|

市场调查报告书

商品编码

1685919

陀螺仪:市场占有率分析、行业趋势和统计数据、成长预测(2025-2030 年)Gyroscopes - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

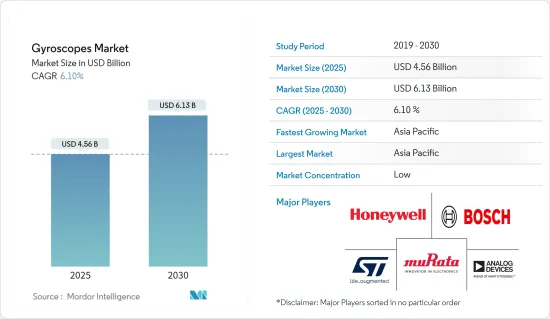

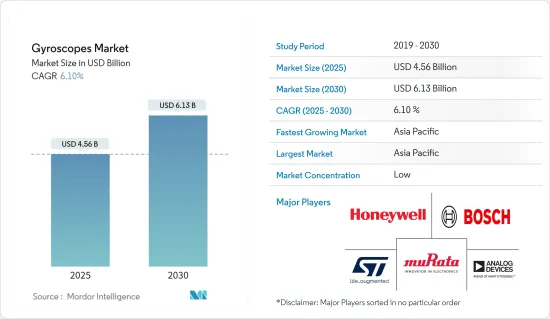

陀螺仪市场规模预计在 2025 年为 45.6 亿美元,预计到 2030 年将达到 61.3 亿美元,预测期内(2025-2030 年)的复合年增长率为 6.1%。

随着基于 MEMS 的陀螺仪的推出,陀螺仪技术在过去十年中经历了许多创新。陀螺仪的精度和效率也得到了提高,多轴陀螺仪现在采用数位整合以提高精度。近年来,陀螺仪的应用领域也不断扩大,该技术在家用电子电器和工业应用领域具有重要意义。

主要亮点

- 预计国防和商业领域对无人机和无人驾驶飞行器(UAV)的快速应用将成为市场的主要驱动力。无人驾驶飞行器(UAV)是一种空中系统或飞行器,由人类操作员远端操作或由机载电脑自主操作,用于战争或监视目的。不断增加的研究和开发正在推动无人机的采用率。

- 根据商业和技术杂誌《国防》报道,无人机研究、开发和采购成本预计将从 2020 年的 111 亿美元增加到 2029 年的 143 亿美元。此外,研发费用预计将从 2020 年的 32 亿美元增加到 2029 年的 40 亿美元。到 2020 年,资金将从 2020 年的 79 亿美元成长到约 103 亿美元。由于无人机和无人驾驶飞机的使用日益增多,市场也不断成长。

- 此外,对工业自动化和小型化消费性设备(如穿戴式装置和物联网连接设备)的需求是推动各地区受调查市场对 MEMS 陀螺仪需求的主要因素。

- 然而,高昂的前期成本和营运问题是预测期内限制市场成长的主要因素。此外,高品质的原材料对製造商来说至关重要,因为它们对于生产优质的感测器至关重要。製造业使用的金属和合金包括铂、铜、硅、钨、镍等,合金进一步分为K型、M型、E型、J型等。此外,原物料价格和供应的波动也是阻碍市场成长的因素。

陀螺仪市场趋势

汽车是一个快速成长的终端用户市场

- 陀螺仪在汽车工业有多种应用。陀螺仪,尤其是 MEMS,用于汽车防翻滚和安全气囊展开系统。陀螺仪也用于车载影像防手震係统,例如行车记录器和其他车载摄影机中的机内影像防手震。它还用于车载导航系统以提高性能和准确性。陀螺仪可以与其他感测器配合使用,提供精确的位置和方向。

