|

市场调查报告书

商品编码

1536811

资安管理服务-市场占有率分析、产业趋势/统计、成长预测(2024-2029)Managed Security Services - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

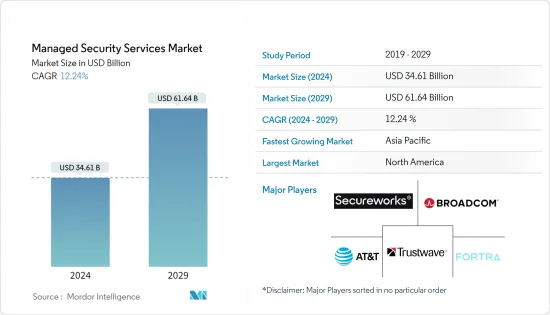

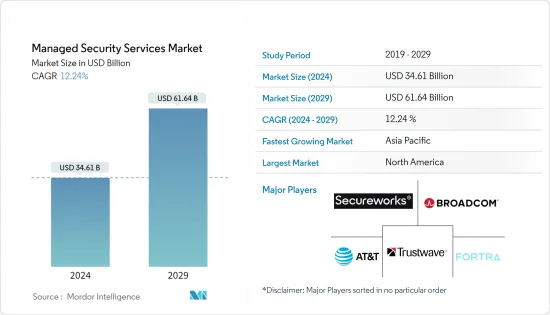

资安管理服务市场规模预计到 2024 年为 346.1 亿美元,预计到 2029 年将达到 616.4 亿美元,在预测期内(2024-2029 年)复合年增长率为 12.24%。

该市场的成长是由云端储存的日益普及、巨量资料分析的出现以及由于物联网的采用而导致的IT基础设施日益复杂性所推动的。然而,这些进步也透过扩大攻击面而增加了网路威胁的风险。

主要亮点

- 资安管理服务将网路安全外包给专业提供者。由于维护强大的安全基础设施的复杂性以及专家监督的需要,组织通常选择资安管理服务提供者 (MSSP)。资料外洩成本的上升进一步强调了这种需求,如附图所示。儘管传统安全解决方案已经发展,但侦测新的非檔案式威胁仍然很困难,从而推动了对资安管理服务的需求。

- 全球数位化趋势为网路犯罪分子提供了利用线上系统、网路和基础设施弱点的机会。这对世界各地的政府、企业和个人有重大的经济和社会影响。网路钓鱼、勒索软体和资料外洩已经是常见的网路威胁,但新型网路犯罪不断出现。

- 数位转型时代刺激了资料密集型应用和技术的扩展,导致企业产生和处理的资料的数量、速度和种类显着激增。随着组织利用巨量资料、人工智慧和机器学习的潜力,保护这项宝贵资产变得至关重要。随着对资料集中方法的日益依赖,组织必须管理包含敏感资讯的大型资料集,这凸显了对强大网路安全措施的需求。

- 随着网路威胁变得更加复杂,公司越来越多地外包其安全业务。选择建立内部安全营运中心 (SOC) 还是委託它会产生重大影响。因为渗透业务系统的单一恶意程式码案例可能会给整个组织带来灾难。

- COVID-19 大流行不仅扰乱了全球业务,而且数位化转型的推动也加速了私营和政府部门网路犯罪活动的活性化。这次疫情导致的网路攻击激增,为端点侦测和回应解决方案打开了大门,以帮助降低网路风险。因此,这些解决方案的市场在大流行期间和之后都显示出成长。

- 此外,网路流量的增加显着增加了各种企业遭受网路攻击的风险,因此需要实施资安管理服务。防火墙管理和端点安全的进步,加上疫情爆发以来网路攻击的激增,进一步推动了资安管理服务市场。

资安管理服务市场的趋势

BFSI 领域作为最终用户产业正在快速发展

- 资安管理服务可能会主导 BFSI 领域,主要是因为它们在保护敏感资料和增强整体安全性方面发挥作用。这些服务在 BFSI 领域的主要优势在于,它们提供全天候监控,并在发生违规情况时实现快速事件回应和补救。

