|

市场调查报告书

商品编码

1686296

辐射检测、监测和安全—市场占有率分析、行业趋势和统计、成长预测(2025-2030 年)Radiation Detection, Monitoring, And Safety - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

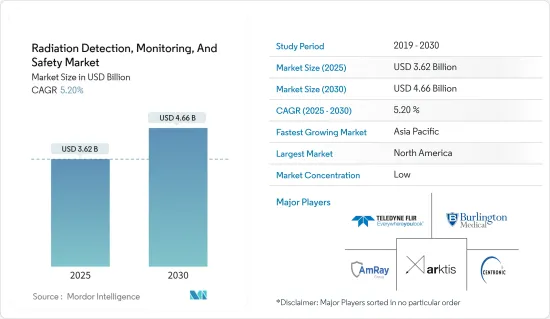

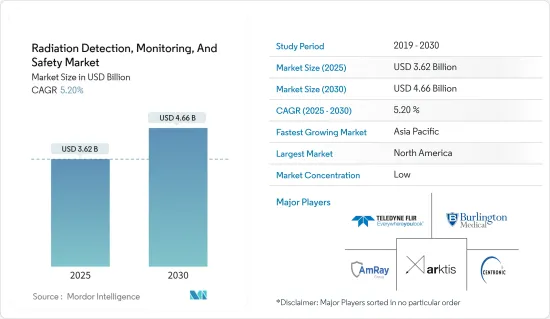

辐射侦测、监测和安全市场规模预计在 2025 年为 36.2 亿美元,预计到 2030 年将达到 46.6 亿美元,预测期内(2025-2030 年)的复合年增长率为 5.2%。

製造业的日益稳定可能会在预测期内推动市场成长。此外,製造业使用X射线检测对製造产品进行品质检测和缺陷检测也可能促进市场发展。

主要亮点

- 根据世界核能协会的《全球新反应器计画》,核能发电能力正在稳定成长,全球正在建造约 50 座核子反应炉。大多数核子反应炉计划建在亚洲(中国、印度、韩国等),新机组正在俄罗斯和阿拉伯联合大公国建造。

- 根据《世界能源展望》(WEO)报告,既定政策情境预测,2019年至2040年间,核能发电装置容量将成长15%以上,达到约480 GWe。该情境预测,到 2040 年总发电量将达到 13,418 GWe,集中在亚洲,特别是印度和中国。预计2040年核能对全球发电量的贡献将达到8.5%左右。

- 电厂寿命延长计画维持了发电能力,尤其是在美国。美国几乎所有发电核子反应炉都拥有潜在的 60 年运行许可证,业主将在大约 30 至 40 年后进行大规模资本工程以对其进行升级。许可证续约程序通常花费 1600 万美元至 2500 万美元,并且非常彻底,涉及公开会议和全面的安全审查。

- 2000年3月,美国核能管理委员会(NRC)将卡尔弗特克利夫斯两座核能发电厂的营运许可证续约20年。 NRC 正在考虑透过后续许可证续约 (SLR) 计划将营运许可证的有效期从 60 年延长至 80 年。在第二波新冠疫情期间,80年核准许可的核子反应炉是美国的Turkey Point 3&4号机组、Peach Bottom 2&3号机组和Surrey 1&2号机组。因此,预计各国植物寿命的延长将在预测期内推动市场成长。

- 监管机构对产品核准、合规性和私营部门主导的监控的严格规定预计将阻碍市场成长。

- 根据中国国家统计局的预测,2023年中国工业增加与前一年同期比较增约4.6%。据印度工业和国内贸易促进部称,由于印度人口快速成长,製造业已成为印度快速成长的产业。预计这些因素将在未来几年为市场创造更多的商机。

辐射探测、监测和安全市场趋势

医疗保健产业是最大的终端用户

- 由于放射学、急诊医学、牙科、核子医学和治疗应用中剂量计和检测器的应用日益广泛,医疗保健产业占据了主要的市场占有率。各种形式的辐射都用于医学诊断和治疗。然而,所有辐射都具有潜在危险,必须仔细控制辐射暴露,以确保患者获得的益处大于辐射暴露的风险。

- 根据辐射防护协会的数据,自然产生的背景辐射是大多数人受到辐射的主要来源,约占人口年度辐射剂量的 88%。

- 此外,世界各地核能发电设施数量的不断增加也推动了对辐射监测设备的需求。这些植物的产品可用于医疗保健产业。顺便说一句,医院正在推进安装带有医用同位素的诊断放射机,以便为患者提供治疗。

