|

市场调查报告书

商品编码

1523318

泵 -市场占有率分析、行业趋势和统计、成长预测(2024-2029)Pump - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

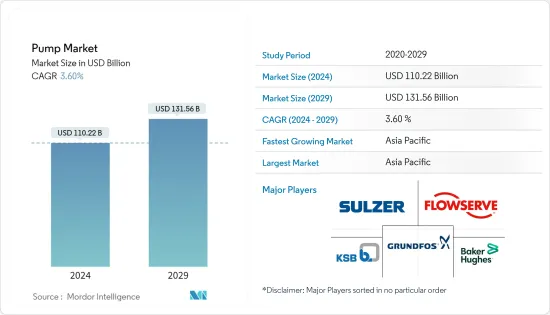

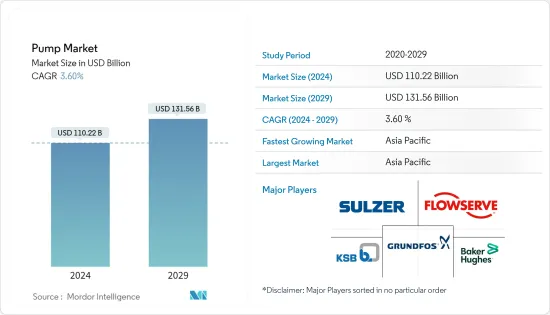

泵浦市场规模预计到2024年为1,102.2亿美元,预计到2029年将达到1,315.6亿美元,在预测期内(2024-2029年)复合年增长率为3.60%。

主要亮点

- 从长远来看,基础设施开拓活动的活性化以及对用水和污水管理的日益关注预计将推动泵浦市场的发展。

- 另一方面,钢铁和各种金属等原材料价格的波动预计将阻碍预测期内的市场成长。

- 然而,新兴国家的快速都市化和工业化为供水和工业流程用泵带来了巨大的成长机会。

- 预计亚太地区将在预测期内主导市场。这一成长是由印度、中国和日本等国家终端用途产业投资增加所推动的。

泵浦市场趋势

石油和天然气产业预计将显着成长

- 石油和天然气行业对泵浦的需求是由碳氢化合物提取和加工的需求所驱动的。随着全球能源需求持续上升,满足此需求的探勘和生产活动备受关注。泵浦在原油开采、油井增产精製以及石油和天然气运输等各种过程中发挥着至关重要的作用,推动了市场的成长。

- 特别是在美国,页岩气革命正在显着推动泵浦的需求。水力压裂(水力压裂)涉及将大量的水化学和支撑剂泵入页岩地层,以在高压下提取天然气。该过程高度依赖泵,推动了对高压泵送设备的需求。

- 此外,由于具有挑战性的操作条件,包括探勘钻井和生产在内的海上石油和天然气活动通常需要专用泵浦。泵浦用于海水取水、注水、冷却系统、管道运输和其他关键过程。成熟地区和新兴地区对海上蕴藏量的日益关注正在为泵浦製造商创造重要的市场机会。

- 根据全球能源统计数据,2021年至2022年全球原油产量成长4.2%。 2022年全球整体原油产量为93,848,000桶/日,而2021年为90,076,000桶/日,显示全球石油需求和产量都在增加。

- 泵浦在石油和天然气作业中持续使用,需要定期维护、修理服务,有时需要更换。 2023 年 6 月,Celeros Flow Technology 与 ONGC 签订协议,为印度石油和天然气资产网路提供泵浦维护和备件服务。

- 考虑到这些因素,由于石油和天然气产业仍然是满足全球能源需求的关键产业,泵浦市场可望大幅成长。因此,预计该行业将在预测期内推动受调查市场的发展。

亚太地区预计将主导市场

- 亚太地区正在经历强劲的工业化和基础设施发展,特别是在中国、印度和东南亚等国家。製造业、建设业、采矿业和发电业等不断扩大的行业对各种应用中的泵浦有巨大的需求,包括供水、废水管理和加工业。

- 亚太地区正在经历快速成长,由于显着的都市化,其人口迅速增加。这种人口结构的变化将导致对水卫生系统和基础设施的需求增加,而所有这些都需要水泵。都市化正在推动住宅、商业和工业领域对泵浦的需求,有助于在该地区占据市场主导地位。

- 亚太地区的石油和天然气产业正在经历显着成长。中国、印度和印尼等国家正在增加探勘和生产活动,需要泵浦用于提取、运输和精製过程。该地区石油和天然气行业的扩张正在加强其主导地位。

- 例如,根据《世界能源统计评论》,亚太地区天然气产量2021年至2022年将成长1%以上,2012年至2022年将成长3%以上,该地区石油和天然气探勘和生产显示活动增加。

