|

市场调查报告书

商品编码

1524099

智慧财产权 (IP) 管理软体:市场占有率分析、产业趋势/统计、成长预测 (2024-2029)Intellectual Property Management Software - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

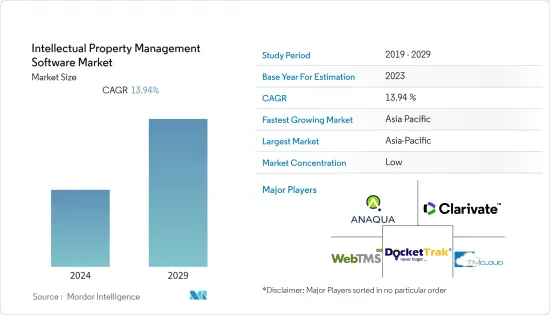

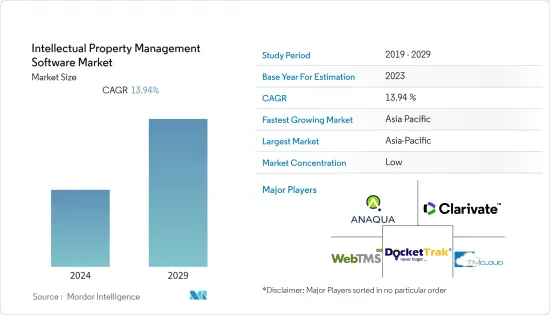

智慧财产权(IP)管理软体市场规模预计到2024年为119.6亿美元,预计到2029年将达到229.8亿美元,复合年增长率预计为13.94%。

智慧财产权 (IP) 管理软体可让公司管理其智慧财产权 (IP),包括与发明揭露、专利组合、商业机密、商标、版权、专利申请、合作伙伴关係、合约和授权 IP 相关的业务和法律活动。资产可以从多个角度进行管理。人工智慧、机器学习和自动化等技术的不断进步正在推动智慧财产权 (IP) 管理软体的创新。预测分析、专利搜寻演算法和自动化文件管理等高级功能增强了这些软体解决方案的功能和价值提案。

主要亮点

- 智慧财产权 (IP) 是一种透过赋予创作者和发明者某些专属权来保护创意和发明以获得商业性利益的法律方法。大型企业越来越多地采用外包服务,大大促进了智慧财产权 (IP) 管理软体市场的成长。

- 随着专利数量的不断增加,管理和追踪智慧财产权 (IP)、申请、申请和续展变得越来越复杂。智慧财产权 (IP) 管理软体提供了一个集中平台,可以简化这些流程、提高效率并降低错误风险。根据 IFI CLAIMS 专利服务公司的数据,韩国科技巨头三星电子在 2023 年总合获得了 6,165 项美国专利,是所有公司中最多的。高通以 3,854 项美国专利排名第二,其次是台积电和 IBM。

- 此外,企业越来越认识到智慧财产权 (IP) 作为创新、竞争力和产生收入力的策略价值。因此,他们投入更多资源来管理和保护其智慧财产权 (IP) 资产,从而刺激了智慧财产权 (IP) 管理软体的采用。例如,2023年4月,着名资讯与通讯技术供应商富士通采用Anaqua的AQX平台进行智慧财产权(IP)管理。

- 随着业务的发展,管理所有潜在的智慧财产权 (IP) 资产已成为确保市场地位的最重要部分之一。这个市场上的供应商可以大大帮助企业保护其竞争优势不被损害。智慧财产权(IP)管理软体和服务提供者利用其丰富的经验来指导开发更智慧的智慧财产权(IP)组合,以符合业务策略并最大化智慧财产权(IP)资产。

- 主要企业之间合作伙伴关係的扩大预计将为预测期内企业知识产权(IP)管理软体产业的成长提供有利的机会。例如,2023 年 5 月,随着塔塔咨询服务公司 (TCS) 独特产品 TCS Generative AI 的推出,该公司宣布扩大与Google云端的合作伙伴关係。 TCS Generative AI 利用 Google Cloud 的 Generative AI 服务协助客户设计和实施专门的商业解决方案,利用这种创新技术来加速成长和转型。

