|

市场调查报告书

商品编码

1521899

衬袋纸盒(BIB) 包装:市场占有率分析、产业趋势与统计、成长预测(2024-2029 年)Bag-in-Box Packaging - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

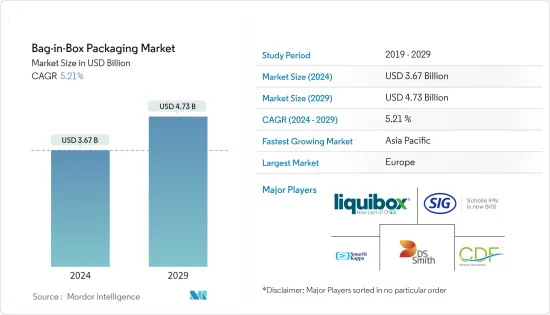

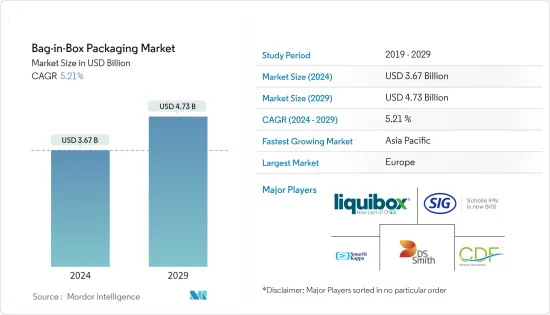

衬袋纸盒(BIB)包装市场规模预计到2024年为36.7亿美元,预计到2029年将达到47.3亿美元,预测期内(2024-2029年)复合年增长率为5.21。

主要亮点

- 衬袋纸盒(BIB) 包装是一种创新的解决方案,在坚固的盒子内使用柔性袋。这种设置提供了一种高效、经济且环保的方式来储存和分配液体和半液体。袋子通常由多层薄膜製成,以保持产品完整性,并配有分配龙头,以便轻鬆控制剂量。由于其多功能性和众多优点,这种包装形式广泛应用于食品和饮料、药品和工业产品等行业。

- BIB 包装的显着优势之一是易于使用的分配器。其设计可以顺利去除产品,而不会夹带空气,透过最大限度地减少氧化和污染的风险来延长产品的保质期。例如,2023 年 3 月,Smurfit Kappa 推出了其专利 Vitop Uno 龙头,这是市场上首款为盒中袋应用提供砸道机保护的龙头。这款水龙头专为易于使用而设计,可确保流量受控,从而最大限度地减少溢出和浪费。在处理时,鼓励消费者将盒子和袋子(包括水龙头)分开,以便正确回收。

- 最新的 BIB 系统采用高阻隔薄膜,可提供卓越的氧气、光线和湿气保护,保持产品新鲜度。袋子製造的进步导致使用更耐用、更灵活的材料,这些材料可以承受各种填充和储存条件。无菌 BIB 系统等创新技术可以在不使用防腐剂的情况下包装易腐烂的产品,使其成为果汁、乳类饮料和其他精緻饮料的理想选择。例如,2024年4月,着名葡萄酒生产商Alireo为其西西里天然盒装葡萄酒推出了更便携的1.5公升规格,旨在重塑盒装葡萄酒的认知。 Arileo 选择盒中袋方法是因为它比传统玻璃瓶更轻,从而减少了运输排放并产生更小的碳足迹。

- 此外,BIB 包装与人们对永续性日益增长的兴趣产生了共鸣。袋子重量轻且折迭式,可降低运输成本和碳排放,特别是与刚性容器相比。外盒通常由可回收纸板製成,进一步强化了 BIB 包装的环保形象。这种包装设计最大限度地减少了产品浪费,与传统的刚性包装相比,可确保近乎完美的分配,没有明显的残留物。

- 儘管有许多好处,BIB 包装也面临挑战。高昂的材料成本,尤其是特殊的袋子和盒子,给生产商的预算带来了压力。物流的复杂性,例如需要小心处理和存储,增加了营运障碍。确保长期的产品品质至关重要,因为包装必须保护内容物免受污染和腐败。

衬袋纸盒(BIB)包装市场趋势

饮料产业需求的增加将有助于市场成长

- 饮料业不断增长的需求对衬袋纸盒(BIB) 包装市场产生了重大影响。这种包装解决方案以其效率和成本效益而闻名,越来越多地被饮料製造商采用,用于葡萄酒、果汁和非酒精饮料等产品。主要优点是可以长期保持饮料的新鲜度和品质。与传统的瓶子和罐头不同,衬袋纸盒(BIB) 包装可以最大程度地减少与空气的接触,减少氧化和腐败,使其特别有利于葡萄酒和新鲜果汁等产品。

