|

市场调查报告书

商品编码

1523350

全球高温涂料市场:市场占有率分析、产业趋势/统计、成长预测(2024-2029)High Temperature Coatings - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

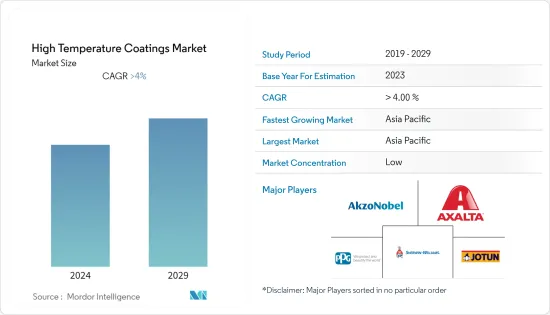

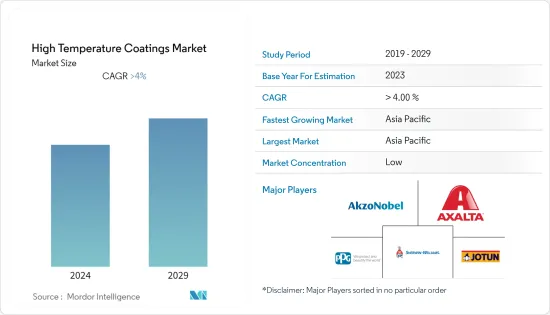

预计2024年全球高温涂料市场规模将达到37.1亿美元,并在2024-2029年预测期内以超过4%的复合年增长率成长,到2029年将达到47.3亿美元。

高温涂料市场受到 COVID-19 大流行的负面影响。多个国家实施了全国封锁,严格的社会疏散措施对建筑、汽车和石化行业产生了不利影响。然而,在COVID-19大流行之后,建筑建设活动和汽车製造厂恢復运营,导致高温涂料市场復苏。

主要亮点

- 石化产业需求的增加以及对无溶剂高温涂料偏好的改变预计将推动目前的研究市场。

- 另一方面,严格的环境法规和原材料价格的波动预计将阻碍市场成长。

- 新兴经济体和基础设施计划的成长预计将在预测期内为市场创造机会。

- 预计亚太地区将主导市场。由于中国、印度和日本等国家消费量的增加,预计在预测期内复合年增长率将保持最高。

高温涂料市场趋势

石化产业需求不断成长

- 石化产业不断面临侵蚀、腐蚀、化学侵蚀、磨损和机械损坏等问题,这些问题会导致基础设施和设备随着时间的劣化。

- 高温涂层设计可承受 150°C 至 800°C 的温度。它有助于最大限度地减少热损失、抑制隔热材料下的腐蚀、保持热疲劳并保持效率。

- 能源和石化行业由于使用热处理设备、分离器、熔炉和加热材料的运输而成为重要的消费者。高温涂层有助于减少能量损失并减少非生产时间。

- 在亚太地区,由于新石化厂的建设,耐热涂料的需求不断增加。例如,中国计画并宣布兴建305座石化工厂,到2030年总产能约1.524亿吨。此外,同期资本支出预计将达到915亿美元。

- 同样,在北美,由于各个最终用户产业对石化产品的需求增加,石化产业录得显着成长。陆上/海上探勘和生产活动的成长、精製和石化厂的高速成长以及其他化工厂(包括製药厂)的建设和现代化推动了该地区对高温涂料的需求。

- 此外,根据VCI统计,石化产品出口额不断增加,带动耐热涂料市场。 2022年,中国石化产品出口额达673亿美元,成为全球第一大出口国。美国和荷兰分居第二和第三位,出口额分别为438亿美元和364亿美元。

- 由于上述因素,石化产业对高温涂料的需求预计在预测期内将会增加。

亚太地区主导市场

- 亚太地区是最大且成长最快的高温涂料市场。高经济成长率、製造业成长、低成本劳动力、外国投资增加、终端用户产业需求增加以及全球生产从已开发国家转移到新兴国家是推动该地区市场成长的主要因素。

