|

市场调查报告书

商品编码

1536795

聚氨酯:市场占有率分析、产业趋势、成长预测(2024-2029)Polyurethane - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

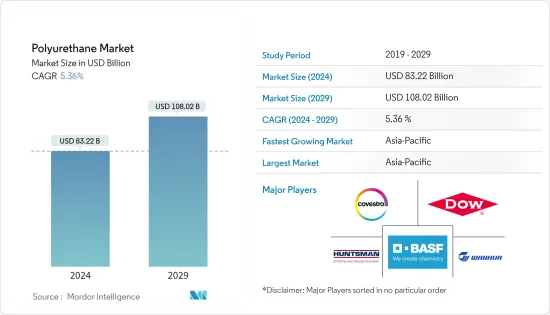

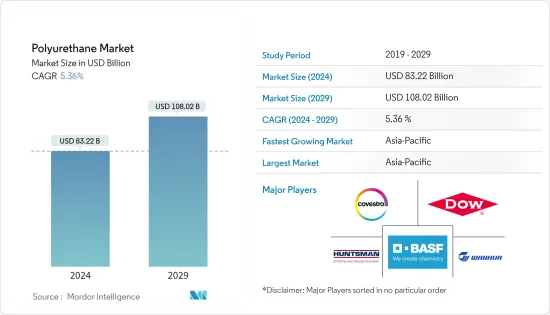

聚氨酯市场规模预计到2024年为832.2亿美元,预计到2029年将达到1080.2亿美元,在预测期内(2024-2029年)复合年增长率为5.36%。

COVID-19 严重影响了各行业的市场成长。为遏制疫情而导致的计划停工和放缓、生产暂停、旅行限制以及劳动力短缺等因素都导致了聚氨酯市场成长的下滑。然而,由于家具、鞋类和汽车等各种最终用途的消费增加,该数字在 2021 年显着復苏。

主要亮点

- 汽车产业对轻质和高性能复合材料的需求不断增长,床上用品、地毯和缓衝产业的需求不断增长,以及建筑业的需求不断增长是推动所研究市场成长的主要因素。

- 然而,日益增长的环境担忧预计将在预测期内抑制所涉及行业的成长。

- 然而,对生物基聚氨酯的需求不断增长可能为全球市场带来利润丰厚的成长机会。

- 亚太地区在市场上占据主导地位,预计在预测期内仍将保持最高的复合年增长率。

聚氨酯市场趋势

建设产业的需求不断成长

- 聚氨酯因其优异的强度重量比、绝缘性能、多功能性和耐用性而广泛应用于建筑应用。聚氨酯组件因其经济实惠和舒适性而被广泛应用于世界各地的住宅。

- 建设产业是硬质聚氨酯泡棉和喷涂聚氨酯泡棉的最大消费者。硬质聚氨酯泡棉隔热材料具有许多优点,包括能源效率、多功能性、高性能、热/机械性能和环保特性。

- 硬质聚氨酯泡棉用作隔热板、墙壁和屋顶隔热材料以及门窗周围的间隙填充材。硬质泡棉黏剂用于门窗安装和活动住宅。

- 全球整体建筑量预计将成长 85%,其中中国、美国和印度以 57% 的成长引领全球。随着全球最大建筑市场的成长在 2030 年之前放缓,中国在全球建筑市场占有率预计将略有增加。

- 根据国际贸易组织的数据,中国是世界上最大的建筑市场,也是世界上都市化最高的国家。中国国家统计局的资料显示,2022年,中国建筑业产值超过31兆元(约4.31兆美元),比前十年增长近100%。

- 根据美国人口普查局的数据,2022 年美国私人建筑业价值为 14,342 亿美元,比 2021 年的 12,795 亿美元增长 11.7% (+-1.0%)。 2022 年住宅支出将为 8,991 亿美元,较 2021 年的 7,937 亿美元增长 13.3% (+2.1%),非住宅支出将为 5,301 亿美元,增长 9.1% (+2.1%)从2021 年的4858亿美元(2.1%)下降(1.0%)。 2023 年 10 月的建筑许可证数量约为 1,487,000 个,而 2022 年 10 月为 1,555,000 个。

