|

市场调查报告书

商品编码

1523356

无氧铜:市场占有率分析、产业趋势/统计、成长预测(2024-2029)Oxygen Free Copper - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

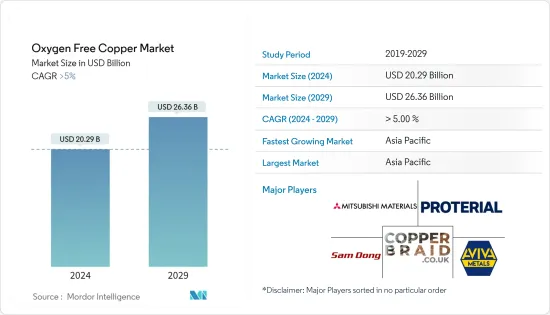

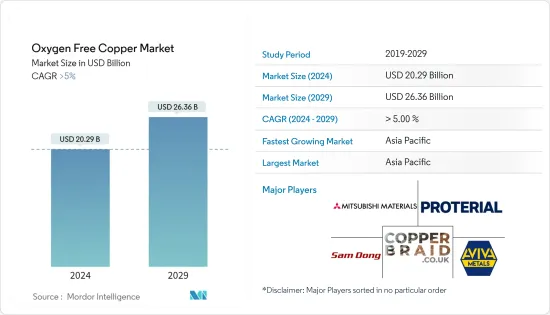

无氧铜市场规模预计2024年为202.9亿美元,预计2029年将达到263.6亿美元,在预测期内(2024-2029年)复合年增长率超过5%。

COVID-19 大流行减缓了生产和运输,导致半导体短缺,并对无氧铜市场产生了负面影响。由于遏制措施和经济中断,电子和汽车等行业也被迫放慢生产速度。目前市场正从疫情中恢復。预计2022年市场将达到疫情前水准并持续稳定成长。

半导体对无氧铜的需求不断增长正在推动预测期内的市场成长。

然而,铜的高成本预计将阻碍所研究市场的成长。

无氧铜在各种电子产品中的不断增长的应用可能会在未来五年为无氧铜市场提供机会。

亚太地区在全球占据主导地位,中国和印度等国家的消费不断增加。

无氧铜市场趋势

电气电子产业主导市场

- 电气和电子产业将成为主导市场的领域,因为它广泛用于半导体和超导体的生产。

- 无氧铜通常用于半导体和超导性製造等製造应用以及需要等离子体沉淀的粒子加速器等高真空系统。

- 氧气和其他杂质可能会与系统中使用的材料发生不良的化学反应。

- 无氧铜用途广泛,包括印刷电路基板、微波管、真空电容器、真空断路器、真空密封件、波导以及广播电视发送器和磁控管的真空管,因此消费量较低。

- 全球电子设备数量迅速增加,例如行动电话、智慧型装置、平板电脑和电视机,可能会在预测期内推动无氧铜的需求。如上所述,电气和电子行业使用量的增加和应用范围的扩大预计将成为市场成长的驱动力。

- 根据日本电子情报技术产业协会(JEITA)预计,2022年全球电子资讯科技产业产值预估为34,368亿美元,而2021年为34,159亿美元,与前一年同期比较成长1%。此外,预计2023年将达35,266亿美元,与前一年同期比较成长3%。

- 此外,根据电子与资讯科技部的数据,2022 财年印度消费性电子产品(电视、配件、音讯)产值将超过 7,450 亿印度卢比(94.6 亿美元),支撑市场成长。

- 上述因素预计将在预测期内推动无氧铜市场。

亚太地区主导市场

- 中国、日本和印度等亚太新兴国家对电子半导体装置的需求不断增长,预计亚太市场将成为预测期内最大、成长最快的市场。

- 整个亚太地区对智慧型手机、个人电脑、笔记型电脑和其他医疗电子产品等消费性设备的需求正在快速增长,其中印度、日本和中国对市场成长做出了巨大贡献。

- 根据工业和资讯化部(MIIT)统计,中国是全球最大的消费性电子生产国,全球份额超过60%。

- 根据日本电子情报技术产业协会(JEITA)预测,2022年日本电子产业国内产值预估为111,243亿日圆(约851.9亿美元),年成长与前一年同期比较2%。预计2023年日本电子业的国内产值将达到114,029亿日圆(约873.2亿美元),年成长与前一年同期比较3%。

- 在高能源需求的支持下,亚太地区能源产业也蓬勃发展。快速成长的工业部门是推动该地区能源需求的主要因素之一,这支持了预测期内的市场成长。

- 亚太地区火力发电产业录得成长,其中中国是该产业成长的主要推手。中国拥有的燃煤发电厂数量比世界上任何其他国家或地区都多。截至2022年7月,中国当地已运作燃煤发电厂1,118座。这大约是排名第二的印度的四倍。中国煤炭发电量占全球一半以上。

