|

市场调查报告书

商品编码

1524196

光纤测试仪:市场占有率分析、产业趋势/统计、成长预测(2024-2029)Fiber Optic Test Equipment - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

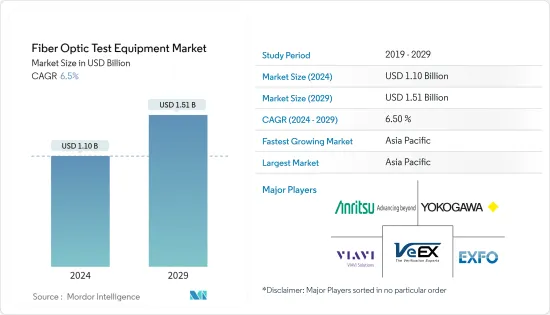

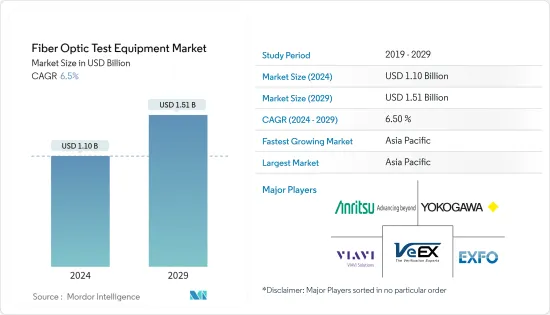

光纤测试仪市场规模预计到2024年为11亿美元,预计到2029年将达到15.1亿美元,在预测期内(2024-2029年)复合年增长率为6.5%。

光纤测试仪透过光纤电缆检测讯号损失和变化。当讯号通过光纤传输时,讯号损失是不可避免的。由于输出和输入讯号的耦合,可能会出现传输损耗。光纤测试仪(FOTE) 对于表征和测量光的物理特性非常有用,光的物理特性是光纤网路的关键特征。

主要亮点

- 随着线上交易和虚拟会议的兴起,企业需要 5G 和光纤电缆来保持竞争力。这些电缆是一种经济高效、方便且简单的解决方案,适用于许多工业应用,包括照明和装饰、资料传输、手术和机械测试。在家工作和混合工作的兴起正在推动美国和欧洲对 FTTH 的需求,进一步推动市场研究。

- 5G基地台建设需要高品质、大批量的光缆。 UDN(超密集网路)的发展引发了对光纤电缆的需求激增。 5G过渡所需的光缆总数将是4G基础设施的两倍以上。其他变化也将需要大量的光纤线路。

- 此外,光纤电缆主要用于医学、生物医学研究和显微镜。与非侵入性手术一样,光纤通讯在内视镜检查中至关重要。此手术使用明亮的小灯照亮体内的手术部位,减少切口的数量和尺寸。光纤电缆也用作成像工具、光导和手术辅助雷射。

- 由于光纤电缆网路的增加,光纤测试仪市场预计将扩大。成功的服务需要增加即时操作以及对频宽和插入损耗的持续测试。由于这种需求,光纤测试仪市场预计将显着成长。

- 各个资料中心供应商不断投资新的资料中心,以满足对资料永不满足的需求。根据印度国家软体和服务公司协会(NASSCOM)预测,2025年印度资料中心市场的投资预计将达到46亿美元。与新兴市场相比,印度资料中心的最大优势在于其在市场开拓和营运方面都具有成本效益。目前,印度的资料中心主要位于孟买、班加罗尔、清奈、德里(NCR)、海得拉巴和普纳。加尔各答、喀拉拉邦和艾哈默德巴德将成为未来的资料中心地点。资料中心市场投资的扩大正在推动印度对光纤测试仪的需求。

光纤测试仪市场趋势

通讯实现显着成长

- 光纤连接彻底改变了通讯领域。它在资料网路领域也拥有强大的影响力。使用光缆的光纤通讯使得在相当长的远距内建立通讯线路成为可能。光纤通讯的传输和介质损耗水准要低得多,从而可以实现更快的资料通讯。由于这些优点,光纤通讯系统被用于广泛的应用,从关键通讯基础设施到乙太网路系统、宽频分配和通用资料网路。

- 新兴大都市对连接和网路存取的需求不断增长,正在积极推动市场成长。对更高互联网速度和改进连接的日益增长的需求最终需要强大而高效的光纤测试仪,而光学技术满足了这一需求,从而积极推动市场成长。

