|

市场调查报告书

商品编码

1685941

钪-市场占有率分析、产业趋势与统计、成长预测(2025-2030)Scandium - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

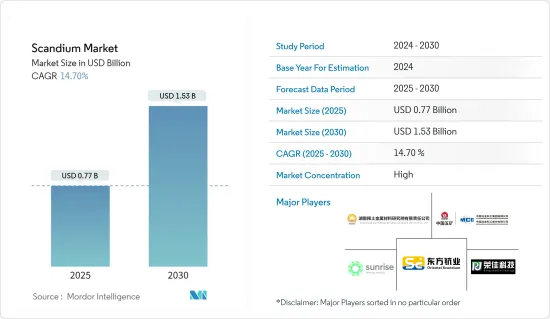

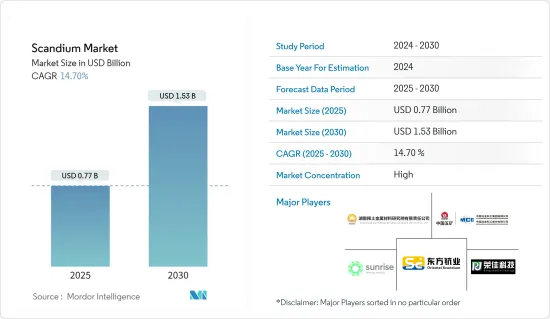

预计 2025 年钪市场规模为 7.7 亿美元,到 2030 年将达到 15.3 亿美元,预测期内(2025-2030 年)的复合年增长率为 14.7%。

主要亮点

- 新冠疫情对钪市场产生了负面影响。封锁导致航太、国防、陶瓷和电子等主要终端用户部门停工,减少了钪的使用量。然而,疫情过后,随着主要终端用户领域的活动持续进行,市场稳定扩张。

- 短期内,固体氧化物燃料电池(SOFCS)的使用量增加以及航太和国防工业对铝钪合金的需求增加是推动研究市场发展的因素。

- 然而,高昂的钪价可能会阻碍 2024 年至 2029 年的市场成长。

- 汽车产业的潜在应用和储能技术的发展可能会在未来几年为市场提供机会。

- 预计中国将主导市场,其次是欧盟,预计欧盟将在 2024 年至 2029 年期间实现最高的复合年增长率。

钪市场趋势

固体氧化物燃料电池(SOFC)领域预计将占据市场主导地位

- SOFC 使用固体氧化物材料来帮助负氧离子从阴极移动到阳极。在这些电池中,阳极和阴极由覆盖电解质的特殊油墨製成。因此,SOFC 不需要贵金属、腐蚀性酸或熔融材料。

- 电解质材料暴露在高温下作为催化剂,将天然气转化为能量。然而,催化转化过程的高温会导致陶瓷电解质快速劣化,增加资本和维护成本。

- 固体电解质中使用钪可以使系统在比传统 SOFC 低得多的温度下运作。因此,钪的使用有助于降低SOFC的成本,使其更容易在许多地方用于发电。

- 随着电费上涨以及人们寻求以更环保的方式发电,这将为 SOFC 创造许多市场机会,并使钪变得更加重要。

- 由于人们对煤炭和天然气等传统能源来源的环境担忧日益加剧,固体氧化物燃料电池未来的需求可能会增加。

- 预计未来推动固体氧化物燃料电池需求成长的将是清洁能源需求的不断增长,而不是对煤炭和天然气等传统能源来源发电的环境担忧。固体氧化物燃料电池效率高,具有环境和经济效益。固体氧化物燃料电池的电效率高达60%。这意味着燃料中储存的60%的能量被转化为有用的电能。这比燃煤发电厂效率高得多。

- 此外,根据美国能源资讯署的数据,2023年能源投资将达到约2.8兆美元,其中1.7兆美元将用于清洁能源,包括可再生、核能、电网、储能、低排放燃料、效率改进、终端用途可再生和电气化。

- 此外,根据美国能源局的数据,到2030年,来自清洁能源的电力比例可能会扩大到80%,几乎是《通膨控制法案》通过前预测的两倍。

- 此外,SOFC 市场的各种扩张也刺激了对钪的需求。例如:

- HD Hyundai 于 2023 年 10 月宣布将向爱沙尼亚固体氧化物燃料电池公司 Elcogen 投资 4,500 万欧元(4,760 万美元)。透过这项新投资,两家公司将专注于基于 Elcogen 专有的固体氧化物燃料电池 (SOFC) 的船舶推进系统和固定发电,以及基于 Elcogen 的固体氧化物电解槽(SOEC) 技术的绿色氢气生产。

