|

市场调查报告书

商品编码

1523353

机器人割草机:市场占有率分析、产业趋势/统计、成长预测(2024-2029)Robotic Lawn Mower - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

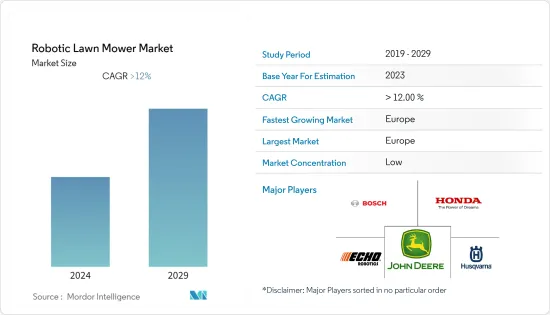

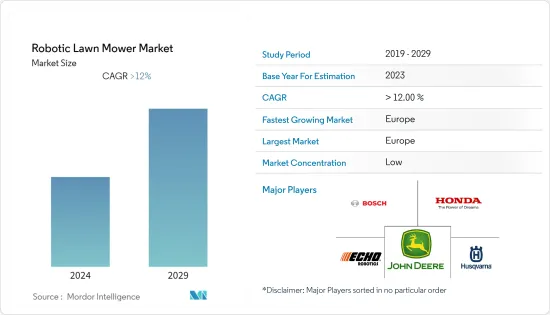

预计2024年机器人割草机市场规模为18.9亿美元,2029年达37.7亿美元,在预测期间(2024-2029年)复合年增长率超过12%。

人工智慧和机器人技术的进步正在创造更有效率的家用电器并减少人为干预。随着世界各地人们收入水准的提高,这些提高美观和使用者体验的家用电器的销售量不断增加。低噪音运作、感测器、自充电和耐用性等功能预计将推动市场成长。

然而,由于机器人割草机初始设定所需的安装成本较高,预计目标市场的成长将受到限制。

欧洲在全球市场中占有很大份额,由于该地区对商务用割草机、园艺设备和自动化工具的需求很高,因此预计将快速成长。此外,客户从传统的汽油动力手动割草机转向更新、更安静、更有效率、更智慧的电池驱动机器人割草机正在拓宽欧洲的成长前景。

自主机器在清洁和割草等家庭应用中的使用显着增加,预计这也将在预测期内推动市场成长。物联网(IoT)和机器学习(ML)等技术的部署也在推动市场成长。这些技术可帮助割草机感知障碍物,感测器根据加速度和方向发挥作用,以提高性能并提供更好的结果。例如,博世在其割草机中同时使用人工智慧和机器学习来识别障碍物。

机器人割草机市场趋势

从最终用户来看,住宅领域预计将是最大的

由于都市化,世界各地人们的快节奏和忙碌的生活方式正在增加对协助日常任务的自主机器和系统的需求。此外,节省花在后院景观、后院烹饪、花园派对和草坪维护活动上的时间的愿望正在推动对各种园艺工具的需求,从而推动目标市场的发展。

全球扩张的建筑业和旅游业也正在影响市场。此外,消费者对高效割草机偏好的改变以及需要最少用户干预的自主设备的日益普及预计将推动全球对机器人割草机的需求。

主要企业正大力投资研发,以增强机器人割草机的功能。主要企业正在将壁架感测器和雷射视觉、草坪测绘、智慧导航和自动排空等附加功能整合到其产品中,以提高性能和效率。预计市场将在不久的将来受益于更有效率的机器人割草机的增加。例如,

- 2022 年 5 月,Toro 宣布推出电池供电的住宅花园护理机器人割草机。它是业界首款具有无线导航功能的基于视觉的定位系统,使该设定易于管理。安装可以针对每个花园进行定制,无需进行昂贵且容易发生故障的地下边界线建设。该公司还提供专用的智慧型手机应用程序,允许用户自订割草时间表。

