|

市场调查报告书

商品编码

1521828

清洗:市场占有率分析、产业趋势与统计、成长预测(2024-2029)Pressure Washer - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

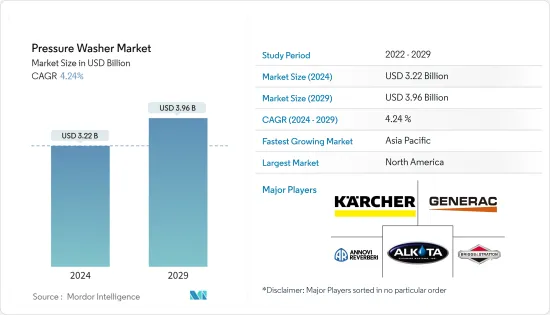

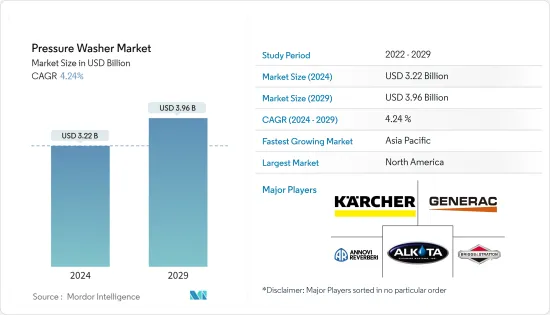

清洗市场规模预计到2024年为32.2亿美元,预计到2029年将达到39.6亿美元,在预测期内(2024-2029年)复合年增长率预计为4.24%。

主要亮点

- 清洗是多功能工具,可用于多种清洗应用。可携式且易于使用,可用于家庭、大型商业和工业清洗。清洗的典型用途包括车辆清洗、脱漆以及建筑物外部、地板和天花板清洗。然而,清洗市场的最新创新允许您使用具有不同水压的多个喷嘴来清洗几乎任何表面,从草坪到园艺工具、家具和栅栏。

- 清洗正成为越来越受欢迎的设施、企业和个人的选择,他们希望创造一个闪亮、安全的环境,而不用担心化学物质、水浪费或中断。清洗也越来越受到家庭用户的欢迎,用于清洗各种表面。这些清洗机适用于清洁墙壁、甲板、路径、花园、家具等。

- 这些机器便于携带且易于使用,不仅可用于家庭,还可用于商业和工业领域的重型清洗。洗车和清洁建筑物的外墙、地板和天花板是清洗最重要的用途。然而,透过一些灵活的水压喷嘴,清洗的最新创新使您可以清洗几乎任何表面,从草坪到园艺工具,从家具到栅栏。

- 阻碍市场成长的主要因素是替代清洗方法的可用性。虽然清洗对于清洗油漆和硬表面上的污垢、油污、涂鸦和污垢很有用,但通常还有更好的解决方案。外墙表面不能承受高水压,可能会剥落或劣化。另外,如果表面有油漆,高压清洗可能会损坏油漆并导致其劣化。因此,最终用户更喜欢热清洗、泡沫清洗、蒸气喷射、喷砂、干冰喷射和冰袋喷射等替代方案。此外,一些清洁公司使用传统方法使用工业肥皂和普通软管清洁房屋和人行道。

- 俄罗斯和乌克兰之间的衝突预计将对自动化产业产生重大影响。这场衝突已经加剧了已经影响该行业的半导体供应链问题和晶片短缺问题。这种干扰可能导致镍、钯、铜、钛、铝和铁矿石等关键原料的价格波动,进而导致材料短缺。因此,清洗的生产可能会受到影响。此外,根据乌克兰投资局的数据,2022 年 3 月初铜价上涨至 10,845 美元/吨。俄罗斯和乌克兰战争、能源成本飙升以及欧洲更严格的废气法规被指出是铜持续短缺的主要原因。

- 此外,根据国际货币基金组织(IMF)2023年7月的更新,预计全球经济成长率将从2022年的3.5%下降至2023年和2024年的3%左右;这是因为央行的政策利率已上调至2022年的3%左右。

清洗市场趋势

商业和工业用途占据主要市场占有率

- 商业和工业应用拥有很大的市场占有率,因为清洗可以在建筑、汽车、公共、零售、农业、酒店、医疗等多个领域执行重型清洗任务。

- 在农业业务中,清洁不仅对于外观至关重要,而且对于保持最佳运作效率以及确保牲畜和作物的健康和福祉也至关重要。清洗是农业领域的宝贵资产,是保持整个农场清洁和卫生的高效、多功能解决方案。这些清洗提供了一种强大而有效的方法来清洗拖拉机、犁、联合收割机和其他机械,清除顽固碎片并延长其使用寿命。

