|

市场调查报告书

商品编码

1523352

全球汽车印刷电路基板(PCB)市场:市场占有率分析、产业趋势/统计、成长预测(2024-2029)Automotive Printed Circuit Board (PCB) - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

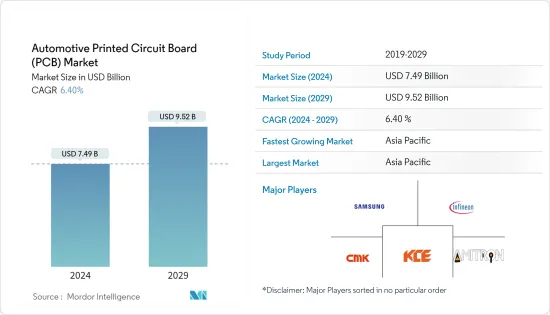

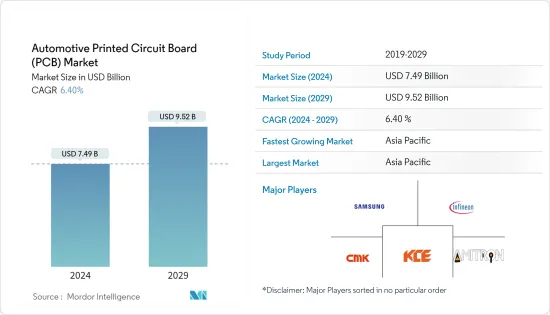

2024年全球汽车印刷电路基板(PCB)市场规模将达到74.9亿美元,2024-2029年预测期间复合年增长率为6.40%,预计2029年将达到95.2亿美元。

汽车电气系统使用的增加、对汽车驾驶员舒适性和安全性的需求不断增长以及汽车行业的显着扩张预计将成为预测期内市场成长的主要驱动力。

此外,随着汽车自动化的广泛普及以及全球联网汽车需求的不断增长,汽车 PCB 的需求预计在预测期内将大幅成长。

人工智慧 (AI)、云端和物联网设备的整合改善和增强了车辆和车辆间通讯。情绪识别、行为识别和个人助理等人工智慧技术正在推动安全性和车辆即市场等场景的成长,这反过来又可能推动对汽车电力电子元件的需求。这样,就进一步促进了目标市场的发展。

从长远来看,工业巨头加大研发投入、电动和混合动力汽车销量增加以及联网汽车需求上升将创造汽车和交通产业的需求,汽车印刷基板的销售将快速成长。

市场主要企业正在扩大产能,以满足汽车印刷电路基板日益增长的需求。

Denkai America Inc.于2022年7月宣布,将投资4.3亿美元在乔治亚奥古斯塔建立北美总部和製造工厂。该製造工厂将包括一条价值 1.5 亿美元的生产线,用于生产电动车电池用 ED 铜箔。 2022年3月,Ather Energy与富士康科技集团子公司Bharat FIH签署协议,由Bharat FIH在印度开发製造Ather Energy的电气元件,包括印刷基板(PCB)。

汽车印刷基板(PCB)市场趋势

电动车销量的扩大推动市场成长

中国、印度和欧洲等许多汽车大国的政府都致力于提高电动车的销量,以实现 2015 年《巴黎气候变迁协议》的碳减排目标,这些市场都在采用电动车。奖励和政策不断推动。

儘管去年整体疲软,但2022年全球整体电动车销量将比2021年成长约60%,首次超过1,000万辆。因此,根据国际能源总署 (IEA) 的数据,到 2022 年,全球购买的七分之一的乘用车将是电动车。然而,到 2023 年,电动车的表现可能会继续跑赢大盘。 2023年第一季电动车销量超过230万辆,较去年同期成长约25%。 2023年,预计电动车销量将达到1,400万辆,较去年同期成长35%。

亚太和欧洲多个国家已宣布计划在 2040 年禁止销售新型内燃机汽车,转而电池式电动车。油价上涨、污染程度上升、环保意识不断增强,以及政府为推广电动车所采取的众多激励措施,正在导致全球电动车销售的健康成长。

在中国,2022年电动车销量达366万辆(截至9月),与前一年同期比较成长119%。在印度,2022年电动车销量达390,399辆(截至7月),与前一年同期比较同期成长333%。

