|

市场调查报告书

商品编码

1523320

Micro LED:市场占有率分析、行业趋势和统计、成长预测(2024-2029)Micro LED - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

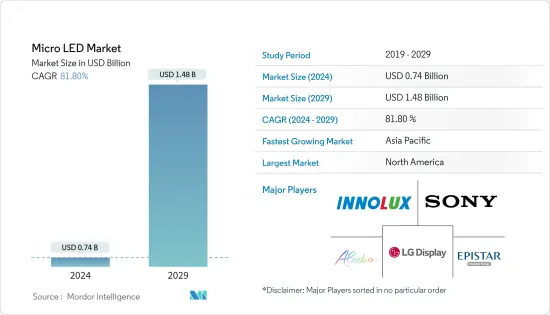

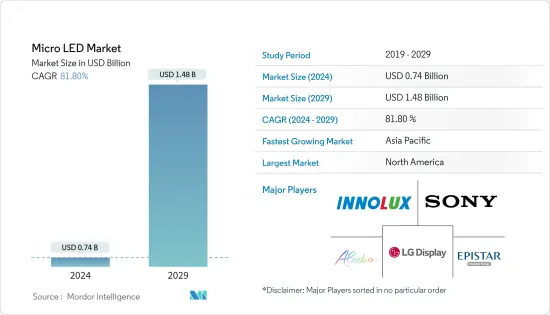

Micro LED市场规模预计到2024年为7.4亿美元,预计到2029年将达到14.8亿美元,在预测期内(2024-2029年)复合年增长率为81.80%。

MicroLED 是一种使用微型 LED(发光二极体)来创建单一像素的显示技术。提供高亮度、高对比度和能源效率。 Micro LED 显示器以其卓越影像品质的潜力而闻名,可用于多种应用,包括电视、显示器和穿戴式装置。

主要亮点

- 近年来,Micro LED 市场成长显着。这主要得益于AR/VR等技术进步以及各地区终端用户产业的扩张。例如,向 5G 的过渡将加速对先进行动装置的需求。

- Micro-LED技术在亮度、解析度、对比、消费量、寿命和热稳定性方面比LCD和OLED具有优势,为显示器产业开启了新的可能性。

- 2023 年 5 月,全球大型公司的远距无线充电解决方案供应商 Wi-Charge 将为零售商、品牌和负责人推出业界最节能、高效能的无线可充电视讯显示器。 Wi-Charge 开发了新一代视讯显示器,大型 Wi-Spot 7"。

- Micro-LED 技术正在消费性电子产业掀起波动,并有望在显示器技术方面取得重大进步。凭藉其独特的功能和优势,Micro-LED 有潜力颠覆使用者在各种装置上体验视觉内容的方式。

- 近年来,Micro-LED技术因其比其他显示技术表现出优越性能的潜力而备受关注。 Micro LED 具有更高的像素密度、更低的功耗、更快的反应时间、阳光直射下更高的亮度以及更宽的视角。这些特性使它们适合各种应用,包括手持设备和近眼显示器。

- COVID-19 大流行减缓了生产,导致许多公司暂时关闭其设施并扰乱了供应链,导致该行业的几个新计画被推迟。在这项挑战中,新技术的发展也可能受到影响。 LEDinside共用了在全球不确定性背景下 micro-LED 技术发展的见解。他指出,下一代显示技术可能是向前迈出一步的机会。

Micro LED市场趋势

最大的最终用户产业是消费性电子产品

- 交通运输业越来越多地使用数位双胞胎技术,预计这将推动对虚拟感测器的需求。数位双胞胎已成为交通运输领域的最新技术现象。透过在供应链中实施数位双胞胎,我们正在提高本地和全球供应链网路的效率。资料使运输公司能够极其准确地预测业务。这项创新技术也有助于产生宝贵的见解,以增强企业策略。

- 虚拟感测器因其多样化的应用而对汽车行业变得越来越重要。在预测期内,虚拟感测器在行业中的日益普及可能会受到关注。在昂贵的感测器不断膨胀的背景下,虚拟感测器的采用得到了广泛的应用。虚拟感测器涉及用车辆电控系统中嵌入的软体替换实体感测器。其目的是无需物理组件即可获取必要的资讯。此虚拟感测器嵌入到许多车辆部件中,包括轮胎、引擎和驾驶室。虚拟感测广泛应用于汽车应用,例如乘员热舒适度、轮胎压力监测系统、动力传动系统应用和弹簧质量状态估计。

