|

市场调查报告书

商品编码

1523335

校车:市场占有率分析、产业趋势、成长预测(2024-2029)School Bus - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

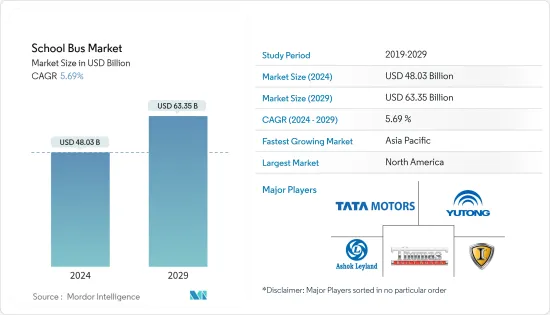

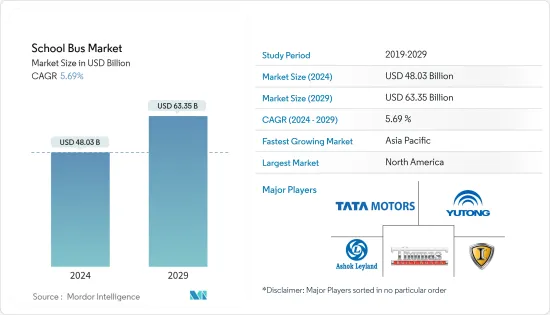

校车市场规模预计到 2024 年为 480.3 亿美元,预计到 2029 年将达到 633.5 亿美元,在预测期内(2024-2029 年)复合年增长率为 5.69%。

多种因素正在重塑学生交通,校车市场正在改变。对学生安全的日益关注推动了对技术先进公车的需求。此外,世界各国政府支持教育基础设施的努力正在支持经济成长。 2023年,按地区划分,北美将占据压倒性的市场占有率,其次是欧洲、亚太地区、拉丁美洲和中东/非洲。

此外,快速的都市化和人口成长是需要创新解决方案来优化路线和缓解拥塞的关键因素。在世界向永续性转变的推动下,对电动校车的需求不断增长,正在为市场创造成长机会。人们对零排放电动公车的兴趣也激增。用于路线优化的人工智慧和支援物联网的维护监控等先进技术的集成为市场参与者提供了实现产品差异化的巨大机会。

此外,采用包括即时追踪、维护计划和资料分析在内的车队管理解决方案已成为关键趋势。这使得教育机构能够优化业务、提高安全性并降低整体成本。然而,教育机构,特别是新兴国家的教育机构,面临预算限制,使得市场扩张成为一个问题。

校车製造商、技术提供者和教育机构之间的合作促进创新。这种合作伙伴关係对于满足市场的多样化需求并提供全面、整合的解决方案至关重要。

儘管仍存在许多挑战,但校车市场预计将继续其成长轨迹。

校车市场趋势

由于电动校车销量增加,预计未来几年将出现成长

到 2035 年,政府对采用电动车和销售电动车的奖励、油价上涨、污染水平上升、环保意识增强、营业成本低于 ICE 出行以及欧洲、中国和印度等各个主要市场都将增加。到2020 年将禁止新销售内燃机汽车,该技术在全球迅速流行。

全球超过 95% 的校车使用石化燃料,尤其是柴油。大量研究表明,吸入柴油引擎废气会导致呼吸道疾病,这种疾病在作为主要通勤者的儿童中普遍存在。如果我们用电动公车替换美国所有校车,我们每年将平均避免 530 万吨温室气体排放。

电动公车零排放气体,每年营运成本几乎是柴油公车的一半。在中国深圳,电动公车的奖励将扩大到包括校车,电动公车的使用量预计将增加。电动公车正在美国加州、纽约州、加拿大魁北克省进行测试和引进,预计将成为市场成长的驱动力。美国加州处于采用电动校车的最前线。例如,2022年11月,美国加州宣布将追加投资18亿美元用于校车电气化。该州已斥资 12 亿美元对其校车车队进行电气化改造。

此外,随着欧盟委员会宣布从2035年起欧洲将禁止销售内燃机车辆,欧洲校车电动化也正在取得进展。

此外,校车市场的领导企业也积极响应这项需求,透过研究、併购、策略联盟等方式,在电动客车领域取得竞争优势。例如

2022年10月,比亚迪与洛斯奥利沃斯小学区签署协议,使其成为美国第一个安装100%零排放公车的学区。

2022年5月,总部位于加拿大不列颠哥伦比亚省温哥华的Greenpower Motor宣布将在美国市场推出名为Nano BEAST(电池电动车学校运输)的新型A型电池电动校车。

