|

市场调查报告书

商品编码

1523308

汽车引擎管理系统:市场占有率分析、产业趋势/统计、成长预测(2024-2029)Automotive Engine Management System - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

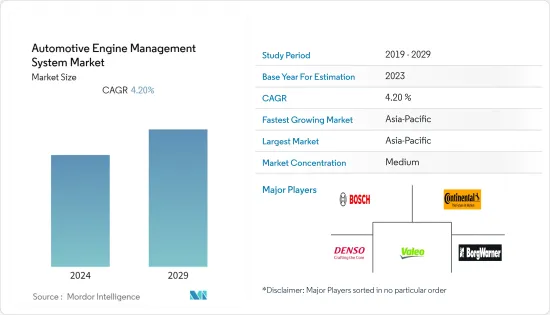

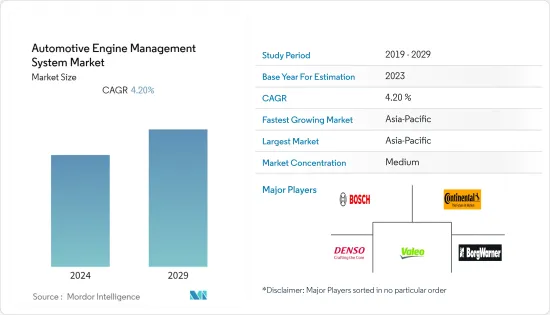

汽车引擎管理系统市场规模预计到 2024 年将达到 662 亿美元,预计到 2029 年将达到 848 亿美元,在预测期内(2024-2029 年)复合年增长率为 4.20%。

从长远来看,消费者对省油车的需求不断增长,正在推动製造商开发先进的组件来控制引擎的运作。全球温室气体浓度的上升可能会显着促进更严格的排放法规的製定。

随着乘用车产销量的增加,全球汽车产业逐年快速成长。例如,2022-23年印度乘用车销量将从14,67,039辆增加到17,47,376辆,多用途车将从14,89,219辆增加到20,03,718辆,货车销量将从1,13,265辆增加与上年度相比,增加到 1,000 台,达到 39,020 台。

随着汽车需求的不断增长,引擎管理公司正在采取产品推出、产能扩张和合併等策略措施来满足高需求。

主要亮点

- 2023年7月,法雷奥将其Sanand工厂的超音波感测器产能扩大至700万个。萨南德的第一条生产线于 2021 年 11 月启动。这条新增生产线将总产能从每年 300 万台增加到 700 万台。

- 2023 年 1 月,森萨塔展示了适用于汽车和重型车辆越野 (HVOR) 应用的各种关键任务感测器和电气保护解决方案。

北美是全球成长最快的汽车引擎管理系统市场。然而,由于汽车销售量较高,汽车引擎管理系统在亚太地区占据了很大的市场占有率,尤其是在中国和印度。印度和中国的客户越来越意识到提高车辆的性能,预计将推动汽车引擎管理系统市场的发展。

汽车引擎管理系统市场趋势

乘用车市场占有率最高

乘用车以其时尚、紧凑、经济等特点深受消费者喜爱。乘用车需求的增加也受到新兴国家中产阶级人口不断增长和生活水准提高的影响。

由于运动型多用途车销量占印度乘用车销量的 50% 以上,运动型多用途车 (SUV) 需求的不断增长为市场参与者创造了商机。在印度和中国等国家,由于多种因素,包括对离地间隙较高的大型车辆的偏好,对运动型多用途车的需求激增。

此外,由于税收补贴和充电基础设施的扩大,对电动车的需求不断增加也导致了市场的成长。 2023年第一季印度电动车销量是2022年同期的两倍。

根据国际清洁交通理事会统计,美国已售出超过100万辆电动车。特别是,2023年第一至第三季的销量较2022年同期成长约58%。

随着乘用车领域的成长,对电控系统和引擎感知器等各种引擎管理系统的需求预计将继续大幅成长。随着与安全性和便利性相关的先进功能的趋势持续发展,汽车配备的功能也越来越多。此外,对自动驾驶和电动车不断增长的需求预计将为引擎管理系统带来新的机会。

公司也致力于创造技术先进的产品并扩大生产能力,以满足高市场需求。例如,2023年6月,基于MEMS的固态汽车雷射雷达和ADAS(高级驾驶员辅助系统)解决方案的领导者MicroVision Inc.推出了基于固态快闪记忆体的MOVIA雷射雷达感测器。 MOVIA 感测器体积小、重量轻,适合各种应用。

亚太地区市场占有率最高

预计亚太地区将在预测期内占据主要市场占有率。该地区的成长主要由印度、中国和日本等顶级汽车生产国推动。

其他驱动因素包括对能够提供更好的驾驶体验、舒适性和安全性的车辆的需求增加,以及对节能引擎的需求增加。电动车销售的成长得益于引擎管理系统的使用,印度等国家正在透过严格的法规、补贴、税额扣抵和其他激励措施进一步支持引擎管理系统的采用。