- 此外,对于中小型企业(SME)来说,实施智慧财产权(IP)管理软体成本高。许可、客製化和培训的初始成本可能会阻止一些公司实施这些解决方案。例如,美国智慧财产权 (IP) 法律协会报告称,采集费用为 10,000 美元,其中包括专利申请成本。

- 通膨上升通常会导致企业(包括软体供应商)的营运成本增加。因此,智慧财产权 (IP) 管理软体授权和服务的价格可能会上涨,影响某些客户的负担能力。此外,俄罗斯和乌克兰之间的衝突可能会扰乱软体供应商的供应链和业务,导致产品开发、客户支援和软体更新的延迟。这可能会影响智慧财产权 (IP) 管理软体解决方案的整体效能和可靠性。

智慧财产权 (IP) 管理软体市场趋势

专利智慧财产权(IP)管理类型的市场预计将显着成长

- 专利智慧财产权(IP)管理软体是一款旨在简化和组织专利、商标、版权等智慧财产权(IP)资产管理流程的工具。它通常包括文件管理、专利组合分析、截止日期追踪和协作工具等功能。

- 近年来,专利智慧财产权管理经历了数位化的重大转变。近年来,各个最终用户产业的专利申请数量显着增加。例如,根据美国专利商标局的数据,2023 财年美国专利商标局授予了 346,152 项专利。这比前 20 年有所增加,前 20 年共颁发了 182,218 项专利。

- 世界各地的商业公司和专利局也正在利用新兴技术来获得巨额利润。例如,美国专利局推出了一种人工智慧解决方案,提案专利类别和搜寻,以使流程更加有效。欧洲专利局也推出了一种工具来翻译以 32 种语言发布的专利。

- 人工智慧的使用会带来法律问题,具体取决于所用技术的规格。儘管人工智慧背后的人类发明者仍然很容易识别,但机器可能会绕过其创造者开发更有效的研发流程。这项进展预计将导致立法机关、专利局和法院处理有关发明人归属和授予专利保护的复杂问题。

- 2024 年 5 月,Elekta 宣布收购飞利浦医疗保健的 Pinnacle 治疗计画系统 (TPS) 专利组合。这项策略性倡议加强了医科达在治疗计画方面的地位,并强调了其对放射治疗创新的承诺。此类专利在各个最终用户产业的扩展可能会进一步推动对研究领域的需求。

- 随着业务在全球扩张,对不同国家和地区的专利进行有效管理的需求日益增长。智慧财产权 (IP) 管理软体集中并视觉化国际专利组合。根据 IFI CLAIMS 专利服务公司的数据,三星电子到 2023 年将获得 6,165 项美国专利,比其他公司都多。

亚太地区可望维持大幅成长

- 由于中国、日本、印度和韩国等国家专利、商标和工业申请的增加,亚太地区预计将显着成长。此外,由于过去几年专利数量的增加,亚太地区的 IT、电讯和 BFSI 等最终用户产业正在大量采用智慧财产权 (IP) 管理软体。

- 根据 IIF 2024 年 4 月的报告,通讯部 (DoT) 为诺基亚、爱立信、思科和高通等跨国公司创建了智慧财产权 (IPR),以销售本地生产的产品。 ,鼓励他们研究最新技术。此外,政府的目标是到 2027 年在行动通讯技术的下一代必要专利中拥有至少 3% 的智慧财产权 (IP)。该相关人员也表示,政府希望在未来几年内占领全球通讯设备市场3%的份额。

- 印度等新兴经济体预计将在未来几年对专利管理软体的需求产生正面影响。印度在全球范围内快速发展,印度专利局 (IPO) 将在 2023 年达到一个重要的里程碑。最新发布的资料显示了印度独特的创新和适应能力,同财年授予超过 75,000 项专利,创下纪录。

- 印度专利局与印度国家银行 (SBI) 合作透露,2023 年专利申请数量将激增 17%,达到 90,000 多项。这是惊人的平均每天约 247 件专利申请,是过去 20 年来的最高水准。