- 该地区建筑、石化和汽车行业的不断增长进一步推动了该地区对高温涂料的需求。在汽车和石化工业中,高温涂料被用作保护涂层。

- 中国是亚太地区最大的建筑市场之一。根据中国国家统计局的数据,2022年中国建筑产值将增加至31.2兆元(4.34兆美元),而2021年将达到29.31兆元人民币(4.84兆美元)。此外,用作投资房产的住宅的需求正在增加。预计到2030年,中国的建筑支出将达到约13兆美元,高温涂料市场前景看好。

- 中国是该地区最大的汽车製造商。根据OICA(国际汽车製造商组织)预计,2022年中国汽车产量将达2,702万辆,与前一年同期比较同期成长3%。

- 印度成为该地区第二大汽车製造商。根据OICA的数据,2022年汽车产量达到545万辆,比2021年的439万辆增加24%。因此,汽车产量的增加预计将提振汽车涂料的需求并带动高温涂料市场。

- 同样,在印度,石化产业近年来也经历了显着成长。据化学和石化部称,印度化学和石化(CPC)产业预计到2022年将达到1,780亿美元,2025年将达到3,000亿美元。因此,化学和石化行业的成长预计将推动该国对高温涂料的需求。

- 由于上述因素,亚太地区预计对高温涂料的需求在预测期内将大幅成长。

高温涂料产业概况

高温涂料市场分为几个部分。该市场的主要企业包括(排名不分先后)Akzo Nobel NV、Axalta Coating Systems、Jotun、PPG Industries Inc. 和 The Sherwin-Williams Company。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第一章简介

- 调查先决条件

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场动态

- 促进因素

- 石化产业需求不断成长

- 改变对无溶剂高温涂料的偏好

- 其他司机

- 抑制因素

- 严格的环境法规

- 原物料价格波动

- 产业价值链分析

- 波特五力分析

- 供应商的议价能力

- 买方议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争程度

第五章市场区隔(市场规模:金额)

- 类型

- 环氧树脂

- 硅胶

- 聚酯纤维

- 丙烯酸纤维

- 醇酸

- 其他类型(聚氨酯、乙烯基酯等)

- 科技

- 水性的

- 溶剂型

- 粉末

- 最终用户产业

- 航太/国防

- 车

- 石油化学

- 建筑/施工

- 其他最终用户产业(船舶、水处理等)

- 地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 马来西亚

- 泰国

- 印尼

- 越南

- 其他亚太地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 义大利

- 法国

- 西班牙

- 北欧的

- 土耳其

- 俄罗斯

- 欧洲其他地区

- 南美洲

- 巴西

- 阿根廷

- 哥伦比亚

- 南美洲其他地区

- 中东/非洲

- 奈及利亚

- 卡达

- 埃及

- UAE

- 沙乌地阿拉伯

- 南非

- 其他中东/非洲

- 亚太地区

第六章 竞争状况

- 併购、合资、联盟、协议

- 市场占有率(%)/排名分析

- 主要企业策略

- 公司简介

- Akzo Nobel NV

- Aremco

- Axalta Coating Systems

- Carboline

- Chemcote PTY LTD

- GENERAL MAGNAPLATE CORPORATION

- Hempel A/S

- Jotun

- PPG Industries Inc.

- The Sherwin-Williams Company

- Valspar

第七章 市场机会及未来趋势

- 新兴经济体的成长和基础建设计划

- 其他机会

The High Temperature Coatings Market size is estimated at USD 3.71 billion in 2024, and is expected to reach USD 4.73 billion by 2029, growing at a CAGR of greater than 4% during the forecast period (2024-2029).