- 汽车产业严重依赖感测技术来实现安全、娱乐、交通管理、导航和引导等各种功能。随着我们向自动驾驶汽车迈进,感测设备的使用预计将会扩大。虽然汽车中的实体感测器可能高成本且不可靠,但虚拟感测器正在成为汽车製造商的一种经济高效的解决方案。这些虚拟感测器可作为实体感测器的辅助安全措施,在增强驾驶员辅助系统 (ADAS) 并最终实现自动驾驶功能方面发挥关键作用。

- 汽车产业对 ADAS 功能的需求不断增长预计将推动该细分市场的成长。世界各国政府已采取各种措施来促进 ADAS 技术的采用,以确保车辆安全。此外,自动驾驶和自动驾驶汽车的成长趋势也有助于扩大市场。例如,英特尔预测,到 2030 年,全球汽车销售将超过 1.014 亿辆,其中自动驾驶汽车约占同年汽车註册量的 12%。

- 此外,人工智慧(AI)已在包括汽车行业在内的各个行业中变得至关重要。该领域的一项关键创新是 ADAS(高级驾驶员辅助系统)的创建,旨在提高车辆安全性并在各种驾驶情况下为驾驶员提供协助。 ADAS 技术具有减少事故和促进道路安全的潜力,因此德国、中国和印度等国家越来越多地采用该技术。这些驱动 ASAD 技术的因素可能会在市场上创造重大机会。

北美占据主要市场占有率

- 随着数位电子看板需求的增加,对高品质显示器的需求也在增加。由于显示、连接和监控空间方面的技术进步,数位电子看板在美国越来越受欢迎。此外,由于采用率的提高,显示面板的价格也大幅下降。

- 教育机构在建筑物的迎宾区和大厅区域的大型显示器上使用数位指示牌,在整个建筑物内广播活动讯息。

- 例如,2022 年 4 月,Busix 宣布威奇托州立大学为其 Metroplex 会议中心选择 AxisTV Signage Suite数位电子看板系统,扩大了其高等教育计划组合。完整的解决方案包括一个云端託管的 CMS、三个 Nano数位电子看板播放器和 10 个电子纸室 (E-Paper) 标牌,用于动态显示活动和会议。

- 随着行销和促销策略的发展,广告商更喜欢数位化促销而不是传统行销,这使得美国和加拿大成为市场相关人员的热门目的地。数位化指示牌还提供诸如提高观众参与度、减少纸张消费量、透过增加消费者影响力增加销售额以及具有成本效益的广告等优势,使其成为该地区实施的一个有吸引力的选择。

- 随着开拓供应商透过合作伙伴关係不断创新新的解决方案,该地区正在见证各种发展。

Micro LED产业概况

Micro LED 市场高度分散。主要厂商有群创光电、Sony Corporation、LG Display、Aledia SA、晶元光电等。公司正在采用合作伙伴关係和收购等策略来丰富其产品供应并获得可持续的竞争优势。

- 2024 年 1 月 - 群创光电 (Innolux) 推出全球首款 53 吋 QD 色彩转换 AM-Micro LED 无缝拼接显示器,可使用无缝拼接模组技术组装成任何尺寸的显示器。该技术可满足市场对110英寸至200英寸尺寸的高品质、超宽、超高显示器不断增长的需求。无缝拼接解决方案的饱和度和色彩均匀度比 OLED 高 1.07 倍。环境对比也比OLED高8倍。即使在正常照明条件下,这也是可以实现的。

- 2023 年 9 月SONY推出 VERONA,这是一款专为满足虚拟製作应用需求而打造的全新水晶 LED 显示器。这款新型显示器专为电影製作人量身定制,为机内视觉特效应用带来高水准的品质和效率。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场洞察

- 市场概况

- 产业价值链分析

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 买家/消费者的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争公司之间敌对关係的强度

- COVID-19 和其他宏观经济因素对市场的影响

第五章市场动态

- 市场驱动因素

- 对更亮、更节能的显示器的需求不断增长

- 扩大 Micro LED 在家用电子电器的应用

- 市场限制因素

- 巨量转移是Micro LED商业化的瓶颈

- 高成本,产能有限

第六章 市场细分

- 按用途

- 智慧型手錶

- 近视设备(AR 和 VR)

- 电视机

- 智慧型手机/平板电脑

- 显示器/笔记型电脑

- 抬头显示器

- 数位电子看板

- 按最终用户

- 消费性电子产品

- 车

- 航太/国防

- 其他最终用户

- 按地区

- 北美洲

- 欧洲

- 亚太地区

- 世界其他地区

第七章 竞争格局

- Vendor Positioning Analysis

- 公司简介

- Innolux Corporation

- Sony Corporation

- LG Display Co. Ltd

- Aledia SA

- Epistar Corporation

- Optovate Limited

- Rohinni LLC

- Samsung Electronics Co. Ltd

- JBD Inc.