- 此外,随着更先进的技术和保护的发展,管理智慧财产权 (IP) 的创建已成为任何企业的强制性要求,以确保已开发的智慧财产权 (IP) 的快速商业化。这意味着更多的区域企业预计将把策略重点放在保护其智慧财产权 (IP) 资产上并依赖最新技术。

- 预计中国将在亚太知识产权(IP)管理软体市场占据主要份额。该国知识产权(IP)管理软体的高采用率主要是由于专利申请数量的增加和最终用户行业的采用率不断增加。中国市场的供应商正成为专利申请的领导公司。例如,根据WIPO资料,华为技术有限公司2023年提交了6,494件国际专利申请,专利申请数量相当可观。

知识产权(IP)管理软体产业概况

智慧财产权 (IP) 管理软体市场较为分散,由多个供应商组成。许多世界领先的市场供应商正在透过引入创新解决方案和建立策略合作伙伴关係来扩大其市场份额。

- 2024 年 1 月 创新与智慧财产权 (IP) 管理技术供应商 Anaqua 宣布对由先进专利分析软体 AcclaimIP 提供支援的 USPTO资料进行年度分析。调查显示,2023年专利授权量为348,774件,比前一年的347,408件微增约一半。

- 2023 年 10 月 智慧财产权 (IP) 管理解决方案供应商 MaxVal Group Inc. 宣布推出 Symphony for Law Firms。 Symphony 是与领先的律师事务所合作开发的最新智慧财产权 (IP) 管理软体解决方案,可协助律师事务所简化业务、提高生产力、降低风险并提高其智慧财产权 (IP)业务的可见度和控制力。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场动态

- 市场概况

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 买方议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争公司之间敌对关係的强度

- 评估主要宏观经济趋势的市场影响

- 市场驱动因素

- 专利、商标和工业设计申请量增加

- 市场限制因素

- 缺乏智慧财产权(IP)外包意识

第五章市场区隔

- 按发展

- 本地

- 云

- 按解决方案

- 软体

- 服务

- 按类型

- 专利智慧财产权(IP)管理

- 商标智慧财产权(IP)管理

- 版权知识产权 (IP) 管理

- 设计智慧财产权(IP)管理

- 其他的

- 按最终用户产业

- BFSI

- 卫生保健

- 车

- 资讯科技/通讯

- 研究机构

- 其他的

- 按地区

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东/非洲

第六章 竞争状况

- 公司简介

- Anaqua Inc.

- Clarivate PLC

- DoketTrak

- WebTMS Limited

- TM Cloud Inc.

- Patrix AB

- Patsnap Pte Ltd

- Alt Legal Inc.

- Gridlogics Technologies Pvt. Ltd

- AppColl Inc.

第七章 投资分析

第八章市场的未来

The Intellectual Property Management Software Market size is estimated at USD 11.96 billion in 2024, and is expected to reach USD 22.98 billion by 2029, growing at a CAGR of 13.94% during the forecast period (2024-2029).

Intellectual property management software allows enterprises to manage multiple aspects of intellectual property (IP) assets, including invention disclosures, patent portfolios, trade secrets, trademarks, copyrights, and the operational and legal activities associated with patent prosecution, partnerships, agreements, and licensing. The continuous evolution of technology, including artificial intelligence, machine learning, and automation, is driving innovation in IP management software. Advanced features such as predictive analytics, patent searching algorithms, and automated document management are enhancing these software solutions' capabilities and value proposition.

Key Highlights

- Intellectual property is a legal approach to preserving ideas or inventions for commercial benefits by providing creators or inventors with certain exclusive rights. The incremental increase in the adoption of outsourcing services by larger enterprises contributes significantly to the growth of the IP management software market.

- As the number of patents grows, managing and tracking intellectual property rights, applications, filings, and renewals becomes increasingly complex. IP management software provides centralized platforms to streamline these processes, enhancing efficiency and decreasing the risk of errors. According to IFI CLAIMS Patent Services, the South Korean technology giant Samsung Electronics was awarded a total of 6,165 US patents in 2023, the most of any company. Qualcomm ranked second among companies, with 3,854 US patents granted, followed by Taiwan Semiconductor Manufacturing Company and IBM.

