|

市场调查报告书

商品编码

1522877

主动车距控制巡航系统(ACC) 和盲点侦测 (BSD) -市场占有率分析、产业趋势和成长预测(2024-2029 年)Adaptive Cruise Control (ACC) And Blind Spot Detection (BSD) - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

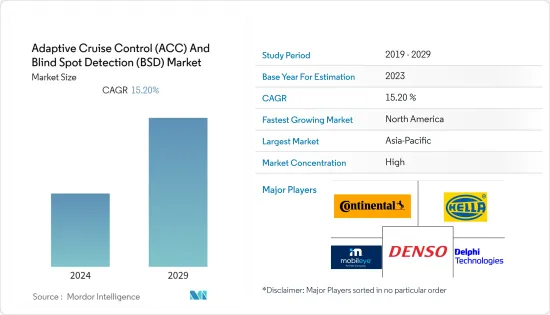

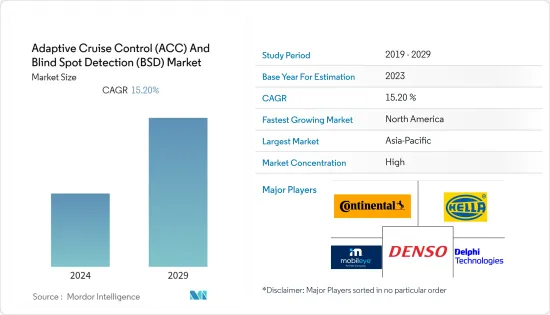

主动车距控制巡航系统和盲点侦测市场规模预计到 2024 年为 35.8 亿美元,预计到 2029 年将达到 72.7 亿美元,预测期内(2024-2029 年)复合年增长率为 15.20,预计将成长%。

近年来,主动式车距维持定速系统和盲点侦测市场经历了显着的快速成长。提高车辆安全意识是开发主动式车距维持定速系统和盲点侦测等先进安全系统的重要因素之一。

此外,全球豪华车销售的成长也推动了 ACC 和 BSD 市场。 2023 年,全球豪华车销量超过 183,000 辆,而 2022 年为 157,000 辆。这意味着增幅超过 16%。

此外,严格的安全法规的颁布以及消费者对车辆安全日益浓厚的兴趣也正在推动 ACC 和 BSD 市场的发展。根据世界卫生组织 (WHO) 统计,每年有近 135 万人死于道路交通事故。这些事故大多数是由于驾驶人无法评估具体情况并做出正确决定而造成的。政府为减少交通事故死亡人数所做的努力正在增加新车安全系统的安装。

OEM厂商占了调查市场的90%以上,盲点侦测系统的售后市场有限且无组织。认识到市场的成长机会,领先公司越来越多地在其车辆中添加这些功能,以满足消费者的需求。

所有这些因素共同显示了 ACC 和 BSD 市场在预测期内的潜在成长。

主动车距控制巡航系统(ACC)和盲点侦测(BSD)市场趋势

乘用车细分市场是最大的汽车细分市场

按车型划分,乘用车细分市场在主动式车距维持定速系统(ACC)和盲点侦测(BSD)方面拥有最大的市场规模。由于对安全性的日益重视以及消费者对改善驾驶体验的需求,ADAS(高级驾驶员辅助系统)整合已在现代乘用车中广泛应用。

乘用车製造商提供尖端功能,以提高安全性和便利性。 ACC系统适合高速公路行驶,对于日常通勤者和使用乘用车的远距旅行者尤其有吸引力。感测器技术的进步、经济性以及向半自动驾驶功能的转变推动了 ACC 在乘用车中的主流采用。

同样,盲点侦测已成为一项重要的安全功能,尤其是在繁忙的城市环境中。乘用车是汽车市场中保有量最大的细分市场,变换车道、併道操作发生率较高。透过使用侦测盲点车辆的感测器,BSD 解决了驾驶因素可见度限制,并降低了变换车道(乘用车使用中的常见情况)时发生事故的风险。

此外,优先考虑具有先进安全功能的车辆的管理方案和安全评级也有助于 ACC 和 BSD 在乘用车中的广泛采用。在北美,美国新车评估计划(US NCAP)是美国运输安全管理局(NHTSA)的旗舰计划,旨在重点关注这些安全系统的纳入,并减轻买家对安全的担忧。

