|

市场调查报告书

商品编码

1536833

汽车自动紧急煞车系统:市场占有率分析、产业趋势/统计、成长预测(2024-2029)Automotive Autonomous Emergency Braking System - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

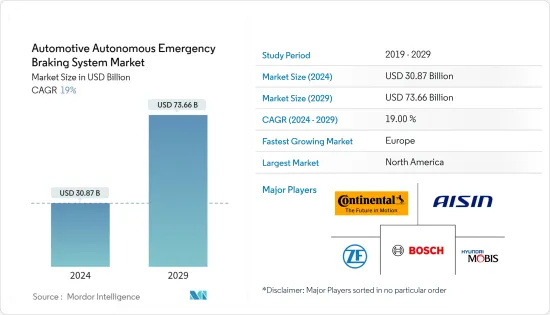

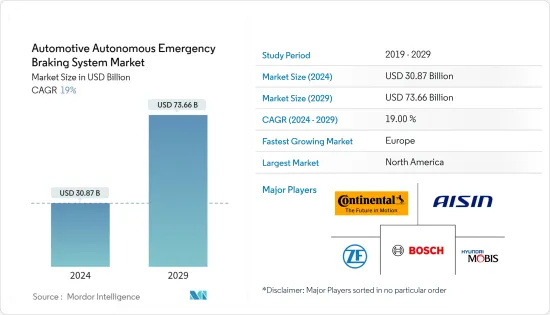

2024年全球汽车自动紧急煞车系统市场规模将达308.7亿美元,2024-2029年预测期间复合年增长率为19%,预计到2029年将达到736.6亿美元。

从中期来看,消费者和当局安全意识的提高将导致汽车自动紧急煞车系统的重大发展,从而提高安全性并减少道路事故。随着技术的进一步进步,市场预计将看到更安全、更可靠的煞车系统。

汽车製造商正在将先进的煞车系统融入其车辆中,以提高煞车效率,预计产业参与者提供的各种产品将在预测期内进一步推动市场成长。

每年约有 125 万人死于交通事故,是开发中国家死亡人数最多的国家。世界各地许多政府已开始推出严格的法规来遏制交通事故的增加。

各大OEM都在加大研发投入,开发先进技术。对车辆安全的日益关注、先进煞车系统的采用增加、先进人工智慧驱动系统的出现、政府车辆安全标准的提高,加上全球车辆产量的增加,自动紧急煞车系统市场预计将在预测期内得到推动。

许多目标商标产品製造商已在其大多数中檔和豪华汽车中安装了 AEB 系统。因此,自动驾驶汽车的产量正在增加。预计此类车辆的产量在预测期内复合年增长率将超过 21%。

汽车自动紧急煞车系统的市场趋势

乘用车占主要市场占有率

世界主要地区对汽车先进安全功能的需求不断增长以及乘用车销量的增加预计将在未来几年推动市场的显着增长。

自动紧急煞车是一种先进的安全技术系统,可在诱发因素未能反应的情况下自动减慢或完全停止车辆,以防止事故发生。与任何先进的驾驶辅助技术一样,自动紧急煞车并非 100% 万无一失。

为了满足这种不断增长的需求,多家汽车製造商正在推出配备这些技术的新车。特斯拉已经将 AEB 功能作为其所有车辆的标准配置,戴姆勒、宝马和福特等其他汽车製造商也有望在其未来的所有车型中配备 AEB 功能。特斯拉汽车配备了实现完全自动驾驶所需的所有硬体。例如

*2023年11月,雷诺在法国推出了Dacia Duster SUV。这款新型 SUV 配备 4x4 地形控制变速箱,具有五种驾驶模式和自动紧急煞车系统。

*2023年11月,丰田汽车公司在北美市场推出中型跨界SUV「Crown Signia」。这款新款SUV配备了自动紧急煞车系统。

世界各地的车主对自动紧急煞车系统的兴趣日益浓厚,正在推动全球市场的发展。交通事故数量的增加也推动了这种需求。世界各国政府鼓励开发各种类型的安全功能,以避免道路事故。

可支配收入的增加以及客户对配备安全功能的汽车的偏好的转变也推动了市场的发展。乘用车领域预计将在预测期内引领市场。

根据 EURO NCAP 的一项研究,城市驾驶环境中 75% 的碰撞发生在时速低于 25 英里/小时的情况下,而 AEB 可以将追撞碰撞减少 38%。未来几年,4 级和 5 级自动驾驶汽车提供的自动驾驶技术可能会成为全球的一个巨大市场。

由于上述全球发展,乘用车自动紧急煞车系统的需求预计在未来几年将保持在较高水准。

北美预计将引领市场

在美国,51% 的OEM提供的车型系列提供自动煞车功能。特斯拉和沃尔沃 100% 的车辆都配备了 AEB 标准。

美国运输部国家公路交通安全管理局 (NHTSA) 最近发布了拟议法规,要求客车和轻型卡车配备自动紧急煞车和行人用AEB 系统。

拟议的规则预计将大大减少与行人相关的事故和追撞事故。 NHTSA 估计,这项提议的规则如果最终确定,将每年挽救至少 360 人的生命并减少至少 24,000 人的伤害。