- 光纤测试仪市场也受到 5G 连接的紧迫性和光纤网路的快速扩张的推动。例如,爱立信表示,到 2028 年,5G 用户预计将达到约 47 亿,并且预计未来几年将快速成长。

- 此外,随着供应商希望将高速网路直接引入家庭和企业,光纤到户部署变得越来越普遍。光纤测试设备对于确保最后一哩连接的品质和可靠性至关重要。

亚太地区成长强劲

- 由于庞大的光纤光缆生态系统的存在,预计中国仍将是亚太地区光纤测试仪的主要市场之一。例如,该国拥有多元化的光缆製造商基地。此外,各国政府见证了数位基础设施投资的显着成长,因为光纤电缆构成了数位基础设施的核心,从而为受访市场创造了机会。

- 中国的技术援助工作还包括「一带一路」倡议,这是一个国际基础设施大型企划,旨在透过与 60 多个国家的基础设施协议将全球经济转向北京。 「一带一路」倡议中最重要的元素预计将是数位丝路(DSR)。中国将建造从巴基斯坦到非洲和欧洲的数位丝绸之路。在华为等公司的主导,DSR 寻求透过不断发展的技术(例如光纤电缆和 5G通讯)来连接全球经济,这些技术正在改变全球网路。

- 日本由于其完善的光纤网路生态系统,光纤测试测试仪市场具有巨大的成长潜力。此外,对增加网路频宽的需求不断增长,以及改变频宽需求的数位技术的扩散,也推动了日本光纤电缆市场的发展。例如,根据最近促进数位化的政府政策,政府的目标是到2028年将高速光纤网路扩展到约99.9%的家庭。

- 此外,政府的目标是到2030年将下一代5G无线网路的覆盖范围扩大到99%的人口,并在2025年底前完成环绕日本的海底电缆。因此,这种趋势可能会在预测期内为调查市场带来充足的机会。

光纤测试仪产业概况

由于市场参与者之间的激烈竞争,光纤测试仪市场变得分散。这些公司也进行了大量投资,为客户提供广泛的特定应用现场测量、监控和维护技术。此外,EXFO Inc.、Anritsu Corporation、VIAVI Solutions Inc.、VeEX Inc. 和横河电机公司等公司继续进行策略合作、收购和产品开发,以获取更多市场占有率。各公司近期动向如下。

- 2024 年 3 月,VIAVI Solutions 同意对思博伦进行现金要约收购的条款,但须获得思博伦董事会的一致核准。此竞标称为「收购」。思博伦正在实施这项策略,以将其产品扩展到即时网络,增加经常性收益来源,并在产品系列中提供付加服务和解决方案。

- 2024 年 2 月 韩国射频协会 (RAPA) 和日本安立公司 (Anritsu) 于 2 月 22 日在安立总部签署了谅解备忘录。该谅解备忘录概述了双方在下一代通讯标准B5G和6G方面的合作。该谅解备忘录旨在建立一个测试环境,用于检验B5G/B6G技术的候选频段FR3(7GHz至24GHz)和亚太赫兹(100GHz以上),并从PoC阶段提供技术合作。安立在多个方面合作以促进发展。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场洞察

- 市场概况

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 买方议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争公司之间的敌对关係

- 产业价值链分析

- COVID-19副作用和其他宏观经济因素对市场的影响

第五章市场动态

- 市场驱动因素

- 5G/LTE 网路的普及和固定宽频用户的增加

- 扩大光纤网路在电力和公共事业管理、安全和通讯的采用

- 市场限制因素

- 测试仪和光纤测试仪高成本

- 缺乏意识和技术知识

第六章 市场细分

- 依设备类型

- 光源

- 光功率损耗计

- 光时域反射仪

- 频谱仪

- 远端光纤测试系统

- 其他的

- 按最终用户应用程式

- 通讯

- 资料中心

- 产业

- 其他的

- 按地区

- 北美洲

- 美国

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 亚洲

- 中国

- 日本

- 印度

- 澳洲/纽西兰

- 拉丁美洲

- 巴西

- 阿根廷

- 墨西哥

- 中东/非洲

- 阿拉伯聯合大公国

- 南非

- 北美洲

第七章 竞争格局

- 公司简介

- EXFO Inc.

- Anritsu Corporation

- VIAVI Solutions Inc.

- VeEX Inc.

- Yokogawa Electric Corporation

- Kingfisher International

- AFL Global

- Fluke Networks

- Pelorus Technologies Pvt. Ltd

- Deviser Instruments

- Terahertz Technologies Inc.(Trends Networks)

- AMS Technologies Ag

第八章投资分析

第9章市场的未来

The Fiber Optic Test Equipment Market size is estimated at USD 1.10 billion in 2024, and is expected to reach USD 1.51 billion by 2029, growing at a CAGR of 6.5% during the forecast period (2024-2029).

