|

市场调查报告书

商品编码

1524118

量子点(QD):市场占有率分析、产业趋势/统计、成长预测(2024-2029)Quantum Dots - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

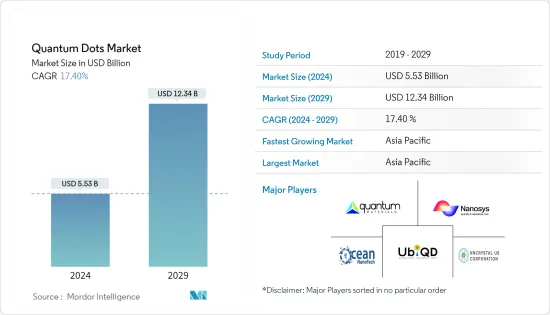

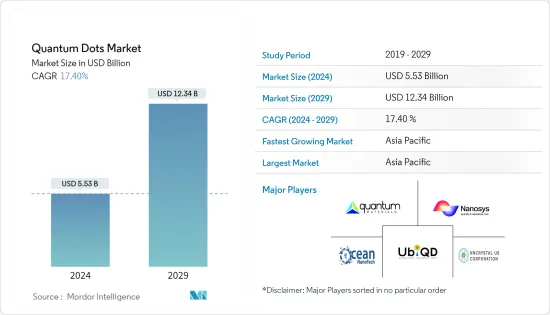

量子点(QD)市场规模预计到 2024 年为 55.3 亿美元,预计到 2029 年将达到 123.4 亿美元,在预测期内(2024-2029 年)复合年增长率为 17.40%。

量子点(QD)是具有动态特性的奈米级半导体颗粒。这些微结构通常由硒化镉等材料製成,可以吸收和发射特定波长的光,这使得它们在电子、医学影像处理和显示器等应用中具有价值。量子点 (QD) 的尺寸依赖性电子特性使得能够精确控制其光学和电子特性。

*量子点 (QD) 表现出独特的光学特性,包括尺寸依赖性萤光和在特定波长下发光的能力。这使得它们在需要精确色彩控制的应用中非常有用,例如显示器和照明。此外,这些半导体量子点 (QD) 的独特成分、可调特性和尺寸为其在各种应用和新技术中的应用带来了巨大的希望。

*在农业领域,可以製造光转换涂层,预计将提高温室果树的产量和成熟速度。荷兰农民越来越多地采用室内种植,先进的温室使用 LED 照明,可以在更小的空间内更快地种植更多作物。

*量子点(QD)辅助显示是最新技术之一。它能够产生更鲜艳的色彩并为现代显示器带来灵活性,预计将推动更多的采用。量子点独特的与尺寸相关的光学、电子、化学和光电特性使其非常适合现代显示器,因为它们具有更高的功率效率、更宽的色域和更低的屏障保护要求。

*然而,由于照明解决方案成本高昂,量子点 (QD) 技术的成长仅限于高端应用。量子点 (QD) 技术无法与 LED 等其他更便宜的技术竞争。此外,与 OLED 相比,对比度较低和视角较差等技术限制也阻碍了研究市场的成长。

*COVID-19疫情对电子产业的成长产生了重大影响。疫情爆发初期,扰乱了产业供应链,部分地区製造商难以业务永续营运。疫情引发的消费性电子和运算产品的激增推动了对显示产品和 LED 的需求,这在量子点 (QD) 市场上也很明显。随着数位解决方案的采用预计将继续增长,预测期内接受调查的市场也预计将出现向上增长。

量子点(QD)市场趋势

光电子和光学元件显着成长

- 量子点 (QD) 显示器已成为传统液晶显示器 (LCD) 的有前途的替代品。透过采用量子点作为颜色转换材料,这些显示器可以实现宽色域、更高的亮度和更高的能源效率。采用量子点 (QD) 增强的 LCD 可提供更明亮、更准确的色彩,适合电视、显示器和行动装置中的高品质成像。

- 量子点 (QD) 也彻底改变了照明领域,主要是在下一代发光二极体(LED) 的开发方面。透过利用量子点作为降压转换器,白光 LED 可以获得更高的显色指数 (CRI) 值和更好的色彩品质。与传统磷光体LED 相比,量子点 (QD) LED 具有更宽的色域、更高的效率和更长的使用寿命。这些进步为家庭、办公室和城市环境中的节能照明解决方案铺平了道路。