- 继第一代 Premium Flex BIB 取得巨大成功之后,包装公司 Allan Group 于 2023 年 11 月推出了第二代衬袋纸盒Premium Flex。这个改进版本是经过严格的研究和开发而创建的,并提供永续的饮料运输和可回收性。

- 衬袋纸盒(BIB) 包装凭藉其无与伦比的保存能力,在非碳酸软性饮料领域占有了一席之地。这种形式的包装可以保护饮料免受空气和光线的影响,对于保存暴露在氧气中很快就会变质的饮料(例如果汁、冰茶和运动饮料)的风味特别有效。

- KNAV 报告强调了 2023 年印度市场的情景,果汁和花蜜占非酒精饮料市场的 19% 以上。饮料衬袋纸盒(BIB) 包装备受关注,不仅因为其成本效益,还因为其延长的保质期和易用性。这种形式可以保护内容物免受光和空气的影响,保留风味,并且易于储存和分配。

- 此外,向衬袋纸盒(BIB) 包装的转变具有成本效益且环保。它重量轻、节省空间,并且在製造和运输成本方面优于传统包装。由于它使用的塑料较少且高度可回收,因此吸引了具有环保意识的消费者并提高了其竞争力。

欧洲实现巨大成长

- 个人保健产品衬袋纸盒(BIB) 包装在欧洲正在兴起,特别是在法国和义大利等化妆品之都。这种包装方法用于乳液、乳霜、液体肥皂等,并提供出色的防止污染和氧化的保护。衬袋纸盒(BIB) 包装也更具永续和成本效益。它减少塑胶废弃物,满足严格的环境标准和消费者对环保产品的偏好。

- 根据 Transfair 预测,2023 年德国果汁销量将达到 14.1 兆升。非碳酸软性饮料(例如果汁、冰茶和调味水)可以采用盒中袋形式包装,因为它们可以透过防止暴露在空气和光线中来保持新鲜度并延长保质期。

- 欧洲国家越来越多地采用衬袋纸盒(BIB) 包装润滑油,因为它在效率和永续性方面具有许多优势。这种包装形式可以保护润滑剂免受污染和氧化,确保产品品质和使用寿命。此外,与传统的金属或塑胶容器相比,盒中袋解决方案占用的空间更少,重量更轻,因此运输和储存更容易且更具成本效益。这种向包装的转变也符合欧洲环境法规和消费者对更永续选择的偏好。盒中袋使用的材料更少,而且通常可以回收,从而减少了整体环境足迹。

- 例如,2023年12月,德国製造的高品质润滑油品牌Liqui Moly为六种热门机油推出了衬袋纸盒(BIB)包装。此外,2023 年 3 月,Petronas Lubricants International (PLI) 在欧洲推出了 Petronas Sintium 衬袋纸盒(BIB),标誌着该公司在永续性和循环之旅中迈出了重要一步。 PETRONAS Syntium BIB 在整个欧洲都有销售,并为各个市场提供智慧、环保的包装解决方案。

衬袋纸盒(BIB) 包装产业概述

衬袋纸盒(BIB) 包装市场的竞争较为分散,主要参与者包括 Smurfit Kappa、Scholle IPN、Liquibox、CDF Corporation 和 DS Smith。市场上有多家公司,市场占有率较大。市场参与者正专注于产品创新,透过永续包装措施提高品牌影响力。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场洞察

- 市场概况

- 产业价值链分析

- 产业吸引力-波特五力分析

- 买方议价能力

- 供应商的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争公司之间的敌对关係

- 目前的市场状况

- 技术进步(更容易分配和引入 BIB 包装格式的先进技术)

- 液体和半固体包装最新趋势分析

- 行业法规

第五章市场动态

- 市场驱动因素

- 饮料製造商对BIB包装格式的需求不断增加

- 电子商务对便利环保包装的需求日益增长

- 市场挑战

- 替代包装形式的市场成长挑战

第六章 市场细分

- 按容量

- 0-5升

- 5-10升

- 10公升以上

- 按最终用户产业

- 饮料

- 有酒精的饮品

- 非酒精饮料

- 食品

- 药品

- 工业(化学、油漆、涂料)

- 医疗/护理

- 饮料

- 按地区

- 北美洲

- 美国

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 亚洲

- 中国

- 印度

- 日本

- 澳洲/纽西兰

- 拉丁美洲

- 巴西

- 墨西哥

- 中东/非洲

- 阿拉伯聯合大公国

- 沙乌地阿拉伯

- 南非

- 北美洲

第七章 竞争格局

- 公司简介

- Smurfit Kappa

- DS Smith PLC

- Liqui-Box Corp.

- Scholle IPN Corp.