汽车製造商正在将这些技术融入他们的乘用车模型中,以增加对更广泛客户的吸引力。市场参与者已註册多项与车辆自动驾驶功能相关的有效专利。 2022年,丰田的案件数量最多,为1,823起,其次是百度和本田。

除乘用车外,商用车,尤其是重型卡车,对先进驾驶辅助和防撞系统的需求也不断增加。商用车比乘用车车身更长、更宽,因此盲点更大。因此,为了提高安全性并消除盲点,企业正在与商用车製造商合作开发适合这些车辆的盲点侦测系统。

对车辆安全的日益关注以及与盲点相关的事故数量的增加是预测期内推动 ACC 和 BSD 系统市场的因素之一。

亚太地区及北美地区引领市场

亚太地区预计将成为成长最快的区域市场,对 BSD 和 ACC 产业的成长做出重大贡献,其次是北美。这些地区的成长是由汽车销量增加(尤其是豪华车)以及每辆车安全设备增加等因素所推动的。

印度和韩国等快速发展的新兴市场的存在,以及该地区对汽车实施的安全法规,正在对亚太地区的驾驶辅助系统市场产生重大影响。这些规定与欧洲和北美一样严格。

- 巴拉特新车评估计画(也称为巴拉特 NCAP)是全球第 10 个 NCAP,由印度政府设立。该计划于 2023 年 10 月启动。该计划旨在评估在印度销售的汽车的安全性能,并根据其安全功能和性能授予星级评级。 Bharat NCAP 为测试车辆提供从 1 到 5 的星级评级,其中 1 为最低评级。这些评估包括成人乘员保护 (AOP)、儿童乘员保护 (COP) 和安全辅助技术安装。

此外,印度、泰国和印尼社会经济经济状况的改善也创造了对豪华乘用车领域的需求,从而增加了这些国家对 ACC 和 BSD 的需求。

此外,人们对驾驶因素安全系统的认识不断提高,亚太国家配备 ADAS 的车辆市场不断扩大。政府法规迫使汽车製造商设计配备先进 ADAS 模组的车辆。此外,该地区自动驾驶汽车的发展为层级製造商创造了利用最新技术和用户友好系统设计和提供 ADAS 的机会。

所有这些新兴市场的开拓预计将推动亚太地区主动式车距维持定速系统(ACC)和盲点侦测(BSD)市场的发展。

主动式车距维持定速系统(ACC) 和盲点侦测 (BSD) 产业概述

主动式车距维持定速系统(ACC)和盲点侦测(BSD)市场高度整合。 Continental AG、Hella KGaA Hueck & Co、Mobileye、Denso Corporation 和 Delphi Automotive PLC 等公司是该市场的主要企业。

为了跟上日益提高的车辆安全功能标准,市场上领先的 ACC 和 BSD 製造商已开始投资研发活动。例如

*2023年7月,工业汽车在泰国曼谷首次推出了重新设计的1吨皮卡「Triton」。该卡车公司计划于 2024 年初在日本推出,这是 12 年来的首次。透过采用主动式车距维持定速系统(ACC) 和使用连网型汽车技术的紧急支援等新型安全设备,安全性和舒适性已显着提高。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 调查先决条件

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场动态

- 市场驱动因素

- 消费者对车辆安全的兴趣日益浓厚,推动市场发展

- 市场限制因素

- ACC 和 BSD 的初始安装成本较高是一个问题

- 产业吸引力-波特五力分析

- 新进入者的威胁

- 买家/消费者的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争公司之间敌对关係的强度

第五章 市场区隔(金额单位)

- 类型

- 主动式车距维持定速系统(ACC)

- 盲点侦测 (BSD)

- 车辆类型

- 客车

- 商用车

- 销售管道

- OEM

- 售后市场

- 秘密艺术

- 红外线的

- 雷达

- 影像

- 其他技术

- 地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 其他北美地区

- 欧洲

- 德国

- 英国

- 法国

- 西班牙

- 其他欧洲国家

- 亚太地区

- 中国

- 日本

- 印度

- 韩国

- 其他亚太地区

- 世界其他地区

- 巴西

- 阿根廷

- 其他国家

- 北美洲

第六章 竞争状况

- 供应商市场占有率

- 公司简介

- Continental AG

- Delphi Technologies PLC

- DENSO Corp

- Autoliv Inc.

- Magna International

- WABCO Vehicle Control Services

- Robert Bosch GmbH

- ZF Friedrichshafen AG

- Bendix Commercial Vehicle Systems LLC(Knorr-Bremse AG)

- Mobileye

- Mando-Hella Electronics Corp.