- 由于 BFSI 部门专注于保护客户资料,资安管理服务的采用量显着增加。此举旨在加强线上服务的安全性,抵御网路攻击的兴起。

- 在当今的数位环境中,BFSI 公司必须采用先进的即时安全措施。这包括端点检测和回应(EDR)、生物识别技术、云端安全、程式码审核、嵌入式系统安全评估、整合安全解决方案、网路情报、多因素身份验证、安全培训、行为分析等。

- 在世界各地的金融机构都在加强网路威胁预防策略的同时,印度 BFSI 正在强调网路安全的重要性和影响。安全漏洞、资料窃取和密码外洩等常见网路攻击给这些公司带来了重大担忧。随着新技术和熟练犯罪者不断发展的网路犯罪格局凸显了印度 BFSI 领域当前网路安全方法的局限性。

- 分散式阻断服务 (DDoS) 攻击在 BFSI 领域迅速增加,使得资安管理服务变得越来越重要,尤其是在 DDoS 缓解领域。 2023 年 9 月,领先的网路安全供应商 Akamai 成功挫败了针对美国金融机构的大规模 DDoS 攻击。这一事件凸显了 BFSI 威胁的升级,塑造了防御 DDoS 攻击的资安管理服务市场。

- 随着恶意软体类型的发展,对检测解决方案的需求也不断增长。据 Zimperium 称,截至 2023 年,Godfather 银行恶意软体有 1,171 个变种。截至 2023 年,Nexus 恶意软体排名第一,约有 500 种变种,Saderat 排名第一,约有 300 种变种。总体而言,排名前五的恶意软体家族有 50 多个变体。

- BFSI 领域网路攻击的频率不断增加,增加了资安管理服务的需求。在日益互联的数位化金融生态系统中,这些服务在保护金融系统、客户资料和相关人员之间的信任方面发挥关键作用。这种不断增长的需求预计将在未来几年推动市场成长。

预计北美将占据较大市场占有率

- 北美地区正在经历新兴技术的重大整合,简化 IT 功能的需求正在迅速增加。该地区越来越多的企业发现,在资安管理服务提供者的帮助下可以更轻鬆地满足这一需求,这将推动未来的业务成长。

- 在美国,智慧型手机和平板装置越来越普及,BYOD(自带装置)政策推广的可能性很高。该全部区域不断上升的设备普及率和强大的网路连接正在推动组织采用 BYOD 政策,增加业务生态系统中的网路攻击风险,并推动该地区未来对资安管理服务的需求。

- 此外,物联网在各个行业和部门的快速整合预计将提高这些智慧设备的普及率。预计这将推动资安管理服务的采用和实施,从而刺激市场成长。

- 多重云端环境的使用在美国正在迅速扩大,客户主要依赖一种云,偶尔使用其他云。资安管理服务提供者 (MSSP) 可以透过提供基于消费的定价模式来利用这一机会。

- 此外,美国预计将越来越多地利用公共云端和 IT 营运管理 (ITOM) 工具的託管服务,推动云端和本地 ITOM 订阅业务设计的成长。儘管如此,本地部署预计将成为最常见的交付方法。

- 该地区还面临大量的 DDoS 攻击,这些攻击可能会随着多个最终用户产业的增加而增加,进一步增加对 DDoS 防护解决方案的需求。此外,该地区的网路攻击正在迅速增加,尤其是在美国。该地区的数字庞大,主要是由于连网设备数量的快速增长。

资安管理服务产业概述

由于跨国公司和中小企业的存在,资安管理服务市场高度分散。该市场的主要参与者包括 AT&T Inc.、SecureWorks Corp.、Broadcom Inc.、Trustwave Holdings Inc. (Chertoff Group) 和 Fortra LLC。市场参与者正在采取联盟和收购等策略来加强其产品供应并获得永续的竞争优势。

