|

市场调查报告书

商品编码

1522863

汽车电池:市场占有率分析、产业趋势/统计、成长预测(2024-2029)Automotive Battery - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

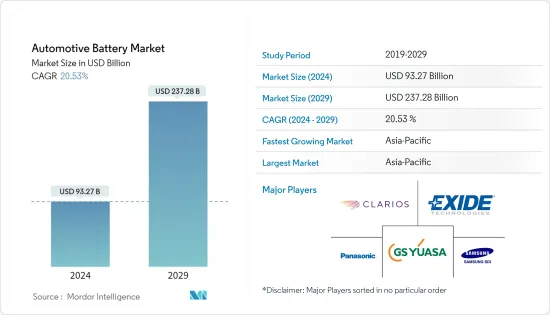

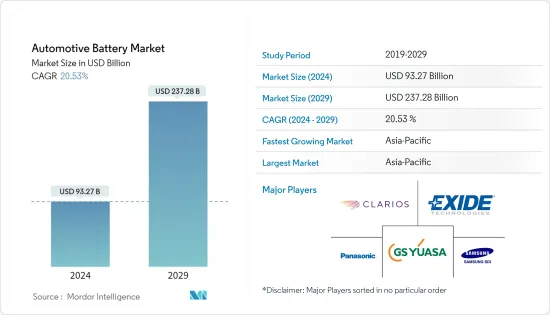

预计2024年汽车电池市场规模为932.7亿美元,预计2029年将达2,372.8亿美元,预测期内(2024-2029年)复合年增长率为20.53%。

汽车电池是一种可以储存和产生电能的电化学装置。启动引擎时,汽车电池提供电流为启动马达和点火系统供电。当交流发电机不处理负载时,它会向灯、收音机和其他电气配件提供电流,并充当安定器。

世界对永续交通和清洁能源不断增长的需求正在推动对纯电动车的需求。诸如车辆范围、较高的初始价格、有限的车型可用性和缺乏知识等消费者限制正在透过促销活动和政府法规得到解决。这些变数将影响电动车的需求并推动目标市场。除此之外,全球电池产能的增加有助于汽车电池产业实现规模经济,这也是市场成长的关键驱动力。

汽车电池市场趋势

电动车领域可望推动市场发展

世界各国政府都在製定雄心勃勃的排放目标,而增加电动车的使用被视为实现这些目标的一种方式。例如,欧盟的目标是到2030年将温室气体排放减少55%,中国则制定了2025年使新车销售的25%为电动车的目标。大多数电动车中使用的锂离子电池在能量密度、充电时间和整体性能方面都有了显着的改进。这使得电动车更加实用,对消费者也更有吸引力。

电动车需求的不断增长将导致电池化学和材料的技术进步,需要更先进、更有效率的汽车电池来确保安全和性能。许多着名的汽车製造商都致力于与汽车电池製造公司建立长期的业务关係。例如

2023年6月,松下控股的负责人表示,该日本公司打算在三年内将与特斯拉共同管理的内华达州工厂的电动车电池产量提高10%。松下能源计画在内华达州超级工厂增设第 15 条生产线。松下能源在会上宣布,计划在2026年3月将内华达工厂的产能提高10%。

随着电动车市场的扩大,许多公司也涉足商用车汽车电池的开发和製造。 Stellantis NV 和三星 SDI 于 2022 年 5 月宣布,将投资超过 25 亿美元在印第安纳州科科莫新建一家合资电池工厂。

随着电动车市场持续快速成长,汽车电池的需求预计将随之增加,为该领域的公司创造重大机会。

亚太地区可望主导汽车电池市场

由于乘用车和商用车对电动车的需求不断增加,预计亚太地区的汽车电池金额将成长最快。大多数电池製造商和汽车製造商都位于该地区。中国是全球最大的电动车生产国和消费国。销售目标、有利的立法和城市空气品质目标支持国内需求。例如,中国对电动和混合动力汽车製造商实施配额,其比例必须至少占新车销量的10%。此外,北市每月仅发放1万张内燃机汽车登记许可证,以鼓励民众转换电动车。

中国拥有全球约80%的锂离子电池製造能力,是电池竞争中压倒性的领跑者。它还控制电池供应链的其他方面,包括电池中使用的两种关键矿物锂和石墨的提取和加工。该地区的一些参与企业已经制定了各种商务策略来占领市场产品。例如