此外,这些 AEB 系统可以显着减少追撞碰撞造成的财产损失。许多事故是完全可以避免的,而另一些事故的破坏性则较小。

该部门的其他道路安全措施包括制定弱势道路使用者安全评估,以支持 2023 年国家规定的评估。评估的参数包括该州针对弱势道路使用者的安全绩效及其安全改进计划。

随着技术的进步,OEM必须继续积极履行 AEB 的承诺,否则将面临在安全进步方面落后于其他市场参与者并可能失去 Masu 品牌的风险。特别是,将 AEB 纳入美国政府的安全评级可能会改变消费者的看法。

随着上述新兴市场的开拓,未来该市场可望高速成长。

汽车自动紧急煞车系统产业概况

汽车自动紧急煞车系统市场由罗伯特·博世有限公司、大陆集团、ZF Friendrichagen AG、现代摩比斯和日立汽车系统有限公司等主要企业主导。主要企业透过采取策略方法继续在全球市场上获得竞争优势。煞车系统的持续进步和创新正在帮助製造商在竞争激烈的市场中获得吸引力。例如

*2023 年 7 月,ZF Friedrichshafen AG 与 Volta Trucks 签署了一项长期协议,为电动式Volta Zero 卡车进行零件整合。采埃孚提供先进的紧急煞车系统「OnGuardACTIVE」、包括煞车踏板盒的电子煞车系统、电子稳定控制系统「ESCsmart」以及电空手煞车「OnHand」。

*2023年6月,美国公路运输安全管理局(NHTSA)宣布五年内要求重型卡车和巴士配备自动紧急煞车(AEB)。

其他好处:

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章 简介

- 调查先决条件

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场动态

- 市场驱动因素

- 车辆安全功能的需求不断增长

- 市场限制因素

- 与系统相关的高成本

- 波特五力分析

- 新进入者的威胁

- 买家/消费者的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争公司之间敌对关係的强度

第五章市场区隔(市场规模:美元)

- 按车型分类

- 客车

- 商用车

- 依技术

- LiDar

- 雷达

- 相机

- 按地区

- 北美洲

- 美国

- 加拿大

- 北美其他地区

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 欧洲其他地区

- 亚太地区

- 印度

- 中国

- 日本

- 韩国

- 其他亚太地区

- 其他领域

- 南美洲

- 中东/非洲

- 北美洲

第六章 竞争状况

- 供应商市场占有率

- 併购

- 公司简介

- Robert Bosch GmbH

- WABCO Holdings Inc.

- Hyundai Mobis Co. Ltd

- Denso Corporation

- ZF Friedrichshafen AG

- Continental AG

- Autoliv Inc.

- Valeo SA

- Aisin Corporation

- Delphi Automotive PLC

第七章 市场机会及未来趋势

The Automotive Autonomous Emergency Braking System Market size is estimated at USD 30.87 billion in 2024, and is expected to reach USD 73.66 billion by 2029, growing at a CAGR of 19% during the forecast period (2024-2029).

Over the medium term, increasing awareness about safety among consumers and authorities has led to significant developments in the automotive automated emergency brake system, resulting in improved security and reduced accidents on the road. With further technological advancements, the market is expected to see even safer and more reliable brake systems.

Factors such as individual vehicle manufacturers incorporating advanced braking systems in their vehicles to improve braking efficiency and industry players offering a wide range of products are further expected to drive market growth during the forecast period.

Annually, around 1.25 million people are killed in road accidents, with the highest numbers being registered in developing countries. Many governments worldwide have started imposing stringent regulations to curb the rising number of road accidents.

Major OEMs have started increasingly investing in R&D efforts to develop advanced technologies. Increasing concerns regarding vehicle safety, the growing adoption of advanced braking systems, the emergence of advanced AI-powered systems, and an increase in government vehicle safety norms, combined with a rise in vehicle production worldwide, are expected to propel the automotive autonomous emergency braking system market during the forecast period.

Many original equipment manufacturers are equipping AEB systems in most of their medium and luxury car ranges. This is resulting in the increasing production of autonomous vehicles. During the forecast period, the production of such vehicles is expected to record a CAGR of over 21%.

Automotive Autonomous Emergency Braking System Market Trends

Passenger Cars Hold Major Market Share

The rise in demand for advanced safety features in vehicles and the increase in passenger car sales across major regions worldwide are likely to result in major growth for the market over the coming years.

Automatic emergency braking is an advanced safety technology system that autonomously slows or completely stops a vehicle in order to prevent an accident if the driver fails to respond. As with other advanced driver assistance technologies, automatic emergency braking is not 100% foolproof.

To cater to this growing demand, several automakers are launching new vehicle models with these technologies. Tesla is already offering AEB features as standard across all its cars, while other automakers like Daimler, BMW, and Ford are expected to provide AEB in all their upcoming models. Tesla's cars are equipped with all the necessary hardware to achieve full autonomy. For instance,

* In November 2023, Renault introduced the Dacia Duster SUV in France. The new SUV offers a 4x4 Terrain Control transmission with five driving modes and an automatic emergency braking system.