- CDF Corporation

- Amcor Group GmbH

- Aran Group

- Goglio SpA

- Fujimori Kogyo Co. Ltd(Zacros Cubitainer)

- AstraPouch(Vine Valley Ventures LLC)

第八章投资分析

第九章 市场未来展望

The Bag-in-Box Packaging Market size is estimated at USD 3.67 billion in 2024, and is expected to reach USD 4.73 billion by 2029, growing at a CAGR of 5.21% during the forecast period (2024-2029).

Key Highlights

- Bag-in-box (BIB) packaging is an innovative solution with a flexible bag housed inside a sturdy box. This setup offers an efficient, cost-effective, and eco-friendly way to store and dispense liquids and semi-liquids. The bag, typically crafted from multiple film layers for product integrity, features a dispensing tap, enabling easy and controlled pouring. This packaging format finds wide application across industries like food and beverages, pharmaceuticals, and industrial products, owing to its versatility and myriad benefits.

- One standout advantage of BIB packaging is its user-friendly dispensing. Its design facilitates smooth product extraction without introducing air, extending the product's shelf life by minimizing oxidation and contamination risks. For example, in March 2023, Smurfit Kappa debuted its patented Vitop Uno tap, boasting the market's first attached tamper protection for bag-in-box applications. These taps are crafted for ease, ensuring a controlled flow that minimizes spillage and waste. At disposal, consumers are encouraged to separate the box from the bag, including the tap, for appropriate recycling.

- Modern BIB systems feature high-barrier films, offering superior protection against oxygen, light, and moisture, thus preserving product freshness. Advancements in bag manufacturing have led to the use of more durable, flexible materials capable of withstanding various filling and storage conditions. Innovations like aseptic BIB systems enable the packaging of perishable products without preservatives, making them ideal for juices, dairy beverages, and other sensitive drinks. For instance, in April 2024, Alileo, a prominent wine producer, introduced a more portable 1.5 l format to its Sicilian natural boxed wines, aiming to reshape perceptions of boxed wine. Alileo opted for the bag-in-box format due to its lighter weight, resulting in reduced transport emissions and a smaller carbon footprint compared to traditional glass bottles.

- Furthermore, BIB packaging resonates with the increasing focus on sustainability. The bags' lightweight, collapsible nature reduces transportation costs and carbon emissions, especially when compared to rigid containers. The outer box, typically crafted from recyclable cardboard, further bolsters the eco-friendly profile of BIB packaging. The packaging's design minimizes product wastage, ensuring nearly complete dispensing without significant residues, a notable contrast to traditional rigid packaging.

- Despite its advantages, BIB packaging faces challenges. High material costs, especially for specialized bags and boxes, can strain producers' budgets. Logistical complexities, such as the need for careful handling and storage, add operational hurdles. Ensuring long-term product quality is paramount, as the packaging must shield contents from contamination and spoilage.

Bag-in-Box Packaging Market Trends

The Rising Demand From Beverage Sector Aids Market Growth

- The rising demand from the beverage sector is significantly influencing the bag-in-box packaging market. This packaging solution, known for its efficiency and cost-effectiveness, is increasingly being adopted by beverage manufacturers for products such as wines, juices, and non-alcoholic drinks. The key advantage lies in its ability to preserve the freshness and quality of beverages over extended periods. Unlike traditional bottles or cans, bag-in-box packaging minimizes exposure to air, reducing oxidation and spoilage, which is particularly beneficial for products like wine and fresh juices.

- In November 2023, Aran Group, a packaging company, unveiled the Bag-In-Box Premium Flex's second iteration, a follow-up to its highly successful first-gen, the Premium Flex BIB. This revamped version was made with rigorous R&D and offers sustainable beverage transportation and recyclability.

- Bag-in-box packaging is carving a niche in the non-carbonated soft drinks arena due to its unmatched preservation prowess. Shielding beverages from air and light, the packaging format excels in maintaining flavors, especially for drinks like juices, iced teas, and sports beverages, which are prone to quick spoilage when exposed to oxygen.

- A KNAV report highlighted India's 2023 market scenario, spotlighting juices and nectars, commanding over 19% of the non-alcoholic beverage market. Bag-in-box packaging for these beverages is gaining prominence, not just for its cost-effectiveness but also for extending shelf life and user-friendliness. The format safeguards contents from light and air, thus preserving flavors, all while being a breeze for storage and dispensing.

- Furthermore, the shift toward bag-in-box packaging offers cost-effectiveness and eco-friendliness. Lighter and space-efficient, it trumps traditional packaging in production and transportation costs. Less plastic and better recyclability resonate with eco-conscious consumers, giving it a competitive edge.

Europe is Set to Witness Significant Growth

- In Europe, particularly in cosmetics hubs like France and Italy, personal care products are increasingly being packaged in bag-in-box formats. This packaging method is used for items such as lotions, creams, and liquid soaps, offering superior protection against contamination and oxidation. Bag-in-box packaging is also more sustainable and cost-effective. It reduces plastic waste and aligns with stringent environmental standards and consumer preferences for eco-friendly products.