- 中国是世界上最大的农业生产国,生产农产品10.95亿吨,为世界粮食供应做出了重大贡献。为了提高产量和效率,中国在农业研发、现代农业方法和机械化方面进行了投资。

- 世界各地的多个政府正在投资和扩大商业和住宅基础设施,预计这将推动所研究市场的成长。例如,美国的商业建筑业正以惊人的速度扩张,正成为支撑国家经济发展的重要力量。根据美国人口普查局的数据,到 2023 年该产业的年销售额将达到 5,000 亿美元。

- 此外,随着国家建筑业的不断发展,用于清洗混凝土、人行道、墙壁和其他硬表面的大型住宅清洗设备预计将显着增长,这使得对压力清洗的需求显而易见。大多数电动清洗的输出压力为 3,000 PSI 或更低。

亚太地区成为成长最快的地区

- 预计亚太地区将成为预测期内成长最快的地区。印度和中国的经济成长是成长的主要动力。可支配收入的增加、商业空间的扩大以及零售和餐旅服务业的改善推动了该地区对商务用清洁设备的需求。

- 中国是最重要的清洗零件出口国之一。由于工业扩张和人口增长,导致住宅和工业活动增加,该国对清洗的需求巨大。此外,人口从农村地区迁移到城市也增加了建设活动和清洁服务的需求。

- 印度的洗车机已经走过了漫长的道路,从手工转变为先进技术。高压洗车机的推出是一项突破,为印度洗车产业的效率和效果树立了新标准。高压洗车比传统方法用水量少,环保,有助于减少水的浪费。高压洗车机具有可调式喷嘴,使其适用于从汽车到车道的各种清洗任务,其彻底清洗车辆的能力增加了对高压洗车机的需求。随着技术的发展,印度的洗车机利用尖端技术彻底改变清洗过程,确保更有效、更有效率的结果。

- 由于前往日本、马来西亚和泰国等国家的游客数量增加,豪华酒店数量的增加预计将在预测期内推动该地区市场的成长。根据日本国家旅游局(JNTO)统计,2024年2月访日外国游客人数迅速增加至278万人次,与前一年同期比较增加89%。

- 由于国际观光的增加,日本的豪华酒店正在经历显着增长。因此,可持续的卫生习惯现已成为旅馆和餐厅的常态。一些饭店投资了清洗,以帮助内部清洁工和维护专业人员满足快速、安全清洁的需求。

清洗产业概况

清洗市场是半固体的,由 Alfred Karcher SE &Co.KG、Generac Power System Inc.、Alkota Cleaning Systems 和 Briggs &Stratton 等公司组成。公司正试图透过推出新产品、扩大业务、策略併购、结盟和建立合作关係来增加其在市场上的影响力。

- 2024 年 4 月,Muc-Off 宣布推出最新创新产品-行动自行车清洗。专用具有内建雪表单功能的自行车而设计。这款移动式清洗是让您的自行车保持Sharp Corporation且运作平稳的终极武器。

- 2024 年 1 月,我们推出了凯驰最新创新产品 CleanWave 的两款型号,这是一款电池供电的商务用强力冷水清洗。电池供电的 CleanWave Deluxe 采用先进的锂离子技术,运行时间长达四小时。还有配备 AGM 电池的 CleanWave Classic 型号,可运行长达 1.5 小时。与传统电动式型号不同,无线设计意味着您无需连接电源。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行概述

第四章市场洞察

- 市场概况

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争公司之间的敌对关係

- 产业价值链分析

- COVID-19副作用和其他宏观经济因素对市场的影响

第五章市场动态

- 市场驱动因素

- 住宅和商业应用需求快速成长

- 全球建设活动增加

- 市场问题

- 替代清洗方法的可用性

第六章 市场细分

- 按类型

- 移动的

- 固定式

- 按动力来源

- 电

- 气体

- 电池

- 按零件

- 水泵

- 马达/燃气引擎

- 高压软管

- 喷嘴

- 透过水作业

- 热水

- 冷水

- 按产量

- 0-1,500PSI

- 1,501~3,000PSI

- 3,001-~4,000PSI

- 4,000PSI 或以上

- 按销售管道

- 在线的

- 离线

- 按最终用户

- 住宅

- 商业/工业

- 合约清洁工

- 按地区*

- 北美洲

- 欧洲

- 亚洲

- 澳洲/纽西兰

- 拉丁美洲

- 中东/非洲

第七章 竞争格局

- 公司简介

- Alfred Karcher SE & Co. KG

- Generac Power System Inc.

- Alkota Cleaning Systems

- Annovi Reverberi Spa

- Briggs & Stratton

- FNA Group

- Nilfisk Group

- Robert Bosch Power Tools GmbH

- Revive Powerwashing Inc.