电动涡轮增压器(也称为电动辅助涡轮增压器或电子涡轮增压器)的出现是最近的趋势。这些系统利用马达来提高涡轮增压器的性能,并透过改善瞬态响应来减少涡轮迟滞。

汽车 PCB 控制电池的所有功能,电池是电动车的核心零件。由此可见,电动车销量的大幅成长已成为全球汽车PCB产业成长的巨大推动力。

对乘用车的需求不断增长以及人们对电动车的意识不断增强,导致主要企业提高了其设备的产能。例如

2023年5月,现代汽车印度有限公司宣布将投资2,000亿印度卢比加强在印度各地的电动车製造设施。

电动车的上升趋势预计将推动未来市场的成长。

预计亚太地区在预测期内将大幅成长

亚太地区是最主要的市场,其次是北美和欧洲。

亚太地区是世界上最大的汽车生产国的所在地:印度、中国、日本和韩国。印度和中国是全球最大的电动车市场之一,占全球电动车销量的近60%,使亚太地区成为汽车印刷线路板最赚钱的市场。该地区的大多数汽车中都有汽车印刷电路基板,因为它们控制着电动车的基本功能。

中国是全球最大的电动车生产国和消费国。国内需求受到销售目标、有利的立法和城市空气品质目标的支持。

中国对电动和混合动力汽车製造商实施配额,要求其销量至少占新车销量的 10%。此外,北京每月仅发放1万辆内燃机汽车登记许可证,鼓励民众转换电动车。随着汽车销售的增加和都市化的快速发展,中国决定减少汽车排放。同时,它正在寻求透过增加电动车的需求和销售来减少对石油进口的依赖。

出口到其他国家的汽车产量增加,以及电动车在中国的普及,预计将推动中国电力电子和印刷电路板需求的主要因素。

欧洲和北美也拥有大量汽车OEM,汽车产业电气化不断推进,使这些地区成为电动车销售量高的主要市场。因此,随着各公司在该领域的创新,预计电动车领域的汽车印刷线路板市场将在预测期内成长。例如,2022 年 6 月,PCB Technologies 推出了 iNPACK,这是一种系统级封装(SIP) 解决方案,可提高讯号完整性并显着减少不必要的电感效应。此 SIP 解决方案可用于汽车、消费性电子和医疗设备产业的各种应用。

汽车印刷电路基板(PCB)产业概述

汽车印刷电路基板(PCB)市场适度整合。该市场的特点是存在与每个地区的主要汽车OEM签订长期供应合约的全球和本地公司。这些参与者还进行合资、併购、新产品发布和产品开拓,以扩大其品牌组合併巩固其市场地位。

主导全球市场的一些主要企业包括三星电机有限公司、英飞凌公司、CMK公司、KCE电子有限公司和Amitron公司。许多参与者正在扩大其製造能力,以确保其市场地位并保持市场领先地位。例如,2023年2月,Elna PCB Malaysia Sdn Bhd宣布将在马来西亚槟城建造新的PCB製造工厂,并于2024年开始量产。该新厂的设备、厂房、机械和建设已预留 10 亿令吉的投资预算,将于 2022 年 12 月开始实施。这家新工厂将生产用于汽车和电子设备的印刷电路板。

2022年4月,英飞凌科技公司完全子公司PT英飞凌科技巴淡岛(印尼)宣布,将在2024年之前扩大在印尼的后端产能。透过此次扩建,巴淡岛工厂将成为英飞凌科技公司继马来西亚马六甲工厂(汽车 PCB)后的第二大工厂。此外,2022 年 6 月,义法半导体推出了适用于汽车和工业应用的新型基于高电压印刷电路基板的运算放大器。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 研究成果

- 研究场所

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场动态

- 市场概况

- 市场驱动因素

- 由于电动车销量增加,对汽车 PCB 的需求增加

- 市场限制因素

- 复杂的设计和整合挑战

- 价值链/供应链分析

- 波特五力分析

- 新进入者的威胁

- 买家/消费者的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争公司之间敌对关係的强度

第五章市场区隔

- 按车型

- 客车

- 商用车

- 依推进类型

- 内燃机

- 电动式

- 按类型

- 单层

- 双层

- 多层

- 按用途

- ADAS

- 身体舒适度

- 资讯娱乐系统

- 动力传动系统零件

- 其他的

- 按地区

- 北美洲

- 美国

- 加拿大

- 北美其他地区

- 欧洲

- 德国

- 英国

- 法国

- 欧洲其他地区

- 亚太地区

- 印度

- 中国

- 日本

- 韩国

- 其他亚太地区

- 其他地区

- 巴西

- 阿拉伯聯合大公国

- 其他国家

- 北美洲

第六章 竞争状况

- 供应商市场占有率

- 公司简介

- Infineon Technologies AG

- Samsung Electro Mechanics

- CMK Corporation

- Amitron Corporation

- KCE Group

- Daeduck Phil. Inc.

- MEIKO ELECTRONICS Co. Ltd

- CHIN POON Industrial Co. Ltd

- Unimicron Group

- STMicroelectronics NV

- Tripod Technologies

第七章 市场机会及未来趋势

The Automotive Printed Circuit Board Market size is estimated at USD 7.49 billion in 2024, and is expected to reach USD 9.52 billion by 2029, growing at a CAGR of 6.40% during the forecast period (2024-2029).