第七章 市场机会及未来趋势

- 在汽车中越来越多地使用 ADAS 功能提供了充足的成长机会

第八章 基于数量的市场规模和预测

第9章 ACC和BSD技术的技术进展分析

第 10 章:深入了解地区/国家层级有关车辆安全和 ADAS 功能的法规

The Adaptive Cruise Control And Blind Spot Detection Market size is estimated at USD 3.58 billion in 2024, and is expected to reach USD 7.27 billion by 2029, growing at a CAGR of 15.20% during the forecast period (2024-2029).

The market for adaptive cruise control and blind spot detection has witnessed a significant surge in recent years. The growing awareness about vehicle safety has been one of the vital factors in the development of advanced safety systems, such as adaptive cruise control and blind-spot detection.

Additionally, the increase in the sales of luxury vehicles worldwide is also driving the market for ACC and BSD. In 2023, over 183 thousand units of luxury cars were sold worldwide, compared to 157 thousand units in 2022. This indicated a significant surge of over 16%.

Further, the enactment of stringent safety regulations and increasing vehicle safety concerns among consumers have also propelled the market for ACC and BSD. According to the World Health Organization, nearly 1.35 million people die annually due to road accidents. The cause of these accidents is mostly attributed to the driver's inability to judge certain conditions and make the right decisions. The efforts of governments to reduce fatalities due to road accidents have led to increased installation of safety systems in new vehicles.

More than 90% of the market studied is captured by OEMs, with a limited and unorganized aftermarket for the blind spot detection system. Eyeing the growth opportunities present in the market, the leading players are increasingly incorporating these features in their vehicles to cater to consumer demand.

All these factors combined indicate potential growth for the ACC and BSD market during the forecast period.

Adaptive Cruise Control (ACC) And Blind Spot Detection (BSD) Market Trends

Passenger Car Segment is The Largest Vehicle Type Segment

The passenger car segment is the largest market segment for adaptive cruise control (ACC) and blind spot detection (BSD) among vehicle types. There has been a widespread integration of advanced driver assistance systems (ADAS) in modern passenger cars, driven by a growing emphasis on safety and the increasing consumer demand for enhanced driving experiences.

Passenger car manufacturers are largely offering cutting-edge features that enhance both safety and convenience. ACC systems are well-suited for highway driving, making them particularly attractive for daily commuters and long-distance travelers using passenger cars. The mainstream adoption of ACC in passenger cars is fuelled by advancements in sensor technologies, affordability, and a shift toward semi-autonomous driving features.

Similarly, blind spot detection has also become a crucial safety feature, especially in urban environments with dense traffic. The passenger car segment, being the largest volume contributor in the automotive market, experiences a higher incidence of lane changes and merging movements. BSD addresses the limitations of driver visibility by using sensors to detect vehicles in blind spots, reducing the risk of accidents during lane changes-a common scenario in passenger car usage.

Furthermore, regulatory initiatives and safety ratings that prioritize vehicles equipped with advanced safety features contribute to the prevalence of ACC and BSD in passenger cars. In North America, the United States New Car Assessment Program (US NCAP), a flagship program of the country's National High Traffic Safety Administration (NHTSA), focused on the incorporation of these safety systems, was introduced to reduce the safety-related concerns of buyers.

Automakers are integrating these technologies into their passenger car models, making them more appealing to a broader customer base. Market players have multiple active patents registered to their name related to autonomous features in their vehicles. In 2022, Toyota had the most number of active patents, amounting to 1,823, followed by Baidu and Honda Motors.

Apart from passenger cars, commercial vehicles, particularly large trucks, are also seeing an increase in demand for sophisticated driver assistance systems and collision avoidance systems. Commercial vehicles are longer and broader than passenger vehicles, resulting in substantially greater blind areas. Thus, to enhance safety and eliminate blind spots, companies, in consultation with commercial vehicle manufacturers, are developing blind spot detection systems that are suitable for these vehicles.

The rising vehicle safety concerns and a growing number of blind spot-related accidents are some of the factors that will drive the market for ACC and BSD systems during the forecast period.

Asia-Pacific and North America Driving the Market

Asia-Pacific is projected to be the fastest-growing regional market, contributing significantly to the growth of both the BSD and ACC industries, followed by North America. The growth in these regions is driven by factors such as increasing vehicle sales, particularly of luxury cars, and an increase in safety installations per vehicle.