- 此外,欧盟復苏基金的投资帮助欧洲建筑业在 2022 年成长了 2.5%。儘管欧盟大多数建设公司面临价格压力,但景气预计将在 2022 年初恢復并达到 COVID-19 之前的水平。此外,随着 COVID-19 危机的缓解以及建筑商越来越不愿意投资新建筑或维修现有房产,非住宅建筑预计将加快步伐,从而支持整体建筑市场的成长。 2021年主要建设计划为非住宅(办公大楼、医院、饭店、学校、工业建筑),占31.3%。

- 中东的一些主要商业建设项目是由沙乌地阿拉伯 2030 年愿景和阿布达比 2030 年经济愿景等政府计划所推动的。 Qiddiya、Al-Ula 的 Sharaan 度假村、法赫德国王医疗城扩建、Al Widyan、阿卜杜拉·本·阿卜杜勒阿齐兹国王医疗综合体是沙乌地阿拉伯建设计划对市场成长产生积极影响的一些例子。

- 由于上述因素,建设产业对聚氨酯的需求预计在预测期内将蓬勃发展。

亚太地区主导市场

- 亚太地区在全球聚氨酯市场中占有很大份额。中国和印度的汽车生产、建设活动和快速都市化正在增加聚氨酯的使用。

- 根据国际贸易组织的数据,中国是世界上最大的建筑市场,也是世界上都市化最高的国家。根据美国建筑师协会(AIA)上海的资料,到 2025 年,中国预计将建成自 1990 年代以来 10 个纽约大小的城市。

- 聚氨酯广泛应用于汽车领域。除了使汽车座椅更加舒适的发泡聚苯乙烯外,聚氨酯还用于保险桿、被称为「头条」的内部天花板、车身、车门、扰流板、车窗等。中国是最大的汽车生产国。由于环境问题日益严重,该国的汽车产业正在经历重大的产品变革,重点是创造在确保燃油效率的同时最大限度地减少排放气体的产品。

- 根据国际汽车工业协会(OICA)的数据,中国是最大的汽车生产国,2022年汽车产量达27,020,615辆,比2021年成长3%。印度汽车产业经历了巨大的成长,2022年汽车产量达到5,456,857辆,比2021年成长24%。

- 聚氨酯泡棉经常用作舒适且实用的衬垫傢俱的核心,产品范围从办公椅到床。亚太地区占全球家具产量的一半以上。最大的家俱生产国是中国。根据中国国家统计局的数据,2023 年 10 月中国家具零售额达到约 137 亿元人民币(约 18.7 亿美元),2023 年 9 月达到 138 亿元(约 18.8 亿美元)。

- 由于这些因素,亚太地区聚氨酯市场预计在预测期内将稳定成长。

聚氨酯产业概况

聚氨酯市场分散。市场上的主要企业(排名不分先后)包括亨斯迈国际有限责任公司、万华、科思创股份公司、BASF股份公司和陶氏化学。

其他好处:

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 调查先决条件

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场动态

- 促进因素

- 汽车产业对轻质、高性能复合材料的需求不断增长

- 建筑和建设产业的需求增加

- 床上用品、地毯和坐垫行业的需求增加

- 抑制因素

- 人们越来越关注环境

- 产业价值链分析

- 波特五力分析

- 供应商的议价能力

- 买方议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争程度

第五章市场区隔

- 类型

- 硬质泡沫

- 软质泡沫

- 被覆剂、黏剂、密封剂、合成橡胶(CASE)

- 热塑性聚氨酯

- 其他类型

- 最终用户产业

- 家具

- 建筑/施工

- 电子设备

- 车

- 鞋类

- 包装

- 其他最终用户产业

- 地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 其他亚太地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 义大利

- 法国

- 俄罗斯

- 其他欧洲国家

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地区

- 中东/非洲

- 沙乌地阿拉伯

- 南非

- 其他中东和非洲

- 亚太地区

第六章 竞争状况

- 併购、合资、联盟、协议

- 市场排名分析

- 主要企业策略

- 公司简介

- BASF SE

- BCI Holding SA

- Carpenter Co.

