|

市场调查报告书

商品编码

1523315

豪华车:市场占有率分析、产业趋势与统计、成长预测(2024-2029)Luxury Car - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

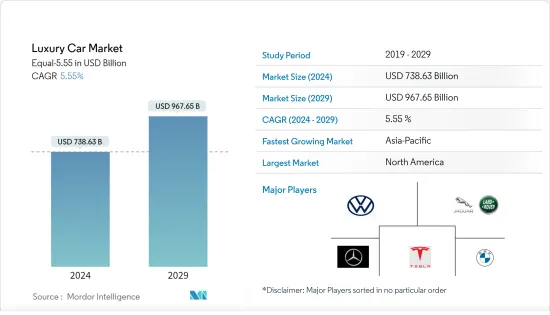

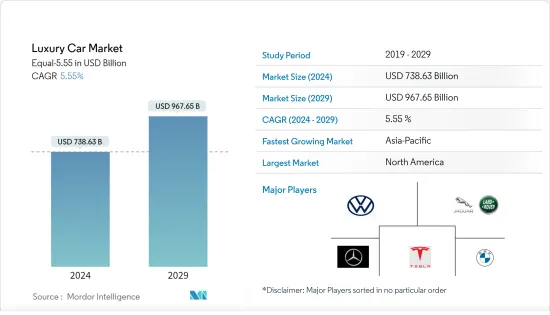

豪华车市场规模预计将从2024年的7,386.3亿美元成长到2029年的9,676.5亿美元,预测期间(2024-2029年)复合年增长率为5.55%。

在全球人口日益富裕和可支配收入增加等关键因素的推动下,豪华车市场预计在 2022 年实现强劲增长,尤其是在新兴市场,促使更多消费者考虑豪华车。此外,包括电动车和自动驾驶汽车创新在内的技术进步正在改变游戏规则,吸引了寻求尖端汽车体验的精通技术的消费者。

电动和混合模式在豪华汽车市场中迅速增加,各大製造商都在研发上投入大量资金,以满足对环保替代品的需求。物联网功能、人工智慧主导的介面和自动驾驶技术等连接功能正在成为常态,改善驾驶体验。

然而,经济的不确定性和更严格的排放法规给豪华车市场带来了挑战。全球经济和环境问题的变化可能会影响消费者信心和购买力。此外,较高的进口关税预计将阻碍豪华车市场的成长。例如,在印度,CIF(成本、保险和运费)价格高于 40,000 美元的汽车需缴纳 100% 关税,CIF(成本、保险和运费)价格低于 40,000 美元的汽车需缴纳 100% 关税。关税。

随着这些新兴市场的不断开拓,豪华车市场预计在预测期内将继续实现正成长。

豪华车市场趋势

SUV成为豪华车市场的主要细分市场

SUV已成为豪华车市场的一个主要部分。这种成长背后有几个因素塑造了豪华汽车产业的格局。豪华 SUV 集多功能性、先进技术、安全性和声望认可于一体,拥有大量追随者。

豪华SUV对包括家庭和年轻专业人士在内的广大消费者越来越有吸引力。市场对这些车辆的性能、舒适性和实用性的结合反应良好,使其成为豪华车购买者的热门选择。

SUV较高的驾驶位置和坚固的构造赋予其安全感,与既希望汽车安全又希望豪华的消费者产生共鸣。此外,ADAS(高级驾驶辅助系统)和连接选项等最新技术功能进一步增强了这款豪华SUV的吸引力。

区域差异在塑造豪华SUV市场方面也发挥着重要作用。例如,北美和中国对豪华SUV表现出强烈的偏好。在中国,大型SUV尤其受到富裕阶层的欢迎。豪华轿车历来在欧洲占有很大份额,但现在人们开始转向豪华SUV,反映出消费者偏好和生活方式的变化。

此外,经济状况和环境因素等因素也影响豪华SUV市场的趋势。某些地区的经济繁荣导致更大、更昂贵的SUV车型销售增加。此外,电动车和混合SUV 的兴起响应了消费者日益增长的环保意识,并促进了整个豪华车市场的发展。