* In November 2023, Toyota Motor Corporation introduced the Crown Signia mid-size crossover SUV in the North American market. The new SUV is equipped with an automatic emergency braking system.

The growing interest among vehicle owners worldwide in autonomous emergency braking systems is driving the global market. This demand has also been fueled by a rising number of road accidents. Governments worldwide are encouraging the development of several kinds of safety features in order to avoid road accidents.

Rising disposable incomes and customer preferences increasingly transitioning toward cars with fully loaded safety features are driving the market. The passenger cars segment is expected to lead the market during the forecast period.

As per research by EURO NCAP, 75% of all collisions in urban driving environments occur at speeds below 25 mph, with AEB having led to a 38% reduction in rear-end crashes. Autonomous vehicle technology offered with level 4 and 5 autonomous cars may become a large market worldwide over the coming years.

In line with the abovementioned developments globally, the demand for automatic emergency braking systems in passenger cars will be high over the coming years.

North America Expected to Lead the Market

Autonomous braking is provided with 51% of the model lines offered by OEMs across the United States. Tesla and Volvo offer AEB as a standard feature in 100% of their vehicles.

The US Department of Transportation's National Highway Traffic Safety Administration (NHTSA) recently issued a notice of proposed regulations that would require automatic emergency braking and pedestrian AEB systems for passenger vehicles and light trucks.

The proposed rule is expected to dramatically reduce pedestrian-related accidents and rear-end collisions. The NHTSA estimates that this proposed rule, if finalized, would save at least 360 lives per year and reduce the number of injuries by at least 24,000 annually.

In addition, these AEB systems would lead to a significant reduction in property damage caused by rear-end collisions. Many accidents could be avoided entirely, while others would be less destructive.

The Department's other road safety actions include the preparation of the Vulnerable Road User Safety Assessment to assist states with the required assessments for 2023. The safety performance of the state in terms of vulnerable road users and its plan to improve their safety are among the parameters assessed.

In line with growing technological advancements, OEMs must remain active in achieving their AEB commitments or face the possibility of brand erosion due to falling behind other market players in safety advances. In particular, the incorporation of AEB into the US government's safety ratings may alter consumer perception.

Based on the aforementioned developments, the market is expected to witness high growth in the upcoming period.

Automotive Autonomous Emergency Braking System Industry Overview

The automotive autonomous emergency braking system market is dominated by several key players, such as Robert Bosch GmbH, Continental AG, ZF Friendrichagen AG, Hyundai Mobis, and Hitachi Automotive System Ltd. Key players continue to gain a competitive edge in the global market by engaging in strategic approaches. Consistent advancements and innovations in braking systems have assisted manufacturers in gaining traction in the competitive market. For instance,

* In July 2023, ZF Friedrichshafen AG and Volta Trucks signed a long-term agreement for the integration of components and parts in the all-electric Volta Zero electric truck. ZF provided the OnGuardACTIVE advanced emergency braking system, the electronic braking system including the brake pedal box, the ESCsmart electronic stability control, and the OnHand electro-pneumatic handbrake.

* In June 2023, the US National Highway Transportation Safety Administration (NHTSA) announced that heavy trucks and buses must include automatic emergency braking equipment (AEB) within five years.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Drivers

- 4.1.1 Rise in Demand for Safety Features in Vehicles

- 4.2 Market Restraints

- 4.2.1 High Costs Associated with the System

- 4.3 Porter's Five Forces Analysis

- 4.3.1 Threat of New Entrants

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Bargaining Power of Suppliers

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION (Market Size in Value - USD)

- 5.1 By Vehicle Type

- 5.1.1 Passenger Cars

- 5.1.2 Commercial Vehicles

- 5.2 By Technology

- 5.2.1 LiDar

- 5.2.2 Radar

- 5.2.3 Camera

- 5.3 By Geography

- 5.3.1 North America

- 5.3.1.1 United States

- 5.3.1.2 Canada

- 5.3.1.3 Rest of North America

- 5.3.2 Europe

- 5.3.2.1 Germany

- 5.3.2.2 United Kingdom

- 5.3.2.3 France

- 5.3.2.4 Italy

- 5.3.2.5 Rest of Europe

- 5.3.3 Asia-Pacific

- 5.3.3.1 India

- 5.3.3.2 China

- 5.3.3.3 Japan

- 5.3.3.4 South Korea

- 5.3.3.5 Rest of Asia-Pacific

- 5.3.4 Rest of the World

- 5.3.4.1 South America

- 5.3.4.2 Middle East and Africa

- 5.3.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Vendor Market Share

- 6.2 Mergers and Acquisitions

- 6.3 Company Profiles*

- 6.3.1 Robert Bosch GmbH

- 6.3.2 WABCO Holdings Inc.

- 6.3.3 Hyundai Mobis Co. Ltd

- 6.3.4 Denso Corporation

- 6.3.5 ZF Friedrichshafen AG

- 6.3.6 Continental AG

- 6.3.7 Autoliv Inc.

- 6.3.8 Valeo SA

- 6.3.9 Aisin Corporation

- 6.3.10 Delphi Automotive PLC