|

市场调查报告书

商品编码

1687458

智慧废弃物管理:市场占有率分析、行业趋势和统计、成长预测(2025-2030 年)Smart Waste Management - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

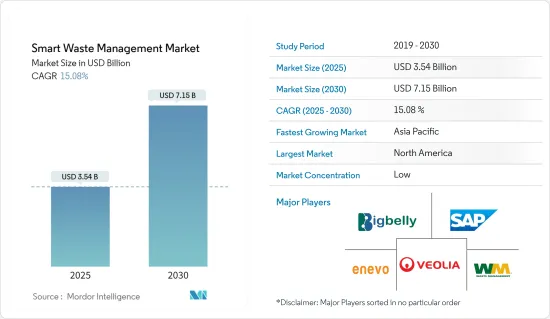

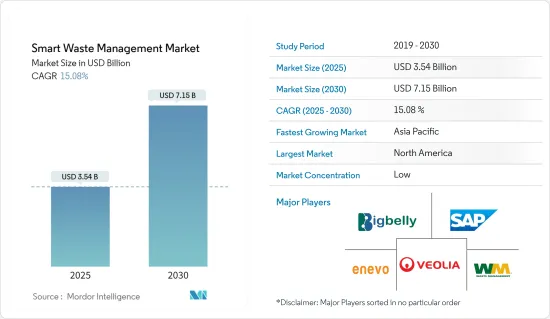

智慧废弃物管理市场在 2025 年的价值预估为 35.4 亿美元,预计到 2030 年将达到 71.5 亿美元,在市场估计和预测期(2025-2030 年)内的复合年增长率为 15.08%。

智慧废弃物管理使用废弃物上的感测器来即时监控市政废弃物收集服务的状态并决定何时清空或装满垃圾箱。此外,可以追踪感测器和资料库收集的历史信息,并将其用于识别和增强驾驶路线和装载模式,从而降低营运成本。透过远端监控和基于物联网的垃圾箱,有效的垃圾收集变得更加实用。都市化和快速工业化是智慧废弃物管理市场的两大驱动力。因此,市政和工业部门的废弃物量不断增加。随着环保意识的增强,日常废弃物收集和处理也变得越来越频繁。

主要亮点

- 智慧废弃物管理对于智慧城市的发展至关重要(与水资源管理、交通管理、能源管理等),以改善都市区生活方式。各个地区越来越多地采用创新城市倡议,推动了智慧废弃物管理市场的成长。废弃物管理产业涵盖收集、处理、运输和回收等多种活动。该行业在废弃物管理的各个阶段都面临效率问题。营运成本与废弃物的收集和运输成本相同,从而增加了智慧废弃物管理的采用率。

- 近年来,由于人口成长和都市化的加快,全球对废弃物管理的需求以及解决维护老化基础设施的成本影响的需求成为智慧废弃物管理市场成长的主要驱动力。

- 此外,配备即时废弃物管理系统的一次性标籤、容器和吸尘器等产品也支援了智慧废弃物管理市场的发展。废弃物管理系统的使用日益增多也源自于人们对环境问题的日益关注。

- 然而,由于全球技术纯熟劳工的短缺,大多数工人将不得不前往服务区解决问题,预计将增加维护成本。然而,在预测期内,对远端系统管理的更多关注可能会减轻成本负担。

智慧废弃物管理市场趋势

分析产业将经历显着成长

- 在科技进步和快速都市化的时代,废弃物管理已成为世界各地城市面临的关键挑战。智慧废弃物管理已成为一种有前景的解决方案。车队管理在智慧废弃物管理系统中发挥核心作用。

- 车队管理解决方案通常指使用资料通讯、记录和分析来增强车辆活动的控制的系统。 FMS 的服务范围包括车队和资产管理、营运管理、供应链管理和法规合规。透过实施车队管理解决方案,您可以降低燃料成本和其他占车辆营运费用的因素。这样,FMS 提供的优势有助于最大限度地降低车辆营运成本。

- 智慧废弃物管理中的车队管理涵盖各种活动,例如废弃物收集车辆的监控和追踪、路线优化、维护安排和性能分析。爱立信预计,到2027年,近距离物联网(IoT)设备的普及率将成长到250亿,而广域物联网设备预计到2027年将达到54亿,并将用于即时追踪废弃物收集车辆的位置和移动情况。