The presence of fast-developing countries, like India and South Korea, and the safety regulations imposed on vehicles in the region have influenced the Asia-Pacific market for driving assistance systems significantly. These regulations are as stringent as those of Europe and North America.

- The Bharat New Car Assessment Program, commonly known as Bharat NCAP, is the 10th NCAP in the world and has been set up by the Government of India. The program commenced in October 2023. The program aims to evaluate the safety performance of cars sold in India and assign star ratings based on their safety features and performance. Bharat NCAP will assign star ratings ranging from 1 to 5 for cars tested, with 1 being the lowest rating. These ratings cover Adult Occupant Protection (AOP), Child Occupant Protection (COP), and Fitment of Safety Assist Technologies.

Additionally, the improvement in socioeconomic conditions in India, Thailand, and Indonesia has also created a demand for the premium passenger cars segment, thereby increasing the demand for ACC and BSD in these countries.

Further, the rising awareness of driver safety systems is enhancing the market for ADAS-equipped vehicles in Asia-Pacific countries. Government regulations are compelling car manufacturers to design their vehicles with advanced ADAS modules. Moreover, the evolution of autonomous cars in this region is creating the opportunity for tier-1 manufacturers to design and deliver ADAS with the latest technologies and user-friendly systems.

All these developments combined are expected to drive the market for adaptive cruise control (ACC) and blind spot detection (BSD) in Asia-Pacific.

Adaptive Cruise Control (ACC) And Blind Spot Detection (BSD) Industry Overview

The adaptive cruise control (ACC) and blind spot detection (BSD) market is fairly consolidated. Companies such as Continental AG, Hella KGaA Hueck & Co., Mobileye, Denso Corporation, and Delphi Automotive PLC are some of the major players in the market.

To meet the increasing standards for safety features in the vehicles, major ACC and BSD manufacturers in the market have started investing in R&D activities. For instance,

* In July 2023, Mitsubishi Motors Corporation premiered the completely redesigned Triton 1-ton pickup truck in Bangkok, Thailand. The truck company scheduled a launch in Japan in early 2024 for the first time in 12 years. Safety and comfort have been greatly improved in the vehicle with the adoption of Adaptive Cruise Control (ACC), among other new safety features and emergency support using connected car technology.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Drivers

- 4.1.1 The Increasing Concern of Consumers Toward Vehicle Safety is Driving the Market

- 4.2 Market Restraints

- 4.2.1 High Initial Installation Costs of ACC and BSD Act as a Major Challenge

- 4.3 Industry Attractiveness - Porter's Five Forces' Analysis

- 4.3.1 Threat of New Entrants

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Bargaining Power of Suppliers

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION (Value in USD Billion)

- 5.1 Type

- 5.1.1 Adaptive Cruise Control (ACC)

- 5.1.2 Blind Spot Detection (BSD)

- 5.2 Vehicle Type

- 5.2.1 Passenger Cars

- 5.2.2 Commercial Vehicles

- 5.3 Sales Channel

- 5.3.1 OEM

- 5.3.2 Aftermarket

- 5.4 Technology

- 5.4.1 Infrared

- 5.4.2 Radar

- 5.4.3 Image

- 5.4.4 Other Technologies

- 5.5 Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.1.4 Rest of North America

- 5.5.2 Europe

- 5.5.2.1 Germany

- 5.5.2.2 United Kingdom

- 5.5.2.3 France

- 5.5.2.4 Spain

- 5.5.2.5 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 China

- 5.5.3.2 Japan

- 5.5.3.3 India

- 5.5.3.4 South Korea

- 5.5.3.5 Rest of Asia-Pacific

- 5.5.4 Rest of the World

- 5.5.4.1 Brazil

- 5.5.4.2 Argentina

- 5.5.4.3 Other Countries

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Vendor Market Share

- 6.2 Company Profiles*

- 6.2.1 Continental AG

- 6.2.2 Delphi Technologies PLC

- 6.2.3 DENSO Corp

- 6.2.4 Autoliv Inc.

- 6.2.5 Magna International

- 6.2.6 WABCO Vehicle Control Services

- 6.2.7 Robert Bosch GmbH

- 6.2.8 ZF Friedrichshafen AG

- 6.2.9 Bendix Commercial Vehicle Systems LLC (Knorr-Bremse AG)

- 6.2.10 Mobileye

- 6.2.11 Mando-Hella Electronics Corp.

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Increasing Use of ADAS Features in Vehicles Presents Ample Growth Opportunities