- 2023 年 11 月 - AT&T 宣布达成协议,创建独立管理的保全服务业务,并由芝加哥投资者 WillJam Ventures 参股该业务。新的网路安全合资企业将持有託管安全业务、精选安全软体解决方案和安全咨询资源。

- 2023 年 10 月 - Trustwave Holdings Inc. 宣布推出适用于 Microsoft Sentinel 的 Trustwave 託管 SIEM。 Trustwave 的最新服务旨在协助使用 Microsoft Sentinel 的企业改善安全功能、优化投资收益并加快回应时间。

其他好处:

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场洞察

- 市场概况

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 买方议价能力

- 新进入者的威胁

- 竞争公司之间的敌对关係

- 替代品的威胁

第五章市场动态

- 市场驱动因素

- 网路犯罪增加、数位破坏和合规要求提高

- 对早期威胁侦测和情报的需求推动了市场成长

- 市场限制因素

- 保全服务意识缺失阻碍因素市场拓展

- MSSP领域的演变和主要趋势

- COVID-19 对市场的影响

第六章 市场细分

- 依部署类型

- 本地

- 云

- 按解决方案类型

- 入侵侦测/预防

- 威胁防御

- 分散式阻断服务

- 防火墙管理

- 端点安全

- 风险评估

- 资安管理服务提供者

- IT服务供应商

- 安全管理专家

- 电信服务供应商

- 按最终用户产业

- BFSI

- 政府/国防

- 零售

- 製造业

- 医疗保健/生命科学

- 资讯科技和电讯

- 其他最终用户产业

- 按地区

- 北美洲

- 欧洲

- 亚洲

- 澳洲/纽西兰

- 拉丁美洲

- 中东/非洲

第七章 竞争格局

- 公司简介

- AT&T Inc.

- Secureworks Corp.

- Broadcom Inc.

- Trustwave Holdings Inc.(the Chertoff Group)

- Fortra LLC

- IBM Corporation

- Verizon Communications Inc.

- Lumen Technologies Inc.

- BAE Systems PLC

- Atos SE

- Capgemini SE

- Wipro Limited

- Fujitsu Limited(Fujitsu Group)

第八章供应商定位分析

第九章投资分析及市场展望

The Managed Security Services Market size is estimated at USD 34.61 billion in 2024, and is expected to reach USD 61.64 billion by 2029, growing at a CAGR of 12.24% during the forecast period (2024-2029).

The market's growth can be attributed to the rising adoption of cloud storage, the emergence of big data analytics, and the increasing complexity of IT infrastructures due to IoT adoption. However, these advancements also heighten the risk of cyber threats, given the expanded attack surface.

Key Highlights

- Managed security services involve outsourcing network security to specialized providers. Organizations often opt for managed security service providers (MSSPs) due to the complexity of maintaining a robust security infrastructure and the need for expert monitoring. This need is further underscored by the rising costs of data breaches, as evident from the accompanying graph. While traditional security solutions have evolved, they still struggle to detect newer, non-file-based threats, fueling the demand for managed security services.

- The global digitalization trend has provided cybercriminals with opportunities to exploit weaknesses in online systems, networks, and infrastructure. This has had significant economic and social repercussions on governments, businesses, and individuals worldwide. While phishing, ransomware, and data breaches are already prevalent cyber threats, new types of cybercrimes continue to emerge.

- The digital transformation era has fueled the expansion of data-intensive applications and technologies, resulting in a significant surge in the volume, velocity, and variety of data generated and processed by businesses. As organizations harness the potential of Big Data, artificial intelligence, and machine learning, securing this valuable asset becomes paramount. With the growing reliance on data-intensive approaches, organizations must manage large datasets containing sensitive information, underscoring the need for robust cybersecurity measures.

