|

市场调查报告书

商品编码

1522876

玻璃纤维:市场占有率分析、产业趋势与统计、成长预测(2024-2029)Glass Fiber - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

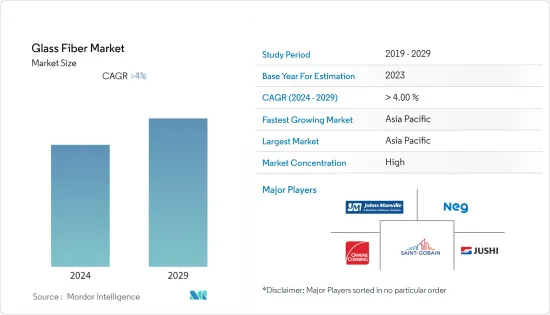

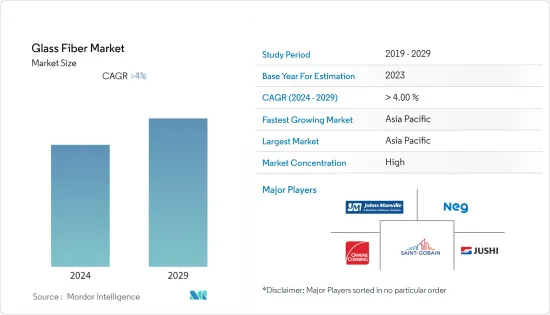

玻璃纤维市场规模预计2024年为292.1亿美元,预计2029年将达到356.8亿美元,在预测期内(2024-2029年)复合年增长率预计将超过4%。

主要亮点

- 预计推动玻璃纤维市场的关键因素是建设产业需求的增加和汽车行业对玻璃纤维复合材料需求的增加。

- 然而,较低的销售利润率以及来自碳纤维和岩绒的竞争可能会在一段时间内抑制玻璃纤维市场的成长。

- 轻质玻璃纤维增强塑胶(GFRP)复合材料的使用不断增加,以及风力发电领域对复合材料的需求不断增加,是未来将要探索的市场机会。

- 亚太地区可能主导玻璃纤维市场。

玻璃纤维市场趋势

建筑和建造领域的需求增加

- 玻璃纤维是一种环保建筑材料。以玻璃纤维增强混凝土(GRC) 的形式提供。 GRC 为建筑物提供坚固的外观,且不会造成重量或环境破坏。

- 水泥混合物中玻璃纤维的使用透过高耐腐蚀纤维增强了材料,使 GRC 能够持久满足任何建筑要求。 GRC 的重量轻,使得墙壁、地基、面板和建筑幕墙的施工变得更加容易和快速。

- 世界上最大的建筑业之一在美国。根据美国人口普查局的数据,2024 年 2 月的建筑支出比 2023 年 2 月的预测增加了 10.7%。此外,2024年1月和2月的建筑支出较2023年增加了11.9%,凸显美国的建筑支出正在逐步改善。

- 根据欧盟统计局的数据,与 2022 年 12 月相比,2023 年 12 月欧元区的建筑支出增加了 1.9%,欧盟成长了 2.4%。

- 因此,由于建筑业的成长,在预测期内对玻璃纤维的需求可能会增加。

亚太地区主导市场

- 亚太地区,特别是中国、印度、日本等国家正在经历快速的工业化和都市化。因此,对建筑材料、汽车零件和基础设施维护的需求不断增加,推动了对玻璃纤维的需求。

- 在都市化、人口成长和基础设施发展倡议的推动下,亚太地区的建筑业正在蓬勃发展。玻璃纤维广泛应用于钢筋混凝土、隔热材料和复合板等建筑材料,推动了该地区的需求。

- 中国的建筑业正在快速成长。该国的建筑市场是全球最大的,占全球建筑投资总额的20%。中国的「十四五」规划重点在于交通、能源、水利和城市发展等领域的新型基础建设计划。据国际贸易局称,「十四五」期间(2021年至2025年)中国将投资约27兆美元用于新基础设施建设,预计金额为4.2兆欧元。

- 根据国家投资促进和便利化局的资料,印度基础设施预算定为1.4兆美元。

- 亚太地区是全球最大的汽车生产中心,占全球产量的近60%。在亚太地区,中国和印度是重要的汽车製造国。根据OICA预测,2023年中国汽车总产量为3,016万辆,比去年的2,702万辆成长16%,成为全球最重要的汽车生产基地。

