|

市场调查报告书

商品编码

1524123

全球软包装市场:市场占有率分析、产业趋势/统计、成长预测(2024-2029)Flexible Packaging - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

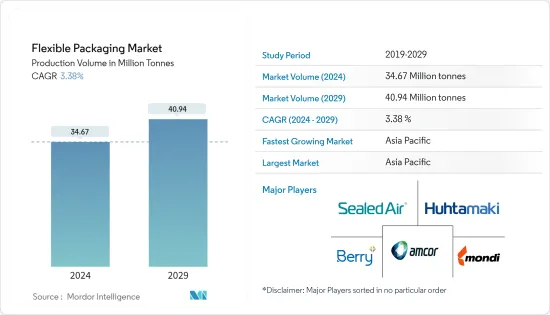

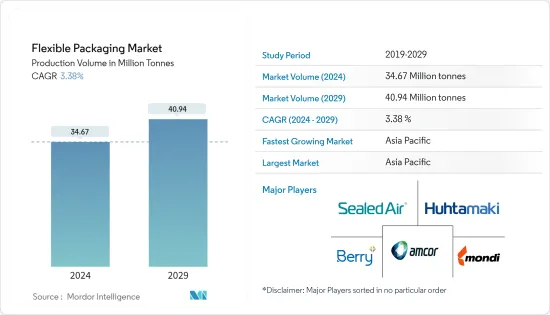

全球软包装市场的生产规模预计将从2024年的3,467万吨扩大到2029年的4,094万吨,预测期间(2024-2029年)复合年增长率为3.38%。

软包装市场受到许多相互交织的因素的推动,包括对方便、轻质包装解决方案的需求不断增长、消费者对永续性的意识不断增强,以及提高保质期和产品保护的包装技术的进步。

主要亮点

- 此外,软包装的多功能性、成本效益和运输便利性也是其成长的推动因素。随着产业优先考虑环保解决方案以及消费者要求便利性和功能性,软包装市场可望扩大。

- 零售收益的增加往往会导致市场扩张,使新产品进入市场,并使现有产品接触更多消费者。软包装可适应多种产品类型,使其适用于多种行业,包括食品和饮料、药品和个人护理品。因此,零售的扩张可能会推动软包装市场多个细分领域的成长。

- 聚乙烯主要用于塑胶袋、塑胶薄膜、地工止水膜等包装。聚乙烯是一种轻质、部分结晶质、低吸湿性热塑性塑料,具有高耐化学性和隔音性能。低密度聚乙烯(LDPE)主要用于生产塑胶袋。 LDPE 聚乙烯袋在低温下柔软且富有弹性,也有自然色可供选择。

- 在包装方面,回收和环保至关重要。海洋和垃圾掩埋场的塑胶污染受到包装废弃物的影响。塑胶包装导致环境中的塑胶污染。塑胶需要数百年才能分解,并会影响海洋生物和生态系统。

- 预计这一趋势将持续下去。 COVID-19 之后,对牛皮纸厂的投资可能会增加。纸包装的使用不断增加,很大程度上是由于电子商务领域的扩张以及消费者对环保解决方案的兴趣。

软包装市场趋势

烘焙点心和零嘴零食领域成长

- 软包装为烘焙点心和零嘴零食的消费者和生产商提供了便利。消费者重视软包装的易用性和可重新密封性,特别是经常食用多次的产品,例如饼干和麵包。

- 此外,根据美国农业部的数据,随着经济成长、富裕程度的提高以及海湾各州年轻人和移民的扩张,零嘴零食食品,特别是巧克力、咸味零嘴零食、甜饼干和砂糖,继续增加。

- 根据加拿大农业和食品部统计,到2026年,美国冷冻烘焙食品的规模预计将达到25.76亿美元,较2022年大幅成长。对糖果零食和烘焙产品的需求增加催生了软包装选择,如小袋、袋子、包装纸和薄膜,因为软包装可以提供广泛的印刷选择,以改善糖果零食包装设计,这预计将推动需求。