- The rising complexity of cyber threats is driving organizations to increasingly outsource their security operations. Choosing between an internal or outsourced Security Operations Center (SOC) carries significant consequences, as a single instance of malicious code infiltrating a business system can now spell the demise of the entire organization.

- The COVID-19 pandemic has not only disrupted businesses globally but has also expedited the rise of cybercriminal activities, both in private enterprises and government sectors, due to the push for digital transformation. This surge in cyberattacks during the pandemic has opened up avenues for endpoint detection and response solutions, given their effectiveness in mitigating cyber risks. As a result, the market for these solutions witnessed growth both during and after the pandemic.

- Additionally, the heightened internet traffic has significantly amplified the risk of cyberattacks across various businesses, necessitating the adoption of managed security services. The market for managed security services has further been propelled by advancements like firewall management and endpoint security, coupled with the surge in cyberattacks since the onset of the pandemic.

Managed Security Services Market Trends

BFSI Sector to be the Fastest-growing End-user Industry

- Managed security services are set to dominate the BFSI sector, primarily due to their role in safeguarding sensitive data and bolstering overall security. A key advantage of these services in the BFSI space is their round-the-clock monitoring, enabling swift incident response and remediation in case of breaches.

- Given the BFSI sector's focus on safeguarding client data, there has been a notable surge in the adoption of managed security services. This move is aimed at bolstering the security of online services against the rising tide of cyberattacks.

- In today's digital landscape, BFSI firms must employ advanced real-time security measures. These include endpoint detection and response (EDR), biometric technology, cloud security, code audit, embedded system security assessment, integrated security solutions, cyber intelligence, multi-factor authentication, security training, and behavioral analytics, among others.

- While financial institutions worldwide are enhancing their cyber threat prevention strategies, BFSI entities in India are grappling with the significance and repercussions of cybersecurity. Common cyberattacks like security breaches, data thefts, and password compromises pose significant concerns for these firms. The evolving cybercrime landscape, with its new techniques and skilled perpetrators, underscores the limitations of current cybersecurity approaches in India's BFSI realm.

- The BFSI sector is witnessing a surge in distributed denial of service (DDoS) attacks, amplifying the significance of managed security services, particularly in the realm of DDoS mitigation. Notably, in September 2023, Akamai, a leading cybersecurity provider, successfully thwarted a major DDoS attack on a US financial institution. This incident underscores the escalating threat landscape for BFSIs, creating a ripe market for managed security services to fortify against DDoS assaults.

- As malware types evolve, the need for detection solutions intensifies. According to Zimperium, in 2023, the banking malware Godfather had 1,171 known variants. As of 2023, Nexus malware ranked first, with approximately 500 variants, while Saderat had around 300 types. Overall, the top five malware families had over 50 variants.

- The mounting frequency of cyberattacks in the BFSI sector is driving up the demand for managed security services. These services play a pivotal role in safeguarding financial systems, customer data, and the overall trust of stakeholders in an increasingly interconnected and digitized financial ecosystem. This heightened demand is poised to propel the market growth in the coming years.

North America is Expected to Hold Significant Market Share

- The North American region has been witnessing a significant integration of modern technology, and the need for streamlined IT functions is growing rapidly, with an increasing number of businesses in the region finding it easy to keep pace with that with the help of managed security service providers, which is driving the business growth in the future.

- The penetration of smartphones and tablets is increasing in the United States, which will likely drive the bring your own device (BYOD) policy. The increasing penetration of devices and strong network connectivity across the region are expected to encourage organizations to adopt BYOD policies, raising the risk of cyberattacks in the business ecosystems and supporting the demand for managed security services in the region in the future.

- Furthermore, the penetration of these smart devices is expected to increase due to the rapid integration of IoT across various industries and sectors. This is expected to propel the adoption and incorporation of managed security services, thereby fueling the market's growth.

- The use of multi-cloud environments is experiencing massive growth in the United States, wherein clients rely majorly on one cloud while using the other sporadically. Here, managed security service providers (MSSPs) can avail of the opportunity by offering consumption-based pricing models.