- 该地区也正在成为全球製造地,其中中国、日本、韩国和印度等国家发挥关键作用。在製造业中,各种应用都需要泵,包括流体处理、化学加工和工业製程。该地区在製造业中的主导地位推动了对泵浦的需求,进一步巩固了其在研究市场中的地位。

- 快速的工业化、人口成长、都市化、水资源管理挑战、不断扩大的石油和天然气工业以及蓬勃发展的製造业相结合,使亚太地区在泵浦市场上占据了主导地位。

泵业概况

泵浦市场适度分散。市场的主要企业(排名不分先后)包括 Flowserve Corporation、Grundfos Holding AS、KSB SE &Co.KGaA、Sulzer Ltd 和 Baker Hughes Company。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第一章简介

- 调查范围

- 市场定义

- 研究场所

第 2 章执行摘要

第三章调查方法

第四章市场概况

- 介绍

- 2029年之前的市场规模与需求预测(单位:美元)

- 最新趋势和发展

- 政府法规政策

- 市场动态

- 市场驱动因素

- 加大基础建设力度

- 日益重视用水和污水管理

- 市场限制因素

- 原物料价格波动

- 市场驱动因素

- 供应链分析

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争公司之间敌对关係的强度

第五章市场区隔

- 按类型

- 离心帮浦

- 正排量泵

- 按最终用户

- 油和气

- 用水和污水

- 化学和石化

- 矿业

- 发电

- 其他最终用户

- 按地区分類的市场分析{2028年之前的市场规模与需求预测(按地区)}

- 北美洲

- 美国

- 加拿大

- 北美其他地区

- 欧洲

- 德国

- 法国

- 西班牙

- 英国

- 俄罗斯

- 北欧的

- 义大利

- 土耳其

- 其他欧洲国家

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 澳洲

- 马来西亚

- 泰国

- 印尼

- 越南

- 其他亚太地区

- 南美洲

- 巴西

- 阿根廷

- 哥伦比亚

- 南美洲其他地区

- 中东/非洲

- 沙乌地阿拉伯

- 阿拉伯聯合大公国

- 南非

- 奈及利亚

- 卡达

- 埃及

- 其他中东/非洲

- 北美洲

第六章 竞争状况

- 併购、合资、联盟、协议

- 主要企业策略

- 公司简介

- Flowserve Corporation

- Grundfos Holding AS

- KSB SE & Co. KGaA

- ITT Inc.

- Sulzer Ltd

- Ebara Corporation

- Weir Group PLC

- Schlumberger Ltd

- Baker Hughes Company

- Clyde Union Inc.

- Dover Corporation

- Market Ranking/Share(%)Analysis

第七章 市场机会及未来趋势

- 新兴国家快速都市化与工业化

简介目录

Product Code: 62632

The Pump Market size is estimated at USD 110.22 billion in 2024, and is expected to reach USD 131.56 billion by 2029, growing at a CAGR of 3.60% during the forecast period (2024-2029).

Key Highlights

- Over the long term, the increasing infrastructure development activities coupled with a rising emphasis on water and wastewater management are expected to drive the pump market.

- On the other hand, volatility in raw material prices, such as steel, iron, and various metals, is expected to hinder the market's growth during the forecast period.

- Nevertheless, the rapid urbanization and industrialization in emerging economies present a substantial growth opportunity for pumps for water supply and industrial processes.

- Asia-Pacific is expected to dominate the market during the forecast period. This growth is attributed to increasing investments across end-use industries in countries including India, China, and Japan.

Pump Market Trends

Oil and Gas Sector Expected to Witness Significant Growth

- The demand for pumps in the oil and gas industry is driven by the need to extract and process hydrocarbons. As global energy demand continues to rise, there is a growing focus on exploration and production activities to meet this demand. Pumps are crucial in various processes such as crude oil extraction, well-stimulation refining, and transportation of oil and gas, thereby driving the growth of the market.

- The shale gas revolution, particularly in the United States, has significantly boosted the demand for pumps. Hydraulic fracturing or fracking requires large volumes of water chemicals and proppants to be pumped into shale formations to extract natural gas at high pressure. This process heavily relies on pumps, driving the demand for high-pressure pumping equipment.

- Furthermore, offshore oil and gas activities, including exploration drilling and production, often require specialized pumps due to the challenging operating conditions. Pumps are utilized for seawater intake, water injection, cooling systems, pipeline transport, and other critical processes. The increasing focus on offshore reserves both in established and emerging regions creates a substantial market opportunity for pump manufacturers.

- A statistical review of world energy shows that global oil production increased by 4.2% between 2021 and 2022. In 2022, the total crude oil production globally was 93,848 thousand barrels per day compared to 90,076 thousand barrels per day in 2021, signifying the increasing oil demand and crude oil production globally.

- As the pumps are used in a continuous way in oil and gas operations, they need maintenance, repair services, and sometimes replacements at regular intervals. In June 2023, Celeros Flow Technology made an agreement with ONGC to provide pump maintenance and spares services across a network of crude oil and natural gas assets in India.

