|

市场调查报告书

商品编码

1523372

冷冻拖车:市场占有率分析、产业趋势/统计、成长预测(2024-2029)Refrigerated Trailer - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

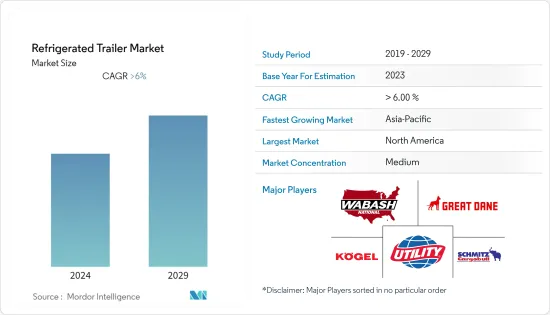

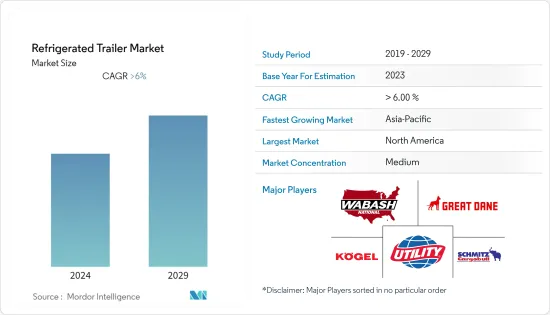

冷冻拖车市场规模预计到2024年为63.2亿美元,预计到2029年将达到96.5亿美元,在预测期内(2024-2029年)复合年增长率预计将超过6%。

由于多种因素,包括运输温度敏感货物的需求增加、冷却系统的技术进步以及全球低温运输物流基础设施的扩张,冷冻拖车市场正在经历强劲增长。冷冻拖车(也称为冷藏车)透过在整个旅程中保持所需温度,在远距运输食品和药品等易腐烂产品方面发挥重要作用。由于全球食品贸易的增加以及减少食品浪费的需求不断增长,预计未来几年对冷冻拖车的需求将稳定增长。

此外,世界各地政府和监管机构制定的严格食品安全法规和品质标准迫使食品生产商、经销商和物流公司投资可靠的冷藏运输解决方案。配备先进温度监测和控制系统的冷冻拖车有助于确保遵守这些法规,并在运输过程中保护生鲜产品的品质。此外,消费者对食品安全和品质的认识不断提高,促使零售商和电子商务公司采用冷冻拖车来运输生鲜食品和其他温度敏感产品。

此外,由永续能源来源动力来源的电动式和混合冷冻拖车的到来有望彻底改变冷冻拖车市场。随着人们对环境永续性和温室气体排放的日益关注,车队营运商和物流公司越来越多地采用环保冷冻解决方案来减少碳排放。与传统柴油引擎拖车相比,电动式冷冻拖车具有运行更安静、排放气体更低和营业成本更低的优点。

北美是市场领先地区,其次是亚太地区和欧洲。製造冷冻拖车的主要公司包括 Wabash National Commercial Trailer Products、Great Dane Trailers、Utility Trailer Manufacturing Company、Schmitz Cargobull AG 和 Kogle Trailer GmbH。

冷冻挂车市场趋势

低温运输物流活动的扩展预计将推动冷冻拖车市场

低温运输技术令人兴奋,因为硬体、远端资讯处理和车辆技术的各种进步正在改变整个北美的生鲜产品运输,促使冷冻车车队考虑保持竞争力的策略,这是一个美好的时光。然而,冷冻车产业面临日益复杂的经营环境的挑战。例如,

- 2024 年 2 月,太古汽车、裕力製药和龙丰医疗物流签署协议,正式在台湾部署沃尔沃 FE 电动卡车用于低温运输物流。该协议强调了共同努力推进绿色运输并开创环境永续物流的新时代。