- Further, businesses are becoming increasingly aware of the strategic value of intellectual property as a driver of innovation, competitiveness, and revenue generation. As a result, they are investing more resources in managing and safeguarding their IP assets, fueling the adoption of IP management software. For instance, in April 2023, Fujitsu, a prominent information and communications technology provider, adopted Anaqua's AQX platform for intellectual property management.

- Managing all the potential intellectual property assets has become one of the most crucial parts of securing a place in the market as the business grows. Vendors in the market can significantly help companies protect their competitive advantages from infringements. Using a wealth of experience, IP management software and service providers guide the development of a smarter IP portfolio that may align with the business strategy and maximize the IP assets.

- The growing partnership among key players is anticipated to offer a lucrative opportunity for enterprise intellectual property management software industry growth during the forecast period. For instance, in May 2023, with the launch of TCS Generative AI, a unique offering from Tata Consultancy Services (TCS), the firm announced an expansion of its partnership with Google Cloud. TCS Generative AI uses Google Cloud's generative AI services to design and implement specialized business solutions that help clients use this innovative technology to speed up their growth and transformation.

- Moreover, for small and medium-sized businesses (SMEs), implementing intellectual property management software can be costly. The upfront expenses associated with license, customization, and training could prevent certain firms from implementing these solutions. For instance, the median cost of a software patent, as reported by the American Intellectual Property Law Association, is USD 10,000, including the filing expenses for the patent application.

- Increasing inflation often leads to higher operating costs for businesses, including software providers. This can result in higher prices for IP management software licenses and services, impacting affordability for some clients. Furthermore, the Russia- Ukraine War conflict could disrupt supply chains and operations for software providers, leading to delays in product development, customer support, and software updates. This could affect the overall performance and reliability of IP management software solutions.

Intellectual Property Management Software Market Trends

Patent Intellectual Property Management Type Expected to Witness Significant Market Growth

- Patent IP management software is a tool designed to streamline and organize the process of managing intellectual property assets, such as patents, trademarks, and copyrights. It typically includes features like document management, patent portfolio analysis, deadline tracking, and collaboration tools.

- Patent IP management has observed a significant shift toward digitization in recent years. The number of patent filings from various end-user industries has increased significantly in the past few years. For instance, according to USPTO, in the fiscal year of 2023, 346,152 patents were granted at the United States Patent and Trademark Office. This was an increase from the last two decades, when 182,218 patents were issued.

- Commercial enterprises and patent offices worldwide also leverage emerging technologies to unlock significant benefits. For instance, the US patent office has implemented AI solutions to suggest patent classes, which are searched to make the process more effective. The European Patent Office has also implemented a tool to translate patents published in 32 languages.

- The use of AI opens legal issues that depend on the specifics of the technology used. Although human inventors behind AI are still easy to identify, the machine may bypass its creators and develop a process for more efficient R&D. This trend is expected to lead legislators, patent offices, and courts to complex questions of attributing inventorship or even awarding patent protection.

- In May 2024, Elekta announced acquiring Philips Healthcare's Pinnacle Treatment Planning System (TPS) patent portfolio. This strategic move bolsters Elekta's position in treatment planning and underscores its commitment to innovation in radiation therapy. Such patent expansion across various end-user industries may further propel the studied segment demand.

- With businesses expanding globally, the need for efficient management of patents across different countries and regions has increased. IP management software provides centralized control and visibility over international patent portfolios. According to IFI CLAIMS Patent Services, Samsung Electronics was awarded 6,165 US patents in 2023, the most of any company.

Asia-Pacific is Expected to Hold the Considerable Growth Rate

- Asia-Pacific is expected to grow significantly due to increased patent, trademark, and industrial applications in countries like China, Japan, India, and South Korea. Further, end-user industries such as IT, telecom, and BFSI in Asia-Pacific are witnessing significant adoption of intellectual property management software owing to the growth in patents in the past few years.