- 过去十年,忙碌的生活方式、劳动力中女性人数的增加以及工业化的不断发展等方面迅速增加了该地区对即时包装食品和零食的需求。此外,双收入专业家庭正在推动零食市场的发展,作为忙碌一天后的代餐或奖励。

- 人口稠密且富裕的阿拉伯联合大公国和沙乌地阿拉伯占零食和糖果零食支出的 75% 以上。卡达和巴林等其他小国也正在经历稳定成长,预计到 2025 年将成为大型市场。

亚太地区正在经历显着成长

- 在中国,泡壳包装主要应用于製药业,因为它具有增强产品保护、简化分销、单位剂量包装和改进产品标识等众多优点。因此,我国泡壳包装产业的范围显着扩大。

- 在人口老化的日本,日本袋装食品以及预先切割的单份蔬菜和肉类变得越来越容易买到,以适应零售商不断变化的偏好。值得注意的是,由层压塑胶和铝製成的杀菌袋在日本越来越受欢迎,尤其是酱汁和咖哩。这些袋子正在取代传统罐头,因为它们在热灭菌过程中更耐用。此外,小袋包装比罐头食品更具成本效益,特别是在罐头食品依赖金属进口的国家,这进一步支持了其在日本的采用。

- 根据日本罐头食品协会统计,2022年日本蒸馏食品产量约157,540吨咖哩,而杀菌袋农产品仅占780吨。预计这些趋势将持续下去并推动市场成长。

- 印度拥有14亿人口,是世界上人口最多的国家,也是世界第五大经济体。该国强劲的製药业,加上投资的增加、人口的成长、健康意识的提高和预期寿命的延长,预计将推动对柔性药品包装解决方案的需求。

- 澳洲包装市场在亚太地区表现突出,成长迅速。特别是加工食品、生鲜食品和肉类产业正在经历快速成长。健康意识的趋势和对消费者道德的日益关注正在推动对本地生产的生鲜食品的需求。

- 马来西亚、菲律宾、泰国、越南、纽西兰、韩国和亚太其他地区占据了亚太地区软包装产业的主要市场占有率。

软包装产业概况

由于少数供应商拥有相当大的市场占有率份额,软包装市场呈现分散化状态。市场较为集中,领导企业采取产品创新、併购等策略来维持竞争力。该行业的主要企业包括 Amcor Group GmbH、Mondi Group、Berry Global Inc.、Sealed Air Corporation 和 Huhtamaki Oyj。

- 2024 年 3 月 Berry Global Group, Inc. 的柔性部门最近提高了三个欧洲回收设施的回收能力,这是扩大该公司 Sustane 系列回收聚合物生产的欧洲范围计划的一部分。该扩建计划预计将利用全球获得高价值再生塑胶的机会,满足对再生材料製成的高性能薄膜不断增长的需求。

- 2024 年 2 月,Amkor 与有机酸奶製造商 Stonyfield Organic 和吸嘴袋包装製造商 Cheer Pack North America 合作,为 Stonyfield Organic 的冷藏 Yo Baby 酸奶创造一种更永续的替代品,以替代传统的多层结构。

其他好处:

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场洞察

- 市场概况

- 产业吸引力:波特五力分析

- 买方议价能力

- 供应商的议价能力

- 替代品的威胁

- 新进入者的威胁

- 竞争公司之间的敌对关係

- 产业价值链分析

第五章市场动态

- 市场驱动因素

- 对便捷包装的需求不断增长

- 长期储存的需求和生活方式的改变

- 市场挑战

- 对环境和回收的担忧

第六章 市场细分

- 依材料类型

- 塑胶

- 聚乙烯(PE)

- 双轴延伸聚丙烯(BOPP)

- 流延聚丙烯 (CPP)

- 聚氯乙烯(PVC)