随着汽车产业越来越注重永续性,汽车製造商正在大力投资电动车技术,以提供具有零排放功能的豪华 SUV。例如

- 2023年11月,印度最大的豪华汽车品牌宾士推出了GLE LWB SUV和AMG C43 4MATIC轿车。该公司在印度推出了 SUV GLE 的拉皮版,起价为 96.40 印度卢比(不含税),共有三种车型。这款 SUV 与 C43 AMG 4Matic 轿车一起首次亮相,售价为 98,000 卢比(117,937.12 美元)。

预计未来几年市场将经历进一步转型,尤其是随着电动豪华 SUV 的出现。

北美是最大市场,亚太是成长最快的市场

包括美国和加拿大在内的北美地区仍然是豪华车的最大市场,并对整个行业收益做出了巨大贡献。尤其是美国,经济强劲,富人众多,是豪华车销售的主要动力。 2022年,该地区豪华车收益超过70亿美元。光是在美国,2022 年销售额就超过 60 亿美元。

北美地区对豪华车的需求受到高可支配收入、重视汽车声誉的文化以及对大型豪华SUV的强烈偏好等因素的推动。由于可支配收入高,消费者可以更偏好豪华车。

儘管北美在整体市场规模上处于领先地位,但凭藉其丰富的汽车传统和豪华汽车製造商的强大影响力,欧洲占据了重要地位。欧洲消费者往往更喜欢豪华轿车和跑车,这促成了全球豪华车市场的多样性。

在中国和印度等国家经济成长的推动下,亚太地区正成为豪华车市场的重要参与者。预计该地区将成为预测期内成长最快的市场。近年来,中国和印度的富裕人士和超高净值人士数量大幅增加。随着这些地区中中阶中产阶级人口的不断扩大,豪华车被视为身分的象征,需求迅速增加。豪华车产业的汽车製造商也越来越关注这些市场,看到了高成长潜力。例如:

- 2023年8月,奥迪在印度推出了新款电动车Q8 e-tron和e-tron Sportback。 Q8 e-tron 系列有两种型号,分别配备 95kWh 和 114kWh 电池组。

总体而言,北美的主导地位在未来几年可能会受到亚太和欧洲等地区的挑战,这些地区越来越多的高所得消费者正在大力投资豪华车。

豪华车产业概况

豪华车市场由少数参与者整合。梅赛德斯-奔驰、宝马、大众集团和特斯拉占据主要市场份额。

在先进技术、提高舒适度、增加对电动车技术的投资以及不断提高的全球生活水准的推动下,主要企业不断产品推出并投资于研发。例如

- 2023年4月,捷豹路虎宣布计划透过其位于英国的海伍德工厂加速转型成为全球领先的现代豪华汽车製造商之一。该工厂将是全电动生产设施。

- 2023 年 9 月,路特斯在纽约推出了首款 4 门超级 GT「Emeya」。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 调查先决条件

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场动态

- 市场驱动因素

- 对舒适驾驶体验和车辆安全的需求不断增长推动市场发展

- 高净值人士(HNWI)和超级富豪阶级的增加将推动需求

- 市场限制因素

- 初始持有高是一个问题

- 产业吸引力-波特五力分析

- 新进入者的威胁

- 买家/消费者的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争公司之间敌对关係的强度

第五章市场区隔(市场规模 - 十亿美元)

- 车型

- 掀背车

- 轿车

- 运动型公共事业车(SUV)

- 多用途汽车(MPV)

- 其他车型(运动型等)

- 驱动系统

- 内燃机(ICE)

- 电动和混合

- 车辆类别

- 入门豪华舱

- 中级豪华级

- 超豪华级

- 地区

- 北美洲

- 美国

- 加拿大

- 其他北美地区

- 欧洲

- 德国

- 英国

- 法国

- 西班牙

- 其他欧洲国家

- 亚太地区

- 中国

- 日本

- 印度

- 韩国

- 其他亚太地区

- 世界其他地区

- 南美洲

- 中东/非洲

- 北美洲

第六章 竞争状况

- 供应商市场占有率

- 公司简介

- Mercedes-Benz Group AG

- BMW AG

- Volvo Group

- Volkswagen Group

- Jaguar Land Rover Automotive PLC

- Fiat Chrysler Automobiles

- Ford Motor Company

- FAW Car Company

- Hyundai Motor Group

- Tesla Inc.