此外,毫无疑问,锂离子电池和机器人技术发展的最新趋势是机器人割草机销售增加的原因。

欧洲有望成为市场领导者

机器人割草机在欧洲的住宅和商业领域用于各种园艺和草坪维护应用。

推动该地区成长的主要因素之一是草坪的受欢迎,因为它提供了美观的场地和花园。英国和荷兰等国家越来越多地采用机器人割草机,预计将推动市场成长。

此外,许多欧洲人拥有独立的住宅空间,通常是个人草坪和花园,这推动了对机器人割草机的需求。此外,商业领域对自动化的需求不断增长,以及人们对机器人割草机的好处(例如无噪音工作、时间管理和节能)的认识不断增强,正在推动该地区的市场成长。在机器人割草机中配备智慧感测控制装置,能够自动割草指定景观,预计将在预测期内影响市场需求。

欧洲主要企业正在采用新技术为其客户提供高品质的产品。促销活动的活性化预计也将对该地区的市场产生正面影响。例如

- 2022年6月,Segway宣布将于5月底在欧洲12个国家推出Navimow机器人割草机。此列表包括英国、荷兰、义大利和瑞典。 Navimow 提供三种型号,其中最大的一次充电可剪草面积达 3,000 平方米(32,392 平方英尺)。

机器人割草机产业概况

机器人割草机市场较为分散,多家厂商争夺重要份额。机器人割草机市场的一些知名公司包括约翰迪尔、罗伯特博世、本田和富世华。本公司投入大量资金研发,开发创新、技术先进的新产品。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第一章简介

- 调查先决条件

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场动态

- 市场驱动因素

- 除了消费者支出之外,住宅活动的活性化也将提振市场需求

- 市场限制因素

- 电动车渗透率上升将长期阻碍市场成长

- 产业吸引力-波特五力分析

- 新进入者的威胁

- 买家/消费者的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争公司之间敌对关係的强度

第五章市场区隔

- 范围

- 低的

- 期间~

- 高的

- 最终用户

- 商业

- 住宅

- 地区

- 北美洲

- 美国

- 加拿大

- 北美其他地区

- 欧洲

- 德国

- 义大利

- 西班牙

- 其他欧洲国家

- 亚太地区

- 印度

- 中国

- 日本

- 韩国

- 其他亚太地区

- 世界其他地区

- 南美洲

- 中东/非洲

- 北美洲

第六章 竞争状况

- 供应商市场占有率

- 公司简介

- Deere & Company

- Honda Motor Company

- Autmow Robotic Mowing

- Husqvarna AB

- ANDREAS STIHL AG & Co. KG

- WORX(Positec Tool Corporation)

- Ambrogio Robot

- The Toro Company

- Mammotion

- MTD Products Inc.

- Robert Bosch GmBH

第七章 市场机会及未来趋势

- 技术进步

The Robotic Lawn Mower Market size is estimated at USD 1.89 billion in 2024, and is expected to reach USD 3.77 billion by 2029, growing at a CAGR of greater than 12% during the forecast period (2024-2029).

Technological advancements in artificial intelligence and robotics have created more efficient household appliances and reduced human intervention. With an increase in the income level of people living worldwide, there is an increase in sales of these appliances that enhance the aesthetics and user experience. Features like low-noise operation, sensors, self-charging, and durability are expected to drive the market growth.

However, the high installation cost required for the initial setup of a robotic lawn mower is expected to limit the growth of the target market.

Europe is expected to hold a significant share of the global market and grow rapidly due to the region's high demand for professional lawn mowers, landscaping devices, and automated tools. Furthermore, the shift of customers away from traditional gasoline-powered manual lawn mowers and toward newer, silent, efficient, smart, and battery-powered robotic mowers is broadening Europe's growth prospects.

The usage of autonomous machines in household applications such as cleaning and cutting grass has witnessed a significant increase, which is also expected to boost the market growth during the forecast period. The inclusion of technologies, such as the Internet of Things (IoT) and machine learning (ML), are also facilitating market growth. These technologies help lawn mowers sense obstacles, and the sensors work on acceleration and orientation to improve performance and provide better results. For instance, Bosch uses both AI and ML in its lawn mowers for obstacle identification.

Robotic Lawn Mower Market Trends

The Residential Segment is Expected to be the Largest Segment by End User

The fast and busy lifestyle of people across the world due to urbanization has increased the demand for autonomous machinery/systems to help people in everyday work. Additionally, increased spending on backyard beautification, backyard cookouts, and garden parties, as well as the desire to save time spent on lawn maintenance activities, are driving demand for a variety of gardening tools, which is driving the target market.