- Covestro AG

- DIC Corporation

- Dow

- Huntsman International LLC

- INOAC Corporation

- Kuwait Polyurethane Industries WLL

- LANXESS

- Mitsui Chemicals Inc.

- Rogers Corporation

- Sheela Foam Limited

- Tosoh Corporation

- Wanhua

第七章 市场机会及未来趋势

- 对生物基聚氨酯的需求增加

The Polyurethane Market size is estimated at USD 83.22 billion in 2024, and is expected to reach USD 108.02 billion by 2029, growing at a CAGR of 5.36% during the forecast period (2024-2029).

COVID-19 severely impacted market growth in various sectors. Stoppage or slowdown of projects, production halts, movement restrictions, and labor shortages to contain the outbreak have led to a decline in the growth of the polyurethane market. However, it recovered significantly in 2021 due to rising consumption from various end-use applications, such as furniture, footwear, and automotive.

Key Highlights

- The increasing demand for lightweight and high-performance composites from the automotive industry, rising demand from the bedding, carpet, and cushioning industries, and increasing demand from the building and construction industry are major factors driving the growth of the market studied.

- However, growing environmental concerns are anticipated to restrain the growth of the target industry during the forecast period.

- Nevertheless, the increasing demand for bio-based polyurethane may create lucrative growth opportunities for the global market.

- Asia-Pacific is expected to dominate the market and is likely to witness the highest CAGR during the forecast period.

Polyurethane Market Trends

Increasing Demand from the Building and Construction Industry

- Polyurethane is widely used in construction applications due to its excellent strength-to-weight ratio, insulation properties, versatility, and durability. Polyurethane components are found in homes across the world due to their affordability and the comfort they provide.

- The building and construction industry is the largest consumer of rigid and sprayed polyurethane foam. Rigid polyurethane foam insulation has many benefits, including energy efficiency, versatility, high performance, thermal/mechanical performance, and environment-friendly nature.

- Rigid polyurethane foams are used as insulated panels, wall and roof insulation, and gap fillers for the space around doors and windows. Rigid foam adhesives are used in window and door installations and manufactured housing.

- The volume of construction work is expected to grow by 85% globally, with China, the United States, and India leading the way, accounting for 57% of global growth. China's global construction market share is expected to increase marginally as growth in the world's largest construction market slows until 2030.

- According to the International Trade Organization, China is the world's largest construction market and has the highest rate of global urbanization. According to data from the National Bureau of Statistics of China, in 2022, the construction industry in the country generated an output of over CNY 31 trillion (~USD 4.31 trillion), representing an increase of almost 100% from the previous decade.

- According to the United States Census Bureau, in the United States, the value of private construction in 2022 stood at USD 1,434.2 billion, 11.7% (+- 1.0%) higher than the USD 1,279.5 billion in 2021. Residential construction spending in 2022 was USD 899.1 billion, up by 13.3% (+-2.1%) from USD 793.7 billion in 2021, while non-residential construction spending accounted for USD 530.1 billion, down by 9.1% (+-2.1%) from USD 485.8 billion in 2021 (1.0%). The total number of building permits in October 2023 was around 1,487,000 units compared to 1,555,000 units in October 2022.

- Furthermore, Europe's construction sector grew by 2.5% in 2022 because of the investments from the EU Recovery Fund. Business confidence picked up in early 2022, despite price pressures at most EU construction firms, and is expected to reach pre-COVID-19 levels. Moreover, as the COVID-19 crisis abates and builders become less reluctant to invest in new corporate buildings and renovate existing properties, non-residential construction is expected to pick up the pace, thus supporting overall growth in the construction market. The major construction projects in 2021 were non-residential (offices, hospitals, hotels, schools, and industrial buildings), accounting for 31.3%.