- 2023年6月,日本汽车製造商马自达汽车与松下公司就建立中长期合作伙伴关係进行讨论,以满足快速扩大的市场对电池式电动车和汽车电池的需求。

- 2023年5月,欧安诺集团与XTC新能源集团签署协议,成立两家专门生产电动车电池关键材料的合资企业。

韩国、印度、马来西亚和印尼等国家对汽车应用产品的需求增加,可能会影响该地区 2024 年至 2030 年的成长。

汽车电池产业概况

汽车电池市场正在整合。主要企业包括松下公司、Exide Technologies、Clarios、GS Yuasa Corporation、三星 SDI 和 LG Chem Ltd。市场上的一些公司正致力于改进其产品和服务组合,以扩大基本客群。其他一些主要企业的目标是透过推出产品或服务、扩大产品范围、与其他公司合併或合作来扩大其市场份额。例如,2023年3月,美国和日本达成协议,对电动车电池中使用的关键矿物进行贸易,以确保电池材料的供应。

2023年3月,Li-Cycle Holdings Corp.与凯傲集团签署了全球锂离子电池回收合作伙伴关係的最终协议,并宣布计划在法国开发一座新的锂离子电池回收设施。

2023年3月,莫罗电池(Morrow)投资2,000万欧元在韩国生产磷酸锂铁(LFP)电池。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第一章简介

- 调查先决条件

- 调查范围

第二章调查方法

第三章执行概述

第四章市场动态

- 市场驱动因素

- 电动车需求不断增长预计将提振市场

- 市场限制因素

- 电动车相关的高成本预计将抑制市场成长

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争公司之间的敌对关係

第五章市场区隔

- 电池类型

- 铅酸蓄电池

- 锂离子

- 其他电池类型

- 汽车模型

- 客车

- 商用车

- 驱动类型

- 内燃机

- 试车

- 地区

- 北美洲

- 美国

- 加拿大

- 北美其他地区

- 欧洲

- 德国

- 法国

- 英国

- 欧洲其他地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 其他亚太地区

- 其他的

- 南美洲

- 中东/非洲

- 北美洲

第六章 竞争状况

- 供应商市场占有率

- 公司简介

- A123 Systems

- Panasonic Corporation

- Exide Technologies

- VARTA

- Clarios

- GS Yuasa Corporation

- Hitachi Group Ltd

- Robert Bosch GmbH

- China Aviation Lithium Battery Co. Ltd

- Contemporary Amperex Technology Co. Limited

- 南美洲 SUNG SDI Co. Ltd

- East Penn Manufacturing Co.

- LG Chem Ltd

第七章 市场机会及未来趋势

The Automotive Battery Market size is estimated at USD 93.27 billion in 2024, and is expected to reach USD 237.28 billion by 2029, growing at a CAGR of 20.53% during the forecast period (2024-2029).

An automotive battery is an electrochemical device that can store and generate electrical energy. When starting the engine, the automotive battery provides electric current to power the starting motor and ignition system. When the alternator is not handling the load, it works as a voltage stabilizer by giving current to the lights, radio, and other electrical accessories.

Globally rising demand for sustainable transportation and cleaner energy has engaged the demand for battery electric vehicles. Consumer constraints such as vehicle range, greater upfront prices, limited model availability, and lack of knowledge are being solved by promotional activities and government legislation. These variables will have an impact on the demand for electric vehicles, which will drive the target market. In addition to this, an increase in the global battery production capacity has helped achieve economies of scale in the automotive battery industry, another major driver for market growth.

Automotive Battery Market Trends

The Electric Vehicles Segment is Anticipated to Drive the Market

Governments around the world are setting ambitious targets to reduce emissions, and promoting the use of electric vehicles is seen as one way to achieve these goals. For instance, the European Union aims to reduce its greenhouse gas emissions by 55% by 2030, and China has set a target of having 25% of new cars sold by 2025 to be electric. Lithium-ion batteries, which are used in most electric vehicles, have seen significant improvements in terms of energy density, charging time, and overall performance. This has made electric vehicles more practical and appealing to consumers.

The increasing demand for EVs will lead to technological advancements in battery chemistry and materials, which will require more sophisticated and efficient automotive batteries to ensure safety and performance. Many prominent automobile manufacturers are focusing on building long-term business relationships with automotive battery manufacturing companies. For instance,

In June 2023, according to a Panasonic Holdings representative, the Japanese corporation intends to increase the output of electric vehicle batteries at a Nevada factory jointly managed with Tesla by 10% within three years. Panasonic Energy plans to add a 15th production line to the Gigafactory Nevada. At a meeting, Panasonic Energy announced a proposal to boost the Nevada factory's manufacturing capacity by 10% by March 2026.

As the electric vehicle market is growing, many companies are involved in the development and manufacturing of automotive batteries for commercial vehicles as well. Stellantis NV and Samsung SDI announced in May 2022 that they would invest more than USD 2.5 billion in a new joint-venture battery plant in Kokomo, Indiana.