- Plessey Semiconductors Limited

- Ostendo Technologies Inc.

- VueReal Inc.

- Allos Semiconductors

第八章投资分析

第9章 未来趋势

The Micro LED Market size is estimated at USD 0.74 billion in 2024, and is expected to reach USD 1.48 billion by 2029, growing at a CAGR of 81.80% during the forecast period (2024-2029).

Micro LED is a display technology that uses microscopic LEDs (light-emitting diodes) to create individual pixels. It offers high brightness, contrast, and energy efficiency. Micro LED displays are known for their potential to deliver superior picture quality and can be used in various applications, including TVs, monitors, and wearable devices.

Key Highlights

- The micro LED market has grown significantly over the years. This is primarily due to the advancement of technologies such as AR/VR and the expansion of end-user industries across various regions. For instance, the transition toward 5G accelerates the demand for advanced mobile devices.

- Micro LED technology provides advantages over LCDs and OLEDs in brightness, resolution, contrast ratio, energy consumption, lifetime, and thermal stability, opening new possibilities in the display industry.

- In May of 2023, the world's leading provider of long-distance wireless power solutions, Wi-Charge, introduced the industry's most energy-efficient and high-performance wirelessly charged video display solutions for retailers, brands, and marketers to deliver directly to consumers at the point-of-sale (POS) on store shelves, in queue lines, and at restaurant tables. Wi-Charge developed the larger Wi-Spot 7", its new generation of video displays, which is available immediately in response to growing worldwide customer demand.

- Micro LED technology has been making waves in the consumer electronics industry, promising significant advancements in display technology. With its unique features and advantages, micro LED can potentially disrupt how users experience visual content on various devices.

- Micro LED technology has gained significant attention in recent years due to its potential for superior performance compared to other display technologies. Micro LEDs offer higher pixel density, lower power consumption, faster response time, higher luminance in direct sunlight, and wider viewing angles. These attributes make them suitable for various applications, including handheld devices and near-eye displays.

- The COVID-19 pandemic delayed production, and some new projects in the industry were delayed as many companies temporarily closed their facilities and the supply chain was interrupted. New technological developments might be affected during the challenging time as well. LEDinside shares its insights toward Micro LED technology development in such global uncertainty. It points out that next-generation display technology might be a chance to move a step forward.

Micro LED Market Trends

Consumer Electronics to be the Largest End-user Industry

- The increasing usage of digital twin technology in the transportation industry is expected to drive the demand for virtual sensors. Digital twins have emerged as the most recent technological phenomenon in the transportation sector. Implementing digital twins in supply chains is enhancing the efficiency of supply chain networks on both local and global scales. By utilizing the data, transportation companies are able to predict their operations with exceptional precision. Significantly, this innovative technology also aids in generating valuable insights to enhance corporate strategies.

- Virtual sensors are increasingly becoming crucial for the automotive industry due to their wide variety of applications. The growing adoption of virtual sensors in the industry will enable the market to gain traction over the forecast period. Amidst this costly sensory inflation, the adoption of virtual sensors has become prevalent. Virtual sensors entail replacing a physical sensor with software embedded in the vehicle's electronic control unit. The objective is to acquire essential information without the need for a physical component. Numerous vehicle parts, including tires, engines, and cabins, are embedded with these virtual sensors. Virtual sensing is widely employed in automotive applications, such as passenger thermal comfort, tire pressure monitoring systems, powertrain applications, estimation of sprung mass state, and others.

- The automotive sector depends significantly on sensing technology for various functions such as safety, entertainment, traffic management, navigation, and guidance. With the advancement toward autonomous vehicles, sensing device usage is expected to grow. Despite the high cost and occasional unreliability of physical sensors in vehicles, virtual sensors are emerging as a cost-effective solution for car makers. These virtual sensors serve as a secondary safety measure to physical sensors and play a crucial role in enhancing driver assistance systems (ADAS) and ultimately achieving autonomous driving capabilities.

- The growing demand for ADAS features in the automotive industry is expected to drive the segment's growth. Several governments worldwide are implementing various measures to boost the adoption of ADAS technology to ensure vehicle safety. Furthermore, the increasing trend of autonomous or self-driving vehicles is also playing a role in the expansion of the market. As an illustration, Intel predicts that worldwide car sales will exceed 101.4 million units by 2030, with autonomous vehicles projected to make up approximately 12% of car registrations by the same year.