- Several primary commercial construction operations in the Middle East are driven by government projects, such as Saudi Arabia Vision 2030 and Abu Dhabi Economic Vision 2030. Qiddiya, Sharaan Resort at Al-Ula, King Fahad Medical City Expansion, Al Widyan, and King Abdullah Bin Abdulaziz Medical Complexes are examples of construction projects in Saudi Arabia with a favorable impact on the market growth.

- According to the above-mentioned factors, the demand for polyurethane from the building and construction industry is expected to flourish during the forecast period.

Asia-Pacific to Dominate the Market

- Asia-Pacific holds the major market share in the global polyurethane market. Polyurethane usage is increasing, with growing automobile production, construction activities, and rapid urbanization in China and India.

- According to the International Trade Organization, China is the largest construction market in the world and has the highest rate of global urbanization. According to data from the American Institute of Architects (AIA) Shanghai, by 2025, China is expected to construct a city equivalent to 10 in New York since the 1990s.

- Polyurethane is widely used in automobiles. In addition to the foam that makes car seats comfortable, polyurethane is used in bumpers, interior "headline" ceiling sections, the car body, doors, spoilers, and windows. China is the largest producer of automobiles. Due to the growing environmental concerns, the country's automotive sector is aiming for large-scale product evolution, focusing on manufacturing products to ensure fuel economy while minimizing emissions.

- According to the International Organization of Motor Vehicle Manufacturers (OICA), China was the largest producer of motor vehicles, with a production of 27,020,615 units of vehicles in 2022, registering a 3% growth compared to 2021. The Indian automobile sector saw immense growth, with a production of 54,56,857 units of vehicles in 2022, a 24% increase from 2021.

- Polyurethane foams are frequently used as the core of comfortable and functional upholstered furniture, with products ranging from office chairs to beds. Asia-Pacific accounted for more than half of global furniture production. China is the largest producer of furniture. According to the National Bureau of Statistics of China, in October 2023, the retail sales of furniture in China amounted to approximately CNY 13.7 billion (~USD 1.87 billion) compared to CNY 13.8 billion (~USD 1.88 billion) in September 2023.

- Due to all such factors, the Asian-Pacific polyurethane market is expected to witness steady growth during the forecast period.

Polyurethane Industry Overview

The polyurethane market is fragmented in nature. Some major players (not in any particular order) in the market include Huntsman International LLC, Wanhua, Covestro AG, BASF SE, and DOW.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Increasing Demand for Lightweight and High-performance Composites from the Automotive Industry

- 4.1.2 Increasing Demand from the Building and Construction Industry

- 4.1.3 Increasing Demand from the Bedding, Carpet, and Cushioning Industries

- 4.2 Restraints

- 4.2.1 Growing Environmental Concerns

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Value)

- 5.1 Type

- 5.1.1 Rigid Foam

- 5.1.2 Flexible Foam

- 5.1.3 Coatings, Adhesives, Sealants, and Elastomers (CASE)

- 5.1.4 Thermoplastic Polyurethane

- 5.1.5 Other Types

- 5.2 End-user Industry

- 5.2.1 Furniture

- 5.2.2 Building and Construction

- 5.2.3 Electronics and Appliances

- 5.2.4 Automotive

- 5.2.5 Footwear

- 5.2.6 Packaging

- 5.2.7 Other End-user Industries

- 5.3 Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 Italy

- 5.3.3.4 France

- 5.3.3.5 Russia

- 5.3.3.6 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 South Africa

- 5.3.5.3 Rest of Middle East and Africa

- 5.3.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 BASF SE

- 6.4.2 BCI Holding SA

- 6.4.3 Carpenter Co.

- 6.4.4 Covestro AG

- 6.4.5 DIC Corporation

- 6.4.6 Dow

- 6.4.7 Huntsman International LLC

- 6.4.8 INOAC Corporation

- 6.4.9 Kuwait Polyurethane Industries WLL

- 6.4.10 LANXESS

- 6.4.11 Mitsui Chemicals Inc.

- 6.4.12 Rogers Corporation

- 6.4.13 Sheela Foam Limited

- 6.4.14 Tosoh Corporation

- 6.4.15 Wanhua

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Increasing Demand for Bio-based Polyurethane