- 根据IEA统计,LED在国际照明市场的渗透率正显着提高,预计2025年将达到76%,2030年将达到87.4%。 LED 也是透过光纤通讯系统传输资讯的重要 IT 和通讯雷射。

- 奈米级半导体装置有望成为下一代高度整合和高功能的技术。量子点 (QD) 由于其量子限製而表现出独特的特性。这种独特的特性引起了人们对量子点(QD)在光电应用中潜力的关注。人们正在对这些有利的奈米材料进行大量努力,以强调下一代光电元件(例如雷射、LED、检测器、放大器和太阳能电池)的增强性能和功能。

亚太地区预计将占据主要市场占有率

- 中国对半导体製造和量子计算研究的投资为量子点(QD)提供了潜在的成长机会。量子点(QD)具有推进半导体技术并为量子电脑的发展做出贡献的潜力。

- 中国在量子技术特别是量子通讯方面取得了长足进展。瓦查纳在量子计算的某些方面落后于美国。其科学家取得了令人瞩目的成果,并且正在取得快速进展。近年来,量子雷达和量子感测器的进展不断涌现,体现了中国对量子技术的承诺。

- 量子点(QD)技术及其应用的重大进步推动了日本量子点(QD)的成长。例如,国家资讯通讯技术研究所光子网路研究所的研究人员开发了一种使用高品质量子点(QD)的新光源技术。与使用传统方法製造的量子点(QD)相比,量子点(QD)表现出更高的稳定性和光学频率,在各个领域开闢了潜在的应用前景。

- 日本 NITC 已完成研究,让光纤网路在新的频谱区域使用量子点 (QD)。透过应用量子点(QD)生长的新方法,我们成功实现了开拓频宽的光资料传输,展现了扩展光纤网路能力的潜力。

量子点 (QD) 产业概览

量子点(QD)市场正在走向半固体,应用数量也在增加,预计在预测期内市场渗透水平将会成长。主要供应商的业务遍及全球,这帮助他们获得了可观的市场占有率。市场主要企业包括Nanosys Inc.(Shoei Electronic Materials Inc.)、NnCrystal US Corporation(NN-Labs)、Quantum Materials Corporation、UbiQD Inc.、Ocean NanoTech.等。每个企业都致力于透过策略合作来增加市场占有率并增强盈利。

*2024 年 2 月 - Quantum Solutions 宣布在 200mm 硅 ROIC(读出积体电路)晶圆上成功展示 QDot PbS 量子点 (QD) n 型墨水的晶圆级沉积。这项突破凸显了在 200mm 晶圆平台上製造高通量 SWIR(短波长红外线)影像感测器的可行性,这对于大规模感测器製造至关重要。

*2023 年 11 月 - Nanoco 集团与一家领先的亚洲化学合作伙伴签订了两项协议,以优化 Nanoco 用于红外线感测应用的第二代量子点(QD) 材料并扩大生产规模。的年度共同开发契约(JDA)。这是该公司成为感测市场奈米材料商业性供应商的最新里程碑,并支持其 2024 财年的前景。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场洞察

- 市场概况

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 买方议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争程度

- COVID-19 和其他宏观经济因素对市场的影响

第五章市场动态

- 市场驱动因素

- 高品质显示设备对量子点 (QD) 的需求增加

- 对节能解决方案的需求不断增长

- 市场挑战

- 对生物应用中细胞毒性的担忧

第六章 市场细分

- 按类型

- III-V族半导体

- II-VI族半导体

- 硅(Si)

- 按用途

- 光电/光学元件

- 医疗保健

- 农业

- 替代能源

- 其他的

- 按地区

- 北美洲

- 美国

- 加拿大

- 欧洲

- 英国

- 德国

- 法国

- 其他欧洲国家

- 亚太地区

- 中国

- 日本

- 印度

- 其他亚太地区

- 其他地区(拉丁美洲、中东、非洲)

- 北美洲

第七章 竞争格局

- 供应商定位分析

- 公司简介

- Nanosys Inc.(Shoei Electronic Materials Inc)

- NnCrystal US Corporation(NN-Labs)

- Quantum Materials Corporation

- UbiQD Inc.