虽然长期合约运价已趋于稳定,但整体货运量却有所下降,导致许多小型冷藏运输公司依赖现货市场寻找商机。现货冷冻运价比2022年同期低约7%,比五年平均低5%以上。儘管存在这些障碍,但与运输等其他行业相比,由于车队关闭、监管变化以及市场动态变化等因素,冷冻车队正在经历显着的变化,并受益于卡车运输行业相对孤立的部分。

预计亚太地区在预测期内将占据最大的市场占有率

消费者对新鲜、生鲜食品的偏好不断增加,特别是在人口稠密的都市区,推动了全部区域对高效、可靠的冷冻拖车将这些产品从生产中心运输到配送中心和零售店的需求不断增加。此外,亚太地区气候多样,从热带到温带,进一步凸显了冷冻拖车在维持整个供应链中生鲜产品的品质和安全方面的重要性。例如,

- 在香港的低温运输物流行业,从收集到订单管理、运输和配送的整个供应链过程中保持低温的需求日益增长。香港现时的低温运输服务未能满足食品进口商、批发商、零售商和餐饮业的期望。许多冷库对产品出库后的温度控制不充分,导致新鲜食材劣化。针对香港低温运输物流服务的不足,TAHUHU于2023年5月推出首个自动化、智慧化低温运输物流服务。

此外,政府提高食品安全标准和现代化交通基础设施的努力也刺激了亚太地区冷冻拖车的采用。中国、印度、日本和韩国等国家正在大规模投资低温运输物流基础设施,如冷库、冷藏设施和冷藏运输车辆,以支持对温度敏感产品不断增长的需求。此外,冷冻系统的技术进步,例如物联网(IoT)感测器和即时监控解决方案的集成,使冷冻拖车更加高效和可靠,进一步推动该地区的市场成长。

冷冻车行业概况

冷冻拖车製造公司正在采用和开发各种先进技术,使拖车更有效率,同时遵守环境法。 Great Dane LLC、Wabash National Corporation、Kogel GmbH、Schmitz Cargobull AG 和 Utility Manufacturing Company 等公司是冷冻拖车市场的主要企业。

2024年3月,由ATA技术与维护委员会主办的年会暨交通科技展览会成为庆祝产业创新、进步与成就的平台。在今年的会议上,Utility Trailer Manufacturing Company LLC 宣布推出创新 Cargobull North America LLC (CBNA) 运输冷冻装置 (TRU)。这些 TRU 将透过公共事业广泛的经销商网路专门安装在公共事业遍布北美的着名 3000R 冷藏拖车上。

2023 年 8 月,Muller Milk & Ingredients 测试了太阳能板和动能作为其冷冻拖车的替代能源。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 调查先决条件

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场动态

- 市场驱动因素

- 市场限制因素

- 波特五力分析

- 新进入者的威胁

- 买家/消费者的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争公司之间敌对关係的强度

第五章市场区隔

- 依产品类型

- 冷冻食品

- 冷冻食品

- 按最终用户

- 乳製品

- 水果和蔬菜

- 肉类/鱼贝类

- 其他的

- 按地区

- 北美洲

- 美国

- 加拿大

- 北美其他地区

- 欧洲

- 德国

- 英国

- 法国

- 俄罗斯

- 西班牙

- 其他欧洲国家

- 亚太地区

- 印度

- 中国

- 日本

- 韩国

- 其他亚太地区

- 世界其他地区

- 南美洲

- 中东/非洲

- 北美洲

第六章 竞争状况

- 供应商市场占有率

- 公司简介

- Wabash National Commercial Trailer Products

- Great Dane Trailers Inc.

- Utility Trailer Manufacturing Company

- Schmitz Cargobull AG

- Kogel GmbH

- Lamberet Refrigerated SAS

- Fahrzeugwerk Beranrd KRONE GmbH

- Montracon Ltd

- Randon Implementos

- Grey & Adams Ltd

第七章 市场机会及未来趋势

The Refrigerated Trailer Market size is estimated at USD 6.32 billion in 2024, and is expected to reach USD 9.65 billion by 2029, growing at a CAGR of greater than 6% during the forecast period (2024-2029).