因此,校车电动化预计将推动校车市场的成长。

北美在校车市场开拓中发挥重要作用

北美拥有完善且广泛的学校交通系统,许多学校和教育机构都严重依赖校车来运送学生。此外,该地区的人口密度和地理位置也大大增加了对校车的需求,特别是在步行到达学校不方便的郊区和农村地区。

北美的经济繁荣也发挥着至关重要的作用,促进了对教育和相关基础设施的大量投资,包括不断更新和扩大我们的校车车队。美国和加拿大对校车实施严格的安全法规,为具有先进安全功能的车辆创造了不断增长的市场。例如

在美国,拜登政府推出了清洁校车(CSB)计划,作为两党基础设施法案的一部分。该倡议旨在用低排放或零排放气体的新车型取代目前使用石化燃料的校车。重点是推广环保且有助于学童健康的公车。

此外,美国环保署 (EPA) 也透过实施温室气体 (GHG) 第三阶段计画发挥了重要作用,该计画实施了更严格的排放标准。此外,在北美,丙烷(也称为液化天然气 (LNG))也奖励,并作为低排放气体选项纳入 CSB 计划。

此外,政府资金和补贴进一步刺激市场,并为教育机构投资现代高效公车提供财政支持。此外,北美是技术进步的早期采用者,例如整合先进的安全功能和探索替代燃料,增加了整个校车市场的成长潜力。例如

2022年10月,戴姆勒卡车北美子公司ThomasBuiltBuses宣布交付美国印第安纳州门罗县公立学校第200辆Proterra动力Saf-T-LinerC2Jouley电池电动式校车。

亚太和欧洲校车市场的推动因素还包括儿童上下学安全交通途径的需求不断增长,以及中国和印度等市场家长为孩子提供校车服务的能力不断增强。 、儿童入学率的增加以及主要客车製造商在这些市场的存在,预计将出现成长。

校车行业概况

校车市场适度整合。该市场的特点是拥有来自世界各地的主要校车製造商以及也向其他国家供货的当地校车製造商。来自美国、中国和印度的製造商主要主导市场。这些参与者也参与合资、併购、新产品发布和产品开拓,以扩大其品牌组合併巩固其市场地位。

主导全球市场的一些主要企业包括 ThomasBuilt Buses、宇通客车有限公司、塔塔汽车有限公司、Ashok Leyland Ltd 和 IC Bus。主要企业正在争取大订单并推出新产品,以确保其市场地位并保持市场领先地位。例如,2022年4月,领先的全电动式中型和重型卡车製造商Lion Electric公司宣布为魁北克省订单50辆全电动式LIONC级校车。 2022 年 9 月,伦敦德怀特学校与全球智慧公车运输公司 Zeelo 合作推出电动公车服务。这项措施预计将使伦敦德怀特学校的碳排放每年减少 33%。

此外,2022 年 5 月,First Student 将从 Lion Electric 采购的电动巴士引入其网路。 First Student 的目标是最终在其网路上拥有 250 辆电动公车。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第一章简介

- 调查先决条件

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场动态

- 市场驱动因素

- 全球政府支持教育基础设施的努力推动成长

- 市场限制因素

- 有关排放气体和安全的严格监管合规标准构成障碍

- 产业吸引力-波特五力分析

- 新进入者的威胁

- 买家/消费者的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争公司之间敌对关係的强度

第五章 市场区隔(金额单位)

- 依推进类型

- 内燃机(ICE)

- 压缩天然气(CNG)/液化天然气(LNG)

- 电动和混合

- 按容量设计类型

- A型

- B型

- C型

- D型

- 按地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 北美其他地区

- 欧洲

- 德国

- 英国

- 法国

- 俄罗斯

- 西班牙

- 其他欧洲国家

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 其他亚太地区

- 世界其他地区

- 南美洲

- 中东/非洲

- 北美洲

第六章 竞争状况

- 供应商市场占有率

- 公司简介

- Thomas Built Buses Inc.

- Collins Bus Corporation

- IC Bus(Navistar International Corporation)

- Blue Bird Corporation

- Lion Electric Company

- Yutong Buses Co. Ltd

- Anhui Ankai Automobile

- JCBL Limited

- Tata Motors

第七章 市场机会及未来趋势

- 公车中人工智慧和物联网技术的整合提供了未来的成长机会

第八章市场规模与单位销售预测

第九章 各地方政府校车安全监理标准

The School Bus Market size is estimated at USD 48.03 billion in 2024, and is expected to reach USD 63.35 billion by 2029, growing at a CAGR of 5.69% during the forecast period (2024-2029).