- Ocean NanoTech

- Thermo Fisher Scientific Inc.

- Nanoco Group PLC.

- NanoOptical Materials Inc

- Merck KGaA

- Quantum Solutions Inc.

第八章投资分析

第九章 市场机会及未来趋势

The Quantum Dots Market size is estimated at USD 5.53 billion in 2024, and is expected to reach USD 12.34 billion by 2029, growing at a CAGR of 17.40% during the forecast period (2024-2029).

Quantum dots are nanoscale semiconductor particles that exhibit quantum mechanical properties. These tiny structures, typically composed of materials like cadmium selenide, can absorb and emit light at specific wavelengths, making them valuable for applications in electronics, medical imaging, and displays. Their size-dependent electronic characteristics allow precise control over their optical and electronic properties.

* Quantum dots exhibit unique optical properties, such as size-dependent fluorescence and the ability to emit specific wavelengths of light. This makes them valuable in applications like displays and lighting, where precise color control is essential. In addition, the unique composition, tunable property, and size of these semiconducting quantum dots make them highly appealing for a wide variety of applications and new technologies.

* In agriculture, it is possible to create light-converting coatings, which are anticipated to increase yield and the speed of maturation of fruit plants in greenhouses. Dutch farmers are increasingly adopting indoor farming, and they can cultivate more crops faster and in a smaller space with advanced greenhouses using LED lights.

* Quantum dot (QD) assisted displays are among the newest technology additions. The adoption is anticipated to grow due to their ability to produce more vivid colors and bring flexibility to modern displays. The unique size-dependent optical, electronic, chemical, and optoelectronic features of QDs make them highly suitable for modern displays owing to their higher power efficiency and wide color gamut with lower barrier protection requirements.

* However, the high costs of lighting solutions have restricted the growth of quantum dot technology to be used only in high-end applications. They are unable to compete with other cheaper technologies, like LEDs. Additionally, technical limitations such as lower contrast ratio and poor viewing angle in comparison to OLEDs also continue to challenge the studied market's growth.

* The outbreak of COVID-19 has had a notable impact on the growth of the electronics industry. The initial pandemic outbreak disrupted the industry's supply chain, making it difficult for manufacturers to continue their operations in some areas. A pandemic-led growth in the adoption of consumer electronic and computing products drove the demand for display products and LEDs, which was also evident in the quantum dots market. With the adoption of digital solutions anticipated to continue to grow, the market studied will also witness upward growth during the forecast period.

Quantum Dots Market Trends

Optoelectronics and Optical Components to Witness Significant Growth

- Quantum dot displays have emerged as a promising alternative to traditional liquid crystal displays (LCDs). By incorporating QDs as color-converting materials, these displays can achieve a wider color gamut, enhanced brightness, and improved energy efficiency. Quantum dot-enhanced LCDs deliver vibrant and more accurate colors, making them suitable for high-quality imaging in televisions, monitors, and mobile devices.

- Quantum dots have also revolutionized the lighting field, mainly in developing next-generation light-emitting diodes (LEDs). By utilizing QDs as down-converters, white LEDs can achieve higher color rendering index (CRI) values and better color quality. Quantum dot LEDs offer a wider range of colors, improved efficiency, and longer lifetimes than conventional phosphor-based LEDs. These advancements have paved the way for energy-efficient lighting solutions in homes, offices, and urban environments.

- LEDs also form a crucial part of the optical fiber communication systems for transmitting data through modulated light; according to IEA, the penetration rate of LEDs into the international lighting market is rising considerably; it is expected to reach 76% by 2025 and 87.4% by 2030, and these LEDs are also telecommunication lasers, vital in transmitting information through optical communication systems.

- Nanometer-scale semiconductor devices have been predicted as next-generation technologies with high integration and functionality. Quantum dots exhibit unique properties due to their quantum confinement. These unique properties have brought to light the potential of quantum dots in optoelectronic applications. Numerous efforts have been dedicated to these favorable nanomaterials for next-generation optoelectronic components, such as lasers, LEDs, photodetectors, amplifiers, and solar cells, highlighting enhancing performance and functionality.

Asia-Pacific is Expected to Hold Significant Market Share

- China's investments in semiconductor manufacturing and quantum computing research offer potential growth opportunities for quantum dots. Quantum dots have the potential to advance semiconductor technologies and contribute to the development of quantum computers.