- 上述因素预计将导致预测期内该地区无氧铜消费需求的增加。

无氧铜行业概况

无氧铜市场较为分散。研究的市场主要参与者包括(排名不分先后)Copper Braid Products、Mitsubishi Materials、Aviva Metals、PROTERIAL Ltd 和 Sam Dong。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第一章简介

- 调查先决条件

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场动态

- 促进因素

- 半导体需求增加

- 汽车领域需求增加

- 其他司机

- 抑制因素

- 铜成本高

- 其他阻碍因素

- 产业价值链分析

- 波特五力分析

- 新进入者的威胁

- 买方议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争程度

第五章市场区隔(以金额为准的市场规模)

- 年级

- CU-OF

- CU-OFE

- 产品

- 金属丝

- 条

- 汇流排,棒

- 其他(管材、管道等)

- 最终用户产业

- 电力/电子

- 车

- 产业

- 其他(发电、航太等)

- 地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 马来西亚

- 泰国

- 印尼

- 越南

- 其他亚太地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 北欧国家

- 土耳其

- 俄罗斯

- 其他欧洲国家

- 南美洲

- 巴西

- 阿根廷

- 哥伦比亚

- 南美洲其他地区

- 中东/非洲

- 沙乌地阿拉伯

- 南非

- 奈及利亚

- 卡达

- 埃及

- 阿拉伯聯合大公国

- 其他中东/非洲

- 亚太地区

第六章 竞争状况

- 併购、合资、联盟、协议

- 市场占有率(%)/排名分析

- 主要企业策略

- 公司简介

- Aviva Metals

- Citizen Metalloys Ltd

- Copper Braid Products

- Cupori

- Farmers Copper LTD

- FURUKAWA ELECTRIC CO. LTD

- KGHM

- KME GERMANY GMBH

- Metrod Holdings Berhad

- Sam Dong

- Lacroix+Kress GmbH

- Mitsubishi Materials Corporation

- PROTERIAL Ltd

第七章 市场机会及未来趋势

The Oxygen Free Copper Market size is estimated at USD 20.29 billion in 2024, and is expected to reach USD 26.36 billion by 2029, growing at a CAGR of greater than 5% during the forecast period (2024-2029).

The market was negatively impacted by the COVID-19 pandemic as there was a slowdown in production and mobility, which caused a shortage of semiconductors, which negatively impacted the market for oxygen-free copper. Also, industries such as electronics, automotive, etc., were forced to delay their production due to containment measures and economic disruptions. Currently, the market has recovered from the pandemic. The market reached pre-pandemic levels in 2022, and it is expected to grow steadily in the future.

Increasing demand for oxygen-free copper from semiconductors has been driving the market growth during the forecast period.

However, the high cost of copper is anticipated to hinder the growth of the studied market.

Growing oxygen-free copper applications in a wide range of electronics are likely to provide opportunities for the oxygen-free copper market over the next five years.

The Asia-Pacific region is dominated across the world, with increasing consumption from countries like China and India.

Oxygen Free Copper Market Trends

Electrical and Electronics Industry to Dominate the Market

- The electrical and electronics industry stands to be the dominating segment owing to wide consumption in the manufacturing of semiconductors and superconductors.

- Oxygen-free copper is commonly used in manufacturing applications such as the manufacture of semiconductors and superconductors and high-vacuum systems such as particle accelerators requiring plasma deposition.

- The use of oxygen-free materials is critical in these applications, as the presence of oxygen or some other impurity contributes to unwanted chemical reactions with the materials used in the system.

- Oxygen-free copper is witnessing growth in consumption due to its wide application in printed circuit boards, microwave tubes, vacuum capacitors, vacuum interrupters, vacuum seals, waveguides, and vacuum tubes for radio and TV transmitters and magnetrons.

- The exponential growth in the number of electronic gadgets across the globe, such as mobile phones, smart devices, tablets, and TV sets, is expected to drive the demand for oxygen-free copper over the forecast period. Thus, the increasing usage and widening arena of application in the electrical and electronics industry is expected to drive market growth.

- According to the Japan Electronics and Information Technology Industries Association (JEITA), the production by the global electronics and IT industry was estimated at USD 3,436.8 billion in 2022, registering a growth rate of 1% year-on-year, compared to USD 3,415.9 billion in 2021. Moreover, the industry is expected to reach USD 3,526.6 billion, with a growth rate of 3% year-on-year in 2023.

- Moreover, according to the Ministry of Electronics and Information Technology, the production value of consumer electronics (TV, accessories, and audio) across India was above INR 745 billion (USD 9.46 billion) in fiscal year 2022, thus supporting the growth of the market.

- All the aforementioned factors are expected to drive the oxygen-free copper market during the forecast period.