- 随着该地区确诊患者数量的增加,对癌症治疗的投资也在增加,预计这将进一步推动对放射治疗和医疗设备的需求。根据美国癌症协会的数据,2022年将有超过1,800万美国人受到癌症的影响。预测到2024年美国将有超过200万例新的癌症病例。图中资料显示,放射治疗是主要类别之一。因此,癌症治疗病例的增加可能为市场供应商带来机会。

- 根据加拿大癌症协会 11 月修订的资料,2022 年加拿大约有 233,900 人罹患癌症。 Globocan 估计,到 2040 年,全球将有超过 3,000 万人受到癌症的影响。因此,预计未来几年全球癌症的高负担将推动市场成长。

亚太地区将经历大幅成长

- 由于中国、印度和日本等新兴经济体越来越重视收益核能以满足日益增长的能源需求,以及对人类和环境安全的严格规定,预计亚太地区将见证全球市场收入的显着增长。

- 例如,埃克森美孚公司预测,到2040年,亚太地区的核能需求预计将达到约22兆英热单位。届时,全球核能需求预计将为45兆英热单位。

- 根据美国能源资讯署的数据,截至 2023 年 5 月,中国拥有 55 座运作中的核子反应炉。根据中国国家统计局的数据,2024年1月和2月,核能发电厂发电量为69兆瓦时。同年,该国每月的核能发电在30至40兆瓦时之间波动。

- 在製造业的无损检测 (NDT) 过程中,辐射检测、监测和安全至关重要。射线照相、伽马射线扫描和中子射线照相等无损检测技术使用辐射来检查材料和零件,而不会造成损坏。

- 推动该地区辐射检测、监测和安全需求的主要因素之一是快速发展的医疗保健基础设施。印度继续投资于医疗设施的现代化,重点是采用先进的诊断和成像技术。

辐射探测、监测和安全产业概况

辐射侦测、监测和安全市场较为分散。公司正在投资即将到来的技术进步以扩大其投资组合。一些新兴企业正在利用无人机和小型飞机进行创新,为现有企业提供公平的竞争环境。 Arktis Radiation Detectors Ltd、Amray Group Limited、Burlington Medical LLC、Centronic Ltd 和 Teledyne FLIR Systems INC 正在利用策略合作计画来增加市场占有率和盈利。

- 2023 年 12 月,赛默飞世尔科技与 RDC 签署独家合作协议,向北美医疗保健、牙科和兽医领域的客户提供 NetDose 数位剂量计。 NetDose 的数位技术可透过蓝牙技术监测辐射,从而无需在每次实验室处理剂量计时重新运送剂量计。

- 2023 年 12 月,辐射侦测公司 (RDC) 与赛默飞世尔科技签署协议,销售和服务赛默飞世尔科技的数位剂量测定解决方案 NetDose,RDC 是一家剂量测定服务公司,致力于为医疗、兽医、牙科和工业应用提供经济实惠、可靠且易于使用的辐射安全。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场动态

- 市场概览

- 产业吸引力-波特五力分析

- 产业价值链分析

- 新冠疫情及其他宏观经济因素的后续影响将如何影响市场

- 技术简介

- 市场驱动因素

- 癌症和其他慢性病发生率增加

- 扩大无人机在辐射监测的应用

- 市场限制

- 严格的政府法规

- 熟练放射科医生短缺

第五章市场区隔

- 依产品类型

- 侦测与监控

- 安全

- 按最终用户产业

- 医疗保健

- 产业

- 国防安全保障与国防

- 能源与电力

- 其他最终用户产业

- 按地区

- 北美洲

- 欧洲

- 亚洲

- 澳洲和纽西兰

- 拉丁美洲

- 中东和非洲

第六章竞争格局

- 公司简介

- Amray Group Limited

- Arktis Radiation Detectors Ltd

- Burlington Medical LLC

- Centronic Ltd

- Teledyne FLIR Systems Inc.

- Landauer Inc.(Fortive Corporation)

- Mirion Technologies Inc.

- Radiation Detection Company

- RAE Systems Inc.(Honeywell International Inc.)

- Thermo Fisher Scientific Inc.

- Unfors RaySafe AB

- ORTEC(Ametek Inc.)