With the electric vehicle market set to continue its rapid growth, the demand for automotive batteries is expected to rise in tandem, presenting significant opportunities for companies operating in this space.

Asia-Pacific is Expected to Dominate the Automotive Battery Market

Asia-Pacific is expected to have the fastest growth in the value of automotive batteries, owing to the increasing demand for electric passenger and commercial vehicles. The region has most of the battery manufacturers' presence and automobile vehicle manufacturers. China is the largest manufacturer and consumer of electric vehicles in the world. Sales targets, favorable laws, and municipal air-quality targets are supporting domestic demand. For instance, China has imposed a quota on manufacturers of electric or hybrid vehicles, which must represent at least 10% of total new sales. Also, the city of Beijing only issues 10,000 permits for the registration of combustion engine vehicles per month to encourage its inhabitants to switch to electric vehicles.

China has approximately 80% of the world's Li-ion manufacturing capacity, and it is by far the front-runner in the battery race. The nation also controls other facets of the battery supply chain, such as the extraction and processing of lithium and graphite, two of the crucial minerals used in batteries. Several players in the region are establishing various business strategies to gain market offerings. For instance,

- In June 2023, Mazda Motor, a Japan-based vehicle manufacturer, and Panasonic Corporation agreed to enter discussions on establishing a medium- to long-term partnership to meet the demand for battery electric vehicles and automotive batteries in a rapidly expanding market.

- In May 2023, the Orano group and the XTC New Energy group signed agreements to create two joint ventures devoted to the production of critical materials for electric vehicle batteries.

Increasing product demand for automotive applications in various countries, including South Korea, India, Malaysia, and Indonesia, is likely to influence the region's growth between 2024 and 2030.

Automotive Battery Industry Overview

The automotive battery market is consolidated. A few prominent companies include Panasonic Corporation, Exide Technologies, Clarios, GS Yuasa Corporation, Samsung SDI Co. Ltd, and LG Chem Ltd. Several companies in the market are focusing on improving their products and service portfolios to widen their customer base. Some other key players aim to expand their presence in the market through product and service launches, offerings expansion, mergers, and collaborations with other companies. For instance, in March 2023, the United States and Japan reached an agreement regarding the trade of critical minerals used for EV batteries to secure the supplies of battery materials.

In March 2023, Li-Cycle Holdings Corp. signed a definitive agreement for a global lithium-ion battery recycling partnership with the KION Group and announced plans to develop a new lithium-ion battery recycling facility in France.

In March 2023, Morrow Batteries (Morrow) invested EUR 20 million in the production of Lithium iron phosphate (LFP) battery cells in South Korea.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Drivers

- 4.1.1 Increasing Demand For Electric Vehicles is Anticipated to Boost the Market

- 4.2 Market Restraints

- 4.2.1 High Cost Associated with Electric Vehicles is Anticipated to Restrain the Growth of the Market

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Consumers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Battery Type

- 5.1.1 Lead-Acid

- 5.1.2 Lithium-Ion

- 5.1.3 Other Battery Types

- 5.2 Vehicle Type

- 5.2.1 Passenger Cars

- 5.2.2 Commercial Vehicles

- 5.3 Drive Type

- 5.3.1 Internal Combustion Engine

- 5.3.2 Electric Vehicles

- 5.4 Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Rest of North America

- 5.4.2 Europe

- 5.4.2.1 Germany

- 5.4.2.2 France

- 5.4.2.3 United Kingdom

- 5.4.2.4 Rest of Europe

- 5.4.3 Asia-Pacific

- 5.4.3.1 China

- 5.4.3.2 India

- 5.4.3.3 Japan

- 5.4.3.4 South Korea

- 5.4.3.5 Rest of Asia-Pacific

- 5.4.4 Rest of the World

- 5.4.4.1 South America

- 5.4.4.2 Middle East and Africa

- 5.4.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Vendor Market Share

- 6.2 Company Profiles*

- 6.2.1 A123 Systems

- 6.2.2 Panasonic Corporation

- 6.2.3 Exide Technologies

- 6.2.4 VARTA

- 6.2.5 Clarios

- 6.2.6 GS Yuasa Corporation

- 6.2.7 Hitachi Group Ltd

- 6.2.8 Robert Bosch GmbH

- 6.2.9 China Aviation Lithium Battery Co. Ltd

- 6.2.10 Contemporary Amperex Technology Co. Limited

- 6.2.11 SAMSUNG SDI Co. Ltd

- 6.2.12 East Penn Manufacturing Co.

- 6.2.13 LG Chem Ltd