- 陀螺仪也用于车辆控制系统,以协助稳定性和控制。它提供有关车辆角运动的信息,有助于优化车辆动力学并提高安全性。陀螺仪是汽车惯性导引系统的一部分。这些系统使用陀螺仪测量和维持车辆的方向和角速度,以提供准确的导航和引导资讯。此外,它也是汽车电子稳定程式 (ESP) 系统的重要组成部分,有助于检测和测量汽车的转速。这些资讯有助于在机动过程中保持车辆的稳定性和控制力。

- 乘用车产量的增加正在推动所研究的市场的发展。例如,根据OICA预测,2022年全球汽车产量将超过8,500万辆。乘用车产量约占汽车总产量的 73%,达到近 6,159 万辆。 2021年全球汽车产量约5,705万辆。

- 陀螺仪对于汽车 ADAS(高级驾驶辅助系统)至关重要。陀螺仪用于稳定控制系统,以检测和纠正车辆偏离预定路径的偏差,提高驾驶时的安全性和稳定性。提高自动驾驶能力、强度和安全性。 GPS辅助陀螺仪系统是为汽车领域的车辆动力学和驾驶辅助参数测量而开发的。这些系统提供高度精确的测量以协助 ADAS 测试和开发。根据国家安全委员会的数据,到 2026 年,大约 71% 的註册车辆将配备后视摄影机,60% 的註册车辆将配备后停车感应器。 ADAS 的日益普及可能会促进所研究市场的成长。

- 此外,自动驾驶和自动驾驶汽车的日益普及也是 ADAS 市场的主要成长要素。例如,根据英特尔预测,2030年全球汽车销量将达到1.014亿辆以上,而自动驾驶汽车预计将占2030年汽车註册量的约12%。

亚太地区预计将经历强劲成长

- 由于庞大的消费性电子市场、不断增长的5G设备需求以及政府积极发展经济以保持全球领先地位,陀螺仪有望成为中国的领先产品。

- 中国正积极致力于将5G技术融入消费性电子产品。根据GSMA统计,中国当地是全球最大的5G技术市场,预计2022年底将占全球5G连线数的60%以上。根据GSMA的《移动经济报告》,到2024年,5G将超越4G,成为中国主导的行动技术。随着5G的发展,网路连线更加先进,智慧型手机和平板装置上的GPS应用也越来越普及,进而带动陀螺仪的需求。

- 日本的汽车、半导体和家电产业是世界上最大的产业之一。日本有丰田、日产、本田、铃木、三菱、大发、马自达、Subaru、日野、五十铃、川崎、Yamaha等主要汽车製造商。汽车行业技术的不断进步、电动汽车销量的不断增长以及自动驾驶和联网汽车中智慧控制系统的集成,对用于精确定位和导航的陀螺仪的需求不断增加。

- 5G 在印度的快速推广势头强劲,该国将在不久的将来获得显着的技术和经济效益。例如,根据爱立信的报告,印度的5G行动用户数将从2022年的666万增加到2028年的6.9984亿。 5G的引入预计将彻底改变各行业的工业和经济表现,并增加就业机会。 5G 手机在该国越来越受欢迎,这有助于推动市场成长。

- 亚太其他地区包括韩国、台湾、泰国、马来西亚、新加坡和印尼等东南亚国家。领先的智慧型手机製造商三星电子的存在以及韩国对开发 5G 市场的投资不断增加正在推动智慧型手机市场的发展,从而对该地区对陀螺仪的需求产生积极影响。

陀螺仪市场概况

陀螺仪市场高度分散,既有全球性企业,也有中小型企业。市场的主要企业包括村田製作所、意法半导体公司、霍尼韦尔国际公司、ADI公司和博世感测器技术有限公司(罗伯特博世有限公司)。该市场的竞争对手正在采取联盟和收购等策略来加强其产品供应并获得永续的竞争优势。