- 总体而言,对各个最终用户领域的持续投资可能会增加亚太地区的玻璃纤维消费量。

玻璃纤维产业概况

玻璃纤维市场正在整合。主要企业(排名不分先后)包括欧文斯科宁、圣戈班维特克斯、约翰曼维尔、日本电气硝子、中国树石等。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 调查先决条件

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场动态

- 促进因素

- 建设产业需求增加

- 汽车产业对玻璃纤维复合材料的需求增加

- 抑制因素

- 与碳纤维、岩绒的竞争

- 销售利润率低

- 产业价值链分析

- 波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争程度

第五章市场区隔(以金额为准的市场规模)

- 树脂型

- 短切丝

- 玻璃棉

- 粗纱的

- 线

- 目的

- 复合材料

- 隔热材料

- 最终用户产业

- 建筑/施工

- 车

- 航太/国防

- 替代能源

- 消费品

- 工业

- 其他最终用户产业(电子)

- 地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 马来西亚

- 泰国

- 印尼

- 越南

- 其他亚太地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 法国

- 英国

- 义大利

- 西班牙

- 土耳其

- 俄罗斯

- 北欧的

- 其他欧洲国家

- 南美洲

- 巴西

- 阿根廷

- 哥伦比亚

- 南美洲其他地区

- 中东/非洲

- 沙乌地阿拉伯

- 南非

- 奈及利亚

- 卡达

- 埃及

- 阿拉伯聯合大公国

- 其他中东/非洲

- 亚太地区

第六章 竞争状况

- 併购、合资、联盟、协议

- 市场占有率(%)**/排名分析

- 主要企业策略

- 公司简介

- ASAHI FIBER GLASS Co. Ltd

- Binani Industries Ltd

- China Jushi Co. Ltd

- Chongqing Polycomp International Corp.(CPIC)

- CTG Group

- Heraeus Holding

- Johns Manville

- Nippon Electric Glass Co. Ltd

- Owens Corning

- PFG FIBER GLASS CORPORATION

- Saint-Gobain Vetrotex

- TAIWAN GLASS IND. CORP.

第七章 市场机会及未来趋势

- 扩大轻质玻璃纤维增强塑胶(GFRP)复合材料的应用

- 风力发电领域对玻璃纤维复合材料的需求不断增加

简介目录

Product Code: 55005

The Glass Fiber Market size is estimated at USD 29.21 billion in 2024, and is expected to reach USD 35.68 billion by 2029, growing at a CAGR of greater than 4% during the forecast period (2024-2029).

Key Highlights

- The significant factors expected to drive the glass fiber market are the increasing demand from the construction industry and the rising demand for fiberglass composites from the automotive industry.

- However, the low-profit margin on sales and competition from carbon fiber and rock wool are likely to restrain the growth of the glass fiber market in the upcoming period.

- The increase in the use of lightweight glass fiber-reinforced plastic (GFRP) composites and the increase in the demand for composite materials from the wind energy sector are opportunities for the market to be studied in the upcoming period.

- Asia-Pacific is likely to dominate the glass fiber market.

Glass Fiber Market Trends

Rising Demand from the Building and Construction Sector

- Glass fiber is an eco-friendly construction material. It is available in the form of glass-fiber reinforced concrete (GRC). Without causing weight and environmental damage, the GRC provides buildings with a solid appearance.

- The use of glass fibers in the cement mix strengthens the material with corrosion-resistant strong fibers, which makes GRC long-lasting for any construction requirement. The construction of walls, foundations, panels, and facades will be made much easier and quicker because of GRC's low weight.

- One of the world's largest construction industries is based in the United States. According to the United States Census Bureau, construction spending in February 2024 grew by 10.7% from February 2023 estimate. In addition, construction spending in the first two months of 2024 was up 11.9% from 2023, thus highlighting the gradual improvement in construction spending in the United States.

- Eurostat stated that building construction increased by 1.9% in the Euro area and 2.4% in the European Union in December 2023 compared to December 2022.

- Thus, due to this growth in the building and construction sector, the demand for glass fiber will increase during the forecast period.

Asia-Pacific to Dominate the Market

- The Asia-Pacific region, particularly countries like China, India, and Japan, has been experiencing rapid industrialization and urbanization. This has increased demand for construction materials, automotive components, and infrastructure development, driving the demand for glass fiber.

- The construction industry in the Asia-Pacific region is booming and fueled by urbanization, population growth, and infrastructure development initiatives. Glass fibers are widely used in construction materials such as reinforced concrete, insulation, and composite panels, driving their demand in the region.