- 透过为这些车辆配备 GPS 设备和感测器,废弃物管理部门可以深入了解业务效率,确定需要改进的领域,并立即应对收集过程中可能出现的任何问题。此外,将路线优化软体整合到车队管理系统中将使废弃物管理部门能够规划更有效率的路线。

北美占有最大市场占有率

- 美国智慧城市越来越多地使用智慧废弃物管理解决方案来解决废弃物收集和处理问题,这有望促进市场销售。此外,预计未来几年各国对减少二氧化碳排放的严格规定将促进市场销售。政府加大力度推动永续性和实现净零废弃物,也可能继续刺激该领域的需求。

- 美国各个城市已经制定了战略计画。光是该国每年就产生约 2.3 亿吨排放,其中大部分由私人营业单位处理。由于政府采取措施促进永续性,以及全部区域智慧城市措施的普及,美国预计将占据智慧废弃物管理市场的大部分份额。

- 工业领域产量的不断增长带来了对智慧管理解决方案的需求。化学製造业处理了超过一半(55%)的 TRI 化学废弃物。美国经济分析局预计,2022年化学品生产增加值将达到约5,013.9亿美元,而2021年为4,475.5亿美元,这意味着美国化学工业创造的价值显着增加。

- 透过移民、自然成长和都市化,加拿大的人口一直稳定成长。随着人口的成长,对商品、服务和基础设施的整体需求也随之增加,导致废弃物产生量增加。据加拿大统计局称,加拿大目前每年约有 50 万移民,是世界上人均移民率最高的国家之一。截至2023年,加拿大永久移民人数将超过800万,约占加拿大总人口的20%。

- 加拿大企业正在寻找可持续管理废弃物并降低成本的新方法。这项变更包括整合感测器和其他云端基础的技术,以减少废弃物并优化服务水准。为了减少温室气体排放,该公司也正在测量排放的废弃物的碳排放。

- 该国正在努力消除政府业务、活动和会议中过度使用一次性塑料,并购买更多可修復、再利用和回收的永续塑料产品。到 2030 年,政府的目标是延长产品寿命,并从公共管理中清除至少 75% 的塑胶废弃物。

智慧废弃物管理市场概览

智慧废弃物管理市场比较分散。随着智慧互联产品功能的急剧扩展,各公司将竞相追赶竞争对手,并可能最终放弃过于先进的产品。这种环境将会推高成本并侵蚀产业盈利。市场的主要企业包括 SAP SE、威立雅环境服务公司、Enevo、Waste Management Inc. 和 Bigbelly Inc.

- 2023年10月 - 威立雅赢得历史性的20亿欧元合同,用于处理香港的无害废弃物,继续推动该市的生态系统转型和资源再生。威立雅集团在香港经营超过30年,拥有超过1,000名员工,致力于透过多项水、废弃物和能源合约实现本地脱碳,以加速香港的生态转型。

- 2023 年 9 月 – WM 在俄亥俄州克利夫兰开设一个占地 100,000 平方英尺的新回收设施。该设施配备了最新的技术,每天可处理多达 420 吨的回收材料。 WM 的新回收设施技术,包括玻璃回收设备、光学分类机、无包装筛机和弹道分离器,旨在支持当地回收项目的发展和为使用回收材料作为原料製造新产品的客户生产高品质的材料。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场洞察

- 市场概况

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 买家的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争

- 新冠肺炎疫情及其他宏观经济因素对市场的影响

第五章 市场动态

- 市场驱动因素

- 垃圾量增加推动市场

- 智慧城市的普及将振兴市场

- 市场挑战

- 实施成本高

第六章 技术简介

- 技术概述

- 创新技术革新废弃物管理

- 智慧废弃物管理阶段 - 按连接器分类

- 智慧废弃物管理市场中的感测器应用

- 智慧废弃物管理阶段

- 智慧收藏

- 智慧处理

- 智慧型能源回收

- 智慧处置

第七章 市场区隔

- 按解决方案

- 车队管理

- 远端监控

- 分析

- 废弃物类型

- 工业废弃物

- 住宅废弃物

- 按地区

- 北美洲

- 美国

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 西班牙

- 义大利

- 亚洲

- 印度

- 中国

- 澳洲

- 日本

- 澳洲和纽西兰

- 拉丁美洲

- 中东和非洲

- 北美洲

第八章 竞争格局

- 公司简介

- SAP SE

- Veolia Environmental Services

- Enevo

- Waste Management Inc.