- Considering these factors, the oil and gas sector is poised to experience significant growth in the pump market as it continues to be the crucial industry for meeting global energy needs. Therefore, this sector is expected to drive the market studied during the forecast period.

Asia-Pacific is Expected to Dominate the Market

- Asia-Pacific is experiencing robust industrialization and infrastructure developmental activities, particularly in countries such as China, India, and Southeast Asia. Expanding industries such as manufacturing, construction, mining, and power generation require a substantial demand for pumps across various applications, including water supply wastewater management and process industries.

- Asia-Pacific has a large and rapidly growing population accompanied by a significant increase in urbanization. This demographic shift leads to increased demand for water supply sanitation systems and infrastructure development, all of which require pumps. Urbanization drives the need for pumps in the residential, commercial, and industrial sectors, contributing to the region's dominance in the market.

- Asia-Pacific is experiencing significant growth in the oil and gas industry. Countries like China, India, and Indonesia have been increasing their exploration and production activities, requiring pumps for extraction, transportation, and refining processes. The expansion of the oil and gas sector in the region strengthens the dominance.

- For instance, according to the statistical review of world energy, gas production in Asia-Pacific increased by more than 1% between 2021 and 2022 and more than 3% between 2012 and 2022, signifying the increased oil and gas exploration and production activities in the region.

- The region has also emerged as a global manufacturing hub, with countries like China, Japan, South Korea, and India playing a significant role. The manufacturing sector requires pumps for various applications, including fluid handling, chemical processing, and industrial processes. The region's dominance in manufacturing drives the demand for pumps, further solidifying its position in the market studied.

- The combination of rapid industrialization, population growth, urbanization, water management challenges, oil and gas industry expansion, and thriving manufacturing sector make Asia-Pacific the dominant market for pumps.

Pump Industry Overview

The pump market is moderately fragmented. Some of the major players in this market (in no particular order) include Flowserve Corporation, Grundfos Holding AS, KSB SE & Co. KGaA, Sulzer Ltd, and Baker Hughes Company, among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD till 2029

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Market Drivers

- 4.5.1.1 Increasing Infrastructure Development

- 4.5.1.2 Rising Emphasis Water and Wastewater Management

- 4.5.2 Market Restraints

- 4.5.2.1 Volatility in Raw Material Prices

- 4.5.1 Market Drivers

- 4.6 Supply Chain Analysis

- 4.7 Industry Attractiveness - Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitute Products and Services

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 By Type

- 5.1.1 Centrifugal Pump

- 5.1.2 Positive Displacement Pump

- 5.2 By End User

- 5.2.1 Oil and Gas

- 5.2.2 Water and Wastewater

- 5.2.3 Chemicals and Petrochemicals

- 5.2.4 Mining Industry

- 5.2.5 Power Generation

- 5.2.6 Other End Users

- 5.3 By Geography Regional Market Analysis {Market Size and Demand Forecast till 2028 (for regions only)}

- 5.3.1 North America

- 5.3.1.1 United States

- 5.3.1.2 Canada

- 5.3.1.3 Rest of North America

- 5.3.2 Europe

- 5.3.2.1 Germany

- 5.3.2.2 France

- 5.3.2.3 Spain

- 5.3.2.4 United Kingdom

- 5.3.2.5 Russia

- 5.3.2.6 NORDIC

- 5.3.2.7 Italy

- 5.3.2.8 Turkey

- 5.3.2.9 Rest of Europe

- 5.3.3 Asia-Pacific

- 5.3.3.1 China

- 5.3.3.2 India

- 5.3.3.3 Japan

- 5.3.3.4 South Korea

- 5.3.3.5 Australia

- 5.3.3.6 Malaysia

- 5.3.3.7 Thailand

- 5.3.3.8 Indonesia

- 5.3.3.9 Vietnam

- 5.3.3.10 Rest of Asia-Pacific

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Colombia

- 5.3.4.4 Rest of South America

- 5.3.5 Middle East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 United Arab Emirates

- 5.3.5.3 South Africa

- 5.3.5.4 Nigeria

- 5.3.5.5 Qatar

- 5.3.5.6 Egypt

- 5.3.5.7 Rest of the Middle East and Africa

- 5.3.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 Flowserve Corporation

- 6.3.2 Grundfos Holding AS

- 6.3.3 KSB SE & Co. KGaA

- 6.3.4 ITT Inc.

- 6.3.5 Sulzer Ltd

- 6.3.6 Ebara Corporation

- 6.3.7 Weir Group PLC

- 6.3.8 Schlumberger Ltd

- 6.3.9 Baker Hughes Company

- 6.3.10 Clyde Union Inc.

- 6.3.11 Dover Corporation

- 6.4 Market Ranking/Share (%) Analysis

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Rapid Urbanization and Industrialization in Emerging Economies

02-2729-4219

+886-2-2729-4219