The high temperature coatings market had negatively affected by the COVID-19 pandemic. Due to nationwide lockdowns in several countries, strict social distancing measures negatively affected the building and construction, automotive, and petrochemical industries. However, post-COVID pandemic, the building construction activities and automotive manufacturing plants resumed their operations, which helped to revive the market for high-temperature coatings.

Key Highlights

- The growing demand from petrochemical industries and the shift in preference towards solvent-free high-temperature coatings is expected to drive the current studied market.

- On the flip side, the stringent environmental regulations and the volatility in raw material prices are expected to hinder the growth of the market.

- The growth of emerging economies and infrastructure projects is expected to create opportunities for the market during the forecast period.

- The Asia-Pacific region is expected to dominate the market. It is also expected to register the highest CAGR during the forecast period owing to the increasing consumption from countries such as China, India, and Japan.

High Temperature Coatings Market Trends

Growing Demand from Petrochemical Industry

- The petrochemical industry is constantly faced with problems like erosion, corrosion, chemical attack, wear, abrasion, and mechanical damage, which cause deterioration of infrastructure and equipment over time.

- High-temperature coatings are designed to withstand temperatures from 150°C to 800°C. It helps minimize heat losses, keep corrosion under insulation in check, maintain thermal fatigue, and maintain efficiency.

- Energy and Petrochemical industries are among the critical consumers owing to the use of heater-treaters, separators, furnaces, and the transport of heated materials. High-temperature coatings help decrease energy losses and reduce non-productive time.

- In the Asia-Pacific region, the demand for heat-resistant coatings is increasing with the development of new petrochemical plants. For instance, China has 305 planned and announced petrochemical plants, with a total capacity of about 152.4 mtpa by 2030. China is also expected to reach a capital expenditure of USD 91.5 billion over the same period.

- Similarly, in North America, the petrochemical industry registered a significant growth rate due to rising demand for petrochemicals from various end-user industries. The growth in onshore/offshore exploration and production activities, high growth observed in oil refineries and petrochemical plants, and the building and modernization of other chemical plants (which include pharmaceuticals) boosted the demand for high-temperature coatings in the region.

- Furthurmore according to VCI statistics the export value of petrochemicals is rising therbey driving the market for heat resistant coatings. China exported over USD 67.3 billion worth of petrochemicals in 2022, becoming the world's major exporting country. The United States and the Netherlands followed second and third, with an export value of USD 43.8 billion and USD 36.4 billion.

- Owing to the above-mentioned factors, the demand for high-temperature coatings from the petrochemical industry is expected to increase over the forecast period.

Asia-Pacific Region to Dominate the Market

- The Asia-Pacific region represents the largest and fastest-growing market for high-temperature coatings. High economic growth rate, growing manufacturing industries, low-cost labor, increasing foreign investments, increasing demand from end-user industries, and the global shift in production from developed countries to emerging countries in the region are some of the major factors leading to the growth of the market in the region.

- The escalating growth of the construction, petrochemical, and automotive industries in the region is further driving the demand for high-temperature coatings in the region. In the automotive and petrochemical industries the high temperature coatings are used as protective coatings.

- China is one of the largest construction markets in the Asia-Pacific region. According to the National Bureau of Statistics of China, the output value of construction works in the country accounted for CNY 31.2 trillion (USD 4.34 trillion) in 2022, as compared to CNY 29.31 trillion (USD 4.084 trillion) in 2021. Additionally, demand is increased for residences that are used as investment properties. China is expected to spend nearly USD 13 trillion on buildings by 2030, creating a positive market outlook for high temperature coatings.

- China is the largest automotive vehicle manufacturer in the region. According to OICA (The Organisation Internationale des Constructeurs d'Automobiles), automotive vehicle production in China reached a total of 27.02 million units in 2022, an increase of 3% over the previous year for the same period.