第七章 市场机会及未来趋势

- 豪华车采用自动驾驶技术成大趋势

- 纯电动车 (BEV) 将主导所有豪华汽车领域

第八章 市场规模和基于单位数量的预测

第九章主要企业市场参与者产品基准

The Luxury Car Market size in terms of Equal-5.55 is expected to grow from USD 738.63 billion in 2024 to USD 967.65 billion by 2029, at a CAGR of 5.55% during the forecast period (2024-2029).

The luxury car market has experienced robust growth in 2022, driven by key factors such as the expanding affluence of the global population, especially in emerging markets, where rising disposable incomes propel an increasing number of consumers to consider luxury cars. Furthermore, technological advancements, including innovations in electric and autonomous vehicles, are reshaping the landscape, attracting tech-savvy consumers seeking cutting-edge automotive experiences.

The luxury car market is experiencing a surge in electric and hybrid models, with major players investing heavily in research and development to meet the demand for eco-friendly alternatives. Connectivity features such as IoT capabilities, AI-driven interfaces, and autonomous driving technologies are becoming standard, elevating the driving experience.

However, economic uncertainties and stringent emission standards pose challenges for the luxury car market. Fluctuations in the global economy and environmental concerns can impact consumer confidence and influence purchasing power. In addition, an increase in import tariffs is expected to hinder the growth of the luxury car market. For instance, in India, cars with CIF (Cost, Insurance, and Freight) value over USD 40,000 incur a 100% customs tax, while those under USD 40,000 face a 60% import duty.

Based on these ongoing developments, the luxury car market is expected to continue its positive growth trajectory during the forecast period.

Luxury Car Market Trends

SUVs will be the Leading Segment in the Luxury Car Market

SUVs have emerged as the leading segment in the luxury car market. This growth could be attributed to several factors shaping the landscape of the luxury automotive industry. Luxury SUVs have gained significant traction, offering a combination of versatility, advanced technology, and a perceived sense of safety and prestige.

Luxury SUVs are becoming increasingly appealing to a broad range of consumers, including families and young professionals. The market has responded positively to the combination of performance, comfort, and practicality that these vehicles offer, making them a popular choice among luxury car buyers.

The elevated driving position and robust build of SUVs contribute to a sense of security, which resonates well with consumers seeking both safety and luxury in their vehicles. In addition, the incorporation of the latest technological features, such as advanced infotainment systems, driver assistance technologies, and connectivity options, has further enhanced the appeal of luxury SUVs.

Regional variances also play a key role in shaping the market for luxury SUVs. For instance, North America and China have shown a strong inclination for luxury SUVs. In China, the popularity of large SUVs among high-net-worth individuals has been particularly significant. While luxury sedans have historically held a significant market share in Europe, there is a growing shift toward luxury SUVs, reflecting changing consumer preferences and lifestyle choices.

Furthermore, factors such as economic conditions and environmental concerns also influence the dynamics of the luxury SUV market. Economic prosperity in certain regions has led to increased sales of larger and more expensive SUV models. Moreover, the rise of electric and hybrid SUVs addresses growing environmental consciousness among consumers, contributing to the overall evolution of the luxury car market.

As the automotive industry places greater emphasis on sustainability, automakers are investing heavily in electric vehicle technology, offering luxury SUVs with zero-emission capabilities. For instance:

- In November 2023, India's largest luxury auto brand, Mercedes-Benz, launched the GLE LWB SUV and AMG C43 4MATIC sedan. The company launched the face-lifted version of the GLE SUV in India at a starting price of INR 96.40 lakh (ex-showroom) across three variants. The SUV has made its debut alongside the C43 AMG 4Matic sedan, with a price tag of INR 98 lakh (USD 117937.12).

The market studied is expected to witness further transformations in the coming years, particularly with the emergence of electric luxury SUVs.

North America is the Largest while APAC is the Fastest Growing Market

North America, encompassing the United States and Canada, remains the largest market for luxury cars, contributing significantly to the industry's overall revenue. The United States, in particular, has been a key driver of luxury car sales, with a robust economy and a substantial population of wealthy consumers. In 2022, the region generated revenue of over USD 7000 million from luxury cars. The United States alone generated revenue of over USD 6000 million in 2022.