- The construction sector in China is increasing rapidly. The country has the most significant building market globally, making up 20% of all construction investment worldwide. The 14th Five-Year Plan of China is focused on new infrastructure projects for transport, energy, water, and urban development. According to the International Trade Administration, approximately USD 27 trillion will be spent on new infrastructure in China during the 14th Five-Year Plan between 2021 and 2025, with an estimated value of EUR 4.2 trillion.

- The Indian budget for infrastructure has been set at USD 1.4 trillion, according to the National Investment Promotion and Facilitation Agency's data.

- The Asia-Pacific region is the world's largest automotive manufacturing hub, accounting for almost 60% of global production. China and India are significant vehicle manufacturers within Asia-Pacific. According to OICA, China, with a total vehicle production of 30.16 million units in 2023, an increase of 16% compared to 27.02 million units produced last year, has the most significant automotive production base in the world, according to the China Automobile Manufacturers' Association.

- Overall, continuous investments in various end-user sectors are likely to boost the consumption of glass fiber in Asia-Pacific.

Glass Fiber Industry Overview

The glass fiber market is consolidated. The major players (not in any particular order) include Owens Corning, Saint-Gobain Vetrotex, Johns Manville, Nippon Electric Glass Co. Ltd, and China Jushi Co. Ltd.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Increasing Demand from the Construction Industry

- 4.1.2 Increasing Demand for Fiberglass Composites from the Automotive Industry

- 4.2 Restraints

- 4.2.1 Competition from Carbon Fiber and Rockwool

- 4.2.2 Low Profit Margin on Sales

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Value)

- 5.1 Resin Type

- 5.1.1 Chopped Strands

- 5.1.2 Glass Wool

- 5.1.3 Roving

- 5.1.4 Yarn

- 5.2 Application

- 5.2.1 Composites

- 5.2.2 Insulation

- 5.3 End-user Industry

- 5.3.1 Buildings and Construction

- 5.3.2 Automotive

- 5.3.3 Aerospace and Defense

- 5.3.4 Alternative Energy

- 5.3.5 Consumer Goods

- 5.3.6 Industrial

- 5.3.7 Other End-user Industries (Electronics)

- 5.4 Geography

- 5.4.1 Asia-Pacific

- 5.4.1.1 China

- 5.4.1.2 India

- 5.4.1.3 Japan

- 5.4.1.4 South Korea

- 5.4.1.5 Malaysia

- 5.4.1.6 Thailand

- 5.4.1.7 Indonesia

- 5.4.1.8 Vietnam

- 5.4.1.9 Rest of Asia-Pacific

- 5.4.2 North America

- 5.4.2.1 United States

- 5.4.2.2 Canada

- 5.4.2.3 Mexico

- 5.4.3 Europe

- 5.4.3.1 Germany

- 5.4.3.2 France

- 5.4.3.3 United Kingdom

- 5.4.3.4 Italy

- 5.4.3.5 Spain

- 5.4.3.6 Turkey

- 5.4.3.7 Russia

- 5.4.3.8 NORDIC

- 5.4.3.9 Rest of Europe

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Colombia

- 5.4.4.4 Rest of South America

- 5.4.5 Middle East and Africa

- 5.4.5.1 Saudi Arabia

- 5.4.5.2 South Africa

- 5.4.5.3 Nigeria

- 5.4.5.4 Qatar

- 5.4.5.5 Egypt

- 5.4.5.6 UAE

- 5.4.5.7 Rest of Middle East and Africa

- 5.4.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share (%)**/ Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 ASAHI FIBER GLASS Co. Ltd

- 6.4.2 Binani Industries Ltd

- 6.4.3 China Jushi Co. Ltd

- 6.4.4 Chongqing Polycomp International Corp. (CPIC)

- 6.4.5 CTG Group

- 6.4.6 Heraeus Holding

- 6.4.7 Johns Manville

- 6.4.8 Nippon Electric Glass Co. Ltd

- 6.4.9 Owens Corning

- 6.4.10 PFG FIBER GLASS CORPORATION

- 6.4.11 Saint-Gobain Vetrotex

- 6.4.12 TAIWAN GLASS IND. CORP.

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Growth in the Usage of Lightweight Glass Fiber Reinforced Plastic (GFRP) Composites

- 7.2 Increasing Demand for Fiberglass Composite Materials for the Wind Energy Sector

02-2729-4219

+886-2-2729-4219