The increasing use of electrical systems in cars and the expanding need for driver comfort and safety in vehicles, coupled with significant expansion of the automotive sector, are anticipated to act as major driving factors for market growth during the forecast period.

Furthermore, with the increasing popularity of vehicle automation and the growing demand for connected cars across the world, the demand for automotive PCBs is expected to grow significantly during the forecast period.

The integration of Artificial Intelligence (AI), cloud, and IoT-enabled devices to improve and enhance vehicle and vehicle-to-infrastructure communication. AI-powered technologies, such as emotional and behavioral recognition and personal assistants, have been fueling the growth of safety and scenarios, such as Vehicle As A Marketplace, which in turn is likely to enhance the demand for power electronics components in vehicles. Thus further propelling the target market.

Over the long term, increasing investments in R&D by major industry players and a rise in sales of electric and hybrid vehicles, as well as rising demand for connected vehicles fare creating demand in the automotive and transportation industry with a surge in sales of automotive printed circuit boards.

Key players in the market are expanding their production capacity to cater to the increased demand for automotive printed circuit boards. For instance,

In July 2022, Denkai America Inc. announced that it would invest USD 430 million in Augusta, Georgia, to set up its North American HQ and manufacturing facility. The manufacturing facility will include a USD 150 million production line to manufacture ED copper foils for EV batteries. In March 2022, Ather Energy and Bharat FIH, a Foxconn Technology Group subsidiary, signed an agreement wherein Bharat FIH will develop and manufacture electric components for Ather Energy, including printed circuit boards (PCBs), in India.

Automotive Printed Circuit Board Market Trends

Growing Electric Vehicles Sales Driving the Market Growth

Many governments in some of the largest automotive markets like China, India, and Europe are relentlessly promoting the adoption of electric vehicles through various government incentives and policies aimed at boosting the sales of EVs to meet the carbon reduction goals under the Paris Climate Change Accord 2015 to which all these markets are signatories.

Sales of electric cars increased by around 60% in 2022 globally when compared to 2021, surpassing 10 million for the first time, even though car sales broadly were soft last year. As a result, one in every seven passenger cars bought globally in 2022 was an EV, according to the International Energy Agency (IEA). Nonetheless, electric vehicles are likely to outperform in 2023 as well. More than 2.3 million electric cars have been sold during the first quarter of 2023, which translates to a growth of about 25%, which is more than in comparison to the same period last year. In 2023, 14 million electric car sales are expected, representing 35% year-on-year growth; this will increase the market share of electric cars up to 18% in total car sales.

Various countries in Asia-Pacific and Europe have announced that they will ban the sales of new ICE vehicles by 2040 in favor of battery electric vehicles. Rising oil prices, growing pollution levels, increasing environmental consciousness, and a number of government incentives to promote electromobility are all contributing to very healthy growth in sales of EVs around the world. For instance,

In China, EV sales rose to 3.66 million units in 2022 (till September), posting a YoY growth of 119%, while in India, EV sales stood at 390,399 units (till July) in 2022, registering a YoY increase of 333%.

The emergence of electric turbochargers, also known as electrically assisted turbochargers or e-turbochargers, is a recent development. These systems utilize electric motors to enhance turbocharger performance and improve transient response, thereby reducing turbo lag.

An automotive PCB controls all the functions of a battery, which is the core component of an EV. Thus, the massive growth in sales of EVs is providing a very high impetus to the growth of the automotive PCB industry worldwide.

Owing to the increase in the demand for passenger cars and the growing awareness of electric mobility, significant players are ramping up the production capacity of their facilities. For instance,

In May 2023, Hyundai Motor India Limited announced an investment of INR 200 billion to enhance its electric vehicle manufacturing facility across India.

The increase in the trend of electric vehicles is expected to drive market growth in the future.

Asia-Pacific Region Anticipated to Grow at a Significant Level During the Forecast Period

The Asia-Pacific is the most dominant market, followed by North America and Europe.

Asia-Pacific is home to India, China, Japan, and South Korea, the world's largest automobile manufacturing countries. India and China are some of the world's largest markets for electric vehicles, contributing to almost 60% of worldwide electric vehicle sales, thus making Asia-Pacific the most lucrative market for automotive printed circuit boards. Automotive printed circuit boards are employed in the majority of these vehicles within the region to control the essential functions of an electric vehicle.