- Furthermore, Artificial Intelligence (AI) has become vital in various industries, including the automotive sector. A significant innovation in this field is the creation of advanced driver assistance systems (ADAS), designed to enhance vehicle safety and assist drivers in different driving situations. The adoption of ADAS technology is increasing in countries such as Germany, China, and India, as it has the potential to reduce accidents and promote road safety. Such factors in boosting ASAD technology may present significant opportunities for the market.

North America to Hold Significant Market Share

- The increasing demand for digital signage creates a need for high-quality displays. Digital signage is becoming popular in the United States with technological advancements in display, connectivity, and monitoring space. Furthermore, the increasing adoption has decreased the prices of display panels significantly.

- Educational institutions are adopting digital signages for huge displays in the building's pre-function and lobby areas to broadcast building-wide event messaging, with directional navigation arrows to direct people to the appropriate conference rooms.

- For instance, in April 2022, Visix Inc. expanded its portfolio of higher education projects by announcing that Wichita State University has chosen an AxisTV Signage Suite digital signage system for its Metroplex convention center. The entire solution includes a cloud-hosted CMS, three Nano digital signage players, and ten Electronic Paper Room (E-Paper) Signs, which dynamically display events and meetings as they happen.

- As marketing and promotional strategies evolve, advertisers favor digitized promotion over traditional marketing, and the United States and Canada are popular destinations for market players. Other advantages of digitized signage, such as higher audience engagement, reduced paper consumption, increased sales due to improved consumer influence, and cost-effective advertising, drive their implementation in the region.

- The region is witnessing various developments as vendors operating in the market are continuously innovating new solutions through partnerships.

Micro LED Industry Overview

The micro LED market is highly fragmented. Some major players are Innolux Corporation, Sony Corporation, LG Display Co. Ltd, Aledia SA, and Epistar Corporation. Companies are adopting strategies such as partnerships and acquisitions to improve their product offerings and gain sustainable competitive advantage.

- January 2024 - Innolux Corp (Innolux) introduced the world's first 53-inch QD color conversion AM-Micro LED seamless tiling displays that can be used to assemble displays of any size using seamless tiling module technology. This technology can meet the growing market demand for high-quality, ultra-wide, and ultra-tall displays measuring 110-200 inches in size. The seamless tiling solution offers high color saturation and color uniformity, which is 1.07 times higher than OLED. It also has a higher ambient contrast ratio, which is eight times higher than OLED. This, among other benefits, can be achieved even under normal lighting conditions.

- September 2023 - Sony launched the VERONA, a new Crystal LED display built to meet the needs of virtual production applications. The new displays are tailored for filmmakers, bringing higher levels of quality and efficiency to in-camera VFX applications.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitutes

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Impact of COVID-19 Aftereffects and Other Macroeconomic Factors on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Demand For Brighter and More Power-efficient Displays

- 5.1.2 Increasing Applications of Micro-LED In Consumer Electronics

- 5.2 Market Restraints

- 5.2.1 Mass Transfer to be a Bottleneck for Commercialization of Micro LED

- 5.2.2 High Cost of Manufacturing, Implementation and Limited Production Capacities

6 MARKET SEGMENTATION

- 6.1 By Application

- 6.1.1 Smartwatch

- 6.1.2 Near-to-eye Devices (AR and VR)

- 6.1.3 Television

- 6.1.4 Smartphone and Tablet

- 6.1.5 Monitor and Laptop

- 6.1.6 Head-up Display

- 6.1.7 Digital Signage

- 6.2 By End User

- 6.2.1 Consumer Electronics

- 6.2.2 Automotive

- 6.2.3 Aerospace and Defense

- 6.2.4 Other End Users

- 6.3 By Geography

- 6.3.1 North America

- 6.3.2 Europe

- 6.3.3 Asia-Pacific

- 6.3.4 Rest of the World

7 COMPETITIVE LANDSCAPE

- 7.1 Vendor Positioning Analysis

- 7.2 Company Profiles*

- 7.2.1 Innolux Corporation

- 7.2.2 Sony Corporation

- 7.2.3 LG Display Co. Ltd

- 7.2.4 Aledia SA

- 7.2.5 Epistar Corporation

- 7.2.6 Optovate Limited

- 7.2.7 Rohinni LLC

- 7.2.8 Samsung Electronics Co. Ltd

- 7.2.9 JBD Inc.

- 7.2.10 Plessey Semiconductors Limited

- 7.2.11 Ostendo Technologies Inc.

- 7.2.12 VueReal Inc.

- 7.2.13 Allos Semiconductors

![Micro LED市场:趋势、机会与竞争分析 [2024-2030]](/sample/img/cover/42/1497021.png)