- 乙烯 - 乙烯醇(EVOH)

- 其他塑胶(PA、生质塑胶)

- 纸

- 铝箔

- 塑胶

- 依产品类型

- 小袋

- 包包

- 薄膜和包装

- 其他产品类型(小袋、套袋、泡壳包装、衬里、层压板等)

- 按最终用途行业

- 食品

- 冷冻/冷藏食品

- 乳製品

- 水果和蔬菜

- 肉/鸡肉/鱼贝类

- 烘焙点心/零嘴零食

- 糖果/糖果零食

- 其他食品

- 饮料

- 药品和医疗用品

- 家居用品/个人护理

- 其他最终用途行业(烟草、化学品、农业等)

- 食品

- 按地区

- 北美洲

- 美国

- 加拿大

- 欧洲

- 英国

- 德国

- 法国

- 义大利

- 西班牙

- 土耳其

- 波兰

- 俄罗斯

- 亚洲

- 中国

- 日本

- 印度

- 澳洲

- 拉丁美洲

- 巴西

- 阿根廷

- 墨西哥

- 中东/非洲

- 阿拉伯聯合大公国

- 沙乌地阿拉伯

- 南非

- 埃及

- 伊朗

- 奈及利亚

- 北美洲

第七章 竞争格局

- 公司简介

- Amcor Group Gmbh

- Berry Global Inc.

- Mondi PLC

- Sealed Air Corporation

- Huhtamaki Oyj

- Uflex Limited

- Coveris Management Gmbh

- ProAmpac LLC

- Wipf AG

- Flexpak Services Llc

- Sigma Plastics Group Inc.

- KM Packaging Services Ltd

- Sonoco Products Company

- Arabian Flexible Packaging LLC

- Gulf East Paper and Plastic Industries LLC

第八章投资分析

第9章市场的未来

The Flexible Packaging Market size in terms of production volume is expected to grow from 34.67 Million tonnes in 2024 to 40.94 Million tonnes by 2029, at a CAGR of 3.38% during the forecast period (2024-2029).

The flexible packaging market is driven by a combination of factors, including increasing demand for convenient and lightweight packaging solutions, rising consumer awareness toward sustainability, and advancements in packaging technology for improved shelf life and product protection.

Key Highlights

- Additionally, the versatility of flexible packaging in accommodating various shapes and sizes, its cost-effectiveness, and ease of transportation further contribute to its growth. As industries prioritize eco-friendly solutions and consumers seek convenience and functionality, the flexible packaging market is poised to expand.

- Higher retail sales often lead to market expansion, with new products entering the market and existing ones reaching broader audiences. Flexible packaging is adaptable to different product categories, making it suitable for various industries, including food and beverage, pharmaceuticals, personal care, and more. Thus, expanding retail sales could drive growth in multiple segments of the flexible packaging market.

- Polyethylene is primarily used for packaging plastic bags, plastic films, geomembranes, etc. It is a lightweight, partially crystalline, low moisture absorbent, thermoplastic resin that has high resistance to chemicals and sound-insulating properties. Low-density polyethylene (LDPE) is mainly used to manufacture plastic bags. LDPE polyethylene bags are soft and flexible, even at low temperatures, and are available in natural colors.

- Recycling and environmental considerations are essential when it comes to packaging. Plastic contamination in oceans and landfills are impacted by packaging trash. Plastic packaging affects the environment's plastic pollution. Plastic can affect marine life and ecosystems since it takes hundreds of years to disintegrate.

- It is expected that this trend will continue. Investments in the kraft paper mills will rise post-COVID-19. The increased use of paper packaging is largely due to the growing e-commerce sector and consumer interest in eco-friendly solutions.

Flexible Packaging Market Trends

Baked Goods and Snack Foods Segment to Witness Growth

- Flexible packaging offers convenience to both consumers and producers of baked goods and snack foods. Consumers appreciate the ease of use and resealability of flexible packaging, especially for items like cookies and bread, which are often consumed multiple times.