- 2023 年 8 月,固体氧化物燃料电池製造商 Bloom Energy 与台湾着名晶片基板和印刷基板(PCB) 製造商欣兴科技股份有限公司达成协议,成功完成了突破性的 10 兆瓦 (MW)固体氧化物燃料电池的初始安装。

- 固体氧化物燃料电池市场对钪的需求在不久的将来可能会大幅增加。

中国可望主导市场

- 中国的钪是钛、铁矿石和锆等其他材料的副产品。目前,中国钪产量的60-70%以上用于钛製品。中国也利用颜料厂二氧化钛(TiO2)浸出液的残留物来生产大量的钪,例如中国攀枝花的磁铁钒铁矿等钛矿石,其浓度达到 0.04%。

- 在全球范围内,钪的主要来源是铌-稀土-稀土元素(Nb-FREE-Fe),它是世界上最大的稀土元素资源,也是第二大钪资源。该矿位于中国内蒙古,约占全球钪产量的90%。在白云鄂博,人们除了开采其他稀土和铁矿产品外,还开采出了钪。

- 随着中国政府在低碳经济转型过程中越来越重视利用清洁能源技术,燃料电池市场潜力巨大。过去几年,中国政府非常重视燃料电池汽车在国内的部署,将公众支持的重点从纯电动车略微转向了燃料电池电动车。中国政府为每辆车提供50万元人民币(7.3万美元)的补贴。

- 此外,中国政府已宣布计划到2025年支持约5万辆零排放燃料电池汽车,到2030年迅速扩大到100万辆FCEV,这为该国的SOFC和钪市场提供了机会。

- 中国是最大的飞机製造国之一,也是最大的国内航空客运市场之一。此外,该国的飞机零件和组装製造业正在快速发展,拥有超过 200 家小型飞机零件製造商。此外,中国政府正大力投资扩大国内製造能力。

- 中国是全球最大的电子产品製造基地。中国正积极生产智慧型手机、电视、电线电缆、可携式电脑、游戏系统和其他个人电子设备等电子产品。中国经济发展、人民生活水准不断提高,带动家电需求成长。智慧型手机、OLED电视和平板电脑等电子产品是家用电子电器市场中成长最快的需求部分。预计到 2025 年收益将以每年 2.04% 的速度成长。

- 因此,预计上述因素将影响研究市场的需求。

钪行业概况

钪市场本质上是整合的。市场的主要企业包括湖南稀土元素材料研究院、中冶集团、新升能源金属有限公司、湖南东方钪业、河南荣嘉钪钒科技有限公司。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章 引言

- 调查前提条件

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场动态

- 驱动程式

- 固体氧化物燃料电池(SOFCS)的应用日益广泛

- 航太和国防工业对铝钪合金的需求不断增加

- 限制因素

- 钪的高成本

- 产业价值链分析

- 波特五力分析

- 供应商的议价能力

- 买家的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争程度

- 定价分析

- 环境影响分析

第五章市场区隔

- 产品类型

- 氧化物

- 氟化物

- 氯化物

- 硝酸盐

- 碘化物

- 合金

- 碳酸盐和其他产品类型

- 最终用户产业

- 航太与国防

- 固体氧化物燃料电池

- 陶瓷

- 照明

- 电子产品

- 3D列印

- 体育用品

- 其他最终用户产业

- 地区

- 生产分析

- 中国

- 俄罗斯

- 菲律宾

- 世界其他地区

- 消费分析

- 美国

- 中国

- 俄罗斯

- 日本

- 巴西

- 欧洲联盟

- 世界其他地区

- 生产分析

第六章竞争格局

- 併购、合资、合作与协议

- 市场占有率(%)**/排名分析

- 主要企业策略

- 公司简介

- Guangxi Maoxin Technology Co. Ltd

- Henan Rongjia Scandium Vanadium Technology Co. Ltd

- Huizhou Top Metal Materials Co. Ltd

- Hunan Rare Earth Metal Materials Research Institute Co. Ltd

- Hunan Oriental Scandium Co. Ltd

- JSC Dalur

- MCC Group

- NioCorp Development Ltd

- Rio Tinto

- Rusal

- Scandium International Mining Corporation

- Stanford Advanced Materials

- Sumitomo Metal Mining Co. Ltd(Taganito HPAL nickel Corp.)