The school bus market is transforming, driven by multiple factors reshaping student transportation. Growing concerns for student safety are fuelling the demand for technologically advanced buses. Additionally, government initiatives worldwide supporting education infrastructure are propelling growth. In 2023, the regional market share was dominated by North America, followed by Europe, Asia-Pacific, Latin America, and the Middle-East and Africa.

Furthermore, rapid urbanization and population growth are key drivers necessitating innovative solutions for route optimization and congestion reduction. The growing demand for electric school buses, driven by a global shift toward sustainability, presents growth opportunities for the market. There has also been a surge in interest in zero-emission, electric-powered buses. Integrating advanced technologies, including artificial intelligence for route optimization and IoT-enabled maintenance monitoring, presents a significant opportunity for market players to differentiate their offerings.

Moreover, the adoption of fleet management solutions, encompassing real-time tracking, maintenance scheduling, and data analytics, is emerging as a key trend. This allows educational institutions to optimize operations, enhance safety, and reduce overall costs. However, budget constraints in educational institutions, especially in developing regions, pose challenges for market expansion.

Collaboration between school bus manufacturers, technology providers, and educational institutions fosters innovation. These partnerships are essential in addressing the market's diverse needs and providing comprehensive, integrated solutions.

Despite all the challenges, the school bus market is expected to continue its growth trajectory in the coming years.

School Bus Market Trends

Growing Sales of Electric School Buses to Witness Growth in Coming Years

Electromobility is gaining pace across the world due to the government incentives provided to the adoption of electromobility and sales of electric vehicles, rising oil prices, increasing pollution levels, growing environmental consciousness, lower operating costs than ICE mobility, and announcements by various major markets like Europe, China, and India to ban new sales of IC engine vehicles by 2035.

More than 95% of school buses worldwide run on fossil fuels, especially diesel. Numerous studies show that inhaling diesel exhaust causes respiratory diseases, seen widely in children, who are the main commuters. Replacing all the school buses only in the United States with electric buses would avoid an average of 5.3 million tons of greenhouse gas emissions yearly.

Electric buses emit zero emissions, and their annual operating cost is almost half that of diesel buses. In Shenzhen, China, it is expected that the incentives for electric transit buses will also be extended to school buses, thus increasing their adoption. A few states in the United States, such as California and New York, and Quebec in Canada, are also testing and adopting electric buses, which is expected to drive the growth of the market. The state of California in the United States is at the forefront of adopting electric school buses. For instance, in November 2022, the state of California in the United States announced the investment of another USD 1.8 billion in the electrification of school buses. The state has spent USD 1.2 billion on the electrification of school buses so far.

Furthermore, the electrification of school buses in Europe is also rising due to the announcement of the European Commission to ban the sales of IC engine vehicles in Europe from 2035.

In addition, leading players in the school bus market are actively catering to this demand through research, mergers and acquisitions, strategic collaborations, etc, to gain a competitive edge in the electric bus segment. For instance,

In October 2022, BYD signed a deal with Los Olivos Elementary School District to create the first US school district with a 100% zero-emissions bus fleet.

In May 2022, Greenpower Motor Co., based in Vancouver, British Columbia, Canada, unveiled a new Type A battery electric school bus named Nano BEAST (Battery Electric Automotive School Transportation) for the US market.

Thus electric segment of school buses is anticipated to drive the growth of the school bus market.

North America to Play a Key Role in the Development of the School Bus Market

With a well-established and extensive school transportation system, North America boasts many schools and educational institutions that heavily rely on school buses for student transportation. Additionally, the region's population density and geographic factors contribute significantly to the demand for school buses, especially in suburban and rural areas where schools are not easily accessible by foot.

The economic prosperity of North America also plays a pivotal role, allowing substantial investments in education and related infrastructure, including the consistent update and expansion of school bus fleets. The United States and Canada enforce stringent safety regulations for school buses, fostering a market for vehicles with advanced safety features. For instance,

In the United States, the Biden administration has rolled out the 'Clean School Bus' (CSB) program as part of the Bipartisan Infrastructure Law. This initiative aims to replace current school buses running on fossil fuels with newer low- or zero-emission models. The key focus is on promoting buses that are environmentally friendly and contribute to the health of school children.