The demand for luxury vehicles in North America has been fueled by factors such as high disposable incomes, a culture emphasizing automotive prestige, and a strong preference for larger luxury SUVs. High disposable incomes enable consumers to indulge in premium automotive offerings.

While North America leads in terms of overall market size, Europe, with its rich automotive heritage and a strong presence of luxury car manufacturers, holds substantial significance. European consumers often favor luxury sedans and sports cars, contributing to the diverse global luxury car market landscape.

The Asia-Pacific region, driven by the economic growth of countries such as China and India, is increasingly becoming a significant player in the luxury car market. The region is expected to be the fastest-growing market during the forecast period. In recent years, the number of HNWIs and UHNWIs has grown significantly in China and India. The expanding middle and upper-middle-class populations in these regions have led to a surge in demand for luxury vehicles, as they are perceived as status symbols. Automakers involved in the luxury car business have also started increasingly focusing on these markets, seeing their high growth potential. For instance:

- In August 2023, Audi launched its new electric duo, the Q8 e-tron and e-tron Sportback in India. The Q8 e-tron range is available in two trims with 95kWh and 114kWh battery packs, respectively.

Overall, in the coming years, North America's dominance will be challenged by regions like APAC and Europe, with their growing high-income groups investing heavily in luxury cars.

Luxury Car Industry Overview

The luxury car market is consolidated with a small number of players. Mercedes-Benz, BMW, Volkswagen Group, and Tesla hold the major share of the market studied.

The key players are engaged in continuous product launches and R&D investments, highly driven by advanced technology, more comfort, growing investment in EV technology, and improved living standards worldwide. For instance:

- In April 2023, JLR announced its plans to accelerate its transition to become the world's leading modern luxury car manufacturer through its Halewood plant in the United Kingdom. The plant will become an all-electric production facility.

- In September 2023, Lotus unveiled Emeya, the company's first four-door hyper-GT, in New York City.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Drivers

- 4.1.1 Rising Demand for Comfortable Driving Experience and Vehicle Safety is Driving the Market

- 4.1.2 Increasing Number of High Net Worth Individuals (HNWI) and Ultra HNWIs Drives Demand

- 4.2 Market Restraints

- 4.2.1 High Initial Cost of Ownership is a Challenge

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Threat of New Entrants

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Bargaining Power of Suppliers

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION (Market Size in Value - USD billion)

- 5.1 Vehicle Type

- 5.1.1 Hatchback

- 5.1.2 Sedan

- 5.1.3 Sports Utility Vehicles (SUV)

- 5.1.4 Multi-Purpose Vehicles (MPV)

- 5.1.5 Other Vehicle Types (Sports, etc.)

- 5.2 Drive Type

- 5.2.1 Internal Combustion Engine (ICE)

- 5.2.2 Electric and Hybrid

- 5.3 Vehicle Class

- 5.3.1 Entry-level Luxury Class

- 5.3.2 Mid-level Luxury Class

- 5.3.3 Ultra Luxury Class

- 5.4 Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Rest of North America

- 5.4.2 Europe

- 5.4.2.1 Germany

- 5.4.2.2 United Kingdom

- 5.4.2.3 France

- 5.4.2.4 Spain

- 5.4.2.5 Rest of Europe

- 5.4.3 Asia-Pacific

- 5.4.3.1 China

- 5.4.3.2 Japan

- 5.4.3.3 India

- 5.4.3.4 South Korea

- 5.4.3.5 Rest of Asia-Pacific

- 5.4.4 Rest of the World

- 5.4.4.1 South America

- 5.4.4.2 Middle East and Africa

- 5.4.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Vendor Market Share

- 6.2 Company Profiles*

- 6.2.1 Mercedes-Benz Group AG

- 6.2.2 BMW AG

- 6.2.3 Volvo Group

- 6.2.4 Volkswagen Group

- 6.2.5 Jaguar Land Rover Automotive PLC

- 6.2.6 Fiat Chrysler Automobiles

- 6.2.7 Ford Motor Company

- 6.2.8 FAW Car Company

- 6.2.9 Hyundai Motor Group

- 6.2.10 Tesla Inc.

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Adoption of Autonomous Driving Technology in Luxury Cars to be a Key Trend

- 7.2 Battery-Electric Vehicles (BEVs) will be Dominant Across all Luxury Segment