- Sunrise Energy Metals Limited

- Treibacher Industrie AG

第七章 市场机会与未来趋势

- 汽车产业的潜在应用

- 不断发展的能源储存技术

简介目录

Product Code: 49669

The Scandium Market size is estimated at USD 0.77 billion in 2025, and is expected to reach USD 1.53 billion by 2030, at a CAGR of 14.7% during the forecast period (2025-2030).

Key Highlights

- The COVID-19 pandemic negatively impacted the scandium market. Due to the lockdown, major end-user segments such as aerospace and defense, ceramics, and electronics were suspended, reducing the usage of scandium. However, post-pandemic, the market expanded steadily because of the continued activities in major end-user segments.

- In the short term, increasing usage in solid oxide fuel cells (SOFCS) and increasing demand for aluminum-scandium alloys in the aerospace and defense industry are the factors driving the studied market.

- However, the high price of scandium may hinder the growth of the studied market between 2024 and 2029.

- Potential applications in the automotive industry and growing technology for storing energy are likely to give the market opportunities in the coming years.

- China is expected to dominate the market, and the European Union is expected to see the highest CAGR between 2024 and 2029.

Scandium Market Trends

The Solid Oxide Fuel Cells (SOFCs) Segment is Expected to Dominate the Market

- SOFCs use a solid oxide material called an electrolyte, which helps move negative oxygen ions from the cathode to the anode. In these cells, anodes and cathodes are made from special inks that cover the electrolyte. Therefore, SOFCs do not require any precious metal, corrosive acids, or molten material.

- Electrolyte materials are subjected to high temperatures to catalyze natural gas conversion to energy. However, the high temperature for the catalyzing conversion process can lead to the quick degradation of ceramic electrolytes, adding to the capital and maintenance costs.

- Using scandium in solid electrolytes helps the system work at much lower temperatures than traditional SOFCs. So, the use of scandium helped lower the cost of SOFCs, which made them easier to use for power generation in many places.

- As electricity prices go up, people will need to use more environmentally friendly ways to make power, which is likely to create many market opportunities for SOFCs and make scandium even more important.

- Due to growing environmental concerns regarding traditional energy sources like coal and natural gas, solid oxide fuel cells are likely to see increased demand in the future.

- The increasing demand for clean energy over environmental concerns of energy generation from conventional sources, such as coal and natural gas, is expected to drive the demand for solid oxide fuel cells in the future. Solid oxide fuel cells offer high efficiency and deliver environmental and financial benefits. The electrical efficiency of solid oxide fuel cells reaches up to 60%. This means 60% of the energy stored in the fuel is converted to useful electrical energy. This is much higher than the efficiency of coal power plants.

- Furthermore, according to the Energy Information Administration, around USD 2.8 trillion was invested in energy in 2023, out of which USD 1.7 trillion was used for clean energy, including renewable power, nuclear, grids, storage, low-emission fuels, efficiency improvements, and end-use renewables and electrification.

- In addition, according to the US Department of Energy, the share of electricity from clean sources in 2030 could grow to 80%, nearly twice the expected amount before the Inflation Reduction Act passed.

- Furthermore, various expansions in the SOFC market are fueling the demand for scandium. For instance:

- In October 2023, HD Hyundai announced an investment of EUR 45 million (USD 47.6 million) in Estonian solid oxide fuel cell firm Elcogen. With the new investment, the two companies intend to focus on marine propulsion systems and stationary power generation based on Elcogen's proprietary solid oxide fuel cell (SOFC) and green hydrogen production based around Elcogen's solid oxide electrolyzer cell (SOEC) technology.

- In August 2023, Bloom Energy, a manufacturer of solid oxide fuel cells, successfully installed the initial phase of a groundbreaking 10-megawatt (MW) solid oxide fuel cell contract with Unimicron Technology Corp., a prominent chip substrate and printed circuit board (PCB) manufacturer in Taiwan.

- The solid oxide fuel cell market is likely to witness a big increase in demand for scandium in the near future.

China is Expected to Dominate the Market

- Scandium in China is produced as a by-product of other materials such as titanium, iron ore, and zirconium. Nowadays, more than 60-70 % of the scandium production in China is as titanium by-products. The sizeable chuck of scandium in the country is also produced by exploiting the residue from titanium dioxide (TiO2) leach streams in pigment plants such as titanium ore like magnetovana-ilmenite located in Panzhihua, China, at a concentration as high as 0.04%.

- Globally, the principal source of scandium is niobium-rare earth element-iron (Nb-REE-Fe), the world's largest REE resource and second largest resource of scandium. It is located in Inner Mongolia, China, and accounts for approximately 90% of global scandium production. In Bayan Obo, scandium is regenerated as a by-product of the mining of the other REEs and iron.