- China has made huge advances in quantum technologies, particularly in quantum communication. Vachana is behind the United States in some aspects of quantum computing. Its scientists have made eye-catching achievements and are progressing rapidly. In recent years, there have been reports of advancements in quantum radar and quantum sensors, showcasing China's commitment to quantum technology.

- The growth of quantum dots in Japan has been driven by significant advancements in quantum dot technology and its application. For instance, researchers at the Photonic Network Research Institute of Japan's National Institute of Information and Communication Technology have developed a new light source technology using high-quality quantum dots. These quantum dots exhibit higher stability and optical frequency than those created using conventional methods, paving the way for potential application in various fields.

- Japan's NITC completes research that could allow fiber optics networks to use quantum dots in new areas of the spectrum. Researchers have successfully transmitted optical data in an untapped frequency band by applying a new approach to quantum dot growth, showing the potential to expand fiber optic network capabilities.

Quantum Dots Industry Overview

The quantum dots market is semi-consolidated and has an increasing number of applications, and the level of market penetration is expected to grow during the forecast period. Major vendors have a global presence, which helps them to gain a substantial market share. Key players in the market include Nanosys Inc. (Shoei Electronic Materials Inc.), NnCrystal US Corporation (NN-Labs), Quantum Materials Corporation, UbiQD Inc., Ocean NanoTech., etc. The businesses are leveraging strategic collaborative actions to improve their market percentage and enhance profitability.

* February 2024 - Quantum Solutions announced the booming demonstration of wafer-level deposition of QDot PbS quantum dot n-type ink on a 200 mm silicon ROIC (read-out integrated circuit) wafer. This groundbreaking work highlights the feasibility of producing SWIR (short-wave infrared) image sensors with high throughput on 200 mm wafer platforms, which is essential for large-scale manufacturing of sensors.

* November 2023 - Nanoco Group has signed a new two-year joint development agreement (JDA) with its existing major Asian chemical partner to optimize and scale up the production of Nanoco's second-generation quantum dot materials for infrared sensing applications. This marks the company's latest milestone in becoming a commercial provider of nanomaterials to the sensing market and supports its FY24 forecasts.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Degree of Competition

- 4.3 Impact of COVID-19 Aftereffects and Other Macroeconomic Factors on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Demand for Quantum Dots in High-Quality Display Devices

- 5.1.2 Growing Demand for Energy-efficient Solutions

- 5.2 Market Challenges

- 5.2.1 Concerns Regarding the Toxicity of Cells in Biological Applications

6 MARKET SEGMENTATION

- 6.1 By Type

- 6.1.1 III-V-Semiconductors

- 6.1.2 II-VI-Semiconductors

- 6.1.3 Silicon (Si)

- 6.2 By Application

- 6.2.1 Optoelectronics and Optical Components

- 6.2.2 Medicine

- 6.2.3 Agriculture

- 6.2.4 Alternative Energy

- 6.2.5 Other Applications

- 6.3 By Geography

- 6.3.1 North America

- 6.3.1.1 United States

- 6.3.1.2 Canada

- 6.3.2 Europe

- 6.3.2.1 United Kingdom

- 6.3.2.2 Germany

- 6.3.2.3 France

- 6.3.2.4 Rest of Europe

- 6.3.3 Asia-Pacific

- 6.3.3.1 China

- 6.3.3.2 Japan

- 6.3.3.3 India

- 6.3.3.4 Rest of Asia-Pacific

- 6.3.4 Rest of the World (Latin America and Middle East and Africa)

- 6.3.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Vendor Positioning Analysis

- 7.2 Company Profiles*

- 7.2.1 Nanosys Inc. (Shoei Electronic Materials Inc)

- 7.2.2 NnCrystal US Corporation (NN-Labs)

- 7.2.3 Quantum Materials Corporation

- 7.2.4 UbiQD Inc.

- 7.2.5 Ocean NanoTech

- 7.2.6 Thermo Fisher Scientific Inc.

- 7.2.7 Nanoco Group PLC.

- 7.2.8 NanoOptical Materials Inc

- 7.2.9 Merck KGaA

- 7.2.10 Quantum Solutions Inc.