Fiber optic test equipment detects signal loss or changes through a fiber optic cable. When a signal is delivered across optical fibers, signal loss is unavoidable. As a result of the coupling of output and input signals, there may be some transmission losses. Fiber Optic Test Equipment (FOTE) is extremely useful for characterizing and measuring the physical properties of light, which is a critical feature of fiber optic networks.

Key Highlights

- With growing online transactions and virtual meetings, companies need 5G and optic fiber cable to stay competitive. These cables are cost-effective, convenient, and easy solutions for many industrial applications, such as lighting and decorations, data transmission, surgeries, and mechanical inspections. The growing work-from-home or hybrid work model drives the demand for FTTH across the United States and Europe, further driving the studied market.

- Fiber optic cables of high quality and quantity are required to build 5G base stations. The development of UDN, or ultra-dense networks, has sparked a surge in demand for fiber optic cables. The total number of fiber optic cables required for the 5G transition is more than double that of the 4G infrastructure. Other changes will necessitate a large number of Fiber optic lines.

- Moreover, Fiber optic cables are primarily employed in medicine, biomedical research, and microscopy. Optical communication is essential in endoscopy, as it is in non-invasive surgery. A small bright light is utilized in this procedure to light up the operation area inside the human body, allowing the number and size of incisions to be reduced. Fiber optic cable is also utilized as an imaging tool, a light guide, and a laser for surgical assistance.

- The fiber optic test equipment market is predicted to increase in response to the growing number of fiber cable networks. To deliver successful services, the increased need for real-time operations necessitates continual testing of bandwidth and insertion loss. As a result of this need, the fiber optic test equipment market is predicted to grow significantly.

- Various data center vendors are consistently investing in new data centers in line with the insatiable need for data. According to the National Association of Software and Service Companies (NASSCOM), India's data center market investment is expected to reach USD 4.6 billion in 2025. India's higher cost efficiency in both development and operation is its most significant advantage compared to more mature markets. Currently, India's data centers are primarily located in Mumbai, Bengaluru, Chennai, Delhi (NCR), Hyderabad, and Pune. Calcutta, Kerala, and Ahmedabad are the upcoming data center hubs. These growing data center market investments drive the demand for fiber optic test equipment in India.

Fiber Optic Test Equipment Market Trends

Telecommunications to Witness Significant Growth

- Fiber optic connections have transformed the telecommunications sector. It has also established a strong presence in the data networking field. Optical communications through fiber optic cable have enabled telecommunications lines to be established over considerably greater distances. With the significantly lower transmission and medium loss levels, fiber optical communications have enabled far higher data speeds to be accommodated. As a result of these advantages, Fiber optic communications systems are widely used for applications ranging from significant telecommunications infrastructure to Ethernet systems, broadband distribution, and general data networking.

- Growing demand for connectivity and internet access among the rising metropolitan cities positively drives the market's growth. The growing need for higher internet speed and better connectivity eventually requires strong and efficient fiber optic test equipment, which optical technology fulfills, thereby positively driving the market's growth.

- The market for fiber optic test equipment is also driven by the emergency of 5G connectivity and the rapid expansion of fiber optic networks. For instance, According to Ericsson, rapid growth is expected over the coming years, with the number of 5G subscriptions forecast to reach almost 4.7 billion by 2028

- Additionally, fiber-to-the-home deployments are becoming more common as providers seek to deliver high-speed internet directly to homes and businesses. Fiber test equipment is essential for ensuring the quality and reliability of these last-mile connections.

Asia Pacific to Register Major Growth

- China is anticipated to remain among the major markets for fiber optic test equipment in the Asia Pacific region, owing to the presence of a large ecosystem for optical fiber cables. For instance, the country has a diversified base of fiber optical cable manufacturers. Furthermore, the government is also witnessing a notable growth in digital infrastructure investment, creating opportunities in the market studied as optical fiber cables form the core of digital infrastructure.

- China's technological outreach also incorporates its international infrastructure mega-project, the Belt and Road Initiative (BRI), which aims to reorient the global economy toward Beijing through infrastructure deals with over 60 countries. BRI's most consequential component is expected to be the Digital Silk Road (DSR). China builds the Digital Silk Road from Pakistan to Africa and Europe. Directed by companies like Huawei, the DSR seeks to connect the global economy through evolving technologies transforming global networks, such as fiber-optic cables and 5G-supported communications.

