorism. Infinova, a manufacturer of dependable security systems and products, deployed more than 6,000 video surveillance cameras, including PTZ (high-speed) domes, minidomes resistant to vandalism, and fixed day/night cameras, at major airports across India. Most of these airports are utilizing Infinova's native video management software, while others are integrating Infinova cameras with third-party VMS suppliers.

- Organizations with multiple locations should have a video management system that integrates all areas and provides centralized monitoring. This factor allows for real-time tracking of all backgrounds and reduces response time. For instance, in May 2023, Secom Co. Ltd, a Japanese security integration company, invested USD 192 million in two security solutions providers, Eagle Eye Networks Inc. and Brivo Inc., specializing in cloud-based video surveillance. Eagle Eye is a provider of cloud video surveillance, offering a comprehensive product offering that combines cyber-secure cloud-based video with AI and analytics capabilities. The company's flagship product, the Eagle Eye Cloud Video Management System (VMS), is designed to centralize video surveillance and assist businesses in increasing their security and operational effectiveness.

- The market is also witnessing positive developments due to the increasing number of governmental initiatives to implement smart city projects. For example, the Indian government reported in May 2023 that over 90% of funds allocated under its Smart Cities Mission had been utilized, and 73% of projects were completed as of May 1, 2023.

Video Management System Industry Overview

The video management system market is fragmented and consists of several players. The companies in the market continuously try to increase their market presence by introducing new products, expanding their operations, or entering into strategic mergers and acquisitions, partnerships, and collaborations. Some of the major players include Milestone Systems, Bosch Security Systems GmbH, Genetec Inc., Honeywell International Inc., Dahua Technology Co. Ltd, Axis Communications AB, Panasonic Corporation, NetApp, Kedacom, Hikvision, Cisco Systems Inc., and many more.

- In July 2023, Milestone Systems, an Open Platform Video technologies provider, partnered with FedCloudIA. This partnership marks a milestone in the development of innovative government security solutions. Milestone Systems' software Milestone XProtect is available as a part of FedCloudIA's FedRAMP Ready cloud service offering. Milestone XProtect is now a certified cloud service technology provider for the US government, having joined the FedRamp Ready environment. This distinction makes it easier for businesses to conduct business within the federal government sector. As a result, any federal government agency that is looking for a FedRamp Ready video management system (VMS) now has the opportunity to utilize Milestone through FedCloudIA.

- In July 2023, Pestra Limited, a security, safety, and IT systems distribution company in West Africa, announced the launch of a distribution partnership with Bosch Security to meet the market's growing demands. Petra offers a comprehensive selection of Bosch security, communications products, solutions, and services, including IP cameras, recorders, video management software, public address systems, voice alarm systems, and more. Through partnerships with leading manufacturers like Bosch, Pestra can provide high-quality security solutions for several industries and applications, including Smart City, integrated border control, baggage scanning, malicious vehicle mitigation solutions, and advanced video surveillance systems.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Impact of COVID-19 After Effects and Other Macroeconomic Trends on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 The Increasing Usage of IP-based Cameras

- 5.1.2 Growing Concerns Regarding Security, as well as the Need for Instantaneous Video Processing and Tracking.

- 5.2 Market Challenges

- 5.2.1 The Lack of Skilled Technical Personnel

- 5.2.2 Concerns Regarding the Preservation of High-resolution Videos and Recordings

6 MARKET SEGMENTATION

- 6.1 By Component

- 6.1.1 Solution

- 6.1.2 Services

- 6.2 By Technology

- 6.2.1 Analog-Based

- 6.2.2 IP-based

- 6.3 By Mode of Deployment

- 6.3.1 On-premise

- 6.3.2 Cloud

- 6.4 By End-user Industry

- 6.4.1 Retail

- 6.4.2 Airports

- 6.4.3 Education

- 6.4.4 Banking

- 6.4.5 Healthcare

- 6.4.6 Transportation and Logistics

- 6.4.7 Other End-user Industries

- 6.5 By Geography***

- 6.5.1 North America

- 6.5.1.1 United States

- 6.5.1.2 Canada

- 6.5.2 Europe

- 6.5.2.1 United Kingdom

- 6.5.2.2 Germany

- 6.5.2.3 France

- 6.5.3 Asia

- 6.5.3.1 China

- 6.5.3.2 Japan

- 6.5.3.3 India

- 6.5.3.4 Australia and New Zealand

- 6.5.4 Latin America

- 6.5.5 Middle East and Africa

- 6.5.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles*

- 7.1.1 Milestone Systems

- 7.1.2 Genetec Inc.

- 7.1.3 Bosch Security Systems GmbH

- 7.1.4 Honeywell International Inc.

- 7.1.5 Dahua Technology Corporation

- 7.1.6 Avigilon Corporation (Motorola Solutions Inc.)

- 7.1.7 Hanwha Vision

- 7.1.8 NetApp

- 7.1.9 Kedacom

- 7.1.10 Hikvision

- 7.1.11 Verint System Inc.

- 7.1.12 Axis Communications AB

- 7.1.13 Cisco Systems Inc.

- 7.1.14 Axon Enterprise Inc.