- 2024 年 1 月-村田製作所推出了结合陀螺仪和加速计的「下一代」感测器 SCH16T-K01。 SCH16T-K01 是多设备 SCH16T 系列六自由度 (6DoF) 感测器之一,基于村田製作所的新一代 3D电子机械系统 (MEMS) 感测器技术。

- 2023 年 11 月-意法半导体推出支援 AI 的汽车惯性测量单元,适用于高达 125°C 的始终开启感知应用。意法半导体用于汽车应用的 ASM330LHXG1 惯性测量单元 (IMU) 结合了感测器内建 AI、增强低功耗操作和 125°C动作温度范围,可在恶劣环境下实现可靠性。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场洞察

- 市场概览

- 产业吸引力-波特五力分析

- 新进入者的威胁

- 买家/消费者的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争对手之间的竞争强度

- 产业价值链分析

- 宏观经济趋势对产业的影响

第五章市场动态

- 市场驱动因素

- 国防和民用无人驾驶车辆的普及

- 技术进步使组件更小、更轻、更有效率

- 市场限制

- 复杂性显着增加,挑战市场需求

第六章市场区隔

- 依技术

- MEMS陀螺仪

- 光纤陀螺仪(FOG)

- 环形雷射陀螺仪(RLG)

- 半球谐振陀螺仪(HRG)

- 动态调谐陀螺仪(DTG)

- 其他技术

- 按行业

- 消费性电子产品

- 车

- 航太与国防

- 工业的

- 海洋

- 其他行业

- 按地区

- 北美洲

- 美国

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 亚洲

- 中国

- 日本

- 印度

- 澳洲和纽西兰

- 拉丁美洲

- 中东和非洲

- 北美洲

第七章竞争格局

- 公司简介

- Murata Manufacturing Co. Ltd

- STMicroelectronics NV

- Honeywell International Inc.

- Analog Devices Inc.

- Robert Bosch GmbH

- MEMSIC Inc.

- EMCORE Corporation

- InnaLabs

- MicroStrain Inc.

- Vectornav Technologies LLC

- Dynalabs

第八章投资分析

第九章 市场机会与未来趋势

The Gyroscopes Market size is estimated at USD 4.56 billion in 2025, and is expected to reach USD 6.13 billion by 2030, at a CAGR of 6.1% during the forecast period (2025-2030).

Gyroscope technology has witnessed many innovations in the past decade with the introduction of MEMS-based gyroscopes. The accuracy and efficiency of the gyroscopes have also improved, as multi-axis gyroscopes are more accurate due to digital integration. The applications of gyroscopes have also expanded over the past few years, with the consumer electronics and industrial segments finding significant implications for the technology.

Key Highlights

- The rapidly growing adoption of drones and unmanned aerial vehicles (UAVs) in the defense and commercial sectors has been expected to be a significant driver in the market. An Unmanned Aerial Vehicle (UAV) is an airborne system or an aircraft operated remotely by a human operator or autonomously by an onboard computer for warfare and surveillance. Due to the increase in research and development, the adoption rate of UAVs is rising.

- According to National Defense, a business technology magazine, the cost of research, development, and procurement for UAVs is expected to increase from USD 11.1 billion in 2020 to USD 14.3 billion by 2029. Additionally, it is anticipated that R&D spending will increase from USD 3.2 billion in 2020 to USD 4 billion in 2029. Procurement funding will rise from USD 7.9 billion in 2020 to approximately USD 10.3 billion by the decade's end. The market is expanding due to the increasing use of drones and UAVs.

- Further, industrial automation and demand for miniaturized consumer devices, such as wearables and IoT-connected devices, among others, across regions are among the significant factors driving the MEMS Gyroscope demand in the studied market.

- However, high initial costs and operational concerns are the major factors anticipated to restrain the growth of the studied market over the forecast period. Further, as an essential part of producing superior sensors, high-quality raw materials are vital for manufacturers. Metals and alloys used in manufacturing include Platinum, Copper, Silicon, Tungsten, and Nickel, and alloys, which are further categorized into type-K, type-M, type-E, type-J, and so on. Fluctuations in prices and supply of raw materials could also cause hindrances in the growth of the studied market.