- Moreover, in the United States, public cloud and managed services are expected to be leveraged more often for IT operations management (ITOM) tools, encouraging the growth of the subscription business design for both cloud and on-premises ITOM. Despite this, on-premises deployments are expected to be the most popular delivery method.

- The region also faces a significant number of DDoS attacks, which are likely to increase with respect to multiple end-user industries, further driving the demand for DDoS protection solutions. Moreover, cyberattacks in the region, especially in the United States, are increasing rapidly. They are reaching high numbers, primarily due to the rapidly increasing number of connected devices in the region.

Managed Security Services Industry Overview

The managed security services market is highly fragmented due to the presence of both global players and small- and medium-sized enterprises. Some of the major players in the market are AT&T Inc., SecureWorks Corp., Broadcom Inc., Trustwave Holdings Inc. (the Chertoff Group), and Fortra LLC. Players in the market are adopting strategies such as partnerships and acquisitions to enhance their product offerings and gain sustainable competitive advantage.

- November 2023 - AT&T announced an agreement to create a standalone managed cybersecurity services business and a capital investment in that business from a Chicago-based investor - WillJam Ventures. Expected to close in 1Q24, the newly managed cybersecurity joint venture will hold associated managed security operations, select security software solutions, and security consulting resources.

- October 2023 - Trustwave Holdings Inc. announced the launch of Trustwave Managed SIEM for Microsoft Sentinel. Trustwave's latest offering is designed to help businesses using Microsoft Sentinel with improved security capabilities, optimized return on investment, and rapid response times.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Intensity of Competitive Rivalry

- 4.2.5 Threat of Substitutes

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Rising Cyber Crime, Digital Disruption, and Increased Compliance Demands

- 5.1.2 Need for Threat Detection and Intelligence at an Early Stage Driving the Market Growth

- 5.2 Market Restraints

- 5.2.1 Lack of Awareness of Security Services is Discouraging the Market Expansion

- 5.3 Evolution and Key Trends in the MSSP Space

- 5.4 Impact of COVID-19 on the Market

6 MARKET SEGMENTATION

- 6.1 By Deployment Type

- 6.1.1 On-premise

- 6.1.2 Cloud

- 6.2 By Solution Type

- 6.2.1 Intrusion Detection and Prevention

- 6.2.2 Threat Prevention

- 6.2.3 Distributed Denial of Services

- 6.2.4 Firewall Management

- 6.2.5 End-point Security

- 6.2.6 Risk Assessment

- 6.3 By Managed Security Service Provider

- 6.3.1 IT Service Providers

- 6.3.2 Managed Security Specialist

- 6.3.3 Telecom Service Provider

- 6.4 By End-user Industry

- 6.4.1 BFSI

- 6.4.2 Government and Defense

- 6.4.3 Retail

- 6.4.4 Manufacturing

- 6.4.5 Healthcare and Life Sciences

- 6.4.6 IT and Telecom

- 6.4.7 Other End-user Verticals

- 6.5 By Geography***

- 6.5.1 North America

- 6.5.2 Europe

- 6.5.3 Asia

- 6.5.4 Australia and New Zealand

- 6.5.5 Latin America

- 6.5.6 Middle East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles*

- 7.1.1 AT&T Inc.

- 7.1.2 Secureworks Corp.

- 7.1.3 Broadcom Inc.

- 7.1.4 Trustwave Holdings Inc. (the Chertoff Group)

- 7.1.5 Fortra LLC

- 7.1.6 IBM Corporation

- 7.1.7 Verizon Communications Inc.

- 7.1.8 Lumen Technologies Inc.

- 7.1.9 BAE Systems PLC

- 7.1.10 Atos SE

- 7.1.11 Capgemini SE

- 7.1.12 Wipro Limited

- 7.1.13 Fujitsu Limited (Fujitsu Group)