第八章投资分析

第9章市场的未来

The Pressure Washer Market size is estimated at USD 3.22 billion in 2024, and is expected to reach USD 3.96 billion by 2029, growing at a CAGR of 4.24% during the forecast period (2024-2029).

Key Highlights

- Pressure washers are highly versatile tools that can be used for several cleaning applications. Being portable and easy to use, these machines can be used for domestic, heavy-duty commercial, and industrial cleaning. Some major applications of pressure washers include vehicle washing, paint stripping, and cleaning building exteriors, floors, and ceilings. However, with the latest technological innovations in the pressure washer market, several nozzles with varying water pressure can clean almost every surface, ranging from lawns to garden tools and furniture to fences.

- Pressure washing is becoming an increasingly popular option for institutions, businesses, and individuals who want to create a sparkling, safe environment without worrying about chemicals, water waste, or interruptions. Pressure washers are also becoming increasingly popular with domestic users for washing various surfaces. These washers are suitable for clearing walls, decks, paths, gardens, and furniture.

- These machines are portable and easy to use, and they can be used for domestic and heavy-duty cleaning in both commercial and industrial sectors. Car washing and cleaning the exterior of buildings, floors, and ceilings are some of the most essential uses for pressure washers. Nevertheless, several flexible nozzles in water pressure can clean almost all surfaces, ranging from lawn to garden tools and furniture or fences, owing to the most recent technological innovations for pressure washers.

- The primary factor hampering the market's growth is the availability of substitute cleaning methods. Although pressure washers can help paint and clean dirt, oil, graffiti, or grime from hard surfaces, there are usually better solutions than these. Several exterior surfaces can not take excess pressure and would fall off or deteriorate owing to the high pressure of water. In addition, if the surface is painted, pressure washing may damage the paint and cause it to disintegrate. Thus, end-users prefer alternative methods such as heat cleaning, foam-based cleaning, vapor blasting, sandblasting, and dry and wet ice blasting techniques for cleaning numerous objects and surfaces. Further, several cleaning companies offer home and walkway cleaning using traditional methods with industrial soap and regular hoses.

- The conflict between Russia and Ukraine will significantly impact the automation industry. The conflict has already exacerbated semiconductor supply chain issues and chip shortages that have affected the industry for some time. The disruption may result in volatile pricing for critical raw materials such as nickel, palladium, copper, titanium, aluminum, and iron ore, resulting in material shortages. This, in turn, could impact the manufacturing of pressure washers. Further, according to UkraineInvest, copper prices escalated to USD 10,845/mt in early March 2022. The Russia-Ukraine War, high energy costs, and stricter emissions standards in Europe have been noted as the primary reasons for the continued shortage of copper.

- Furthermore, according to the International Monitory Fund's (IMF's) July 2023 update, global economic growth was anticipated to fall from 3.5% in 2022 to about 3% in 2023 and 2024 owing to the rising Central Bank policy rates to fight inflation, thereby slowing down economic activities.

Pressure Washer Market Trends

Commercial and Industrial To Hold Significant Market Share

- The commercial and industrial application is expected to hold a significant market share as pressure washers can perform heavy-duty cleaning tasks in several sectors, such as construction, automobile, public and municipality, retail, agriculture, hospitality, healthcare, and others.

- In the agricultural business, cleanliness is not only about appearance but also crucial for maintaining optimal operational efficiency and ensuring the health and well-being of livestock and crops. High-pressure washers are invaluable assets within the agricultural sector, offering efficient and versatile solutions to maintain cleanliness and hygiene across the farm. These high-pressure washers provide a powerful and efficient way to clean tractors, plows, combine harvesters, and other machinery, removing stubborn debris and extending their lifespan.

- China is the largest agricultural producer globally, producing 1095 million metric tonnes of agricultural products that contribute significantly to the world food supply. To enhance production and efficiency, China has invested in agriculture research and development, modern farming practices, and mechanization.

- Several governments across the globe are investing and expanding their commercial & residential infrastructure, which is expected to fuel the growth of the studied market. For instance, the United States commercial building construction business is expanding at an impressive rate and is establishing itself as a significant force behind the nation's economic progress. According to the US Census Bureau, an industry's annual sales stood at USD 500 billion in 2023.

- Additionally, given the country's growing construction sector, significant growth in heavy-duty residential cleaning equipment to clean concrete, sidewalks, walls, and other hard surfaces is expected as the demand for pressure washing becomes evident. Most electric-corded pressure washers have an output pressure capacity of below 3,000 PSI.