- According to TransFair, Germany's fruit juice sales volume reached 14.1 megaliters in 2023. Non-carbonated soft drinks such as juices, iced teas, and flavored waters are increasingly being packed in bag-in-box formats due to their ability to preserve freshness and extend shelf life by protecting against air and light exposure.

- In European countries, lubricants are increasingly being adopted in bag-in-box packaging due to their numerous advantages in terms of efficiency and sustainability. This packaging format protects the lubricants from contamination and oxidation, ensuring the product's quality and longevity. Additionally, bag-in-box solutions are easier and more cost-effective to transport and store, as they take up less space and are lighter than traditional metal or plastic containers. The shift toward this packaging also aligns with European environmental regulations and consumer preferences for more sustainable options, as bag-in-box uses less material and is often recyclable, reducing the overall environmental footprint.

- For instance, in December 2023, Liqui Moly, a high-quality lubricant brand made in Germany, introduced bag-in-box packaging for six of its popular motor oils. Moreover, in March 2023, Petronas Lubricants International (PLI) launched Petronas Syntium Bag In Box (BIB) in Europe, marking a significant step forward in the company's sustainability and circularity journey. The PETRONAS Syntium BIB is available across Europe, offering a smart, environmentally friendly packaging solution in various markets.

Bag-in-Box Packaging Industry Overview

The competitiveness of the bag-in-box packaging market is fragmented, with the presence of major players like Smurfit Kappa, Scholle IPN, Liquibox, CDF Corporation, and DS Smith, among others. The market has several firms with significant market shares. The market players are focusing on product innovation to enhance their brand presence through sustainable packaging initiatives.

- December 2023: Smurfit Kappa Bag-in-Box unveiled a recyclable polyethylene film, matching nylon's robustness. Nylon bags, known for their durability, are a staple in packaging, especially for items like motor oil, detergents, and large industrial food bags.

- April 2023: Scholle IPN Corp. inaugurated its second production facility in Palghar, India. This plant is dedicated to producing SIG's bag-in-box and spouted pouch packaging, previously under the brands Scholle IPN and Bossar. The facility boasts a range of production assets, from blown film extruders to injection molding cells and even a specialized unit for crafting packaging fitments and closures.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Buyers

- 4.3.2 Bargaining Power of Suppliers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Current Market Scenario

- 4.4.1 Technological Advancements (Easier Dispensing and Implementation of Advanced Technology for BIB Packaging Format)

- 4.4.2 Recent Trend Analysis for Liquid and Semi-solid Packaging

- 4.4.3 Industry Regulations

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 The Rising Demand for BIB Packaging Format Among Beverage Manufacturers

- 5.1.2 The Rising Need for Convenience and Eco-friendly Packaging in E-commerce

- 5.2 Market Challenge

- 5.2.1 Alternative Forms of Packaging is Challenging the Market's Growth

6 MARKET SEGMENTATION

- 6.1 By Capacity

- 6.1.1 0-5 Liter

- 6.1.2 5-10 Liter

- 6.1.3 Greater than 10 Liter

- 6.2 By End-User Industry

- 6.2.1 Beverage

- 6.2.1.1 Alcoholic Drinks

- 6.2.1.2 Non-alcoholic Drinks

- 6.2.2 Food

- 6.2.3 Pharmaceutical and Medicine

- 6.2.4 Industrial (Chemical, Paintings and Coatings)

- 6.2.5 Perosnal Care and Homecare

- 6.2.1 Beverage

- 6.3 By Geography***

- 6.3.1 North America

- 6.3.1.1 United States

- 6.3.1.2 Canada

- 6.3.2 Europe

- 6.3.2.1 Germany

- 6.3.2.2 United Kingdom

- 6.3.2.3 France

- 6.3.2.4 Italy

- 6.3.3 Asia

- 6.3.3.1 China

- 6.3.3.2 India

- 6.3.3.3 Japan

- 6.3.3.4 Australia and New Zealand

- 6.3.4 Latin America

- 6.3.4.1 Brazil

- 6.3.4.2 Mexico

- 6.3.5 Middle East and Africa

- 6.3.5.1 United Arab Emirates

- 6.3.5.2 Saudi Arabia

- 6.3.5.3 South Africa

- 6.3.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Smurfit Kappa

- 7.1.2 DS Smith PLC

- 7.1.3 Liqui-Box Corp.

- 7.1.4 Scholle IPN Corp.

- 7.1.5 CDF Corporation

- 7.1.6 Amcor Group GmbH

- 7.1.7 Aran Group

- 7.1.8 Goglio SpA

- 7.1.9 Fujimori Kogyo Co. Ltd (Zacros Cubitainer)

- 7.1.10 AstraPouch (Vine Valley Ventures LLC)