- Fuji Electric Co. Ltd

- ATOMTEX SPE

第七章投资分析

第八章:市场的未来

The Radiation Detection, Monitoring, And Safety Market size is estimated at USD 3.62 billion in 2025, and is expected to reach USD 4.66 billion by 2030, at a CAGR of 5.2% during the forecast period (2025-2030).

The increased stability of manufacturing industries will likely drive the market's growth during the forecast period. Using radiography testing in the manufacturing industry to test the quality of manufactured goods and inspect flaws is also likely to fuel the market.

Key Highlights

- According to the World Nuclear Association Plans for New Reactors Worldwide, nuclear power capacity increased steadily, with about 50 power reactors under construction around the world. Most of the reactors are planned in Asia (in China, India, and South Korea, among others), with new units in Russia and the United Arab Emirates, while the existing capacity is being created by plant upgrading.

- According to the World Energy Outlook (WEO) report, its Stated Policies Scenario' witnesses installed nuclear capacity growth of over 15% from 2019 to 2040, about 480 GWe. The scenario predicts a total generating capacity of 13,418 GWe by 2040, concentrated heavily in Asia, particularly India and China. The contribution of nuclear to global power generation is expected to reach about 8.5% by 2040.

- Plant lifetime extension programs maintain capacity, particularly in the United States. Almost all the power reactors in the United States can potentially be licensed to operate for 60 years, with owners undertaking significant capital works to upgrade them at around 30-40 years. The license renewal process typically costs USD 16-25 million, and the procedures for such renewals, with public meetings and complete safety reviews, are exhaustive.

- In March 2000, the Nuclear Regulatory Commission (NRC) renewed the two-unit Calvert Cliffs nuclear power plant's operating licenses for an additional 20 years. The NRC is considering applications for extending operating licenses beyond 60 out to 80 years with its subsequent license renewal (SLR) program. During the second wave of the COVID-19 pandemic, reactors approved for 80-year licenses were Turkey Point 3&4, Peach Bottom 2&3, and Surry 1&2 in the United States. Therefore, plant lifetime extensions by various countries are expected to boost the market's growth during the forecast period.

- The strict regulations provided by regulatory bodies are expected to affect product approvals and compliances and private body-led monitoring, thereby hampering the market's growth.

- According to the National Bureau of Statistics of China, in 2023, China's industrial production increased by about 4.6% compared to the previous year. According to the Department for Promotion of Industry and Internal Trade (India), the manufacturing industry appears to be a fast-growing sector owing to the rapidly growing population in India. Factors like these are expected to create more opportunities in the market in the coming years.

Radiation Detection, Monitoring, And Safety Market Trends

Medical and Healthcare Industry to be the Largest End User

- The medical and healthcare industry accounts for major market shares due to the increasing adoption of dosimeters and detectors in radiology, emergency care, dentistry, nuclear medicine, and therapy applications. Several forms of radiation are being used in medical diagnostics and treatment. However, all forms are potentially dangerous, and exposure must be carefully controlled to ensure that the benefit to patients outweighs the risks from exposure.

- According to the Society for Radiological Protection, naturally occurring background radiation is the primary source of exposure for most people, contributing about 88% of the annual dose to the population, while medical procedures contribute most of the remaining 12%.

- Additionally, the increasing number of nuclear power facilities worldwide is increasing the demand for radiation monitoring equipment. Byproducts of these power plants can be used in the healthcare industry. Incidentally, hospitals have been promoting the installation of diagnostic radiology equipment accompanied by medical isotopes administered to patients.

- The increasing investments in cancer therapy within the regions witnessing an increase in diagnosed patients are further expected to increase the demand for radiation therapy and medical devices. According to the American Cancer Society, over 18 million Americans were reported to have cancer in the year 2022. It is estimated that over 2 million new cancer cases are predicted to be diagnosed in the United States in 2024. The data provided in the graph shows that the radiation therapy segment is among the major categories. Therefore, increasing cancer treatment cases may create an opportunity for the market vendors.

- According to Canadian Cancer Society data revised in November 2022, about 233,900 people were living with cancer in Canada in 2022. The Globocan estimates that globally, there will be more than 30 million individuals living with cancer by the year 2040. Thus, the high burden of cancer worldwide is expected to propel the market's growth in the coming years.