- China has great potential in the fuel cell market as the government increasingly focuses on utilizing clean energy technology to switch to a low-carbon economy. For the past 2-3 years, the Chinese government put great emphasis on the roll-out of fuel cell mobility in the country, shifting the public support focus slightly away from BEV to FCEV. The national government offers CNY 500,000 (USD 73 thousand) as a subsidy for each vehicle.

- Furthermore, the Chinese government announced plans to support around 50,000 zero-emissions fuel cell vehicles by 2025, with plans to rapidly expand to 1 million FCEVs in service by 2030, providing opportunities to SOFCs and the scandium market in the country.

- China is one of the largest aircraft manufacturers and one of the largest markets for domestic air passengers. Moreover, the country's aircraft parts and assembly manufacturing sector has been growing rapidly, with the presence of over 200 small aircraft parts manufacturers. Also, the Chinese government is investing heavily in increasing its domestic manufacturing capacities.

- China is the largest base for electronics production in the world. China is actively engaged in manufacturing electronic products, such as smartphones, TVs, wires, cables, portable computing devices, gaming systems, and other personal electronic devices. Economic development in China and improving living standards among the population drive consumer electronics demand. Electronic products, such as smartphones, OLED TVs, and tablets, have the highest growth rates in the consumer electronics segment of the market in terms of demand. The revenue is expected to show an annual growth rate of 2.04% by 2025.

- Therefore, the above-mentioned factors are expected to impact the demand for the studied market.

Scandium Industry Overview

The scandium market is consolidated in nature. Some of the major players in the market are Hunan Institute of Rare Earth Metal Materials, MCC Group, Sunrise Energy Metals Limited, Hunan Oriental Scandium Co. Ltd, and Henan Rongjia Scandium Vanadium Technology Co. Ltd.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Increasing Usage in Solid Oxide Fuel Cells (SOFCS)

- 4.1.2 Increasing Demand for Aluminum-Scandium Alloys in the Aerospace and Defense Industry

- 4.2 Restraints

- 4.2.1 High Cost of Scandium

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

- 4.5 Price Analysis

- 4.6 Environmental Impact Analysis

5 MARKET SEGMENTATION

- 5.1 Product Type

- 5.1.1 Oxide

- 5.1.2 Fluoride

- 5.1.3 Chloride

- 5.1.4 Nitrate

- 5.1.5 Iodide

- 5.1.6 Alloy

- 5.1.7 Carbonate and Other Product Types

- 5.2 End-user Industry

- 5.2.1 Aerospace and Defense

- 5.2.2 Solid Oxide Fuel Cells

- 5.2.3 Ceramics

- 5.2.4 Lighting

- 5.2.5 Electronics

- 5.2.6 3D Printing

- 5.2.7 Sporting Goods

- 5.2.8 Other End-user Industries

- 5.3 Geography

- 5.3.1 Production Analysis

- 5.3.1.1 China

- 5.3.1.2 Russia

- 5.3.1.3 Philippines

- 5.3.1.4 Rest of the World

- 5.3.2 Consumption Analysis

- 5.3.2.1 United States

- 5.3.2.2 China

- 5.3.2.3 Russia

- 5.3.2.4 Japan

- 5.3.2.5 Brazil

- 5.3.2.6 European Union

- 5.3.2.7 Rest of the World

- 5.3.1 Production Analysis

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share (%) **/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 Guangxi Maoxin Technology Co. Ltd

- 6.4.2 Henan Rongjia Scandium Vanadium Technology Co. Ltd

- 6.4.3 Huizhou Top Metal Materials Co. Ltd

- 6.4.4 Hunan Rare Earth Metal Materials Research Institute Co. Ltd

- 6.4.5 Hunan Oriental Scandium Co. Ltd

- 6.4.6 JSC Dalur

- 6.4.7 MCC Group

- 6.4.8 NioCorp Development Ltd

- 6.4.9 Rio Tinto

- 6.4.10 Rusal

- 6.4.11 Scandium International Mining Corporation

- 6.4.12 Stanford Advanced Materials

- 6.4.13 Sumitomo Metal Mining Co. Ltd (Taganito HPAL nickel Corp.)

- 6.4.14 Sunrise Energy Metals Limited

- 6.4.15 Treibacher Industrie AG

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Potential Applications in the Automotive industry

- 7.2 Growing Technology for Storing Energy

02-2729-4219

+886-2-2729-4219