Gyroscopes Market Trends

Automotive to be the Fastest Growing End-user Vertical

- Gyroscopes have several applications in the automotive industry. Gyroscopes, particularly MEMS, are used in vehicle roll-over prevention and airbag deployment systems. Gyroscopes are used in vehicle image stabilization systems, such as in-camera stabilization systems for dashcams or other onboard cameras. They are also utilized in-vehicle navigation systems to improve performance and accuracy. They can be used with other sensors to provide precise positioning and orientation.

- Gyroscopes can also be used in vehicle control systems to assist with stability and control. They can provide information about the vehicle's angular motion, which can be used to optimize vehicle dynamics and improve safety. They are utilized as a part of inertial guidance systems in cars. These systems use gyroscopes to measure and maintain a vehicle's orientation and angular velocity, providing accurate navigation and guidance information. Further, they form a crucial part of the electronic stability program (ESP) systems of vehicles that aid in the detection and measurement of the rate of rotation of the car. This information assists in maintaining vehicle stability and control during maneuvers.

- The increased production of passenger vehicles drives the market studied. For instance, according to OICA, worldwide motor vehicle production in 2022 amounted to more than 85 million units. The passenger cars segment generated approximately 73 percent of the motor vehicle production, almost 61.59 million units. In 2021, the worldwide motor vehicle production totaled about 57.05 million.

- Gyroscopes are essential in the automotive advanced driver assistance systems (ADAS). They are used in stability control systems to detect and correct deviations from the vehicle's intended path, improving safety and stability during driving. They enhance autonomous driving capabilities, strength, and safety. GPS-aided gyro systems have been developed to measure vehicle dynamics and driver assistance parameters in the automotive sector. These systems provide high-precision measurements to aid in ADAS testing and development. According to the National Safety Council, by 2026, approximately 71% of registered vehicles will be equipped with rear cameras, while 60% will have rear parking sensors. Such increasing adoption of ADAS would aid the growth of the market studied.

- Moreover, the increasing adoption of self-driving or autonomous vehicles is a primary growth factor for the ADAS market. For instance, according to Intel, global car sales are expected to reach over 101.4 million units in 2030, and autonomous vehicles will account for about 12% of car registrations by 2030.

Asia Pacific Expected to Witness Significant Growth

- Gyroscopes are expected to gain traction in China owing to the huge consumer electronics market, growing demand for 5G devices, and active efforts by the government to develop the economy to stay at the leading position in the world.

- China is actively focusing on the integration of 5G technology in consumer electronics. According to GSMA, Mainland China is the largest 5G technology market in the world, and at the end of 2022, it accounted for over 60% of global 5G connections. According to the Mobile Economy Report by GSMA, in 2024, 5G will surpass 4G to become the central mobile technology in China. With the advancement in network connectivity with the 5G development, the proliferation of GPS applications in smartphones and tablets increased, which created demand for gyroscopes.

- The automotive, semiconductor, and consumer electronics industries in Japan are some of the most prominent and largest industries in the world. The country is home to several leading automakers such as Toyota, Nissan, Honda, Suzuki, Mitsubishi, Daihatsu, Mazda, Subaru, Hino, Isuzu, Kawasaki, and Yamaha. The growing technological advancement in the automotive industry, the rise in sales of electric vehicles, and the integration of smart control systems in autonomous and connected vehicles create demand for gyroscopes for accurate positioning and navigation.

- In India, the rapid expansion of 5G is gaining momentum and will soon allow the country to reap significant technological and economic benefits. For instance, according to Ericsson's report, 5G mobile subscriptions in India will increase from 6.66 million in 2022 to 699.84 million in 2028. The introduction of 5G is expected to revolutionize industrial and economic performance in various sectors, as well as enhance access to employment opportunities. 5G mobile smartphones are gaining traction in the country which encourages market growth.