China is the largest manufacturer and consumer of electric vehicles in the world. Domestic demand is being supported by sales targets, favorable laws, and municipal air-quality targets. For instance,

China has imposed a quota on manufacturers of electric or hybrid vehicles, which must represent at least 10% of total new sales. Also, the city of Beijing only issues 10,000 permits for the registration of combustion engine vehicles per month to encourage its inhabitants to switch to electric vehicles. With increased vehicle sales and rapid urbanization, China is determined to reduce vehicle exhaust emissions. Meanwhile, the country intends to reduce its reliance on oil imports by increasing demand for and sales of electric vehicles.

An increase in vehicle production for exporting to other countries, along with the adoption of electric mobility in the country, are the key factors that are expected to boost the demand for power electronics and PCBs in China.

Europe and North America are also major markets due to the large presence of automotive OEMs and the rising electrification of the automotive industry, leading to high electric vehicle sales in these geographies. Thus, with companies coming up with innovations in this segment, the market for automotive Printed Circuit Boards is expected to grow over the forecast period for the electric vehicles segment. For instance, in June 2022, PCB Technologies launched iNPACK, a System-in-Package (SIP) solution that offers improved signal integrity and a significant reduction in unwanted inductance effects. The SIP solution can be utilized for a variety of applications in the automobile, consumer electronics, and medical devices industries.

Automotive Printed Circuit Board Industry Overview

The automotive PCB market is moderately consolidated. The market is characterized by the presence of some global and local players who have secured long-term supply contracts with major automotive OEMs in their respective regions. These players also engage in joint ventures, mergers and acquisitions, new product launches, and product development to expand their brand portfolios and cement their market positions.

Some of the major players dominating the global market are Samsung Electro-Mechanical Ltd, Infineon Corp., CMK Corp., KCE Electronics Ltd, and Amitron Corp. Many players are expanding their manufacturing capacity to secure their market position and stay ahead of the market curve. For instance, in February 2023, Elna PCB Malaysia Sdn Bhd announced a new PCB manufacturing plant in Penang, Malaysia, with mass production set to start in 2024. MYR's 1 billion investment budget has been set aside for the equipment, plant, and machinery, as well as the construction of this new plant that commenced in December 2022. This new plant will manufacture PCBs for automotive and electronic devices usage, among other products.

In April 2022, PT Infineon Technologies Batam, Indonesia, a wholly owned subsidiary of Infineon Technologies Corp, announced it would expand the backend production capacity in Indonesia by 2024. This expansion will see the Batam site become the second biggest one for Infineon Technologies Corp after their Melaka, Malaysia plant for automotive PCBs. Additionally, in June 2022, STMicroelectronics NV introduced a new high-voltage Printed Circuit board-based op amplifier for automotive and industrial applications.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Deliverables

- 1.2 Study Assumptions

- 1.3 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising EV Sales to Fuel Automotive PCB Demand

- 4.3 Market Restraints

- 4.3.1 Complex Design and Integration Challenges

- 4.4 Value Chain / Supply Chain Analysis

- 4.5 Porter's Five Forces Analysis

- 4.5.1 Threat of New Entrants

- 4.5.2 Bargaining Power of Buyers/Consumers

- 4.5.3 Bargaining Power of Suppliers

- 4.5.4 Threat of Substitute Products

- 4.5.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 By Vehicle Type

- 5.1.1 Passenger Cars

- 5.1.2 Commercial Vehicles

- 5.2 By Propulsion Type

- 5.2.1 IC Engine

- 5.2.2 Electric

- 5.3 By Type

- 5.3.1 Single Layer

- 5.3.2 Double Layer

- 5.3.3 Multi-Layer

- 5.4 By Application

- 5.4.1 ADAS

- 5.4.2 Body and Comfort

- 5.4.3 Infotainment System

- 5.4.4 Powertrain Components

- 5.4.5 Other Applications

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Rest of North America

- 5.5.2 Europe

- 5.5.2.1 Germany

- 5.5.2.2 United Kingdom

- 5.5.2.3 France

- 5.5.2.4 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 India

- 5.5.3.2 China

- 5.5.3.3 Japan

- 5.5.3.4 South Korea

- 5.5.3.5 Rest of Asia-Pacific

- 5.5.4 Rest of the World

- 5.5.4.1 Brazil

- 5.5.4.2 United Arab Emirates

- 5.5.4.3 Other Countries

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Vendor Market Share

- 6.2 Company Profiles

- 6.2.1 Infineon Technologies AG

- 6.2.2 Samsung Electro Mechanics

- 6.2.3 CMK Corporation

- 6.2.4 Amitron Corporation

- 6.2.5 KCE Group

- 6.2.6 Daeduck Phil. Inc.

- 6.2.7 MEIKO ELECTRONICS Co. Ltd

- 6.2.8 CHIN POON Industrial Co. Ltd

- 6.2.9 Unimicron Group

- 6.2.10 STMicroelectronics NV

- 6.2.11 Tripod Technologies