- According to IIF reports in April 2024, the Department of Telecommunications (DoT) pushed multinational companies like Nokia, Ericsson, Cisco, and Qualcomm to collaborate with university institutions and work on the latest technologies as part of their attempts to create intellectual property rights (IPRs) and build locally produced products. Further, the government is expected to target at least 3% of IPRs in next-generation essential patents by 2027 in mobile telecom technologies. The official also stated that the government hopes to capture 3% of the worldwide telecom equipment market in the coming years.

- Emerging economies such as India are expected to positively influence the demand for patent management software in the coming years. The country has surged globally, with the Indian Patent Office (IPO) marking a significant milestone in 2023. The latest data released showcases India's unique ability to innovate and adapt, setting a record with over 75,000 patents granted in the fiscal year.

- The Indian Patent Office, in collaboration with research conducted by the State Bank of India (SBI), revealed a striking 17% surge in patent filings, reaching over 90,000 in 2023. This translated to an astonishing average of nearly 247 patents applied daily, marking the highest number recorded in the past two decades.

- Furthermore, with the evolution of more advanced technologies and protection, management of IP creation has become a mandate in every business to ensure faster commercialization of the IP developed. This means that more regional companies are anticipated to rely on the latest technologies with a strategic focus on protecting their IP assets.

- China is expected to hold a significant share of the intellectual property management software market in the Asia Pacific region. The country's high adoption of intellectual property management software is primarily driven by the increasing growth in patent applications and growing adoption among end-user industries. Chinese market vendors are emerging as the leading companies in filing patent applications. For instance, according to the data from WIPO, Huawei Technologies filed a significant number of international patent applications in 2023, with 6,494 applications.

Intellectual Property Management Software Industry Overview

The intellectual property management software market is fragmented and consists of several market vendors. Many major market vendors worldwide are increasing their market presence by introducing innovative solutions or entering strategic partnerships.

- January 2024: Anaqua, the significant innovation and intellectual property (IP) management technology provider, announced its annual analysis of USPTO data utilizing its advanced AcclaimIP patent analytics software. The study found that patent grants grew nearly one-half of one percent to 348,774 in 2023, a slight gain compared to 347,408 patents in the previous year.

- October 2023: MaxVal Group Inc., a provider of intellectual property management solutions, announced the release of Symphony for Law Firms. Developed in partnership with significant law firms, Symphony is a modern IP management software solution that empowers law firms to streamline operations, enhance productivity, reduce risk, and improve visibility and control over their IP practice.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Assessment of Impact of Key Macroeconomic Trends on the Market

- 4.4 Market Drivers

- 4.4.1 Growing Patent, Trademark, and Industrial Design Applications

- 4.5 Market Restraints

- 4.5.1 Lack of Awareness About Intellectual Property Outsourcing

5 MARKET SEGMENTATION

- 5.1 By Deployment

- 5.1.1 On-premise

- 5.1.2 Cloud

- 5.2 By Solution

- 5.2.1 Software

- 5.2.2 Service

- 5.3 By Type

- 5.3.1 Patent Intellectual Property Management

- 5.3.2 Trademark Intellectual Property Management

- 5.3.3 Copyright Intellectual Property Management

- 5.3.4 Design Intellectual Property Management

- 5.3.5 Other Types

- 5.4 By End-user Industry

- 5.4.1 BFSI

- 5.4.2 Healthcare

- 5.4.3 Automotive

- 5.4.4 IT and Telecom

- 5.4.5 Research Institutes

- 5.4.6 Other End-user Industries

- 5.5 By Geography

- 5.5.1 North America

- 5.5.2 Europe

- 5.5.3 Asia-Pacific

- 5.5.4 Latin America

- 5.5.5 Middle East and Africa

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 Anaqua Inc.

- 6.1.2 Clarivate PLC

- 6.1.3 DoketTrak

- 6.1.4 WebTMS Limited

- 6.1.5 TM Cloud Inc.

- 6.1.6 Patrix AB

- 6.1.7 Patsnap Pte Ltd

- 6.1.8 Alt Legal Inc.

- 6.1.9 Gridlogics Technologies Pvt. Ltd

- 6.1.10 AppColl Inc.