- Moreover, according to USDA, the snacks and confectionery, especially chocolates, salty snacks, sweet biscuits, and sugar confectionery, continue to rise along with the growing economy, rising affluence, and expanding young and migrant residents in the Gulf states.

- According to Agriculture and Agri-Food Canada, the value of frozen bakery food in the United States is expected to witness a bolstered growth amounting to USD 2.576 billion by 2026, significantly up from 2022. Since flexible packaging can provide a wide range of printing options to improve the packaging design of confectionery products, a rise in demand for confectionery and baked products would consequently drive the demand for flexible packaging options like pouches, bags, wraps, and films.

- Aspects such as busy lifestyles, more women in the workforce, and growing industrialization have strengthened the need for ready-to-eat packaged foods and snacks in the region over the last decade. Dual-income professional households have also spurred the market for snacks between meals as a meal replacement and a reward after a busy workday.

- With their extensive and affluent populations, the United Arab Emirates and Saudi Arabia account for more than 75% of snacks and sweets consumption by value. Other smaller countries like Qatar and Bahrain are witnessing steady growth and are predicted to become larger markets by 2025.

Asia Pacific to Witness Significant Growth

- China predominantly employs blister packaging in its pharmaceutical sector, owing to its numerous advantages, such as enhanced product protection, streamlined distribution, unit dosage packaging, and improved product identification. This has significantly expanded the scope of the country's blister packaging industry.

- With Japan's aging population, there's a rising availability of Japanese pouch meals and pre-cut, single-serving portions of vegetables and meats, all catering to the evolving retail preferences. Notably, retort pouches, made from laminated plastic and aluminum, are gaining traction in Japan, particularly for sauces and curries. These pouches are replacing traditional cans due to their durability during thermal sterilization. Moreover, pouch packaging proves more cost-effective than cans, especially in countries reliant on metal imports for canning, further bolstering its adoption in Japan.

- According to the Japan Canners Association, in 2022, curry emerged as the dominant retort food pouch product in Japan, with a production volume of about 157.54 thousand tons, overshadowing agricultural products in retort pouches, which accounted for a mere 780 tons. These trends are expected to persist, driving market growth in the coming years.

- With a population of 1.4 billion, India stands as the world's most populous nation and the fifth-largest economy. The country's robust pharmaceutical industry, coupled with growing investments, a rising population, heightened health awareness, and increasing life expectancy, is set to bolster the demand for flexible pharmaceutical packaging solutions.

- The Australian packaging market has been a standout in the Asia-Pacific region, boasting rapid growth. Notably, the country is witnessing a surge in its processed food, fresh produce, and meat sectors. Health-conscious trends and a heightened focus on consumer ethics are propelling the demand for locally-grown fresh food.

- The Rest of Asia-Pacific, encompassing Malaysia, the Philippines, Thailand, Vietnam, New Zealand, South Korea, and other countries in the region, commands a significant market share in the Asia-Pacific flexible packaging sector.

Flexible Packaging Industry Overview

The flexible packaging market is fragmented owing to the presence of a few vendors with significant market share. The market is slightly concentrated, with the major players adopting strategies like product innovation, mergers, and acquisitions to remain competitive. The key players in the industry are Amcor Group GmbH, Mondi Group, Berry Global Inc., Sealed Air Corporation, and Huhtamaki Oyj, among others.

- In March 2024, Berry Global Group, Inc.'s Flexibles division recently increased recycling capacity at three European recycling facilities as part of a Europe-wide project to scale up production of the company's Sustane line of recycled polymers. The expansion project is expected to meet the increasing demand for high-performing films created with recycled content by leveraging the company's global access to high-value recycled plastic.