The refrigerated trailer market is experiencing robust growth driven by various factors, including the increasing demand for the transportation of temperature-sensitive goods, technological advancements in refrigeration systems, and expanding cold chain logistics infrastructure globally. Refrigerated trailers, also known as reefers, play a crucial role in transporting perishable goods such as food and pharmaceuticals over long distances while maintaining the desired temperature throughout the journey. With the rise in global food trade and the growing need to reduce food wastage, the demand for refrigerated trailers is expected to grow steadily in the coming years.

Moreover, stringent food safety regulations and quality standards set by governments and regulatory bodies across the world are compelling food producers, distributors, and logistics companies to invest in reliable refrigerated transportation solutions. Refrigerated trailers equipped with advanced temperature monitoring and control systems help ensure compliance with these regulations, safeguarding the quality of perishable goods during transit. In addition, increasing consumer awareness regarding food safety and quality is driving the adoption of refrigerated trailers by retailers and e-commerce companies for the transportation of fresh produce and other temperature-sensitive products.

Furthermore, the advent of electric and hybrid refrigerated trailers powered by sustainable energy sources is poised to revolutionize the refrigerated trailer market. As concerns over environmental sustainability and greenhouse gas emissions intensify, fleet operators and logistics companies are increasingly embracing eco-friendly refrigeration solutions to reduce their carbon footprint. Electric refrigerated trailers offer benefits such as quieter operation, reduced emissions, and lower operating costs compared to traditional diesel-powered trailers.

North America is the region leading the market, followed by Asia-Pacific and Europe. The major players manufacturing refrigerated trailers include Wabash National Commercial Trailer Products, Great Dane Trailers, Utility Trailer Manufacturing Company, Schmitz Cargobull AG, and Kogle Trailer GmbH.

Refrigerated Trailer Market Trends

Growing Cold Chain Logistics Activities are Expected to Drive the Refrigerated Trailer Market

This is an exciting period for cold-chain technology as various advancements in hardware, telematics, and vehicle technology are transforming the transportation of perishable goods across North America, prompting refrigerated fleets to contemplate strategies to stay competitive. However, the reefer community is facing challenges amid business conditions that are more complex than ever before. For instance,

- In February 2024, the agreement between Taikoo Motors, Zuellig Pharma, and Long Feng Medical Logistics officially marked the inaugural deployment of a Volvo FE Electric truck for cold chain logistics in Taiwan. The agreement underscores their collaborative efforts to advance eco-friendly transportation and usher in a fresh era of environmentally sustainable logistics.

While long-term contract freight rates remain stable, overall freight volume has decreased, leading many smaller refrigerated haulers to rely on the spot market for business opportunities. Spot refrigerated rates are approximately 7% lower than the same period in 2022 and more than 5% below their five-year average. Despite these obstacles, refrigerated fleets benefit from a relatively insulated segment of the trucking industry compared to other sectors like dry van transportation, which is experiencing significant upheaval due to factors such as fleet closures, regulatory changes, and shifts in market dynamics.

Asia-Pacific is Expected to Hold the Largest Market Share During the Forecast Period

With rising consumer preferences for fresh and perishable goods, particularly in densely populated urban areas, there is a heightened need for efficient and reliable refrigerated trailers to transport these products from production centers to distribution hubs and retail outlets across the region. Moreover, Asia-Pacific encompasses diverse climates ranging from tropical to temperate, further accentuating the importance of refrigerated trailers in maintaining the quality and safety of perishable goods throughout the supply chain. For instance,

- In Hong Kong, the cold chain logistics industry is witnessing increased demand for maintaining low temperatures throughout the supply chain process, from pickup and warehousing to order management, transportation, and delivery. Current cold chain services in Hong Kong have fallen short of meeting the expectations of food importers, wholesalers, retailers, and the catering industry, as many cold storage facilities lack temperature control once goods leave the cold room, resulting in the degradation of fresh ingredients. To address these deficiencies in Hong Kong's cold chain logistics services, TAHUHU introduced its first automated and intelligent cold chain logistics service in May 2023.