- Bigbelly Inc.

- Covanta Holding Corporation

- Evoeco

- Pepperl+Fuchs GmbH

- IBM Corporation

- BIN-e

第九章投资分析

第 10 章:市场的未来

The Smart Waste Management Market size is estimated at USD 3.54 billion in 2025, and is expected to reach USD 7.15 billion by 2030, at a CAGR of 15.08% during the forecast period (2025-2030).

Smart waste management directs the use of sensors in waste to observe the real-time status of municipal waste collection services and decide when bins should be emptied or filled. It also maintains track of past information collected by sensors and databases that can be utilized to pinpoint and enhance driver routes, fill patterns, and lower operating costs. Effective waste collection is more functional with remote monitoring and IoT-based waste bins. Urbanization and rapid industrialization are the two main drivers of the smart waste management market. Therefore, the volume of waste from the municipal and industrial sectors has grown. The routine collection and disposal of waste have risen due to rising environmental awareness.

Key Highlights

- Smart waste management is crucial in developing smart cities (along with water management, traffic management, energy management, etc.) to improve lifestyles in urban areas. The increasing adoption of innovative city initiatives across regions helps the smart waste management market's growth. The waste management industry involves diverse activities, such as collection, disposal, transportation, and recycling. The industry has been facing efficiency problems at different stages of waste management. The operational costs equal the collection and transport of the waste, thereby increasing the adoption of smart waste management.

- In recent years, owing to the growing population and urbanization, the global demand for waste management and the demand to address the cost implications of maintaining an aging infrastructure have been among the primary motivating factors for the smart waste management market's growth.

- Moreover, the development of the smart waste management market has been assisted by products like disposable tags, containers, and vacuum cleaners that contain real-time waste management systems. The rising usage of waste management systems also results from growing environmental concerns.

- However, the lack of skilled laborers worldwide is expected to increase maintenance costs as most of them have to travel down to the service areas and resolve issues. Nevertheless, the growing focus on remote management may reduce the cost burden during the forecast period.

Smart Waste Management Market Trends

Analytics Sector to Witness Major Growth

- Waste management has become a crucial issue for cities worldwide in the era of technological advancements and rapid urbanization. Smart waste management has emerged as a promising solution. Fleet management plays a central role in smart waste management systems.

- Fleet management solutions often refer to systems that offer greater control over fleet activities using data communications, logging, and analytics. FMS's various services include vehicle and asset management, operation management, supply chain management, and regulatory compliance. Deploying fleet management solutions reduces factors that account for a significant portion of fleet operation spending, such as fuel costs. Thus, by the benefits they provide, FMS minimizes the cost of fleet operation.

- Fleet management in smart waste management encompasses a range of activities, including monitoring and tracking waste collection vehicles, route optimization, maintenance scheduling, and performance analysis. One of the crucial components of fleet management in this context is using GPS and Internet of Things technologies; according to Ericsson, the adoption number of short-range Internet of Things (IoT) devices is forecast to increase to 25 billion by 2027. and wide-area IoT devices are predicted to reach 5.4 billion by 2027 and used to track the location and movement of waste collection vehicles in real-time

- By equipping these vehicles with GPS devices and sensors, waste management authorities can gain valuable insights into their operations' efficiency, identify improvement areas, and respond immediately to any issues that may arise during the collection process. Moreover, the integration of route optimization software into fleet management systems enables waste management authorities to plan more efficient routes.

North America Holds Largest Market Share

- Smart cities in the United States use smart waste management solutions more frequently to solve waste collection and disposal issues, which is expected to boost market sales. In addition, strict rules governing the reduction of carbon emissions across the country are anticipated to drive market sales in the coming years. The increasing government's efforts to promote sustainability and achieve net-zero waste will continue to drive up demand in the area.

- Cities in the United States are already implementing strategic programs. The country alone contributes most of the yearly waste produced, with around 230 million metric tons of trash, a significant chunk of which private entities handle. The United States is expected to account for a significant share of the smart waste management market due to government initiatives promoting sustainability and the penetration of smart city initiatives across the high urban concentration region.

- The industrial sector's increased production creates a demand for smart management solutions. The chemical manufacturing industry manages over half (55%) of all TRI chemical waste. According to the BEA, in 2022, the value added from producing chemical products reached approximately USD 501.39 billion, which was USD 447.55 billion in 2021. This demonstrates a substantial increase in the value generated by the chemical industry in the United States.