- The rest of the Asia Pacific segment comprises countries such as South Korea and Taiwan and Southeast Asian countries such as Thailand, Malaysia, Singapore, Indonesia, and others. The presence of leading smartphone manufacturer Samsung Electronics and growing investment in 5G development in South Korea drives the smartphone market, which positively impacts the gyroscope demand in the region.

Gyroscopes Market Overview

The gyroscope market is highly fragmented due to the presence of both global players and small and medium-sized enterprises. Some of the major players in the market are Murata Manufacturing Co. Ltd, STMicroelectronics NV, Honeywell International Inc., Analog Devices Inc., and Bosch Sensortec Gmbh (Robert Bosch GmbH). Players in the market are adopting strategies such as partnerships and acquisitions to enhance their product offerings and gain sustainable competitive advantage.

- January 2024 - Murata Manufacturing has launched a "next-generation" combined gyroscope and accelerometer sensor, offering the company's "high-precision" sensing for machine control and more: the SCH16T-K01. The multi-device SCH16T family of six degrees of freedom (6DoF) sensors, the SCH16T-K01, is based on a new generation of Murata's 3D micro-electromechanical systems (MEMS) sensor technology.

- November 2023 - STMicroelectronics introduced an AI-enabled automotive inertial measurement unit for always-aware applications up to 125°C. STMicroelectronics' ASM330LHHXG1 inertial measurement unit (IMU) for automotive applications combines in-sensor AI with enhanced low-power operation and a 125°C operating temperature range for reliability in harsh environments.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Threat of New Entrants

- 4.2.2 Bargaining Power of Buyers/Consumers

- 4.2.3 Bargaining Power of Suppliers

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain Analysis

- 4.4 Impact of Macro Economic trends on the Industry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Rapid Rise of Unmanned Vehicle in Both Defense and Civilian Applications

- 5.1.2 Technological Advancements Enabling More Effective Components at a Smaller and Lighter Size

- 5.2 Market Restraints

- 5.2.1 Substantial Increase in Complexity Challenging the Market Demand

6 MARKET SEGMENTATION

- 6.1 By Technology

- 6.1.1 MEMS Gyroscope

- 6.1.2 Fiber Optic Gyroscope (FOG)

- 6.1.3 Ring Laser Gyroscope (RLG)

- 6.1.4 Hemispherical Resonating Gyroscope (HRG)

- 6.1.5 Dynamically Tuned Gyroscopes (DTG)

- 6.1.6 Other Technologies

- 6.2 By End-user Vertical

- 6.2.1 Consumer Electronics

- 6.2.2 Automotive

- 6.2.3 Aerospace and Defense

- 6.2.4 Industrial

- 6.2.5 Marine

- 6.2.6 Other End-user Verticals

- 6.3 By Geography

- 6.3.1 North America

- 6.3.1.1 United States

- 6.3.1.2 Canada

- 6.3.2 Europe

- 6.3.2.1 Germany

- 6.3.2.2 United Kingdom

- 6.3.2.3 France

- 6.3.3 Asia

- 6.3.3.1 China

- 6.3.3.2 Japan

- 6.3.3.3 India

- 6.3.4 Australia and New Zealand

- 6.3.5 Latin America

- 6.3.6 Middle East and Africa

- 6.3.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Murata Manufacturing Co. Ltd

- 7.1.2 STMicroelectronics NV

- 7.1.3 Honeywell International Inc.

- 7.1.4 Analog Devices Inc.

- 7.1.5 Robert Bosch GmbH

- 7.1.6 MEMSIC Inc.

- 7.1.7 EMCORE Corporation

- 7.1.8 InnaLabs

- 7.1.9 MicroStrain Inc.

- 7.1.10 Vectornav Technologies LLC

- 7.1.11 Dynalabs