Furthermore, government initiatives aimed at improving food safety standards and modernizing transportation infrastructure are fueling the adoption of refrigerated trailers in Asia-Pacific. Countries such as China, India, Japan, and South Korea are witnessing significant investments in cold chain logistics infrastructure, including refrigerated warehouses, cold storage facilities, and refrigerated transportation fleets, to support the growing demand for temperature-sensitive products. Additionally, technological advancements in refrigeration systems, such as the integration of IoT (Internet of Things) sensors and real-time monitoring solutions, are enhancing the efficiency and reliability of refrigerated trailers, further driving market growth in the region.

Refrigerated Trailer Industry Overview

Refrigerated trailer manufacturing companies are adopting and developing various advanced technologies to make the trailers more efficient while adhering to environmental laws. Companies like Great Dane LLC, Wabash National Corporation, Kogel GmbH, Schmitz Cargobull AG, and Utility Manufacturing Company are the major players in the refrigerated trailer market.

In March 2024, the Annual Meeting & Transportation Technology Exhibition organized by the ATA Technology & Maintenance Council served as a platform to celebrate industry innovation, progress, and achievements. During this year's conference, Utility Trailer Manufacturing Company LLC announced the availability of the innovative Cargobull North America LLC (CBNA) transport refrigeration units (TRUs). These TRUs will be exclusively available on Utility's renowned 3000R reefer trailer throughout North America via Utility's extensive dealer network.

In August 2023, Muller Milk & Ingredients tested solar panels and kinetic energy as alternative power sources for its refrigerated trailers, seeking eco-friendly alternatives to diesel-powered refrigeration systems.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Drivers

- 4.2 Market Restraints

- 4.3 Porter's Five Forces Analysis

- 4.3.1 Threat of New Entrants

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Bargaining Power of Suppliers

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 By Product Type

- 5.1.1 Frozen Food

- 5.1.2 Chilled Food

- 5.2 By End User

- 5.2.1 Dairy Products

- 5.2.2 Fruits and Vegetables

- 5.2.3 Meat and Seafood

- 5.2.4 Other End Users

- 5.3 Geography

- 5.3.1 North America

- 5.3.1.1 United States

- 5.3.1.2 Canada

- 5.3.1.3 Rest of North America

- 5.3.2 Europe

- 5.3.2.1 Germany

- 5.3.2.2 United Kingdom

- 5.3.2.3 France

- 5.3.2.4 Russia

- 5.3.2.5 Spain

- 5.3.2.6 Rest of Europe

- 5.3.3 Asia-Pacific

- 5.3.3.1 India

- 5.3.3.2 China

- 5.3.3.3 Japan

- 5.3.3.4 South Korea

- 5.3.3.5 Rest of Asia-Pacific

- 5.3.4 Rest of the World

- 5.3.4.1 South America

- 5.3.4.2 Middle East and Africa

- 5.3.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Vendor Market Share

- 6.2 Company Profiles

- 6.2.1 Wabash National Commercial Trailer Products

- 6.2.2 Great Dane Trailers Inc.

- 6.2.3 Utility Trailer Manufacturing Company

- 6.2.4 Schmitz Cargobull AG

- 6.2.5 Kogel GmbH

- 6.2.6 Lamberet Refrigerated SAS

- 6.2.7 Fahrzeugwerk Beranrd KRONE GmbH

- 6.2.8 Montracon Ltd

- 6.2.9 Randon Implementos

- 6.2.10 Grey & Adams Ltd