- In February 2024, Amcor partnered with Stonyfield Organic, the organic yogurt maker, and Cheer Pack North America, a spouted pouch packaging manufacturer, to introduce an all-polyethylene (PE)-based spouted pouch that replaces Stonyfield Organic's previous multilayered structure with a more sustainable pouch design for their Yo Baby refrigerated yogurt.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Buyers

- 4.2.2 Bargaining Power of Suppliers

- 4.2.3 Threat of Substitutes

- 4.2.4 Threat of New Entrants

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain Analysis

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increased Demand for Convenient Packaging

- 5.1.2 Demand for Longer Shelf Life and Changing Lifestyles

- 5.2 Market Challenges

- 5.2.1 Concerns Regarding the Environment and Recycling

6 MARKET SEGMENTATION

- 6.1 By Material Type

- 6.1.1 Plastic

- 6.1.1.1 Polyethene (PE)

- 6.1.1.2 Bi-orientated Polypropylene (BOPP)

- 6.1.1.3 Cast polypropylene (CPP)

- 6.1.1.4 Polyvinyl Chloride (PVC)

- 6.1.1.5 Ethylene Vinyl Alcohol (EVOH)

- 6.1.1.6 Other Plastic Types (PA, Bioplastics)

- 6.1.2 Paper

- 6.1.3 Aluminum Foil

- 6.1.1 Plastic

- 6.2 By Product Type

- 6.2.1 Pouches

- 6.2.2 Bags

- 6.2.3 Films & Wraps

- 6.2.4 Other Product Types (Sachets, Sleeves, Blister Packs, Liners, Laminates, etc.)

- 6.3 By End-user Industry

- 6.3.1 Food

- 6.3.1.1 Frozen and Chilled Food

- 6.3.1.2 Dairy Products

- 6.3.1.3 Fruits and Vegetables

- 6.3.1.4 Meat, Poultry, and Seafood

- 6.3.1.5 Baked Goods and Snack Foods

- 6.3.1.6 Candy and Confections

- 6.3.1.7 Other Food Products

- 6.3.2 Beverage

- 6.3.3 Pharmaceutical and Medical

- 6.3.4 Household and Personal Care

- 6.3.5 Other End-user Industries (Tobacco, Chemical, and Agriculture, Among Others)

- 6.3.1 Food

- 6.4 By Geography

- 6.4.1 North America

- 6.4.1.1 United States

- 6.4.1.2 Canada

- 6.4.2 Europe

- 6.4.2.1 United Kingdom

- 6.4.2.2 Germany

- 6.4.2.3 France

- 6.4.2.4 Italy

- 6.4.2.5 Spain

- 6.4.2.6 Turkey

- 6.4.2.7 Poland

- 6.4.2.8 Russia

- 6.4.3 Asia

- 6.4.3.1 China

- 6.4.3.2 Japan

- 6.4.3.3 India

- 6.4.3.4 Australia

- 6.4.4 Latin America

- 6.4.4.1 Brazil

- 6.4.4.2 Argentina

- 6.4.4.3 Mexico

- 6.4.5 Middle East and Africa

- 6.4.5.1 United Arab Emirates

- 6.4.5.2 Saudi Arabia

- 6.4.5.3 South Africa

- 6.4.5.4 Egypt

- 6.4.5.5 Iran

- 6.4.5.6 Nigeria

- 6.4.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles*

- 7.1.1 Amcor Group Gmbh

- 7.1.2 Berry Global Inc.

- 7.1.3 Mondi PLC

- 7.1.4 Sealed Air Corporation

- 7.1.5 Huhtamaki Oyj

- 7.1.6 Uflex Limited

- 7.1.7 Coveris Management Gmbh

- 7.1.8 ProAmpac LLC

- 7.1.9 Wipf AG

- 7.1.10 Flexpak Services Llc

- 7.1.11 Sigma Plastics Group Inc.

- 7.1.12 KM Packaging Services Ltd

- 7.1.13 Sonoco Products Company

- 7.1.14 Arabian Flexible Packaging LLC

- 7.1.15 Gulf East Paper and Plastic Industries LLC