- India has become the second-largest automotive vehicle manufacturer in the region. According to OICA, the total production volume of automotive vehicles reached 5.45 million units in 2022, indicating a growth of 24% as compared to 4.39 million units registered in 2021. Thus, the increase in the production of automotive vehicles is expected to drive the demand for automotive coatings, thereby driving the market for high temperature coatings.

- Similarly in India the petrochemical industry registered a significant growth in recent years. According to the Department of Chemicals & Petrochemicals, India's chemical and petrochemical (CPC) industry registered USD 178 billion in 2022, and it is expected to reach USD 300 billion by 2025. Thus the growth in chemical and petrochemical industries is expected to drive the demand for high temperature coatings in the country.

- Owing to the above mentioned factors, the demand for high-temperature coatings in Asia-Pacific region is expected to grow considerably over the forecast period.

High Temperature Coatings Industry Overview

The high-temperature coatings market is partially fragmented in nature. Some of the major players in the market (not in any particular order) include Akzo Nobel N.V., Axalta Coating Systems, Jotun, PPG Industries Inc., and The Sherwin-Williams Company, among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Growing Demand from Petrochemical Industry

- 4.1.2 Shift in Preference Toward Solvent-Free High Temperature Coatings

- 4.1.3 Other Drivers

- 4.2 Restraints

- 4.2.1 Stringent Environmental Regulations

- 4.2.2 Volatility in Raw Material Prices

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Value)

- 5.1 Type

- 5.1.1 Epoxy

- 5.1.2 Silicone

- 5.1.3 Polyester

- 5.1.4 Acrylic

- 5.1.5 Alkyd

- 5.1.6 Other Types (Polyurethane, Vinyl Ester, etc.)

- 5.2 Technology

- 5.2.1 Water based

- 5.2.2 Solvent based

- 5.2.3 Powder

- 5.3 End-user Industry

- 5.3.1 Aerospace and Defense

- 5.3.2 Automotive

- 5.3.3 Petrochemical

- 5.3.4 Building and Construction

- 5.3.5 Other End-user Industries (Marine, Water Treatment, etc.)

- 5.4 Geography

- 5.4.1 Asia-Pacific

- 5.4.1.1 China

- 5.4.1.2 India

- 5.4.1.3 Japan

- 5.4.1.4 South Korea

- 5.4.1.5 Malaysia

- 5.4.1.6 Thailand

- 5.4.1.7 Indonesia

- 5.4.1.8 Vietnam

- 5.4.1.9 Rest of Asia-Pacific

- 5.4.2 North America

- 5.4.2.1 United States

- 5.4.2.2 Canada

- 5.4.2.3 Mexico

- 5.4.3 Europe

- 5.4.3.1 Germany

- 5.4.3.2 United Kingdom

- 5.4.3.3 Italy

- 5.4.3.4 France

- 5.4.3.5 Spain

- 5.4.3.6 NORDIC

- 5.4.3.7 Turkey

- 5.4.3.8 Russia

- 5.4.3.9 Rest of Europe

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Colombia

- 5.4.4.4 Rest of South America

- 5.4.5 Middle-East and Africa

- 5.4.5.1 Nigeria

- 5.4.5.2 Qatar

- 5.4.5.3 Egypt

- 5.4.5.4 UAE

- 5.4.5.5 Saudi Arabia

- 5.4.5.6 South Africa

- 5.4.5.7 Rest of Middle-East and Africa

- 5.4.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share (%)**/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 Akzo Nobel N.V.

- 6.4.2 Aremco

- 6.4.3 Axalta Coating Systems

- 6.4.4 Carboline

- 6.4.5 Chemcote PTY LTD

- 6.4.6 GENERAL MAGNAPLATE CORPORATION

- 6.4.7 Hempel A/S

- 6.4.8 Jotun

- 6.4.9 PPG Industries Inc.

- 6.4.10 The Sherwin-Williams Company

- 6.4.11 Valspar

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 The Growth of Emerging Economies and Infrastructure Projects

- 7.2 Other Opportunities