- Canada's population continues to grow steadily, driven by immigration, natural population increase, and urbanization. As the population expands, so does the overall demand for goods, services, and infrastructure, leading to increased waste generation. As per StatCan, currently, annual immigration in Canada amounts to almost 500,000 new immigrants, which is one of the highest rates per population of any country in the world. As of 2023, there were more than eight million immigrants with permanent residence living in Canada, roughly 20% of the total Canadian population.

- Companies in the country are finding new ways to manage waste sustainably while cutting costs. The changes include integrating sensors and other cloud-based technologies to reduce waste volumes and optimize service levels. Companies are also measuring the carbon footprint of the waste produced to reduce greenhouse gas emissions.

- The country is working towards eliminating the excessive use of single-use plastics in government operations, events, and meetings and purchasing more sustainable plastic products that can be repaired, reused, or repurposed. By 2030, the government aims to extend product life and remove at least 75% of plastic waste from public administrations.

Smart Waste Management Market Overview

The Smart Waste Management Market is fragmented. The vast expansion of capabilities in smart connected products may tempt companies to keep up with rivals and give away too much improved product performance. This environment escalates costs and erodes industry profitability. Some of the key players in the market are SAP SE, Veolia Environmental Services, Enevo, Waste Management Inc., and Bigbelly Inc.

- October 2023 - Veolia continues Hong Kong's ecological transformation and the regeneration of its resources, following the award of a historic EUR 2 billion contract to dispose of the city's non-hazardous waste. With a presence in Hong Kong for over 30 years and more than a thousand employees, the Group is working locally to decarbonize the city's activities through multiple water, waste, and energy contracts to accelerate the local ecological transformation.

- September 2023 - WM has opened a new 100,000-square-foot recycling facility in Cleveland, Ohio. The facility has the latest technology and can process up to 420 tonnes of recyclables daily. WM's new recycling facility technology, which includes glass recovery equipment, an optical sorter, a non-wrapping screen, and ballistic separators, is designed to support the growth of recycling programs in the region and the production of high-quality material for customers who use recycled material as raw material to create new products.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Impact of COVID-19 Aftereffects and Other Macroeconomic Factors on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Volumes of Waste to Boost the Market

- 5.1.2 Rising Adoption of Smart Cities to Flourish the Market

- 5.2 Market Challenges

- 5.2.1 High Costs of Implementation

6 Technology Snapshot

- 6.1 Technology Overview

- 6.2 Innovative Technologies Revolutionizing Waste Management

- 6.3 Smart Waste Management Stages - By Connectors

- 6.4 Application of Sensors in the Smart Waste Management Market

- 6.5 Smart Waste Management Stages

- 6.5.1 Smart Collection

- 6.5.2 Smart Processing

- 6.5.3 Smart Energy Recovery

- 6.5.4 Smart Disposal

7 MARKET SEGMENTATION

- 7.1 By Solution

- 7.1.1 Fleet Management

- 7.1.2 Remote Monitoring

- 7.1.3 Analytics

- 7.2 By Waste Type

- 7.2.1 Industrial Waste

- 7.2.2 Residential Waste

- 7.3 By Geography

- 7.3.1 North America

- 7.3.1.1 United States

- 7.3.1.2 Canada

- 7.3.2 Europe

- 7.3.2.1 Germany

- 7.3.2.2 United Kingdom

- 7.3.2.3 France

- 7.3.2.4 Spain

- 7.3.2.5 Italy

- 7.3.3 Asia

- 7.3.3.1 India

- 7.3.3.2 China

- 7.3.3.3 Australia

- 7.3.3.4 Japan

- 7.3.3.5 Australia and New Zealand

- 7.3.4 Latin America

- 7.3.5 Middle East and Africa

- 7.3.1 North America

8 COMPETITIVE LANDSCAPE

- 8.1 Company Profiles

- 8.1.1 SAP SE

- 8.1.2 Veolia Environmental Services

- 8.1.3 Enevo

- 8.1.4 Waste Management Inc.

- 8.1.5 Bigbelly Inc.

- 8.1.6 Covanta Holding Corporation

- 8.1.7 Evoeco

- 8.1.8 Pepperl+Fuchs GmbH

- 8.1.9 IBM Corporation

- 8.1.10 BIN-e