- 印度道路运输和公路部 (MoRTH) 已强制要求车辆从 2023 年起必须满足燃油效率标准,以提高燃油效率。灵活燃料汽车的新指南正在促进内燃机汽车的成长。

- 中国在供应燃油泵和喷油器的引擎管理系统(EMS)领域占据全球市场占有率。新的柴油引擎排放法规可能为中国引擎管理公司带来更多商机。

除传统内燃机汽车外,电动车的需求预计将推动市场成长。由于每个地区更严格的排放法规,在预测期内对电动车的需求可能会增加。根据国际清洁交通理事会的数据,中国仍是全球最大的电动车市场,2023 年上半年电动车销量约 300 万辆。

- 截至2024年1月,中国製造商在自动驾驶技术的雷射雷达创新方面继续处于主导,自2000年以来,提交的雷射雷达相关专利申请数量达到惊人的25,957件,超过了美国和日本公司。

汽车引擎管理系统产业概况

汽车引擎管理系统市场由全球和地区知名企业整合和主导。公司采用新产品推出、联盟和合併等策略来维持其市场地位。

- 例如,2023年4月,TTTech Auto推出了N4网路控制器,这是一款具有先进网路功能的高效能ECU。 N4 旨在在现代汽车 E/E架构中发挥核心作用,为软体定义汽车铺平道路。

该市场的主要企业包括大陆集团、Denso公司、法雷奥公司和罗伯特博世有限公司。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 调查先决条件

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场动态

- 市场驱动因素

- 乘用车销量增加

- 市场限制因素

- 由于增加安全设备而导致车辆成本增加

- 产业吸引力-波特五力分析

- 新进入者的威胁

- 买家/消费者的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争公司之间敌对关係的强度

第五章市场区隔

- 按车型

- 客车

- 商用车

- 依组件类型

- 引擎控制单元(ECU)

- 引擎感知器

- 燃油帮浦

- 其他组件类型

- 按地区

- 北美洲

- 美国

- 加拿大

- 北美其他地区

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 其他欧洲国家

- 亚太地区

- 印度

- 中国

- 日本

- 韩国

- 其他亚太地区

- 世界其他地区

- 南美洲

- 中东/非洲

- 北美洲

第六章 竞争状况

- 供应商市场占有率

- 公司简介

- Robert Bosch GmbH

- Continental AG

- BorgWarner Inc.

- DENSO Corporation

- Hella KGaA Hueck & Co.

- Infineon Technologies AG

- Sensata Technologies

- Mobiletron Electronics Co. Ltd

- NGK Spark Plugs Pvt Ltd.

- Hitachi Automotive Systems Ltd

- Dover Corporation

第七章 市场机会及未来趋势

The Automotive Engine Management System Market size is estimated at USD 66.20 billion in 2024, and is expected to reach USD 84.80 billion by 2029, growing at a CAGR of 4.20% during the forecast period (2024-2029).

Over the long term, the growing consumer trend toward fuel-efficient vehicles has encouraged manufacturers to develop advanced components that control engine operation. The enactment of stringent emission norms is likely to increase significantly due to the rise in greenhouse gas levels globally.

With the growth in sales and production of passenger cars, the global automotive sector has been witnessing exponential growth year on year. For instance, the sales of passenger cars in India increased from 14,67,039 to 17,47,376, utility vehicles from 14,89,219 to 20,03,718, and vans from 1,13,265 to 1,39,020 units in FY 2022-23, compared to the previous year.

With the growth in demand for vehicles, engine management companies are adopting strategic moves such as product launches, capacity expansion, and mergers to cater to the high demand.

Key Highlights

- In July 2023, Valeo expanded its ultrasonic sensor manufacturing capacity to 7 million units at the Sanand plant. The first production line at Sanand was started in November 2021. With this additional line, the total production capacity increased from 3 million to 7 million units annually.

- In January 2023, Sensata showcased its broad range of mission-critical sensors and electrical protection solutions for automotive and heavy vehicle off-road (HVOR) applications.

North America is the fastest automotive engine management systems market in the world. However, due to the more significant automotive sales, especially in China and India, the automotive engine management systems in Asia-Pacific hold the major market share. Customers in India and China are becoming more aware of enhancing their vehicles' performance, which is expected to boost the automotive engine management system market.

Automotive Engine Management System Market Trends

Passenger Cars Holds Highest Market Share

Passenger cars have become exceptionally popular among consumers due to features like their stylish and compact design and economic value. The rise in the demand for passenger cars is also influenced by the increasing middle-class population and the enhanced standard of living in emerging countries.

The rise in demand for sports utility vehicles (SUVs) creates profitable opportunities for market players as the sale of sports utility vehicles accounts for more than 50% of passenger car sales in India. The demand for sports utility vehicles in countries like India and China surged due to various factors, such as buying preference for bigger cars with high ground clearance.

Furthermore, the increase in demand for electric vehicles due to tax subsidies and expansion in charger infrastructure also resulted in the growth of the market. Electric car sales in India in the first quarter of 2023 were double what they were in the same period in 2022.