Furthermore, the Environmental Protection Agency (EPA) also plays a crucial role by implementing the Green House Gases (GHG) phase 3 program, which enforces stricter emission standards. Additionally, North America also provides incentives for propane, also known as liquefied natural gas (LNG), and it is included in the CSB program as a low-emission option.

Moreover, government funding and subsidies further fuel the market, providing financial support for educational institutions to invest in modern and efficient buses. Additionally, North America's early adoption of technological advancements, such as integrating advanced safety features and exploring alternative fuels, increases the overall growth potential of the school bus market. For instance,

In October 2022, Thomas Built Buses, a subsidiary of Daimler Truck North America, announced the delivery of the 200th Proterra Powered Saf -T-Liner C2 Jouley battery-electric school bus to Monroe County Public Schools in Indiana, United States.

The market for school buses in Asia-Pacific and Europe is also expected to grow rapidly due to the growing demand for safe and secure transportation for school-going children, rising disposable incomes of parents in markets like China and India who now can afford school bus services for their children, rising sales of electric school buses in Europe, increasing enrolment of children in schools, and the presence of large bus manufacturers in these markets.

School Bus Industry Overview

The school bus market is moderately consolidated. The market is characterized by the presence of major global and local school bus manufacturers who also cater to other countries. The United States, China, and India players mainly dominate the market. These players also engage in joint ventures, mergers and acquisitions, new product launches, and product development to expand their brand portfolios and cement their market positions.

Some of the major players dominating the global market are Thomas Built Buses, Yutong Bus Co., Tata Motors Ltd, Ashok Leyland Ltd, and IC Bus. Key players are securing large orders and launching new products to secure their market position and stay ahead of the market curve. For instance, in April 2022, Lion Electric Company, a leading all-electric medium and heavy truck manufacturer, announced that it had received an order for 50 all-electric school buses of the LIONC segment for the province of Quebec. In September 2022, Dwight School London introduced electric bus services in partnership with the global smart bus transport company Zeelo. The initiative is expected to reduce the carbon emissions of Dwight School London by as high as 33% annually.

Additionally, in May 2022, First Student introduced electric school buses in its network with the buses procured from Lion Electric Company. First Student aims to eventually induct 250 electric school buses into its network.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Drivers

- 4.1.1 Government Initiatives Worldwide Supporting Education Infrastructure are Propelling Growth

- 4.2 Market Restraints

- 4.2.1 Stringent Regulatory Compliance Standards Related to Emissions and Safety Present Hurdles

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Threat of New Entrants

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Bargaining Power of Suppliers

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION (VALUE IN USD BILLION)

- 5.1 By Propulsion Type

- 5.1.1 Internal Combustion Engine (ICE)

- 5.1.2 Compressed Natural Gas (CNG)/ Liquified Natural Gas (LNG)

- 5.1.3 Electric and Hybrid

- 5.2 By Capacity Design Type

- 5.2.1 Type A

- 5.2.2 Type B

- 5.2.3 Type C

- 5.2.4 Type D

- 5.3 By Geography

- 5.3.1 North America

- 5.3.1.1 United States

- 5.3.1.2 Canada

- 5.3.1.3 Mexico

- 5.3.1.4 Rest of North America

- 5.3.2 Europe

- 5.3.2.1 Germany

- 5.3.2.2 United Kingdom

- 5.3.2.3 France

- 5.3.2.4 Russia

- 5.3.2.5 Spain

- 5.3.2.6 Rest of Europe

- 5.3.3 Asia-Pacific

- 5.3.3.1 China

- 5.3.3.2 India

- 5.3.3.3 Japan

- 5.3.3.4 South Korea

- 5.3.3.5 Rest of Asia-Pacific

- 5.3.4 Rest of the World

- 5.3.4.1 South America

- 5.3.4.2 Middle-East and Africa

- 5.3.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Vendor Market Share

- 6.2 Company Profiles*

- 6.2.1 Thomas Built Buses Inc.

- 6.2.2 Collins Bus Corporation

- 6.2.3 IC Bus (Navistar International Corporation)

- 6.2.4 Blue Bird Corporation

- 6.2.5 Lion Electric Company

- 6.2.6 Yutong Buses Co. Ltd

- 6.2.7 Anhui Ankai Automobile

- 6.2.8 JCBL Limited

- 6.2.9 Tata Motors

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Integration of AI and IoT enabled Technologies in Buses Presents Growth Opportunities for Future