Asia-Pacific to Witness Major Growth

- Asia-Pacific is expected to witness significant growth in the global market in terms of revenue, owing to the rising focus on nuclear power for electricity generation to meet the growing energy demands and rising stringent regulation for human and environmental safety among the emerging countries, such as China, India, and Japan.

- For instance, according to Exxon Mobil, it is anticipated that in 2040, the nuclear energy demand in Asia-Pacific will amount to approximately 22 quadrillion BTUs. That year, the world's nuclear energy demand is expected to account for 45 quadrillion BTUs.

- According to EIA, there are 55 operable nuclear power reactors in China as of May 2023. According to the National Bureau of Statistics of China, in January and February 2024, the electricity output from nuclear power plants was 69 terawatt-hours. That year, the monthly nuclear electricity production fluctuated between 30 and 40 terawatt-hours in the country.

- Radiation detection, monitoring, and safety are crucial in the manufacturing sector's non-destructive testing (NDT) processes. NDT techniques like radiography, gamma-ray scanning, and neutron radiography rely on radiation to inspect materials and components without causing damage.

- One of the primary factors fueling the region's demand for radiation detection, monitoring, and safety is its rapidly advancing healthcare infrastructure. As India continues to invest in modernizing its medical facilities, there is a growing emphasis on incorporating advanced diagnostic and imaging technologies.

Radiation Detection, Monitoring, And Safety Industry Overview

The radiation detection, monitoring, and safety market is fragmented. Companies are investing in upcoming technological advancements to increase their portfolio. Several startups are innovating with drones and mini-planes, providing equal competition to the existing players. The companies Arktis Radiation Detectors Ltd, Amray Group Limited, Burlington Medical LLC, Centronic Ltd, and Teledyne FLIR Systems INC leverage strategic collaborative initiatives to increase their market share and profitability.

- In December 2023, a contract was signed to seal the exclusive partnership between Thermo Fisher Scientific and RDC to offer NetDose, a digital dosimeter, to North American customers in the healthcare, dental, and veterinary fields. The digital technology of NetDose allows radiation to be monitored with Bluetooth technology and eliminates the need for reshipments from dosimeters every time they are processed in a laboratory.

- In December 2023, Radiation Detection Company (RDC), a dosimetry service company focused on making radiation safety in the healthcare, veterinary, dental, and industrial fields affordable, reliable, and easy to use, signed an agreement with Thermo Fisher Scientific to distribute and service Thermo Fisher Scientific's digital dosimetry solution, NetDose.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3 Industry Value Chain Analysis

- 4.4 Impact of COVID-19 Aftereffects and Other Macroeconomic Factors on the Market

- 4.5 Technology Snapshot

- 4.6 Market Drivers

- 4.6.1 Increasing Incidence of Cancer and Other Chronic Diseases

- 4.6.2 Growing Use of Drones for Radiation Monitoring

- 4.7 Market Restraints

- 4.7.1 Stringent Government Regulations

- 4.7.2 Lack of Skilled Radiation Professionals

5 MARKET SEGMENTATION

- 5.1 By Product Type

- 5.1.1 Detection and Monitoring

- 5.1.2 Safety

- 5.2 By End-user Industry

- 5.2.1 Medical and Healthcare

- 5.2.2 Industrial

- 5.2.3 Homeland Security and Defense

- 5.2.4 Energy and Power

- 5.2.5 Other End-user Industries

- 5.3 By Geography

- 5.3.1 North America

- 5.3.2 Europe

- 5.3.3 Asia

- 5.3.4 Australia and New Zealand

- 5.3.5 Latin America

- 5.3.6 Middle East and Africa

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 Amray Group Limited

- 6.1.2 Arktis Radiation Detectors Ltd

- 6.1.3 Burlington Medical LLC

- 6.1.4 Centronic Ltd

- 6.1.5 Teledyne FLIR Systems Inc.

- 6.1.6 Landauer Inc. (Fortive Corporation)

- 6.1.7 Mirion Technologies Inc.

- 6.1.8 Radiation Detection Company

- 6.1.9 RAE Systems Inc. (Honeywell International Inc.)

- 6.1.10 Thermo Fisher Scientific Inc.

- 6.1.11 Unfors RaySafe AB

- 6.1.12 ORTEC (Ametek Inc.)

- 6.1.13 Fuji Electric Co. Ltd

- 6.1.14 ATOMTEX SPE