Asia-Pacific Region to Dominate the Market

- The Asia-Pacific market is expected to be the largest and fastest-growing market over the forecast period, owing to the increasing demand for electronic semiconductor devices in developing countries of Asia-Pacific, such as China, Japan, and India.

- Demand for consumer devices, such as smartphones, PCs, laptops, and other medical electronics products, is growing rapidly through the Asia-Pacific region, with India, Japan, and China contributing majorly to the market growth.

- According to the Ministry of Industry and Information Technology (MIIT), China is the world's largest producer of consumer electronics, with a global share of more than 60%.

- Furthermore, Japan is one of the largest producers of electronics; as per the Japan Electronics and Information Technology Industries Association (JEITA), the domestic production by the Japanese electronics industry was estimated at JPY 11,124.3 billion (~USD 85.19 billion) in 2022, witnessing a growth rate of 2% compared to the previous year. The domestic production by the Japanese electronics industry is likely to reach JPY 11,402.9 billion (~USD 87.32 billion) by 2023, registering a growth rate of 3% year-on-year.

- The Asia-Pacific energy sector is also thriving, owing to the high demand for energy. The rapidly growing industrial sector is one of the key factors driving the energy demand in the region, which in turn is supporting the market growth during the forecast period.

- The Asia-Pacific thermal sector is registering growth, with China primarily driving the growth of the sector. China has the most coal-fired power plants of any country or territory in the world. On the Chinese Mainland, as of July 2022, there were 1,118 operational coal power plants. This is approximately four times the number of such power plants in India, which came in second place. China accounts for more than half of the world's coal electricity generation.

- The aforementioned factors are anticipated to contribute to the increasing demand for oxygen-free copper consumption in the region during the forecast period.

Oxygen Free Copper Industry Overview

The oxygen-free copper market is fragmented in nature. The major players in the studied market (not in any particular order) include Copper Braid Products, Mitsubishi Materials Corporation, Aviva Metals, PROTERIAL Ltd, and Sam Dong.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Increasing Demand from Semiconductor

- 4.1.2 Increasing Demand from Automotive Sector

- 4.1.3 Other Drivers

- 4.2 Restraints

- 4.2.1 High Cost of Copper

- 4.2.2 Other Restraints

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Threat of New Entrants

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Bargaining Power of Suppliers

- 4.4.4 Threat of Substitute Products

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Value)

- 5.1 Grade

- 5.1.1 CU-OF

- 5.1.2 CU-OFE

- 5.2 Product

- 5.2.1 Wires

- 5.2.2 Strips

- 5.2.3 Busbars and Rods

- 5.2.4 Other Products (Tubes and Pipes, Etc.)

- 5.3 End-user Industry

- 5.3.1 Electrical and Electronics

- 5.3.2 Automotive

- 5.3.3 Industrial

- 5.3.4 Other End-user Industries (Power Generation, Aerospace, Etc.)

- 5.4 Geography

- 5.4.1 Asia-Pacific

- 5.4.1.1 China

- 5.4.1.2 India

- 5.4.1.3 Japan

- 5.4.1.4 South Korea

- 5.4.1.5 Malaysia

- 5.4.1.6 Thailand

- 5.4.1.7 Indonesia

- 5.4.1.8 Vietnam

- 5.4.1.9 Rest of Asia-Pacific

- 5.4.2 North America

- 5.4.2.1 United States

- 5.4.2.2 Canada

- 5.4.2.3 Mexico

- 5.4.3 Europe

- 5.4.3.1 Germany

- 5.4.3.2 United Kingdom

- 5.4.3.3 France

- 5.4.3.4 Italy

- 5.4.3.5 Spain

- 5.4.3.6 NORDIC Countries

- 5.4.3.7 Turkey

- 5.4.3.8 Russia

- 5.4.3.9 Rest of Europe

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Colombia

- 5.4.4.4 Rest of South America

- 5.4.5 Middle-East and Africa

- 5.4.5.1 Saudi Arabia

- 5.4.5.2 South Africa

- 5.4.5.3 Nigeria

- 5.4.5.4 Qatar

- 5.4.5.5 Egypt

- 5.4.5.6 UAE

- 5.4.5.7 Rest of Middle-East and Africa

- 5.4.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share(%)**/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 Aviva Metals

- 6.4.2 Citizen Metalloys Ltd

- 6.4.3 Copper Braid Products

- 6.4.4 Cupori

- 6.4.5 Farmers Copper LTD

- 6.4.6 FURUKAWA ELECTRIC CO. LTD

- 6.4.7 KGHM

- 6.4.8 KME GERMANY GMBH

- 6.4.9 Metrod Holdings Berhad

- 6.4.10 Sam Dong

- 6.4.11 Lacroix + Kress GmbH

- 6.4.12 Mitsubishi Materials Corporation

- 6.4.13 PROTERIAL Ltd

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Growing Oxygen-free Copper Application in Wide Range of Electronics

- 7.2 Other Opportunities