- Japan holds significant growth potential for the fiber optic test equipment market as the country houses an established ecosystem for fiber optic networks. Furthermore, the growing demand for increased network bandwidth is also driving the Japanese optical fiber cable market with the proliferation of digital technologies that shift the bandwidth requirements. For instance, according to the recent government policy promoting digitization, the government aims to expand the high-speed fiber-optic networks to about 99.9% of households by 2028.

- Furthermore, the government aims to expand the coverage of next-generation 5G wireless networks to 99% of the population by 2030 and complete seabed cables surrounding Japan by the end of fiscal year 2025. Hence, such trends will drive ample opportunities in the market studied during the forecast period.

Fiber Optic Test Equipment Industry Overview

The fiber optics test equipment market is fragmented due to the high competitive rivalry among the market players. Also, these companies are extensively investing in offering customers a wide range of technologies for application-specific field measurement, monitoring, and maintenance. Moreover, companies such as EXFO Inc., Anritsu Corporation, VIAVI Solutions Inc., VeEX Inc.Yokogawa Electric Corporation continuously invest in strategic partnerships, acquisitions, and product development to gain more market share. Some of the recent actions by the companies are listed below.

- In March 2024, VIAVI Solutions entered into an agreement on terms of a cash tender for Spirent, subject to the unanimous approval of Spirent's Board. The tender is known as the 'Acquisition'. Spirent is implementing this strategy to expand its products into live networks, grow recurring revenue streams, and deliver value-added services and solutions across its product portfolio.

- In February 2024, Korea's Radio Frequency Association (RAPA) and Japan's Anritsu Corp. (Anritsu) signed an MoU on February 22, 2024, at Anritsu's Headquarters. The MoU outlines their collaboration on B5G and 6G, the next generation of communication standards. The MoU outlines RAPA's plan to collaborate with Anritsu in multiple areas to promote the development of B5G / 6G technologies, including setting up a test environment to validate candidate frequency bands for the B5G / B6G technologies, namely FR3 (7GHz to 24GHz) and sub-THz (100GHz and above) and technical cooperation from the PoC stage.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain Analysis

- 4.4 Impact of COVID-19 Aftereffects and Other Macroeconomic Factors on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Penetration of 5G/LTE Networks and Fixed Broadband Subscription

- 5.1.2 Growing Adoption of fiber optic networks for power and utility management, Security, and Communication

- 5.2 Market Restraints

- 5.2.1 High Cost of Testers and Fiber Optic Test Equipment

- 5.2.2 Lack of Awareness and Technical Knowledge

6 MARKET SEGMENTATION

- 6.1 By Equipment Type

- 6.1.1 Optical Light Sources

- 6.1.2 Optical Power and Loss Meters

- 6.1.3 Optical Time Domain Reflectometer

- 6.1.4 Optical Spectrum Analyzers

- 6.1.5 Remote Fiber Test System

- 6.1.6 Other Equipment Types

- 6.2 By End-user Application

- 6.2.1 Telecommunications

- 6.2.2 Data Centers

- 6.2.3 Industries

- 6.2.4 Other End-user Applications

- 6.3 By Geography***

- 6.3.1 North America

- 6.3.1.1 United States

- 6.3.1.2 Canada

- 6.3.2 Europe

- 6.3.2.1 Germany

- 6.3.2.2 United Kingdom

- 6.3.2.3 France

- 6.3.3 Asia

- 6.3.3.1 China

- 6.3.3.2 Japan

- 6.3.3.3 India

- 6.3.4 Australia and New Zealand

- 6.3.5 Latin America

- 6.3.5.1 Brazil

- 6.3.5.2 Argentina

- 6.3.5.3 Mexico

- 6.3.6 Middle East and Africa

- 6.3.6.1 United Arab Emirates

- 6.3.6.2 South Africa

- 6.3.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles*

- 7.1.1 EXFO Inc.

- 7.1.2 Anritsu Corporation

- 7.1.3 VIAVI Solutions Inc.

- 7.1.4 VeEX Inc.

- 7.1.5 Yokogawa Electric Corporation

- 7.1.6 Kingfisher International

- 7.1.7 AFL Global

- 7.1.8 Fluke Networks

- 7.1.9 Pelorus Technologies Pvt. Ltd

- 7.1.10 Deviser Instruments

- 7.1.11 Terahertz Technologies Inc. (Trends Networks)

- 7.1.12 AMS Technologies Ag