Asia-Pacific To Be The Fastest Growing Region

- Asia-Pacific is expected to be the fastest-growing region during the forecast period. India and China's growing economies are a significant driver of growth. The demand for professional cleaning equipment in the region is driven by increased disposable income, expansion of commercial space, and improvements in the retail and hospitality sectors.

- China is one of the most significant pressure washer component exporters. The country is witnessing substantial demand for pressure washers due to fast industrial expansion and a growing population, leading to increased residential and industrial activities. Furthermore, the population transition from rural to urban rose in construction activity, raising the demand for cleaning services.

- The car washer in India has come a long way, transforming from manual labor to advanced technology. Introducing high-pressure car washers has been a game-changer and set a new standard for efficiency and effectiveness in the Indian car washing industry. Pressure washers are helping car washers to use less water compared to traditional methods, making them environment-friendly and reducing water wastage, which is increasing the demand for pressure washers as they come with adjustable nozzles, making them suitable for various cleaning tasks, from vehicles to driveways and can clean the vehicle thoroughly. As technology evolves, car washers in India will harness cutting-edge advancements to revolutionize the cleaning process, ensuring more effective and efficient results.

- An increasing number of high-end hotels is expected to drive the regional market's growth during the forecast period due to increased tourism to countries such as Japan, Malaysia, and Thailand. According to the Japan National Tourism Organization (JNTO), international visitors visiting Japan in February 2024 jumped 89% from the previous year to 2.78 million people.

- Japan's luxury hotels are experiencing significant growth due to the rise in international tourism. Thus, sustainable hygiene management is now standard practice in hotels and restaurants. Several hotels are investing in pressure washers that are helping in-house cleaners and maintenance professionals meet the demands for fast and safe cleaning.

Pressure Washer Industry Overview

The pressure washer market is semi-consolidated and consists of players like Alfred Karcher SE & Co. KG, Generac Power System Inc., Alkota Cleaning Systems, and Briggs & Stratton. Companies continuously try to increase their market presence by introducing new products, expanding their operations, or entering strategic mergers and acquisitions, partnerships, and collaborations.

- April 2024: Muc-Off announced the launch of its latest innovation: the mobile bike pressure washer. It is designed specifically for bikes with built-in Snow Foam capability. This mobile washer is the ultimate weapon for keeping the bike looking sharp and running smooth.

- January 2024: Karcher launched its latest innovation, two CleanWave models, a battery-powered commercial-strength cold-water pressure washer. The battery-powered CleanWave Deluxe is equipped with advanced lithium-ion technology and can run for up to four hours. The CleanWave Classic model, featuring AGM batteries, is also available and can run for up to 1.5 hours. Unlike conventional electric models, the cordless design means the operator is not tethered to a power source.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain Analysis

- 4.4 Impact of COVID-19 Aftereffects and Other Macroeconomic Factors on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Surge in Demand in Residential & Commercial Applications

- 5.1.2 Increasing Number of Construction Activities Worldwide

- 5.2 Market Challenges

- 5.2.1 Availability of Substitute Cleaning Methods

6 MARKET SEGMENTATION

- 6.1 By Type

- 6.1.1 Mobile

- 6.1.2 Stationary

- 6.2 By Power Source

- 6.2.1 Electric

- 6.2.2 Gas

- 6.2.3 Battery

- 6.3 By Component

- 6.3.1 Water Pump

- 6.3.2 Electric Motor/Gas Engine

- 6.3.3 High-Pressure Hose

- 6.3.4 Nozzle

- 6.4 By Water Operation

- 6.4.1 Hot Water

- 6.4.2 Cold Water

- 6.5 By Output

- 6.5.1 0-1,500 PSI

- 6.5.2 1,501-3,000 PSI

- 6.5.3 3,001-4,000 PSI

- 6.5.4 Above 4,000 PSI

- 6.6 By Distribution Channel

- 6.6.1 Online

- 6.6.2 Offline

- 6.7 By End User

- 6.7.1 Residential

- 6.7.2 Commercial & Industrial

- 6.7.3 Contract Cleaners

- 6.8 By Geography***

- 6.8.1 North America

- 6.8.2 Europe

- 6.8.3 Asia

- 6.8.4 Australia and New Zealand

- 6.8.5 Latin America

- 6.8.6 Middle East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles*

- 7.1.1 Alfred Karcher SE & Co. KG

- 7.1.2 Generac Power System Inc.

- 7.1.3 Alkota Cleaning Systems

- 7.1.4 Annovi Reverberi Spa

- 7.1.5 Briggs & Stratton

- 7.1.6 FNA Group

- 7.1.7 Nilfisk Group

- 7.1.8 Robert Bosch Power Tools GmbH

- 7.1.9 Revive Powerwashing Inc.