The market is also influenced by the expanding construction and tourism industries around the globe. Furthermore, shifting consumer preference for efficient lawn mowers and the growing popularity of autonomous equipment requiring minimal user intervention is expected to boost global demand for robotic lawn mowers.

Major players are investing heavily in research and development to enhance the features of robotic lawn mowers. Key players are integrating ledge sensors and additional features such as laser vision, lawn mapping, smart navigation, and self-emptying into their products to improve their performance and efficiency. The market is expected to benefit from the increased availability of more efficient robotic lawn mowers in the near future. For instance,

- In May 2022, Toro announced the launch of a battery-powered residential yard care category robotic mower. It is the industry's first vision-based localization system with wire-free navigation, making this setup manageable. It is tailored to each yard without a pricey and failure-prone underground boundary wire installation. The company also offers a dedicated smartphone application that helps users customize their mowing schedule.

Furthermore, recent advances in the development of lithium-ion batteries and robot technology are undoubtedly responsible for this increase in the sales of robotic mowers.

Europe is Expected to be the Market Leader

Robotic lawn mowers are used for various gardening and lawn-maintenance applications in Europe's residential and commercial sectors.

One of the major factors driving growth in the region is the popularity of lawns to provide aesthetic and pleasing premises and gardens. The increased adoption of robotic lawn mowers in countries like the United Kingdom and the Netherlands is expected to drive market growth.

Furthermore, many Europeans own independent residential spaces, typically private lawns and gardens, boosting demand for robotic lawn mowers. Aside from that, the rising demand for automation in the commercial sector and increased awareness of the benefits of robotic lawn mowers, such as noise-free operations, time management, and energy conservation, have boosted the market growth in the region. The inclusion of smart sensory controls in robotic lawn mowers, which enable automated mowing of a given landscape, is expected to impact market demand during the forecast period.

Key players in Europe are adopting new technologies to provide quality products to their customers. The rise in promotional activities is also expected to have a positive impact on the market in the region. For instance,

- In June 2022, Segway announced that its Navimow robot lawn mower would be available in 12 European countries by the end of May. The countries on this list include the United Kingdom, Netherlands, Italy, and Sweden. Navimow is available in three models, with the largest able to mow an area up to 3,000 m2 (32,392 ft2) between charges.

Robotic Lawn Mower Industry Overview

The robotic lawn mower market is fragmented, with several players competing for a considerable share of the market. Some of the prominent companies in the robotic lawn mower market include John Deere, Robert Bosch, Honda, and Husqvarna. The companies spend heavily on R&D to innovate and develop new and technologically advanced products.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Drivers

- 4.1.1 Rising Residential Activities in Addition to Consumer Spending to Enhance Market Demand

- 4.2 Market Restraints

- 4.2.1 Rising Electric Vehicle Adoption to Hinder Market Growth in the Long Run

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Threat of New Entrants

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Bargaining Power of Suppliers

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Range

- 5.1.1 Low

- 5.1.2 Medium

- 5.1.3 High

- 5.2 End User

- 5.2.1 Commercial

- 5.2.2 Residential

- 5.3 Geography

- 5.3.1 North America

- 5.3.1.1 United States

- 5.3.1.2 Canada

- 5.3.1.3 Rest of North America

- 5.3.2 Europe

- 5.3.2.1 Germany

- 5.3.2.2 Italy

- 5.3.2.3 Spain

- 5.3.2.4 Rest of Europe

- 5.3.3 Asia-Pacific

- 5.3.3.1 India

- 5.3.3.2 China

- 5.3.3.3 Japan

- 5.3.3.4 South Korea

- 5.3.3.5 Rest of Asia-Pacific

- 5.3.4 Rest of the World

- 5.3.4.1 South America

- 5.3.4.2 Middle East and Africa

- 5.3.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Vendor Market Share

- 6.2 Company Profiles

- 6.2.1 Deere & Company

- 6.2.2 Honda Motor Company

- 6.2.3 Autmow Robotic Mowing

- 6.2.4 Husqvarna AB

- 6.2.5 ANDREAS STIHL AG & Co. KG

- 6.2.6 WORX (Positec Tool Corporation)

- 6.2.7 Ambrogio Robot

- 6.2.8 The Toro Company

- 6.2.9 Mammotion

- 6.2.10 MTD Products Inc.

- 6.2.11 Robert Bosch GmBH

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Technological Advancements