According to the International Council of Clean Transportation, the sales of electric vehicles in the United States crossed 1 million. Notably, the sales through the first three quarters of 2023 were about 58% higher than the same period in 2022.

With the growth in the passenger car segment, demand for various engine management systems, such as electronic control units and engine sensors, is expected to continue to grow exponentially in the future. With the ongoing trend of advanced features related to safety and convenience, cars are becoming more feature-loaded. Moreover, the rise in demand for autonomous and electric vehicles is anticipated to create new opportunities for engine management systems.

Companies are also focusing on creating technologically advanced products and expanding their capacity to cater to the high demand in the market. For example, in June 2023, MicroVision Inc., a leader in MEMS-based solid-state automotive lidar and advanced driver-assistance systems (ADAS) solutions, launched its solid-state flash-based MOVIA lidar sensor. The small form factor and light weight of the MOVIA sensor make it appealing for a wide variety of applications.

Asia-Pacific Holds the Highest Market Share

Asia-Pacific is expected to hold a major market share during the forecast period. The regional growth is mainly driven by the top-producing automotive countries like India, China, and Japan.

Other driving factors include the increase in demand for automobiles that provide enhanced driving experiences, comfort, and safety and an increase in demand for fuel-efficient engines. The rise in the sale of electric vehicles has further boosted the use of engine management systems, as countries like India are promoting their adoption through strict regulations, subsidies, tax credits, and other incentives.

- The Ministry of Road Transport and Highways (MoRTH) in India made it mandatory for vehicles to comply with fuel consumption standards from 2023 to make vehicles fuel efficient. The new guidelines on flex-fuel vehicles contribute to the growth of ICE engines.

- China is leading the global market share in the engine management system (EMS) segment, supplying fuel pumps and injectors. New emission norms for diesel engines could mean additional opportunities for Chinese engine management companies.

Apart from conventional IC engine vehicles, the demand for electric vehicles is anticipated to boost the growth of the market. With stringent emission regulations across every region, the demand for electric vehicles is likely to increase during the forecast period. According to the International Council of Clean Transportation, China remained the world's largest EV market, with approximately 3 million EVs sold in 2023 H1.

- As of January 2024, Chinese manufacturers continue to lead the charge in lidar innovation of autonomous driving technology and have filed a staggering 25,957 patent applications related to lidar since 2000, surpassing American and Japanese companies.

Automotive Engine Management System Industry Overview

The automotive engine management system market is consolidated and led by globally and regionally established players. The companies adopt strategies such as new product launches, collaborations, and mergers to sustain their market positions.

- For instance, in April 2023, TTTech Auto launched the N4 Network Controller, a high-performance ECU with advanced networking capabilities. The N4 is designed to play a central role in modern automotive E/E architectures, paving the way to software-defined vehicles.

Some of the major players in the market include Continental AG, DENSO Corporation, DENSO Corporation, Valeo, and Robert Bosch GmbH.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Drivers

- 4.2 Increase in Sales of Passenger Cars

- 4.3 Market Restraints

- 4.4 Increased Cost of Vehicles Due to Additional Safety Features

- 4.5 Industry Attractiveness - Porter's Five Forces Analysis

- 4.5.1 Threat of New Entrants

- 4.5.2 Bargaining Power of Buyers/Consumers

- 4.5.3 Bargaining Power of Suppliers

- 4.5.4 Threat of Substitute Products

- 4.5.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION (Market Size by Value - USD Billion)

- 5.1 By Vehicle Type

- 5.1.1 Passenger Car

- 5.1.2 Commercial Vehicle

- 5.2 By Component Type

- 5.2.1 Engine Control Unit (ECU)

- 5.2.2 Engine Sensors

- 5.2.3 Fuel Pump

- 5.2.4 Other Component Types

- 5.3 By Geography

- 5.3.1 North America

- 5.3.1.1 United States

- 5.3.1.2 Canada

- 5.3.1.3 Rest of North America

- 5.3.2 Europe

- 5.3.2.1 Germany

- 5.3.2.2 United Kingdom

- 5.3.2.3 France

- 5.3.2.4 Italy

- 5.3.2.5 Spain

- 5.3.2.6 Rest of Europe

- 5.3.3 Asia Pacific

- 5.3.3.1 India

- 5.3.3.2 China

- 5.3.3.3 Japan

- 5.3.3.4 South Korea

- 5.3.3.5 Rest of Asia-Pacific

- 5.3.4 Rest of the World

- 5.3.4.1 South America

- 5.3.4.2 Middle East and Africa

- 5.3.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Vendor Market Share

- 6.2 Company Profiles*

- 6.2.1 Robert Bosch GmbH

- 6.2.2 Continental AG

- 6.2.3 BorgWarner Inc.

- 6.2.4 DENSO Corporation

- 6.2.5 Hella KGaA Hueck & Co.

- 6.2.6 Infineon Technologies AG

- 6.2.7 Sensata Technologies

- 6.2.8 Mobiletron Electronics Co. Ltd

- 6.2.9 NGK Spark Plugs Pvt Ltd.

- 6.2.10 Hitachi Automotive Systems Ltd

- 6.2.11 Dover Corporation